How I'm getting 240000% APY on my MEMO, instead of the usual 80000%, a thread

#wonderland #FrogNation #pendle #memo @pendle_fi

#wonderland #FrogNation #pendle #memo @pendle_fi

1st step: starting with 0.56 MEMO, I wrapped it to wMEMO on Wonderland:

snowtrace.io/tx/0x15f6bd9da…

snowtrace.io/tx/0x15f6bd9da…

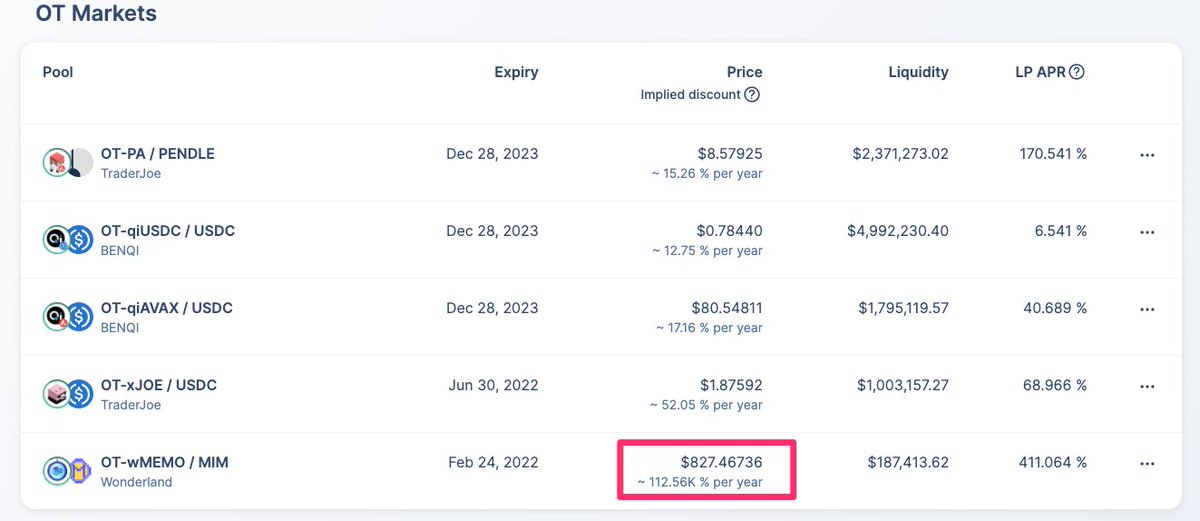

2nd step: using Pendle, I converted the wMEMO into 0.56 YT-wMEMO and 0.56 OT-wMEMO

snowtrace.io/tx/0x70b503b78…

snowtrace.io/tx/0x70b503b78…

Anw, what the heck are these YT-wMEMO and OT-wMEMO tokens?

Basically, 1 YT-wMEMO will constantly give you the staking yield on 1 MEMO in Wonderland (currently at ~80k%) until the expiry (24 Feb 22)

1 OT-wMEMO will give you the right to get back 1MEMO after the expiry

Basically, 1 YT-wMEMO will constantly give you the staking yield on 1 MEMO in Wonderland (currently at ~80k%) until the expiry (24 Feb 22)

1 OT-wMEMO will give you the right to get back 1MEMO after the expiry

Ok back to business, 3rd step: I converted all the 0.567 OT-wMEMO into 0.404 YT-wMEMO, by swapping OT-wMEMO to MIM in TraderJoe and swapping MIM to OT-wMEMO in Pendle

snowtrace.io/tx/0xe88253ced…

snowtrace.io/tx/0xe8b3ad9ac…

snowtrace.io/tx/0xe88253ced…

snowtrace.io/tx/0xe8b3ad9ac…

4th step: sit back and relax until the expiry (24 Feb 2022), while my 0.40+0.56=0.96 YT-wMEMO is working hard to give me that juicy 240000% APY

Why 240000% APY? Well, 0.96 YT-wMEMO will give me yield on 0.96 MEMO for 69 days from now until the expiry, that is 0.96 * (1+80000%)^(69/365) - 0.96 = 2.44 MEMO

Getting 2.44 MEMO from a 0.56 MEMO capital within 69 days is basically (2.44/0.56)^(365/69)-1 = 240000% APY

Getting 2.44 MEMO from a 0.56 MEMO capital within 69 days is basically (2.44/0.56)^(365/69)-1 = 240000% APY

How is this even possible? Is this a scam?

Well, I must say that I was somewhat lucky because YT-wMEMO was significantly underpriced this morning in Pendle’s AMM.

Well, I must say that I was somewhat lucky because YT-wMEMO was significantly underpriced this morning in Pendle’s AMM.

However, the point here is that: with Pendle, it's possible to execute these strategies if you understand well enough and have good timing.

FYI (NFA): YT-wMEMO is still almost as underpriced now as I am writing this thread

FYI (NFA): YT-wMEMO is still almost as underpriced now as I am writing this thread

Ser, but how do I understand all this math to execute these trades?

I have made this calculator just for you to put in simple numbers and be able to see the APY for this particular strategy:

docs.google.com/spreadsheets/d…

You are welcome, anon

I have made this calculator just for you to put in simple numbers and be able to see the APY for this particular strategy:

docs.google.com/spreadsheets/d…

You are welcome, anon

If you would like to discuss more on yield trading using Pendle, feel free to join our Discord at discord.gg/uawbcnRMK9

Link to more resources regarding MEMO yield trading on Pendle:

Link to more resources regarding MEMO yield trading on Pendle:

https://twitter.com/pendle_fi/status/1471481317996982272?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh