1/ CBDCs often associated with a dystopian behavioral control model of governments at the individual level. What's overlooked is that we already have this in the aggregate sense today. Given proper privacy implementations, the concerns over discrete control could be ameliorated.

2/ Studies have shown that a CBDC model, wherein issuance against government debt is on the order of 30% of GDP, could increase steady state aggregate economic output by as much as 3% over the long term, while at the same time dampening the magnitude of inherent boom/bust cycles.

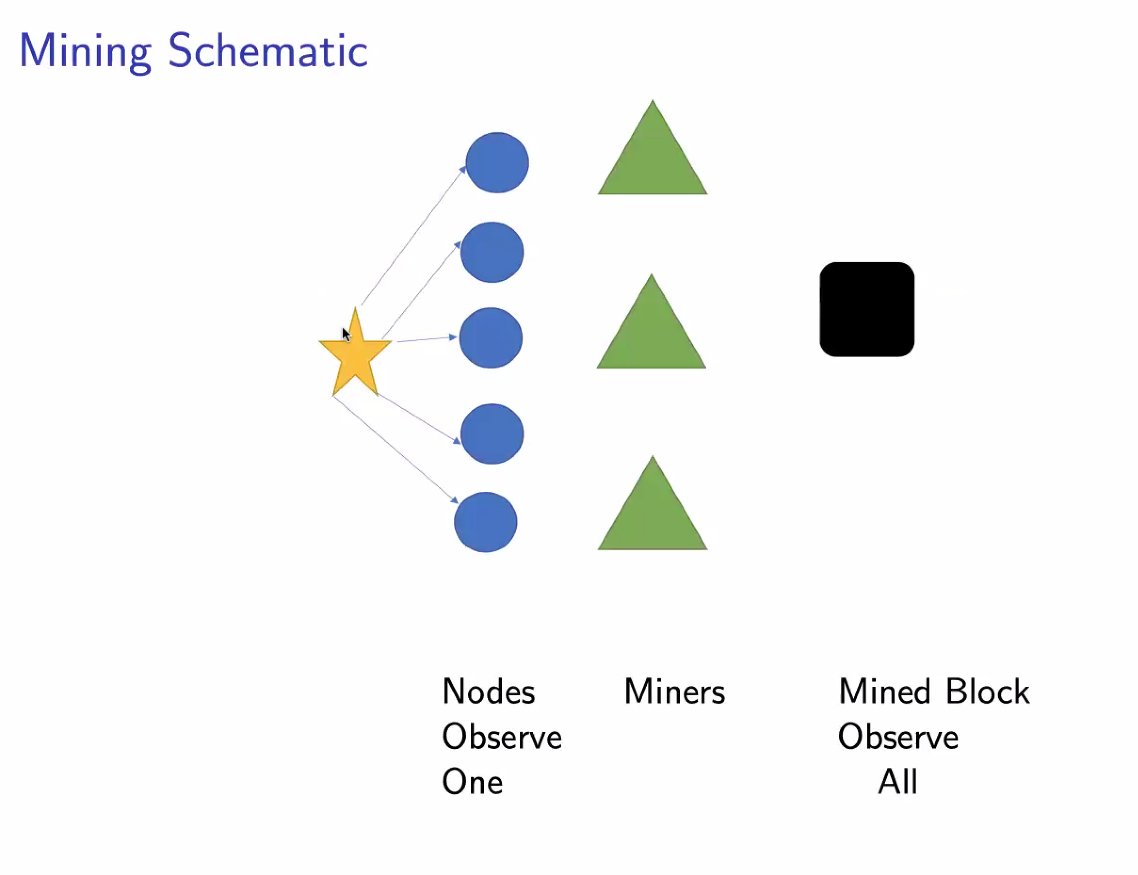

3/ The structure of CBDCs could theoretically be decentralized in terms of DLT (w/ interoperable sidechain BFT systems!). It is known that at current reliability thresholds existing RTGS systems are inadequate for this purpose, so new tech / private services likely to be deployed

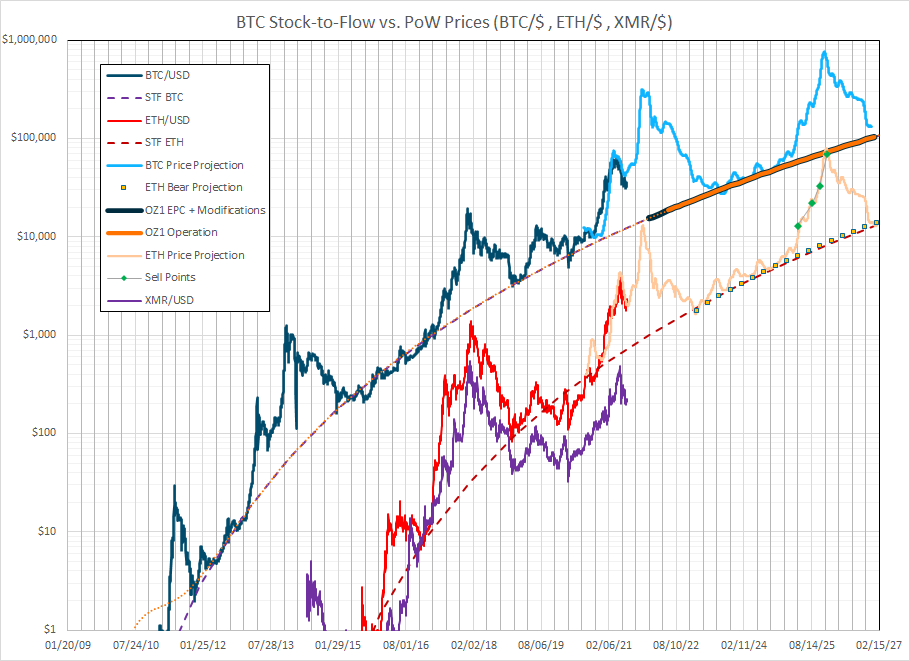

4/ The impact of CBDCs could also be counter cyclical in terms of smoothing the business cycle. The stock to flow of CBDCs could be algorithmically adjusted to address real time private actor demand.

5/ It's possible we could see a more efficient, long term stable economy, with ironically less centralized control by the Tier 1 banking system (Cantillonaires). If DLT is provisioned, the solution to privacy could be zkSNARKs + wallet based association to a digital identity.

6/ Researchers, like Michael Kumhof at the @bankofengland have studied this specific construction (which is more than a wholesale design) & outlined some key design principals to make this possible:

7/

A. CBDC pays an adjustable interest rate & may be negative rate!

B. No on demand convertabiliy of either reserves or bank deposits into CBDCs (to avoid lender of last resort scenarios during crises / bank runs)

C. Central bank only issues CBDCs against eligible securities.

A. CBDC pays an adjustable interest rate & may be negative rate!

B. No on demand convertabiliy of either reserves or bank deposits into CBDCs (to avoid lender of last resort scenarios during crises / bank runs)

C. Central bank only issues CBDCs against eligible securities.

8/ To get to this point, the debate should be less around whether they are allowed, will happen whether we like it or not!, & more focus on how they are designed for public good. Increasing seigniorage, liquidity, GDP, cycle stability & reducing financial risk, threats to privacy

9/ What NOT to do:

1. Disintermediate the private banking system by offering CBDCs as universal access to reserves at the risk free rate

2. Have no consideration for the implementation of CBDCs in terms of run risk

3. Eliminate all anonymity from business transactions (dystopia!)

1. Disintermediate the private banking system by offering CBDCs as universal access to reserves at the risk free rate

2. Have no consideration for the implementation of CBDCs in terms of run risk

3. Eliminate all anonymity from business transactions (dystopia!)

• • •

Missing some Tweet in this thread? You can try to

force a refresh