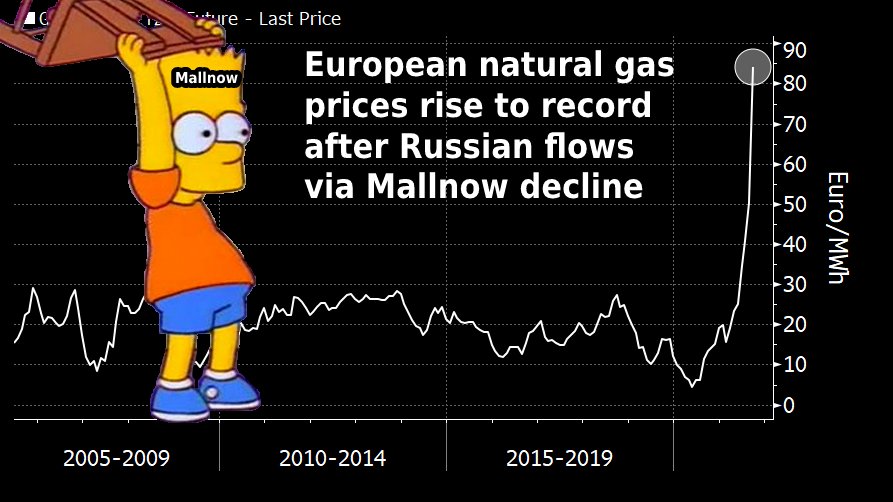

Russian natural gas flows to Europe remain weak 🇷🇺

There were no Gazprom shipments toward Mallnow, a key point on the Yamal-Europe transit route to Germany, for a fifth consecutive day

(Putin says this reflects a lack of requests from European clients)

bloomberg.com/news/articles/…

There were no Gazprom shipments toward Mallnow, a key point on the Yamal-Europe transit route to Germany, for a fifth consecutive day

(Putin says this reflects a lack of requests from European clients)

bloomberg.com/news/articles/…

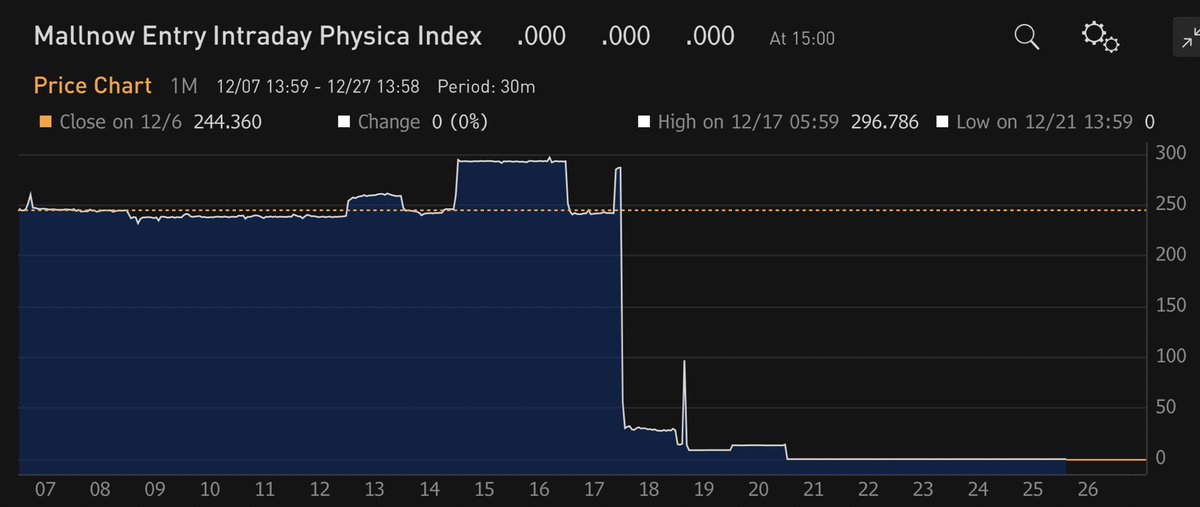

Russian natural gas flows via Mallnow connection on Poland-German border are zero for sixth straight day

Gazprom gas supplies from Belarus (Yamal pipeline) to the EU are down by rough 50% in the last week

Meanwhile, the Mallnow point has been flowing in reverse from Germany to Poland. It usually flows the other way

Meanwhile, the Mallnow point has been flowing in reverse from Germany to Poland. It usually flows the other way

Gazprom and its customers typically arrange a minimal volume that must be supplied and paid for under a pre-set formula that, this year, allowed much lower prices than spot rates

If a buyer wants more gas, they have to pay the prevailing market rate, which is at a record high

If a buyer wants more gas, they have to pay the prevailing market rate, which is at a record high

Response from Russia’s Gazprom 👇

https://twitter.com/afp/status/1475086995772690441

• • •

Missing some Tweet in this thread? You can try to

force a refresh