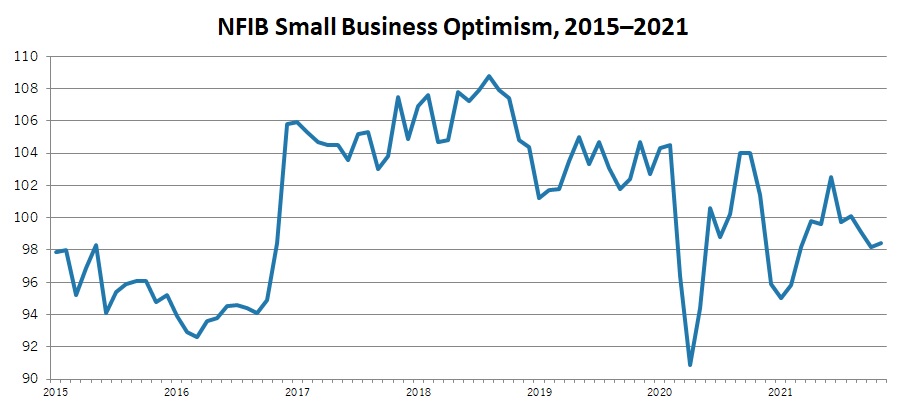

The National Federation of Independent Business reported that the Small Business Optimism Index edged up from 98.2 in October to 98.4 in November. Yet, the headline index has generally drifted lower since June (102.5). #SmallBusiness #Economy

Small business owners remain challenged by supply chain disruptions, workforce shortages, inflation and COVID-19. The net percentage expecting better business conditions 6 months from now has plummeted from -33% in Sept. to -38% in Nov., the lowest level since November 2012.

Pricing pressures remain very elevated. In Nov., the net percentage of respondents reporting higher prices today than 3 months ago jumped from 53% to a record 59%. The net percentage planning a price increase over the next three months rose from 51% to 54%, a new all-time high.

In addition, the net percentage of respondents saying that they had increased compensation in the last three months remained at a record 44%, with the net percentage planning to raise compensation in the next three months continuing to be 32%, also an all-time high.

Along those lines, hiring continued to be a challenge. Respondents once again cited difficulties in obtaining qualified labor as the top “single most important problem,” followed closely by concerns about taxes and inflation.

• • •

Missing some Tweet in this thread? You can try to

force a refresh