Alpha is hard to come by, especially in a space filled with unlimited amounts of info contrived behind economic bias

Yet, the blockchain still offers tons of strategies to put yourself above the rest

You CAN afford to be a genius.

Here’s how a pastry finds breadcrumbs… 🧁

Yet, the blockchain still offers tons of strategies to put yourself above the rest

You CAN afford to be a genius.

Here’s how a pastry finds breadcrumbs… 🧁

Etherscan

The beauty of blockchain technology is its transparency.

Anything & everything that occurs is published on-chain, readily at the hands of the public.

Learning your way around Etherscan will place you first among those looking for new opportunities

The beauty of blockchain technology is its transparency.

Anything & everything that occurs is published on-chain, readily at the hands of the public.

Learning your way around Etherscan will place you first among those looking for new opportunities

Analytical tools (GlassNode, Nansen)

The data doesn’t lie.

Paid tools like GlassNode & Nansen are well worth the money and provide you with a variety of metrics you can use to develop your own thesis for your investments

The data doesn’t lie.

Paid tools like GlassNode & Nansen are well worth the money and provide you with a variety of metrics you can use to develop your own thesis for your investments

Podcasts (Real Vision, Bankless HQ)

This section is still extremely underrated.

There are a select few groups dedicated to sharing their expertise on crypto on a daily basis who’s podcasts are filled with meaningful & intelligent discussion

This section is still extremely underrated.

There are a select few groups dedicated to sharing their expertise on crypto on a daily basis who’s podcasts are filled with meaningful & intelligent discussion

Discord groups

Twitter is for gossip, Telegram is for moonboy talk, but Discord is where the real chatter takes place.

Find a group of like minded individuals who are determined to make money, & collectively you can share your knowledge & successes together

Twitter is for gossip, Telegram is for moonboy talk, but Discord is where the real chatter takes place.

Find a group of like minded individuals who are determined to make money, & collectively you can share your knowledge & successes together

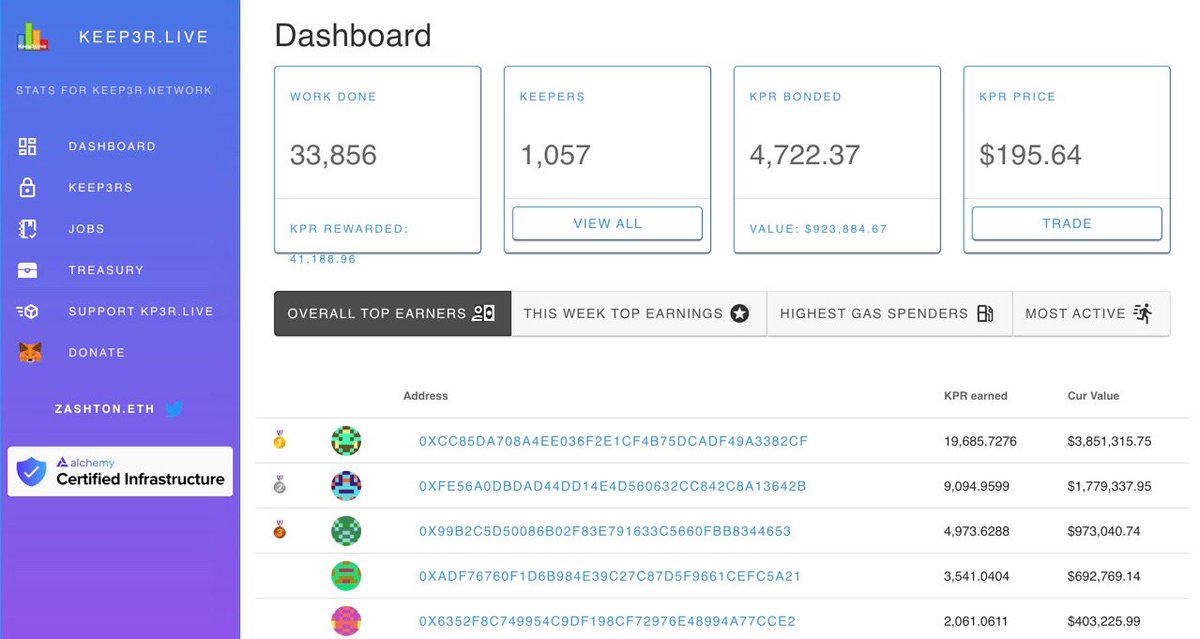

Wallet tracking

In other words, follow the money. Find big players that actively trade on DEX’s and track their wallets on Nansen or Zerion.

Odds are that if someone with a substantial amount of money puts a large amount into a project, they know something that you don’t know.

In other words, follow the money. Find big players that actively trade on DEX’s and track their wallets on Nansen or Zerion.

Odds are that if someone with a substantial amount of money puts a large amount into a project, they know something that you don’t know.

Education

You will have a difficult time finding alpha in this space if you aren’t willing to inform yourself about it.

In any financial market (especially crypto), those with particular expertise in the area outperform average traders 99 times out of 100.

You will have a difficult time finding alpha in this space if you aren’t willing to inform yourself about it.

In any financial market (especially crypto), those with particular expertise in the area outperform average traders 99 times out of 100.

Narrative flips

A large amount of the crypto markets movements can be attributed to hype or narratives

These narratives change quickly, but being first to spot them is extremely profitable

We saw it w yield farming, we saw it w dog coins, we saw it w L1’s, & we will see it w X

A large amount of the crypto markets movements can be attributed to hype or narratives

These narratives change quickly, but being first to spot them is extremely profitable

We saw it w yield farming, we saw it w dog coins, we saw it w L1’s, & we will see it w X

https://twitter.com/croissanteth/status/1430293254684151808

News

Stay up to date with news.

A single headline can be the difference of -50% or +50% in one day.

Additionally, you will be the first to spot partnerships or potentially bearish news which you can then act on accordingly.

Stay up to date with news.

A single headline can be the difference of -50% or +50% in one day.

Additionally, you will be the first to spot partnerships or potentially bearish news which you can then act on accordingly.

Get involved

We’re still so early in this space that dedicating even a portion of your time to it will be profitable.

The people who got the 2 largest airdrops in history (Uni, Dydx) didn’t get it because they were aware they’d receive an airdrop, but because they were involved

We’re still so early in this space that dedicating even a portion of your time to it will be profitable.

The people who got the 2 largest airdrops in history (Uni, Dydx) didn’t get it because they were aware they’d receive an airdrop, but because they were involved

Funding rounds

Stay up to date with funding rounds from established (emphasis on “established”) VC’s like Alameda Research & CB ventures.

These big players know what they’re doing and invest in the top of the top quality projects

Stay up to date with funding rounds from established (emphasis on “established”) VC’s like Alameda Research & CB ventures.

These big players know what they’re doing and invest in the top of the top quality projects

Bear markets

While these market conditions are dreadful for the majority of traders, bear markets are where the real money is made.

Depending on its length, bear markets present opportunities to buy extremely undervalued blue chips projects at a discount

While these market conditions are dreadful for the majority of traders, bear markets are where the real money is made.

Depending on its length, bear markets present opportunities to buy extremely undervalued blue chips projects at a discount

Biz

This place isn’t for everyone, but i’ve included it because it has been of paramount importance during my time in crypto.

Among the midst of shitposts, there are a few extremely intelligent anons that will drop the occasional alpha

This place isn’t for everyone, but i’ve included it because it has been of paramount importance during my time in crypto.

Among the midst of shitposts, there are a few extremely intelligent anons that will drop the occasional alpha

New primitives

Innovation here is rampant. We are barely tapping into the uses of this tech & there are new frontiers discovered every day

AMM’s (Uni, Sushi), Yield farming (YFI, COMP), & flashloans (Aave) all presented extremely profitable investments opportunities

Innovation here is rampant. We are barely tapping into the uses of this tech & there are new frontiers discovered every day

AMM’s (Uni, Sushi), Yield farming (YFI, COMP), & flashloans (Aave) all presented extremely profitable investments opportunities

Determination

Making money here isn’t easy.

In crypto, you either make money or end up learning a lesson.

Don’t let a few bad trades bring down your confidence & instead reflect upon these decisions and apply what you’ve learned in the future

Making money here isn’t easy.

In crypto, you either make money or end up learning a lesson.

Don’t let a few bad trades bring down your confidence & instead reflect upon these decisions and apply what you’ve learned in the future

Patience

Having a long term outlook in this space is key.

Alpha doesn’t always come around a lot, but when it does it rewards heavily.

Missing out on an opportunity is better than pulling the trigger & being wrong.

Remember, all it takes is one trade.

Having a long term outlook in this space is key.

Alpha doesn’t always come around a lot, but when it does it rewards heavily.

Missing out on an opportunity is better than pulling the trigger & being wrong.

Remember, all it takes is one trade.

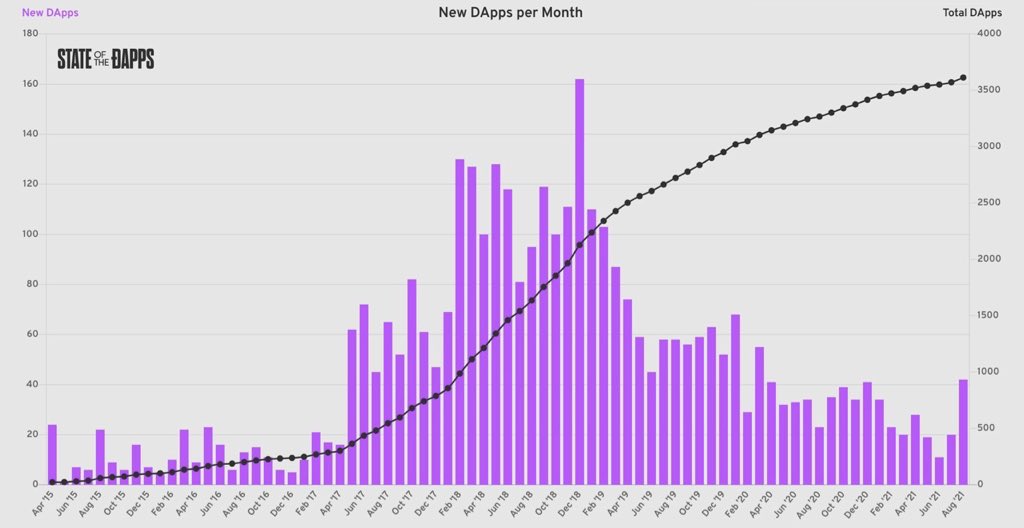

Learn to code

Not only will it be useful in a variety of fields outside of crypto, but it will also place you years ahead of your competitors.

Additionally, demand for developers has gone exponential, & established solidity devs/auditors are making upwards of $200k/yr

Not only will it be useful in a variety of fields outside of crypto, but it will also place you years ahead of your competitors.

Additionally, demand for developers has gone exponential, & established solidity devs/auditors are making upwards of $200k/yr

Github

This ecosystem is a lot smaller than you think. Well known devs usually do freelance work for other startups that may not be too well known.

Learning your way around Github & following the contributions of these devs will get you in on quality projects first

This ecosystem is a lot smaller than you think. Well known devs usually do freelance work for other startups that may not be too well known.

Learning your way around Github & following the contributions of these devs will get you in on quality projects first

Go out on your own

Alpha is rarely given out for free.

If you truly want it bad enough, you have go out & do what the person beside you isn’t willing to do.

Alpha is rarely given out for free.

If you truly want it bad enough, you have go out & do what the person beside you isn’t willing to do.

• • •

Missing some Tweet in this thread? You can try to

force a refresh