What the Ship is Going on?

Dec 13, 2021

1⃣ Abandoned Mariners

2⃣ @IMOHQ Elections & Expansion

3⃣ @PortofLA/@portoflongbeach, @PortVancouver & #AlmiranteStorni Update

4⃣ China Shipping & Ningbo Closure

5⃣ New US Training Vessels

Dec 13, 2021

1⃣ Abandoned Mariners

2⃣ @IMOHQ Elections & Expansion

3⃣ @PortofLA/@portoflongbeach, @PortVancouver & #AlmiranteStorni Update

4⃣ China Shipping & Ningbo Closure

5⃣ New US Training Vessels

1⃣Leaking Hull, Hazardous Cargo: Aboard a Stranded Ship No One Would Help

H/T @WSJ, @drewhinshaw & @JoeWSJ

wsj.com/articles/aband…

H/T @WSJ, @drewhinshaw & @JoeWSJ

wsj.com/articles/aband…

2⃣International Maritime Organization Elects New 40-Member Council

H/T @gCaptain @MikeSchuler

gcaptain.com/international-…

H/T @gCaptain @MikeSchuler

gcaptain.com/international-…

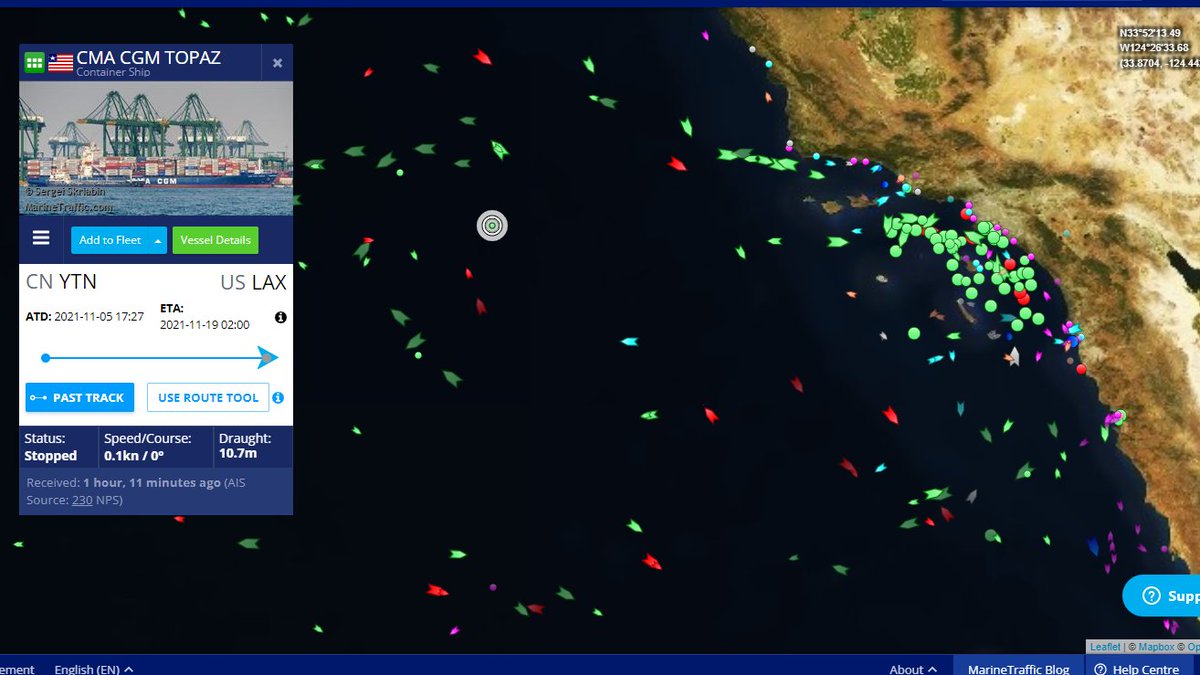

3⃣ Vanishing Ships Underscore Supply Woe: Crisis Peak Is a Mirage

H/T @gCaptain @business

gcaptain.com/vanishing-ship…

H/T @gCaptain @business

gcaptain.com/vanishing-ship…

Port of Vancouver ship backlog hits 60

H/T @FreightWaves @natetabak

freightwaves.com/news/port-of-v…

H/T @FreightWaves @natetabak

freightwaves.com/news/port-of-v…

MV Almirante Storni Arrives at Dock With Timber Fire Under Control

H/T @gCaptain @MikeSchuler

gcaptain.com/mv-almirante-s…

H/T @gCaptain @MikeSchuler

gcaptain.com/mv-almirante-s…

4⃣Chinese Seafarers Face Crew Change Challenges

H/T @gCaptain @business

gcaptain.com/chinese-seafar…

H/T @gCaptain @business

gcaptain.com/chinese-seafar…

5⃣ Keel Laying Held for First National Security Multi-Mission Vessel at Philly Shipyard

H/T @gCaptain @MikeSchuler

gcaptain.com/keel-laying-he…

H/T @gCaptain @MikeSchuler

gcaptain.com/keel-laying-he…

I referenced your @Splash_247 story in my video @lawyer_shipping.

• • •

Missing some Tweet in this thread? You can try to

force a refresh