Should crypto investors buy the dip or cut their losses?

While there's a lot of discussion, most of it isn't backed by data.

Here's a thread on what the numbers tell us about altcoins bouncing back and the validity of dip-buying:👇

While there's a lot of discussion, most of it isn't backed by data.

Here's a thread on what the numbers tell us about altcoins bouncing back and the validity of dip-buying:👇

For simplicities sake, we're looking within market cycles, not from market cycle to market cycle.

So this thread will look at four points in time:

• April 14, BTC ATH (Peak 1)

• July 20, BTC bottom (Trough)

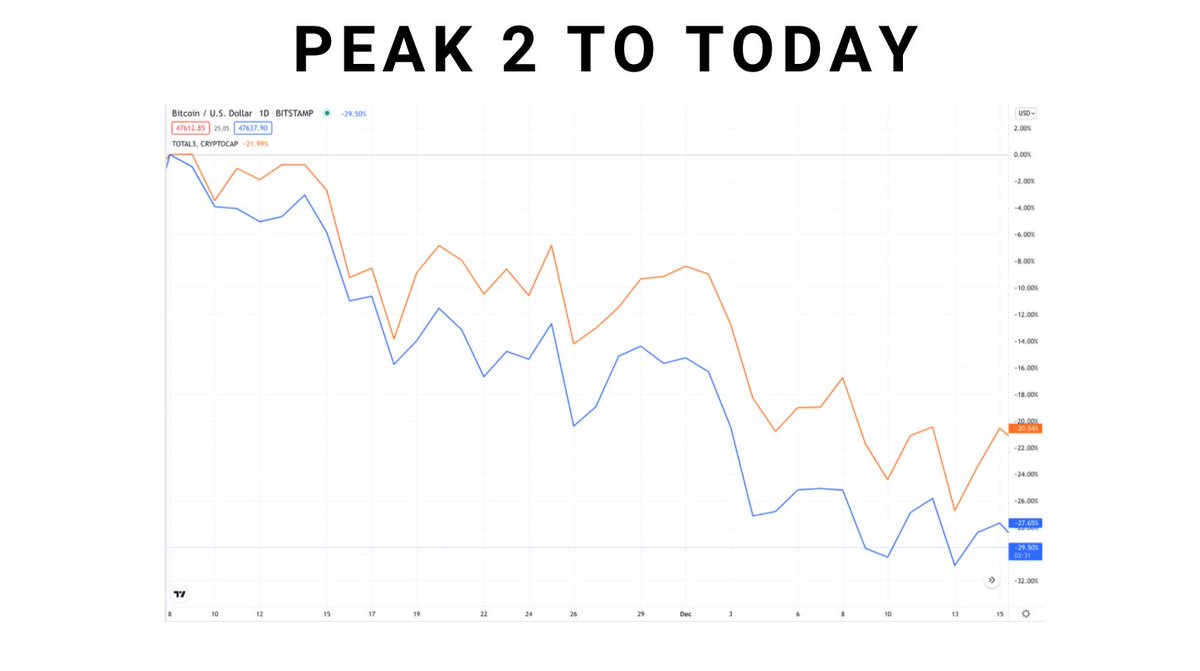

• November 8, BTC ATH (Peak 2)

• December 15, (Present)

So this thread will look at four points in time:

• April 14, BTC ATH (Peak 1)

• July 20, BTC bottom (Trough)

• November 8, BTC ATH (Peak 2)

• December 15, (Present)

First thing to look at: are alts even worth investing in?

Answer is undoubtedly, yes. Alts have beaten BTC from:

• Trough (July) - Present

• Peak 1 (Apr) - Present

• Peak 2 (Nov) - Present

Answer is undoubtedly, yes. Alts have beaten BTC from:

• Trough (July) - Present

• Peak 1 (Apr) - Present

• Peak 2 (Nov) - Present

First part of the analysis: how do top 200 alts perform by market cap?

Below graph looks at April to July pullback

Below: alt returns compared to market cap ranking.

Line of best fit shows a trend downward, meaning the smaller the alt, the worse the drawdown, at least on avg.

Below graph looks at April to July pullback

Below: alt returns compared to market cap ranking.

Line of best fit shows a trend downward, meaning the smaller the alt, the worse the drawdown, at least on avg.

In this next chart, each dot represents a single crypto.

Vertical axis: % pump from trough to peak

Horizontal axis: % drawdown peak to trough

Line of best fit has negative slope, meaning that the further a crypto draws down, the harder it pumps!

Vertical axis: % pump from trough to peak

Horizontal axis: % drawdown peak to trough

Line of best fit has negative slope, meaning that the further a crypto draws down, the harder it pumps!

That's a crazy takeaway. This graph makes strength in a downturn look irrelevant.

So:

• “Ride winners and cut losers.”

• “Buy relative strength.”

Might be bad investing advice.

So:

• “Ride winners and cut losers.”

• “Buy relative strength.”

Might be bad investing advice.

One more graph:

Vertical axis: % drop from peak to trough

Horizontal axis: % pump from peak to peak

Bottom left: dropped but hasn't pumped past april price

Bottom right: dropped and has pumped past April price

Top right: Pumped during drawdown, continued to pump afterwards

Vertical axis: % drop from peak to trough

Horizontal axis: % pump from peak to peak

Bottom left: dropped but hasn't pumped past april price

Bottom right: dropped and has pumped past April price

Top right: Pumped during drawdown, continued to pump afterwards

Avg return, July - Nov:

• Cryptos that dropped Apr-Jul: 186%

• Cryptos that pumped Apr-Jul: 113%

Cryptos that lost ground pumped harder. Winners didn't do as well.

• Cryptos that dropped Apr-Jul: 186%

• Cryptos that pumped Apr-Jul: 113%

Cryptos that lost ground pumped harder. Winners didn't do as well.

So the real takeaway from this is:

• Losers tend to bounce back (surprisingly well)

• Buying the top is a bad idea

• Winners tend to continue doing well

• Losers tend to bounce back (surprisingly well)

• Buying the top is a bad idea

• Winners tend to continue doing well

If you'd like to take a look, here are the biggest losers and winners of the last 1.5 months.

$MATIC is the only top 200 crypto that pumped across all time frames:

• 66% Apr -July

• 162% July - Nov

• 12% Nov - Today.

$MATIC is the only top 200 crypto that pumped across all time frames:

• 66% Apr -July

• 162% July - Nov

• 12% Nov - Today.

Did you like the thread? Please do me a favor by favoriting/retweeting it. I've got it linked below.👇

Give me a follow if you're interested in more data-backed altcoin analysis: @jackniewold

Give me a follow if you're interested in more data-backed altcoin analysis: @jackniewold

https://twitter.com/JackNiewold/status/1471658337418637313?s=20

Last thing: this thread is based on a newsletter I wrote! You should check it out, we perform crypto analysis and write reports on altcoins!

Link below: cryptopragmatist.com/sign-up-twitte…

Link below: cryptopragmatist.com/sign-up-twitte…

• • •

Missing some Tweet in this thread? You can try to

force a refresh