🉐 12 Crypto Hedge Fund Trading Strategies 🉐

They make 4000% ARR.

You make 40%.

What’s their secret sauce?

What are the pros doing that’s so different or smarter than you??

And where might you have an edge that they don't?

HOW TO WIN. 12 strategies.

👇

They make 4000% ARR.

You make 40%.

What’s their secret sauce?

What are the pros doing that’s so different or smarter than you??

And where might you have an edge that they don't?

HOW TO WIN. 12 strategies.

👇

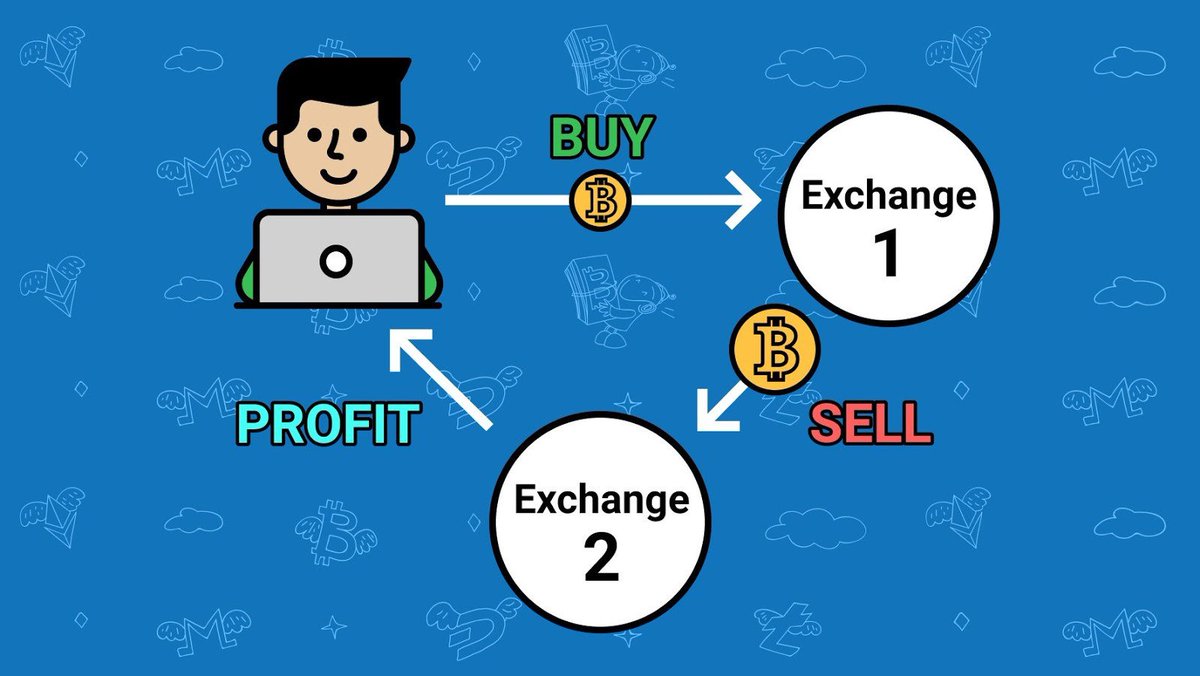

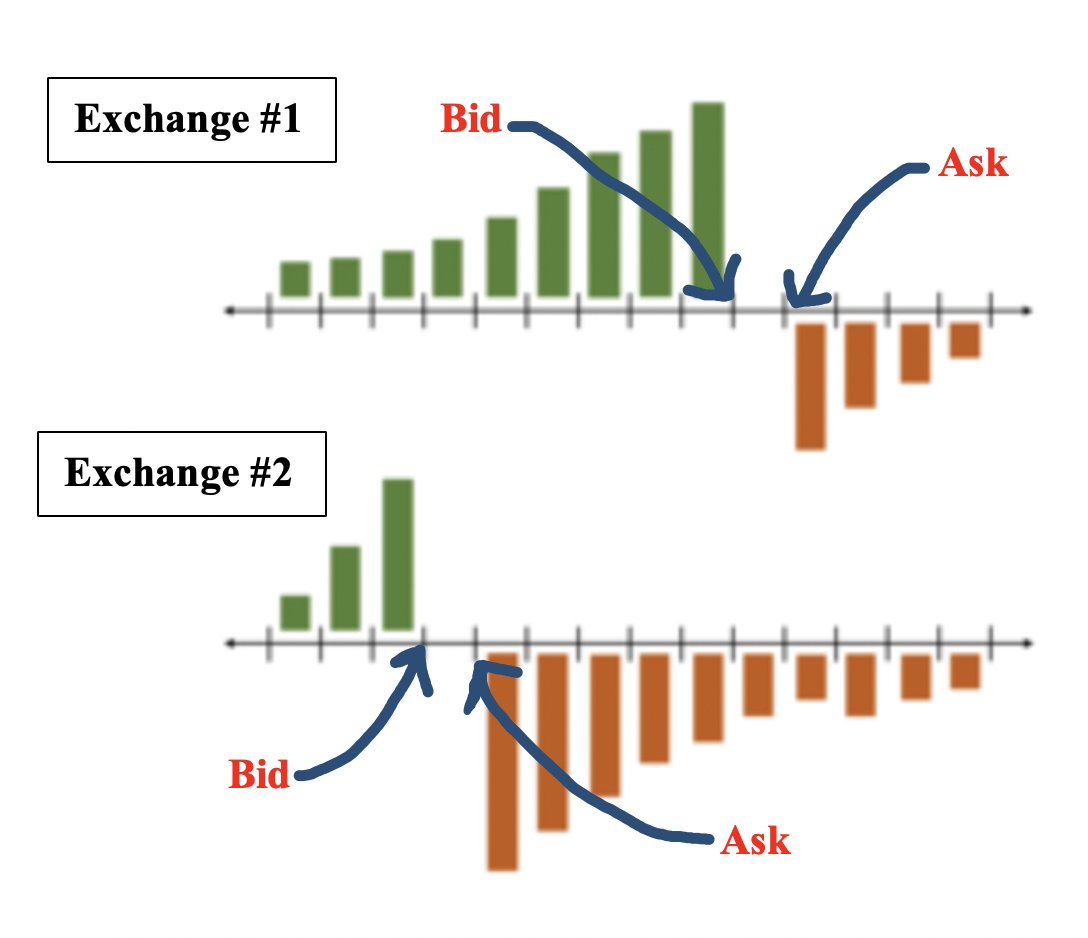

1/ The simplest arb: cross-exchange

This strategy *rarely* exists today, but it makes sense to start w/ basics.

Back in the day different exchanges had different quotes. If u subscribed to multiple order book feeds **as every hedge fund does**, u might've seen smth like this:

This strategy *rarely* exists today, but it makes sense to start w/ basics.

Back in the day different exchanges had different quotes. If u subscribed to multiple order book feeds **as every hedge fund does**, u might've seen smth like this:

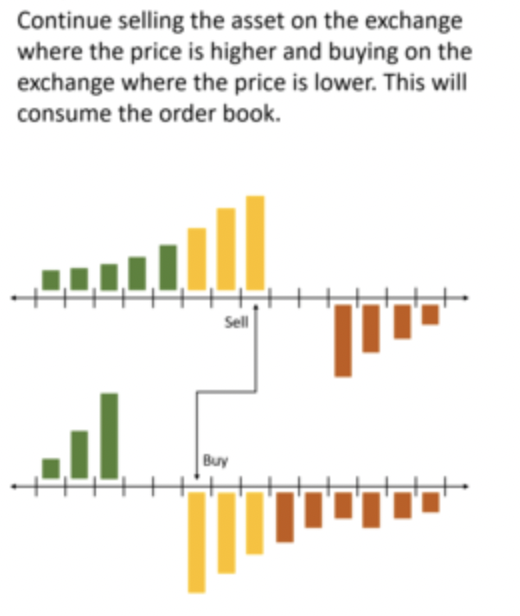

So what do you do? Well well what a juicy buy-low-sell-high opportunity! (yellow area)

Keep lifting the offer on the lower exchange (#2) & hitting the bid on the higher exchange (#1) until the gap narrows.

Soon the gap will close.

Stop trading.

Move on to the next opportunity.

Keep lifting the offer on the lower exchange (#2) & hitting the bid on the higher exchange (#1) until the gap narrows.

Soon the gap will close.

Stop trading.

Move on to the next opportunity.

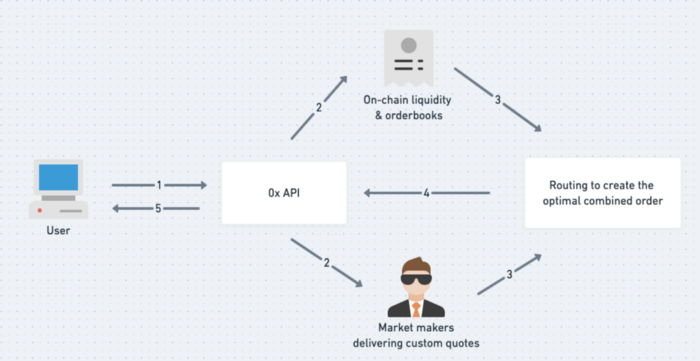

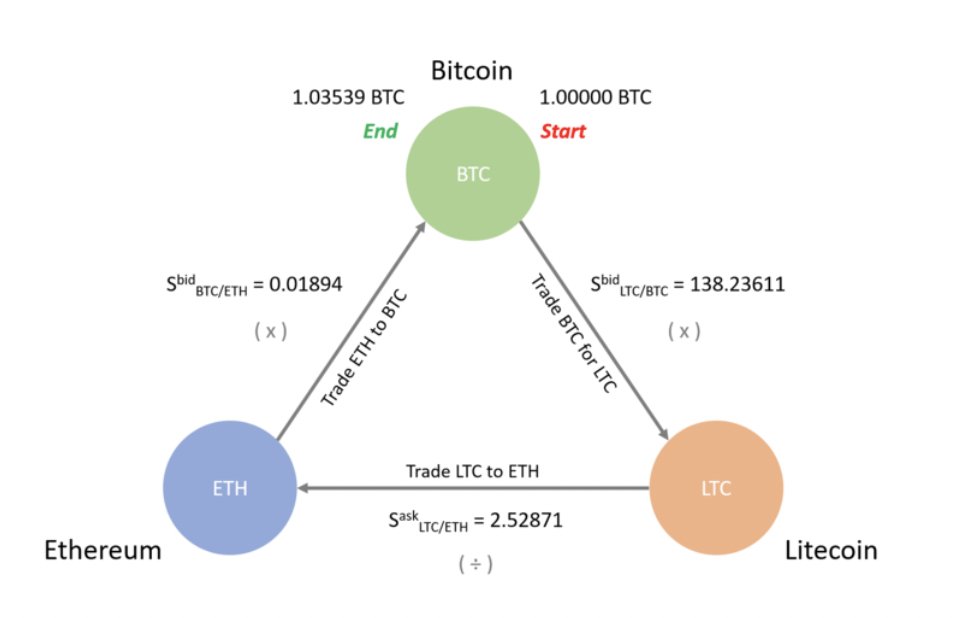

2/ Triangle arb📐

This one's also rare. If it exists, will be gobbled up by HFT bots in no time.

Triangle arb is when u can swap btw 3 different assets & end up w/ more than you started. Can occur on 1 single exchange or multiple.

Example below:

Start @ 1 BTC, end @ 1.035 BTC.

This one's also rare. If it exists, will be gobbled up by HFT bots in no time.

Triangle arb is when u can swap btw 3 different assets & end up w/ more than you started. Can occur on 1 single exchange or multiple.

Example below:

Start @ 1 BTC, end @ 1.035 BTC.

3/ FX currency arb

@QCPCapital makes heavy use of this strategy given they deal a lot with on & offramps to volatile SE Asian currencies (rupiah, ringgit, etc.)

They founder @dariussitzl talks about it on @RealVision. Listen to the real pro here:

@QCPCapital makes heavy use of this strategy given they deal a lot with on & offramps to volatile SE Asian currencies (rupiah, ringgit, etc.)

They founder @dariussitzl talks about it on @RealVision. Listen to the real pro here:

Ok so what is the arb here?

Imagine a scenario where USD gains against RP, while BTC quotes remains the same on US & Indonesian exchanges.

A smart trade would swap USD to JPY, buy BTC in Indonesia & sell back out on a US exchange. Of course, accounting for transaction fees.

Imagine a scenario where USD gains against RP, while BTC quotes remains the same on US & Indonesian exchanges.

A smart trade would swap USD to JPY, buy BTC in Indonesia & sell back out on a US exchange. Of course, accounting for transaction fees.

4/ Order book depth arbs

I don't know a single crypto fund that doesn't use order book feeds.

I know tons of hobby crypto traders that don't know what "order book depth" means.

For a quick intro on order book price level, read these 3 tweets:

I don't know a single crypto fund that doesn't use order book feeds.

I know tons of hobby crypto traders that don't know what "order book depth" means.

For a quick intro on order book price level, read these 3 tweets:

https://twitter.com/FabiusMercurius/status/1452349300126597121

The obvious strategy here:

With enough capital, you can buy through an entire price level across every exchange in the market, then sell at the next higher price level (the new best offer).

It's basically cornering the market.

With enough capital, you can buy through an entire price level across every exchange in the market, then sell at the next higher price level (the new best offer).

It's basically cornering the market.

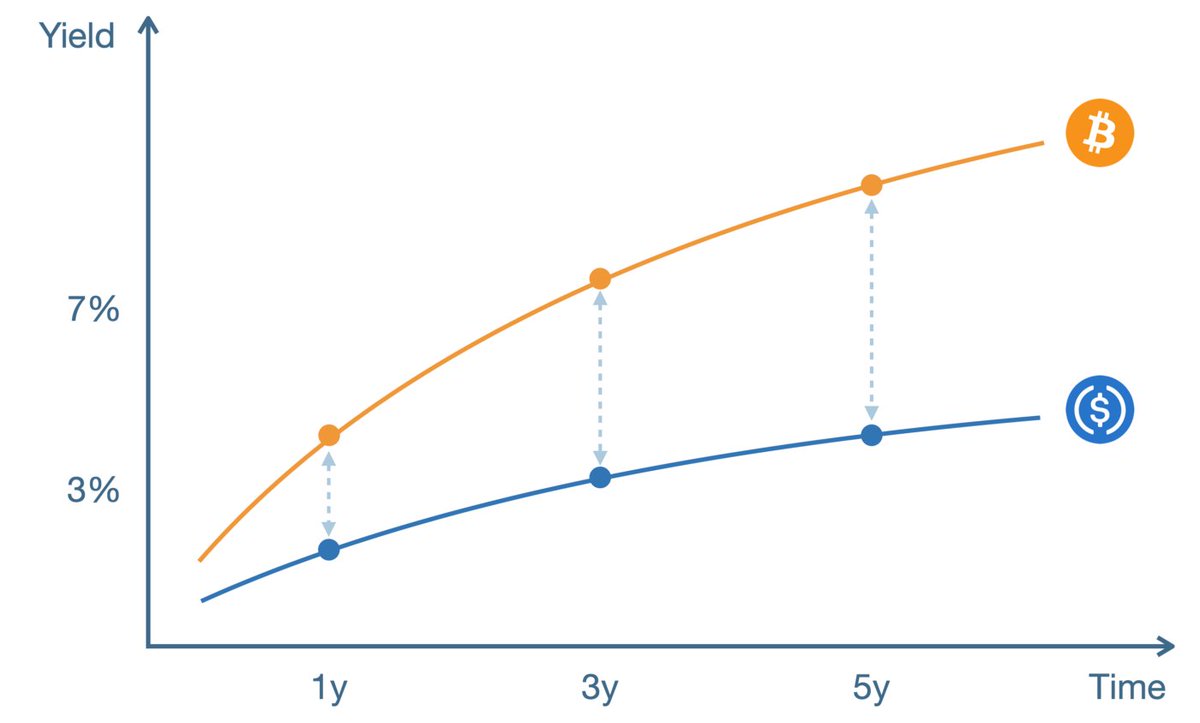

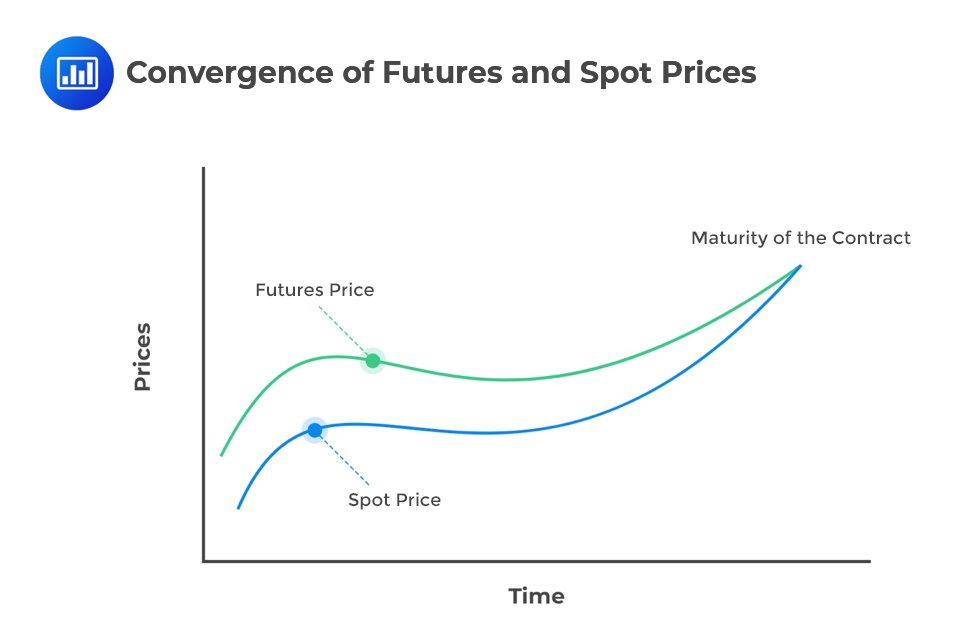

5/ Spread Trading

Most crypto funds I've talked to run close to market neutral. So unlike my mother they don't make their dough aping 70% AUM in $TSLA.

The most famous market neutral strategy is the basis trade: long spot, short future (or perp).

Lock in the premium & lever up.

Most crypto funds I've talked to run close to market neutral. So unlike my mother they don't make their dough aping 70% AUM in $TSLA.

The most famous market neutral strategy is the basis trade: long spot, short future (or perp).

Lock in the premium & lever up.

6/ Get Inside Information

Have you noticed that every single big crypto market maker / fund has a VC arm these days?

I'm not saying it's right or wrong. After all u can argue that ALL trading edge is information edge. But I do want to get in on those investor update calls... 🤔

Have you noticed that every single big crypto market maker / fund has a VC arm these days?

I'm not saying it's right or wrong. After all u can argue that ALL trading edge is information edge. But I do want to get in on those investor update calls... 🤔

7/ Acquire validator nodes & front-run

Since Dex transactions show up first in a mempool, miners can scalp for profitable trades, copy & submit their own trade ahead of the originals.

For more on frontrunning here's an oldie but goodie from @danrobinson

paradigm.xyz/2020/08/ethere…

Since Dex transactions show up first in a mempool, miners can scalp for profitable trades, copy & submit their own trade ahead of the originals.

For more on frontrunning here's an oldie but goodie from @danrobinson

paradigm.xyz/2020/08/ethere…

8/ Corner the market

The ability to corner markets is one obvious advantage of being well-capitalized (aka being a hedge fund).

But even retail traders can find niche illiquid markets & do the same. Here's how one onion farmer did it.

s/o @SahilBloom:

The ability to corner markets is one obvious advantage of being well-capitalized (aka being a hedge fund).

But even retail traders can find niche illiquid markets & do the same. Here's how one onion farmer did it.

s/o @SahilBloom:

https://twitter.com/sahilbloom/status/1295387751076913153?lang=en

9/ Move the market with size

There's a story from traditional markets of some MM that deployed a trade at 10-lot increments.

Result: no profit.

Then the MM put on the exact same trade at 100-lots.

Result: made it rain.

How does that work? See #4 from earlier in this thread.

There's a story from traditional markets of some MM that deployed a trade at 10-lot increments.

Result: no profit.

Then the MM put on the exact same trade at 100-lots.

Result: made it rain.

How does that work? See #4 from earlier in this thread.

10/ Lock in special privileges on certain exchanges

Not specific to crypto (as with most other strategies I discuss here).

Let's not point fingers & offend anyone. JK let's do it.

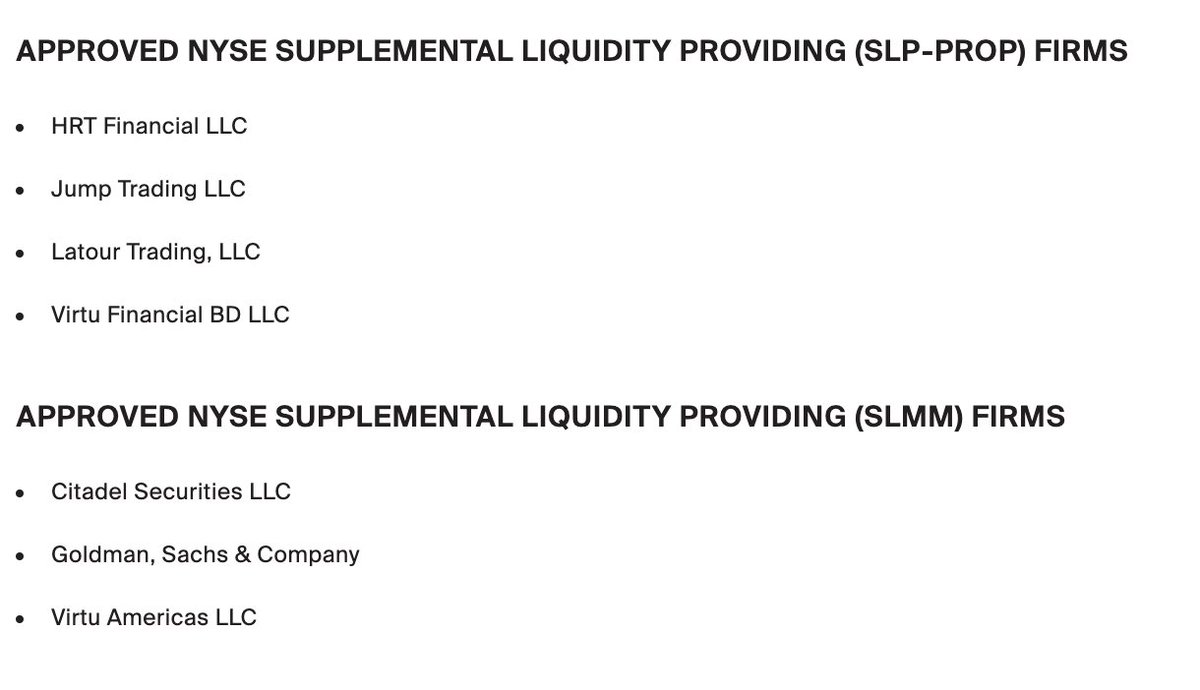

Here the DMMs ("designated market makers") & SLPs ("supplemental liquidity providers") on NYSE:

Not specific to crypto (as with most other strategies I discuss here).

Let's not point fingers & offend anyone. JK let's do it.

Here the DMMs ("designated market makers") & SLPs ("supplemental liquidity providers") on NYSE:

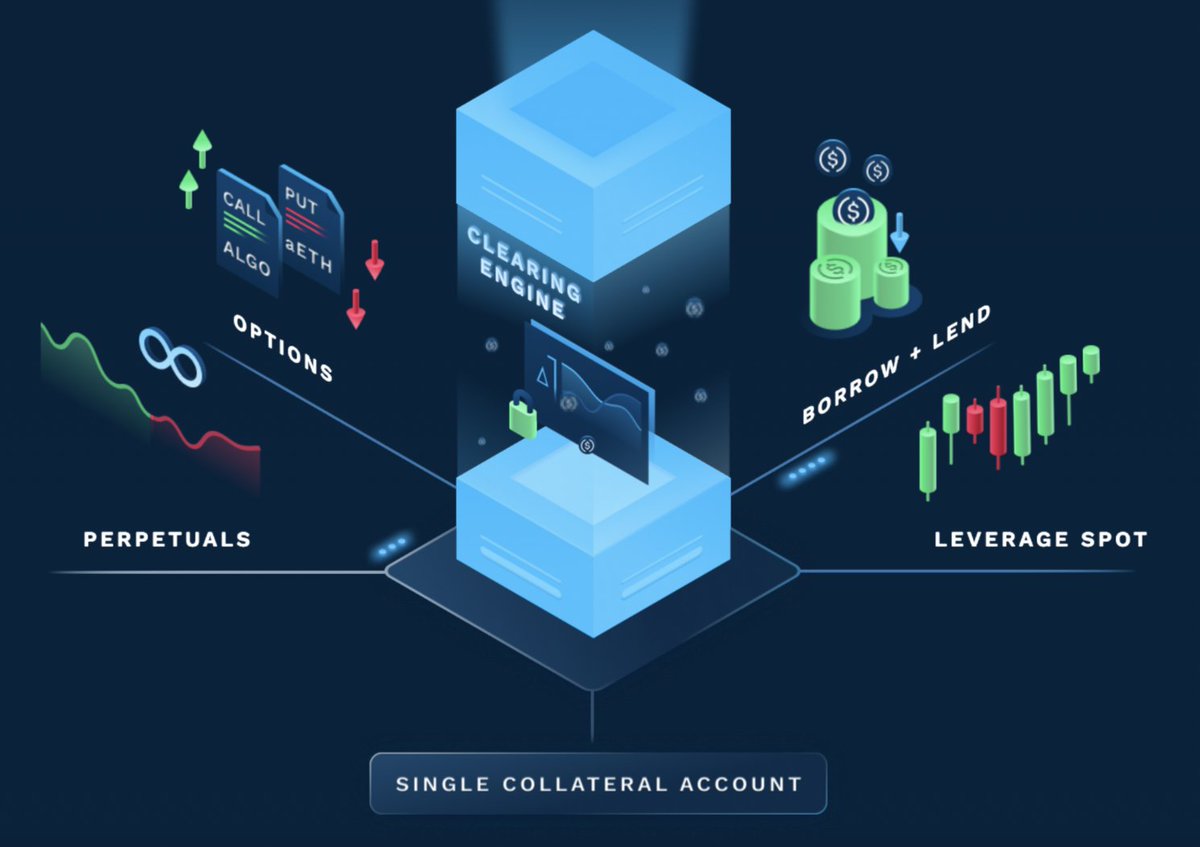

11/ Optimize borrowing rates, capital efficiency & cost basis

Hedge funds can get lower borrow rates from sheer size & efficiency from prime brokers. Unfort, you can't beat them here.

But then there's also cost basis, i.e. a little something called TAXES. Don't trade out of SF.

Hedge funds can get lower borrow rates from sheer size & efficiency from prime brokers. Unfort, you can't beat them here.

But then there's also cost basis, i.e. a little something called TAXES. Don't trade out of SF.

12/ Clout

Clout is alpha.

Clout moves markets out of sheer reflexivity & expectations.

Step 1: Make a trade (e.g. sell DOGE)

Step 2: Tweet about it & give extensive persuasive reasons for your view, or just rely on the reflexivity of the market.

Clout is alpha.

Clout moves markets out of sheer reflexivity & expectations.

Step 1: Make a trade (e.g. sell DOGE)

Step 2: Tweet about it & give extensive persuasive reasons for your view, or just rely on the reflexivity of the market.

https://twitter.com/elonmusk/status/1366668744748007425

• • •

Missing some Tweet in this thread? You can try to

force a refresh