How I am getting a guaranteed* fixed yield of 112000% on my MEMO, a thread

#wonderland #FrogNation #pendle #memo

@pendle_fi

*assuming no contract risks

#wonderland #FrogNation #pendle #memo

@pendle_fi

*assuming no contract risks

Before that, what do I mean by a guaranteed fixed yield? It means that no matter what happens (to Wonderland’s rebase APY, or to Wonderland's treasury,...), assuming no smart contract risks, I am guaranteed to get that yield rate.

So how did I do it?

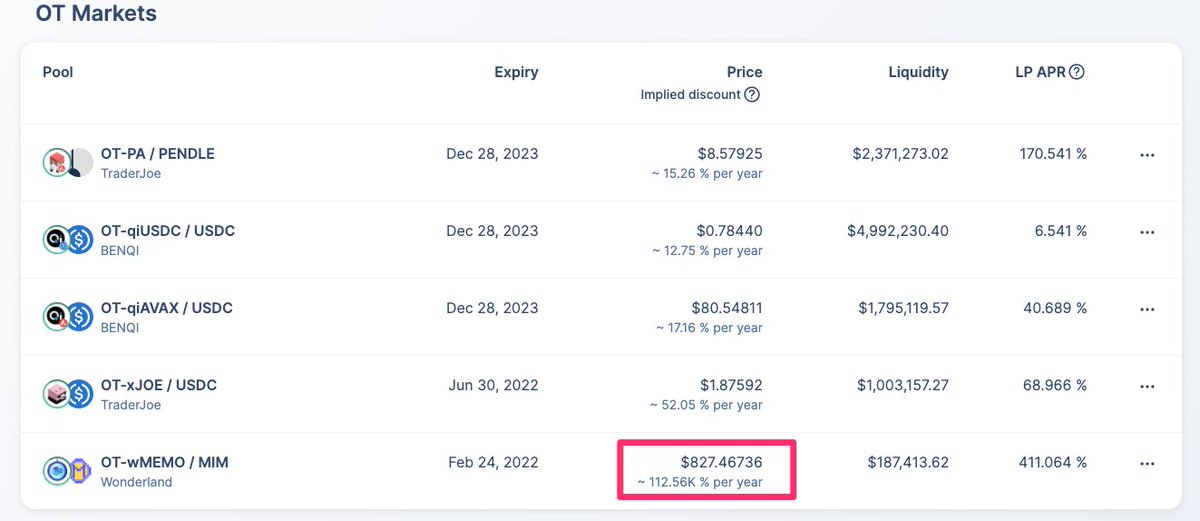

1st step: I visited Pendle app at app.pendle.finance/market to check the Implied discount of OT-wMEMO

When I was doing this yesterday, the Implied discount was shown at ~112000%

1st step: I visited Pendle app at app.pendle.finance/market to check the Implied discount of OT-wMEMO

When I was doing this yesterday, the Implied discount was shown at ~112000%

Anyway, what is this OT-wMEMO token? Basically, 1 OT-wMEMO can be converted into 1 MEMO after the expiry (24th Feb 22 in this case). Because of the wait, 1 OT-wMEMO is trading at a lower price than MEMO

Now for the 2nd step: I went to TraderJoe to buy 1 OT-wMEMO with 837 MIM. A convenient way to navigate to buy OT is to click the three dots on the market and choose Swap

My transaction: snowtrace.io/tx/0x7ab31b7ce…

My transaction: snowtrace.io/tx/0x7ab31b7ce…

3rd step: sit back and relax until the expiry (24th Feb 2022) to covert 1 OT-wMEMO to 1 MEMO.

Since my initial capital was 837 MIM = 0.278 MEMO (TIME was $3012), and I’m getting back 1 MEMO after 66.5 days, my fixed APY was (1/0.278)^(365/66.5)-1 = 112000%

Since my initial capital was 837 MIM = 0.278 MEMO (TIME was $3012), and I’m getting back 1 MEMO after 66.5 days, my fixed APY was (1/0.278)^(365/66.5)-1 = 112000%

How is this possible? I would say I was lucky again to be able to buy OT-wMEMO at such a relatively cheap price (and high implied discount). At the time of writing this thread, OT-wMEMO’s implied discount is only 66000%.

However, since the yield you are getting from buying OT-wMEMO is fixed and “guaranteed”, one could argue that it should be less than the floating yield (of 80k%), because of uncertainties.

Anw, the point of this strategy is that you would be able to fix your MEMO yield, which protects you against uncertainties. You could even beat the floating yield of 80k% if you are lucky.

You could check out this calculator for the different ways to maximise your MEMO yield using Pendle: docs.google.com/spreadsheets/d…

The strategy mentioned in this thread is Option 3, you could check out another strategy for Option 2 here:

The strategy mentioned in this thread is Option 3, you could check out another strategy for Option 2 here:

https://twitter.com/gabavineb/status/1471782829419745284?s=20

If you would like to discuss more on yield trading using Pendle, feel free to join our Discord at discord.gg/uawbcnRMK9

Link to other resources regarding MEMO yield trading on Pendle:

Link to other resources regarding MEMO yield trading on Pendle:

https://twitter.com/pendle_fi/status/1471481317996982272?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh