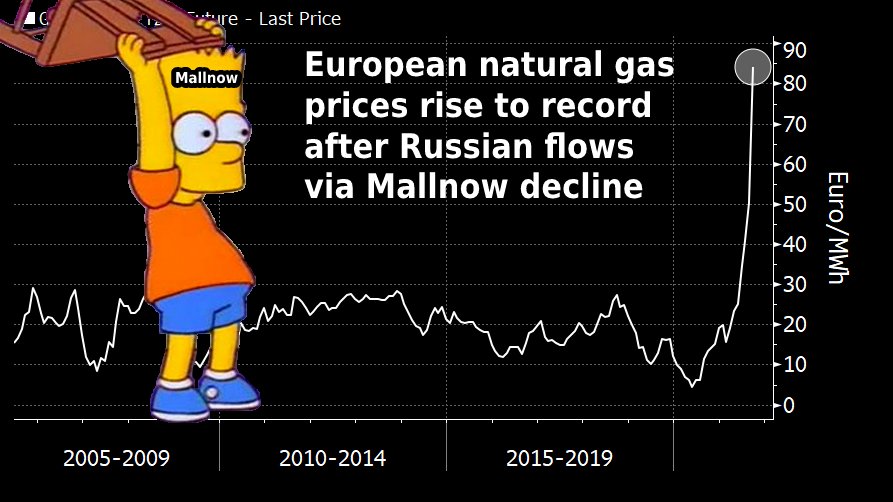

European natural gas traders are waiting for a cold snap that could see prices break new records 🥶 📈

Only a mild winter seems capable of alleviating the stress on the energy market as the world grapples with a fuel shortage

Via @rachelmorison

bloomberg.com/news/articles/…

Only a mild winter seems capable of alleviating the stress on the energy market as the world grapples with a fuel shortage

Via @rachelmorison

bloomberg.com/news/articles/…

The bad news:

The rest of December is set to be colder than usual and this will persist into January with widespread below average temperatures for the first two weeks ⛄️

Frigid cold weather means rolling blackouts could be a last resort ⚡️

The rest of December is set to be colder than usual and this will persist into January with widespread below average temperatures for the first two weeks ⛄️

Frigid cold weather means rolling blackouts could be a last resort ⚡️

Russian natural gas flows remain weak, exacerbating the supply crunch 🇷🇺

If Russian gas exports remain at current levels, Europe’s storage sites will be less than 15% full at the end of March, the lowest on record, according to consultant consultant Wood Mackenzie

If Russian gas exports remain at current levels, Europe’s storage sites will be less than 15% full at the end of March, the lowest on record, according to consultant consultant Wood Mackenzie

https://twitter.com/JavierBlas/status/1472505786878287877

European daily power prices for Monday surged due to colder-than-normal temperatures, sky-high gas prices and nuclear outages

🇪🇸 Spanish daily power prices rise to a record 339.84 euros

🇫🇷 French day-ahead jumps to highest since rare peak in 2009

bloomberg.com/news/articles/…

🇪🇸 Spanish daily power prices rise to a record 339.84 euros

🇫🇷 French day-ahead jumps to highest since rare peak in 2009

bloomberg.com/news/articles/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh