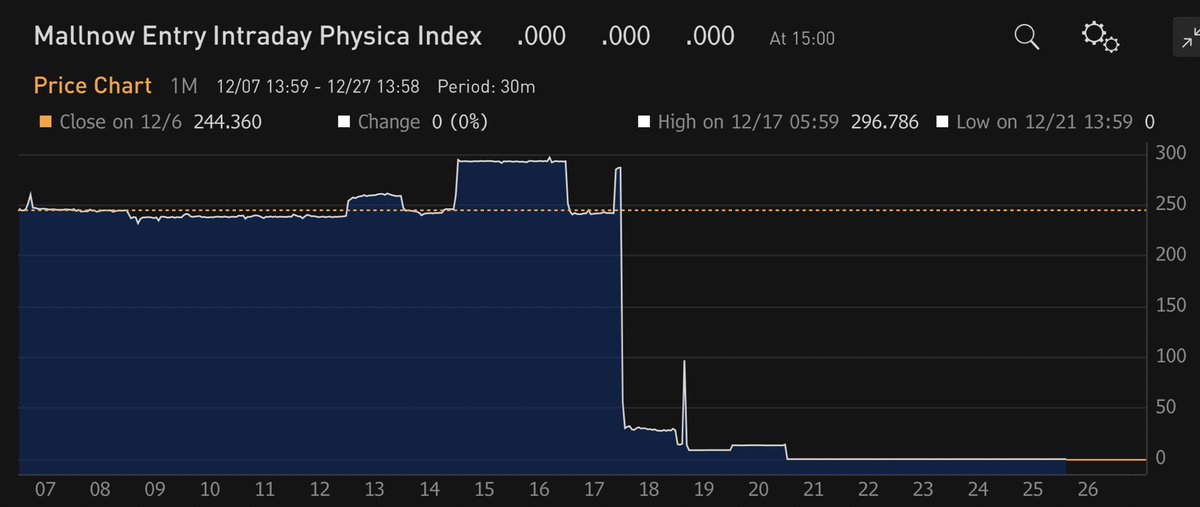

European natural gas prices plummet after hitting record high this week 📉📉

That’s due in part to forecast for mild weather and more LNG deliveries, as well as traders curbing their position on high margin calls

More volatility is expected this winter

news.bloomberglaw.com/international-…

That’s due in part to forecast for mild weather and more LNG deliveries, as well as traders curbing their position on high margin calls

More volatility is expected this winter

news.bloomberglaw.com/international-…

Europe is receiving a lot of LNG deliveries as suppliers divert cargoes away from Asia and other regions 🚢

European buyers are willing to pay more than rivals for spot shipments, making it a prime location for suppliers 💰

European buyers are willing to pay more than rivals for spot shipments, making it a prime location for suppliers 💰

https://twitter.com/sstapczynski/status/1474149324624113666

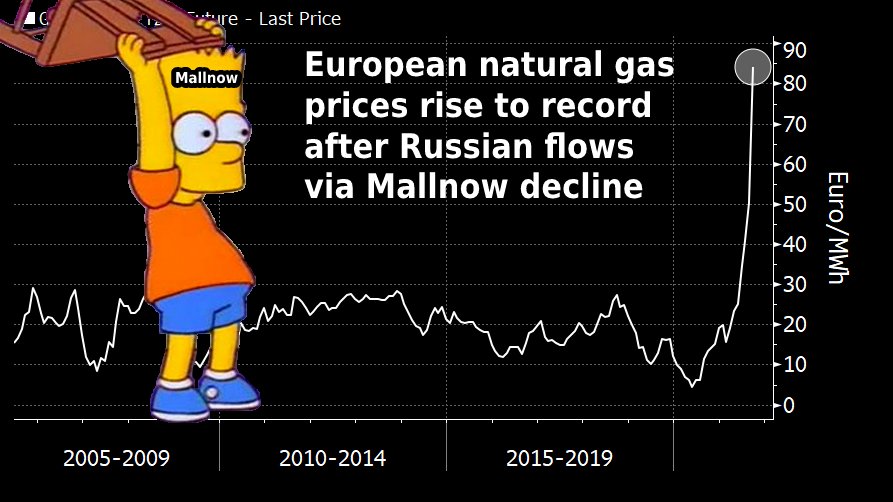

Despite the massive drop in European natural gas futures over the last two days, prices are still way higher than normal and very expensive for consumers

Until this year, TTF barely broke 30 euros/MWh. Now it is casually trading around 100 euros

Until this year, TTF barely broke 30 euros/MWh. Now it is casually trading around 100 euros

European natural gas futures extend slump and are trading near a 3-week low 📉📉📉

An outlook for milder weather, as well as a jump in LNG deliveries, has thrown cold water on the record-breaking rally

An outlook for milder weather, as well as a jump in LNG deliveries, has thrown cold water on the record-breaking rally

“The European energy complex shows no sign of calming down for the holiday period,” said Timera Energy. “Industrial demand has been struggling in response, with metals and fertilizer producers having to curtail production.”

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh