Five bullish thoughts I've had on $SPELL:

(thread) 👇

(thread) 👇

1. There's definitely a chance that @danielesesta is a manic, anarchistic autocrat and that $SPELL goes to zero.

But if he ends up being crypto's Steve Jobs, his projects could 100x.

Zero or 100x = risk/reward asymmetry.

But if he ends up being crypto's Steve Jobs, his projects could 100x.

Zero or 100x = risk/reward asymmetry.

2. This might be the first memecoin with actual utility.

I'm not sure if that's more or less powerful than something like $DOGE.

I'm not sure if that's more or less powerful than something like $DOGE.

3. Big downward price pressure has been put on $SPELL due to emissions paid to liquidity providers.

$SPELL liquidity on CEXes is virtually free: the market is made by the CEX, so buyers pay the cost via fees/unfavorable spread.

$SPELL liquidity on CEXes is virtually free: the market is made by the CEX, so buyers pay the cost via fees/unfavorable spread.

This means that $SPELL trading on centralized exchanges brings volume without downward price pressure, and thus positive price pressure.

Bullish.

Bullish.

4. Borrowing against yield-bearing collateral is much more LT-viable than directly borrowing against crypto assets. (MakerDAO collateralizes loans against $ETH)

• Less liquidation risk

• Doesn't depend on positive returns

• Guaranteed yields

• Less liquidation risk

• Doesn't depend on positive returns

• Guaranteed yields

5. The narrative of buying something and getting paid for it is a great way to introduce the mainstream to DeFi.

There's no hook to yield farming, AMMs, or synthetic assets.

But getting paid to borrow? That's very compelling.

There's no hook to yield farming, AMMs, or synthetic assets.

But getting paid to borrow? That's very compelling.

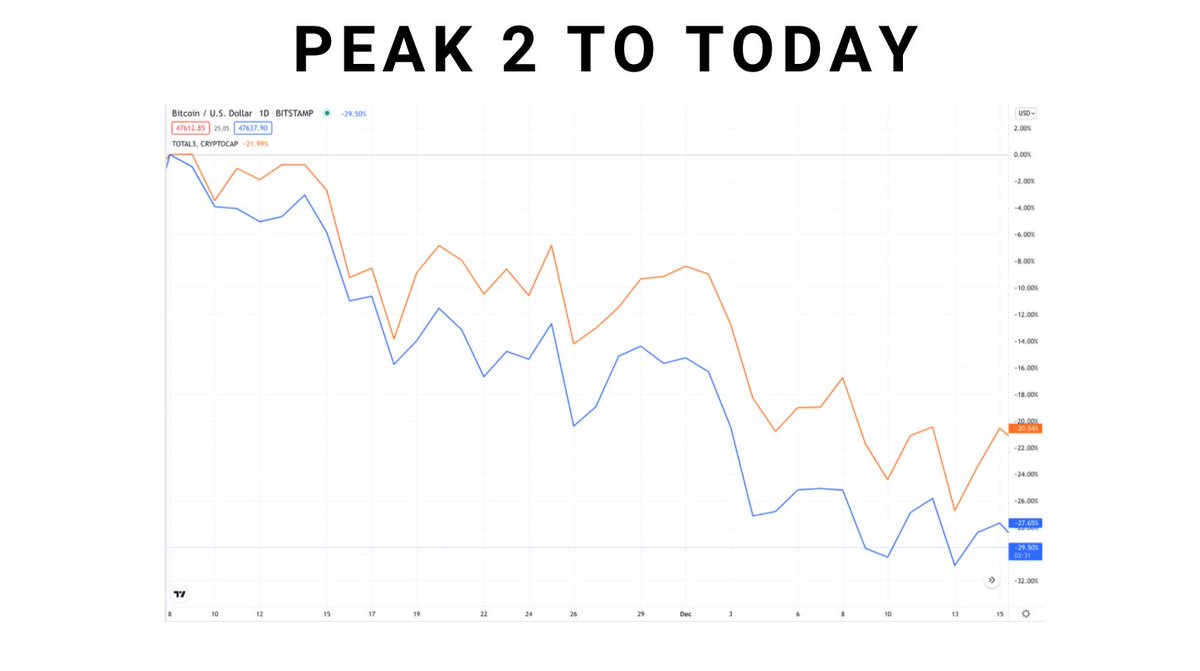

Market conditions have had me a bit nervous lately, but I think the short-term conviction I've had with $SPELL is expanding out to the long term.

If we do head for a bear market, I'll probably be accumulating.

If we do head for a bear market, I'll probably be accumulating.

One more thing. If you're new to my altcoin analysis coverage, consider checking out my newsletter (cryptopragmatist.com/sign-up/) and/or my altcoin reports.

You can get the $SPELL report for free via the tweet below.

You can get the $SPELL report for free via the tweet below.

https://twitter.com/JackNiewold/status/1450880516908064775?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh