It's the weekend!

Grab a cup of coffee, in this thread I will explain

1. What are REITs and REOCs?

2. How do they work?

3. How to value and invest in them?

Lets dive right in!

Grab a cup of coffee, in this thread I will explain

1. What are REITs and REOCs?

2. How do they work?

3. How to value and invest in them?

Lets dive right in!

This is Embassy Golf Links Business Park, my old office, the place I spent 12 hours a day, 5 days a week for 7 years.

It's one of the biggest and oldest Business Parks in Bangalore, spread across 2.7 million square feet and is centrally located.

Lush green fields, swans and adjacent golf course adore the business park.

It is home to Indian offices of International Investment Banks, Insurance Companies, Tech firms like Microsoft and IBM and even start ups like Ola!

It is home to Indian offices of International Investment Banks, Insurance Companies, Tech firms like Microsoft and IBM and even start ups like Ola!

Is it too expensive and you don't have 1500cr lying in your bank account?

You're worried about Real Estate cycles and don't want to put substantial part of your net worth in Real Estate?

Well, lets fix that.

You're worried about Real Estate cycles and don't want to put substantial part of your net worth in Real Estate?

Well, lets fix that.

REITs were created in 1960s United States, when then President Dwight Eisenhower signed a new law called the 'Cigar Excise Tax Law'

The purpose of the law was to allow small investors invest in large scale income producing real estate projects.

The purpose of the law was to allow small investors invest in large scale income producing real estate projects.

US in 1960s was going through an infrastructure boom & Govt couldn't fund everything on its own

REITs allowed a common US citizen to become a part owner of an infrastructure project and the developers could easily raise necessary funds to develop

It was a win-win for everybody.

REITs allowed a common US citizen to become a part owner of an infrastructure project and the developers could easily raise necessary funds to develop

It was a win-win for everybody.

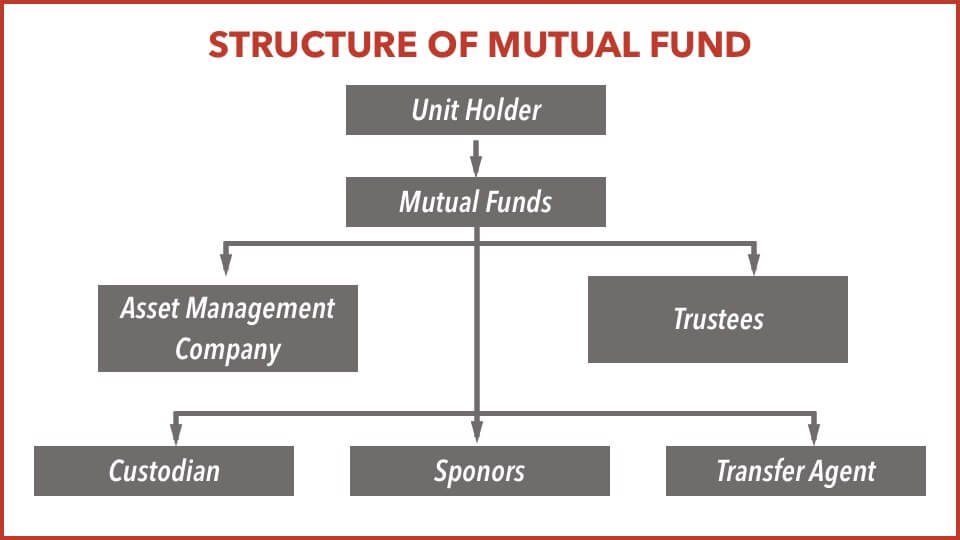

REITs are modelled after Mutual Funds

When you invest in a Mutual Fund you are allocated units

These units represent part ownership in all the assets (shares of various companies) owned by the Mutual Fund.

When you invest in a Mutual Fund you are allocated units

These units represent part ownership in all the assets (shares of various companies) owned by the Mutual Fund.

Similarly, when you buy a REIT, you're allocated units which represent part ownership in all the assets owned by a REIT

The only difference is, in a REIT, assets are limited to real estate properties while in a Mutual Fund, assets are limited to shares/bonds of a listed company.

The only difference is, in a REIT, assets are limited to real estate properties while in a Mutual Fund, assets are limited to shares/bonds of a listed company.

At a broader level there are three main types of REITs

1⃣ Equity

2⃣ Mortgage

3⃣ Hybrid

Here is what each of them do.

1⃣ Equity

2⃣ Mortgage

3⃣ Hybrid

Here is what each of them do.

When you invest in a Mutual Fund today, your money doesn't go into the bank account of the Asset Management Company (AMC)

Instead it is routed to an Investment Trust referred to as 'Trustee'

The AMC has discretion to use the funds and invest them in wherever they think is best.

Instead it is routed to an Investment Trust referred to as 'Trustee'

The AMC has discretion to use the funds and invest them in wherever they think is best.

Similarly, in a REIT, your money is routed to an investment trust managed by a 'Trustee'

The REIT Manager has discretion to investment funds from the Trust into various real estate properties.

The REIT Manager has discretion to investment funds from the Trust into various real estate properties.

The main reason why REITs are structured this way is to enable them to be

1⃣ Liquid - An investor should be able to Buy and Sell Units whenever they want

2⃣ To prevent Taxes - REITs are exempt from taxes at corporate and trust level

1⃣ Liquid - An investor should be able to Buy and Sell Units whenever they want

2⃣ To prevent Taxes - REITs are exempt from taxes at corporate and trust level

When a REIT generates rental income from its real estate properties, it is by Law required to distribute more than 90% of this income to its unit holders

Another advantage of REIT over Traditional Real Estate is that when you buy a real estate property yourself, you're limited to investment amount you can come up with.

For an individual is very hard to buy a large 2.7 Million Sq feet business park in the central business district

For an individual is very hard to buy a large 2.7 Million Sq feet business park in the central business district

The only major difference between the two are

1⃣ REITs primary income is from income (rent) produced by their real estate portfolio while REOCs primary income is from buying and selling real estate properties

2⃣ REITs are required to distribute income, REOCs reinvest it

1⃣ REITs primary income is from income (rent) produced by their real estate portfolio while REOCs primary income is from buying and selling real estate properties

2⃣ REITs are required to distribute income, REOCs reinvest it

Since 1960s REITs have come a long way

Today you can find a REIT to invest in any type of real estate property from warehouses, to hospitals to casinos, to data centers.

If there is a type of real estate property, you can find a listed REIT for it.

Today you can find a REIT to invest in any type of real estate property from warehouses, to hospitals to casinos, to data centers.

If there is a type of real estate property, you can find a listed REIT for it.

Digital Realty, owns and operates data centers across the world for some of the biggest tech firms in the world

In return it charges them a fee/rent for its services which is then distributed to the REIT holders.

In return it charges them a fee/rent for its services which is then distributed to the REIT holders.

Its a simple proxy bet on greater use of technology in the world.

Whether it is cloud computing or autonomous vehicles, everyone will ultimately use a data center and Digital Realty will be there to provide that service.

Whether it is cloud computing or autonomous vehicles, everyone will ultimately use a data center and Digital Realty will be there to provide that service.

While the unitholders of the REIT have received 90%+ of the profits/income of the company, the value of their units too have increased 14x since listing

REITs like Mutual Funds are valued at Net Asset Value(NAV)

You should only buy a REIT when it is available for below its NAV

This is same as buying a stock below its intrinsic value

Calculating intrinsic value of a REIT is much easier than a stock

Intrinsic Value of REIT = NAV

You should only buy a REIT when it is available for below its NAV

This is same as buying a stock below its intrinsic value

Calculating intrinsic value of a REIT is much easier than a stock

Intrinsic Value of REIT = NAV

Another important point to keep in mind while investing in REITs is that these are not your typical growth investments

No REIT will ever give you a 100x return in 10 or 20 years

REITs instead are income investments designed to mimic the income yield from real estate

No REIT will ever give you a 100x return in 10 or 20 years

REITs instead are income investments designed to mimic the income yield from real estate

Combine REIT investing with emerging themes and you can build a good low risk investment case

Pick up any real estate theme and you will find a listed REIT for it.

While REITs as an investment market are much more matured in US and Canada, the journey of REITs have only begun in India

There are only three listed REITs in India and all are targeted at commercial/office properties

1. Embassy REIT

2. Brookfield India Real Estate

3. Mindspace Business REIT

1. Embassy REIT

2. Brookfield India Real Estate

3. Mindspace Business REIT

The Embassy Golf Links Business park we talked about earlier?

It is owned by Embassy REIT

If you buy a few units of the listed Embassy REIT, you automatically become a part owner of the property and every other property owned by the REIT.

It is owned by Embassy REIT

If you buy a few units of the listed Embassy REIT, you automatically become a part owner of the property and every other property owned by the REIT.

I hope this thread helped you understand what REITs are and how you can incorporate them into your portfolios.

If you're new here, I write a new thread every weekend, explaining an investing concept.

Here is a link to all my other threads

If you're new here, I write a new thread every weekend, explaining an investing concept.

Here is a link to all my other threads

https://twitter.com/itsTarH/status/1401095938945425410?s=20

I also write detailed posts on various emerging themes, investment opportunities and deep dives into listed companies across US, India and China

You may subscribe for free to read them at investkaroindia.substack.com

You may subscribe for free to read them at investkaroindia.substack.com

Please retweet, the first tweet in this thread.

https://twitter.com/itsTarH/status/1472144135943385091?s=20

Thank you for reading!

See you all next weekend with a brand new thread🧵

See you all next weekend with a brand new thread🧵

• • •

Missing some Tweet in this thread? You can try to

force a refresh