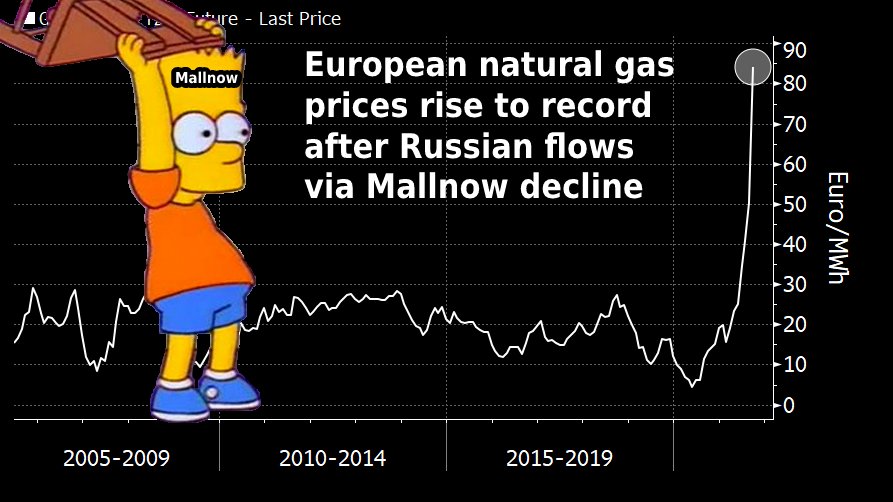

🚨EUROPEAN NATURAL GAS PRICES SURGE TO NEW RECORD🚨

Dutch TTF futures topped 162 euros/MWh for the first time. Here are some of the reasons why:

> Lower flows via Russia

> Colder weather

> Nuclear outages

> Very low inventories

> LNG production issues

bloomberg.com/news/articles/…

Dutch TTF futures topped 162 euros/MWh for the first time. Here are some of the reasons why:

> Lower flows via Russia

> Colder weather

> Nuclear outages

> Very low inventories

> LNG production issues

bloomberg.com/news/articles/…

So how did we get here? 🤔

The writing had been on the wall for years

Since there was a lack of investment in 2017-18, supplies were already slated to be tight in the early 2020s

Investments in new upstream gas comes in cycles. And it takes years for LNG projects to start up

The writing had been on the wall for years

Since there was a lack of investment in 2017-18, supplies were already slated to be tight in the early 2020s

Investments in new upstream gas comes in cycles. And it takes years for LNG projects to start up

To make matters worse, utilities were lulled into a false sense of security in 2018 and 2019 due to milder-than-normal winters

Prices continued to fall due to the persistent supply glut. So utilities doubled down on cheap gas amid a shift away from coal

bloomberg.com/news/articles/…

Prices continued to fall due to the persistent supply glut. So utilities doubled down on cheap gas amid a shift away from coal

bloomberg.com/news/articles/…

Then Covid hit 🦠

The world's biggest LNG importers saw demand disappear. China's economy shut down, Japan canceled school, European borders closed

Natural gas prices fell to a record low in April 2020 -- $1.83/mmbtu in Asia

bloomberg.com/professional/b…

The world's biggest LNG importers saw demand disappear. China's economy shut down, Japan canceled school, European borders closed

Natural gas prices fell to a record low in April 2020 -- $1.83/mmbtu in Asia

bloomberg.com/professional/b…

It’s easy to forget, but last year’s global natural gas glut was intense

🇯🇵 🇰🇷 Japan and Korea were asking suppliers to delay LNG deliveries

🇺🇸 US LNG buyers were cancelling scheduled loading due to lacklustre overseas prices and weak demand

bloomberg.com/news/articles/…

🇯🇵 🇰🇷 Japan and Korea were asking suppliers to delay LNG deliveries

🇺🇸 US LNG buyers were cancelling scheduled loading due to lacklustre overseas prices and weak demand

bloomberg.com/news/articles/…

But a few short months later, the unexpected happened -- demand came roaring back

Consumption slowly returned due to the economic rebound in China/neighbors, and crescendoed when frigid winter weather hit. That triggered panic buying, sending LNG rates to a record in Jan. 2021

Consumption slowly returned due to the economic rebound in China/neighbors, and crescendoed when frigid winter weather hit. That triggered panic buying, sending LNG rates to a record in Jan. 2021

To put it simply, Asia's biggest gas consumer were caught flat footed in winter 2020-21. And they were forced to pay a heft price to secure spot LNG to keep the lights on

They let their guard down after two mild winters and Covid-related demand destruction earlier in the year

They let their guard down after two mild winters and Covid-related demand destruction earlier in the year

LNG buyers in North Asia weren't going to get caught short again. They started preparing early in 2021 to make sure they would have enough supply in the winter, snatching up spot shipments

China bought so much LNG they will even surpassed Japan as the world's biggest importer

China bought so much LNG they will even surpassed Japan as the world's biggest importer

In Europe, it was a similar story

A long, cold winter -- coupled with the economic rebound -- quickly drained inventories in early 2021. But unlike Asia, Europe struggled to attract much needed LNG to refill stockpiles

That's partly because Asian buyers were willing to pay more

A long, cold winter -- coupled with the economic rebound -- quickly drained inventories in early 2021. But unlike Asia, Europe struggled to attract much needed LNG to refill stockpiles

That's partly because Asian buyers were willing to pay more

Amid all of this, a historic drought hit South America

🇧🇷 Brazil became desperate to replace a collapse in hydroelectric generation, forcing it to reply on gas-fired power generation. Brazil's LNG imports jumped to a record over the summer

bloomberg.com/news/articles/…

🇧🇷 Brazil became desperate to replace a collapse in hydroelectric generation, forcing it to reply on gas-fired power generation. Brazil's LNG imports jumped to a record over the summer

bloomberg.com/news/articles/…

And just as the world needed natural gas the most, production issues plagued some suppliers including:

🇦🇺 Australia

🇵🇪 Peru

🇳🇴 Norway

🇳🇬 Nigeria

🇹🇹 Trinidad

🇩🇿 Algeria

🇲🇾 Malaysia

🇮🇩 Indonesia

🇦🇺 Australia

🇵🇪 Peru

🇳🇴 Norway

🇳🇬 Nigeria

🇹🇹 Trinidad

🇩🇿 Algeria

🇲🇾 Malaysia

🇮🇩 Indonesia

Then there is Russia, which could be a thread of its own 🇷🇺

Uncertainty over the timeline for the Nord Stream 2 pipeline starting up and if Gazprom PJSC will send extra volumes via existing routes across Ukraine and Belarus, have been key price drivers

bloomberg.com/news/articles/…

Uncertainty over the timeline for the Nord Stream 2 pipeline starting up and if Gazprom PJSC will send extra volumes via existing routes across Ukraine and Belarus, have been key price drivers

bloomberg.com/news/articles/…

📈 Russian gas flows via a pipeline to Europe slides? TTF surges

📈 Nord Stream 2 hits a regulatory hurdle? TTF surges

📈 US threatens to slap sanctions on Russia? TTF surges

All eyes have been on Russia, Europe's main supplier of gas

bloomberg.com/news/articles/…

📈 Nord Stream 2 hits a regulatory hurdle? TTF surges

📈 US threatens to slap sanctions on Russia? TTF surges

All eyes have been on Russia, Europe's main supplier of gas

bloomberg.com/news/articles/…

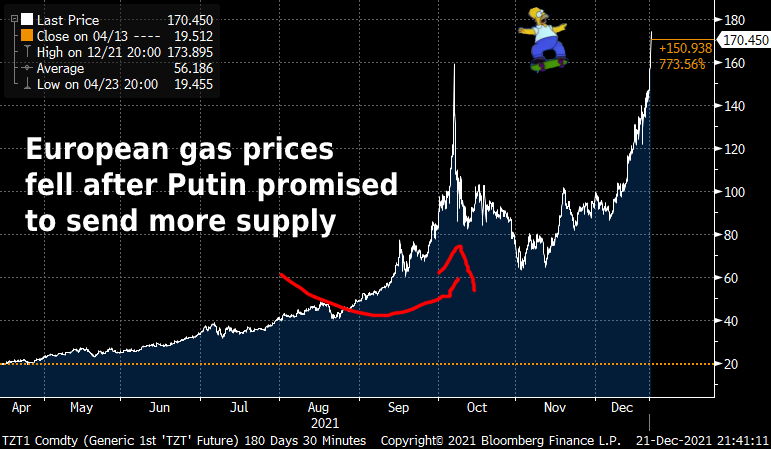

Natural gas prices actually fell in October and remained steady in November after Putin promised more supply to Europe

But as those flows never really materialized, gas prices clawed their way back to a record high levels

But as those flows never really materialized, gas prices clawed their way back to a record high levels

(Recent nuclear outages, higher carbon prices, low wind output and colder weather have also contributed to the rally in European gas prices over the last several months)

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

Silver lining: Asia appears to be well supplied for the winter

But still, as European gas prices rise, it will boost competition for LNG and force Asia to pay higher rates when they need to purchase fuel

Europe is pushing gas rates up around the world

bloomberg.com/news/articles/…

But still, as European gas prices rise, it will boost competition for LNG and force Asia to pay higher rates when they need to purchase fuel

Europe is pushing gas rates up around the world

bloomberg.com/news/articles/…

And so here we are, today is the winter solstice in Europe -- the official start to winter -- and natural gas prices are at a record high

Gas demand will rise as temperatures fall. And there likely isn't enough supply to go around

(TTF jumped 7% since this thread started, btw)

Gas demand will rise as temperatures fall. And there likely isn't enough supply to go around

(TTF jumped 7% since this thread started, btw)

Quick update -- Dutch TTF natural gas futures closed above 180 euros/MWh on Tuesday 🚀🚀

That's a record and nearly 1,000% higher than this time last year

High costs have forced factories to shut down or curb output, while inflation fears climb

bloomberg.com/news/articles/…

That's a record and nearly 1,000% higher than this time last year

High costs have forced factories to shut down or curb output, while inflation fears climb

bloomberg.com/news/articles/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh