Hard Reit Portfolio (#REITs + #BTC)

2021 Returns : +60% 🚀

My Holiday Gift to you: a unique portfolio that beats #inflation, outperforms $SPY, and yields a juicy monthly income.

Let me show you this magic portfolio designed to beat inflation and manage volatility...🧵 1/10

2021 Returns : +60% 🚀

My Holiday Gift to you: a unique portfolio that beats #inflation, outperforms $SPY, and yields a juicy monthly income.

Let me show you this magic portfolio designed to beat inflation and manage volatility...🧵 1/10

PORTFOLIO STRUCTURE

The portfolio uses a Barbell Structure (h/t @nntaleb).

80% Long Value #REITs

20% Long #BTC

40% Short $CAD (Leverage)

2/10

The portfolio uses a Barbell Structure (h/t @nntaleb).

80% Long Value #REITs

20% Long #BTC

40% Short $CAD (Leverage)

2/10

ALLOCATION

[53%] #RioCan $REI.UN

[27%] @DreamOfficeREIT $D.UN

[20%] #BTC

[40%] Leverage [Short $CAD]

Income [4.25% Dividend] from the 80% allocation to #REITs services and pays down the 40% leverage with monthly dividend payments.

3/10

[53%] #RioCan $REI.UN

[27%] @DreamOfficeREIT $D.UN

[20%] #BTC

[40%] Leverage [Short $CAD]

Income [4.25% Dividend] from the 80% allocation to #REITs services and pays down the 40% leverage with monthly dividend payments.

3/10

CASH + COMPOUND MACHINE

The portfolio combines a #REIT cash machine with a #BTC compound machine and enhances it with leverage.

1) Cash Machine = pay debt service + invest/allocate monthly

2) Strategic Optionality to pay off leverage

🖨️ Print 💲 Dollars and Stack Sats. 4/10

The portfolio combines a #REIT cash machine with a #BTC compound machine and enhances it with leverage.

1) Cash Machine = pay debt service + invest/allocate monthly

2) Strategic Optionality to pay off leverage

🖨️ Print 💲 Dollars and Stack Sats. 4/10

INVESTMENT CHARACTERISTCS

Inflation Protection + Durability/Anti-Fragility + Income + Growth

This combination of characteristics helps the portfolio manage volatility and inflation. It utilizes a leveraged value/income core with a growth kicker.

5/10

Inflation Protection + Durability/Anti-Fragility + Income + Growth

This combination of characteristics helps the portfolio manage volatility and inflation. It utilizes a leveraged value/income core with a growth kicker.

5/10

LOW CORRELATION +

VOLATILITY OPPOSITES

The magic of the #REITs and #BTC relationship is created by combining a low correlation (0.15) with opposite ends of the volatility spectrum.

#REITS Daily Std Deviation Vol 1%

#BTC Daily Std Deviation Vol 5%

6/10

VOLATILITY OPPOSITES

The magic of the #REITs and #BTC relationship is created by combining a low correlation (0.15) with opposite ends of the volatility spectrum.

#REITS Daily Std Deviation Vol 1%

#BTC Daily Std Deviation Vol 5%

6/10

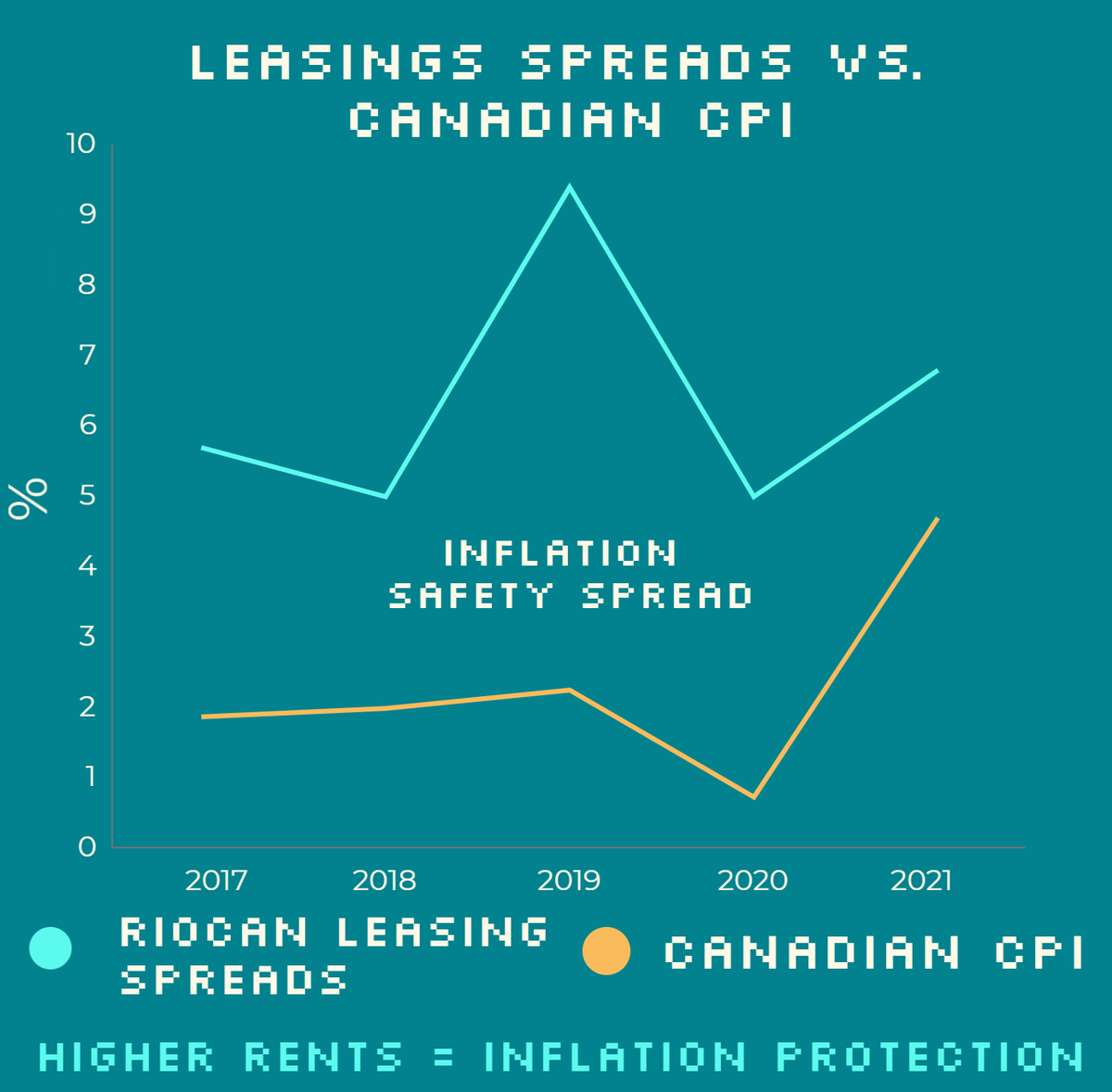

POSITIVE REAL CASHFLOW FORMULA

[Increasing Real Income]

#REITS generate dividend cashflows that outpace inflation.

-Leasing Spreads > CPI,

-Completed Developments = New Recurring Revenue

vs

[Depreciating Fixed Expenses]

Real value of loan payments depreciate over time

7/10

[Increasing Real Income]

#REITS generate dividend cashflows that outpace inflation.

-Leasing Spreads > CPI,

-Completed Developments = New Recurring Revenue

vs

[Depreciating Fixed Expenses]

Real value of loan payments depreciate over time

7/10

RIOCAN

🏬 AAA Urban Retail Portfolio +

🏗️ 40.5M SF Residential Development Pipeline

= 💲CASH💲 & Condo 🖨️

(in a housing shortage).

✔️ Strategy Shift: Income -> Growth

✔️ 96.4% Occupancy

✔️ 6% Earn Yield

✔️ 7.5% Lease Spreads

✔️ Implied Cap 5.7% vs. Sales at 3.9% 8/10

🏬 AAA Urban Retail Portfolio +

🏗️ 40.5M SF Residential Development Pipeline

= 💲CASH💲 & Condo 🖨️

(in a housing shortage).

✔️ Strategy Shift: Income -> Growth

✔️ 96.4% Occupancy

✔️ 6% Earn Yield

✔️ 7.5% Lease Spreads

✔️ Implied Cap 5.7% vs. Sales at 3.9% 8/10

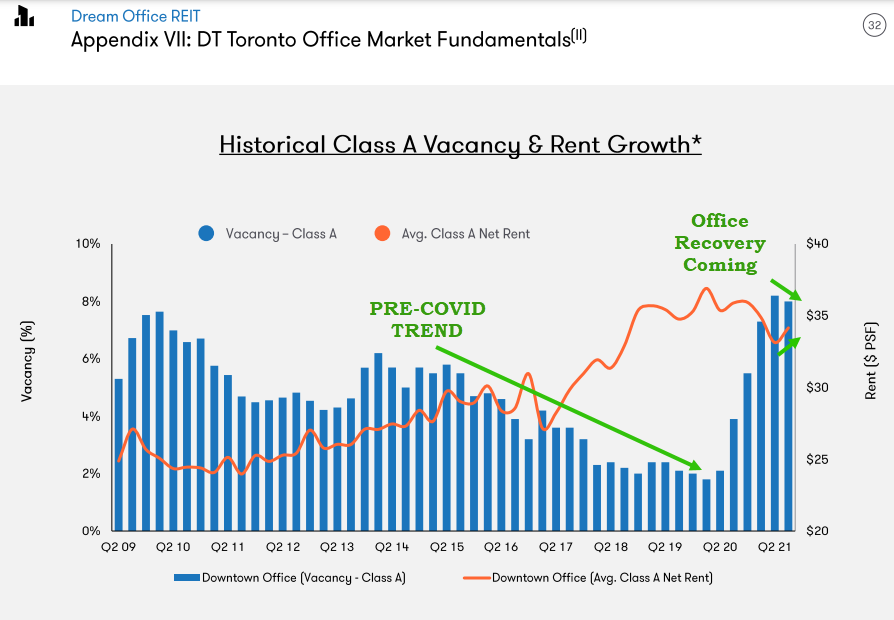

@DreamOfficeREIT

Toronto Offices 🏢 ($609/sqft) + $400M Dream Industrial 🔥 $DIR 📈 = Deep #Contrarian Value

✔️ 4.19% Yield, Low Payout Ratio

✔️ 8.9% Lease Spreads

✔️ 22% Below NAV

✔️ Strategy: sell non-core properties, buy back shares, NAV📈

✔️ Scarcity 9/10

Toronto Offices 🏢 ($609/sqft) + $400M Dream Industrial 🔥 $DIR 📈 = Deep #Contrarian Value

✔️ 4.19% Yield, Low Payout Ratio

✔️ 8.9% Lease Spreads

✔️ 22% Below NAV

✔️ Strategy: sell non-core properties, buy back shares, NAV📈

✔️ Scarcity 9/10

Thanks for reading the 🧵, DYODD.

#BTC + #REITS = Inflation Proof Income + Growth Portfolio

Follow the Hard Reit portfolio and see more Riocan/Dream Office/Reit content for free:

wealthplaybook.ca

Print #Fiat. Stack #Sats.

Beat #Inflation.

10/10

#BTC + #REITS = Inflation Proof Income + Growth Portfolio

Follow the Hard Reit portfolio and see more Riocan/Dream Office/Reit content for free:

wealthplaybook.ca

Print #Fiat. Stack #Sats.

Beat #Inflation.

10/10

@HedgeyeREITs your two favourite things Reits and Bitcoin together at last.

@JussiAskola consider mixing btc and Reits. I believe it is the winning formula.

@LawrenceLepard

Take a look at what happens when you combine leveraged reits with bitcoin.

You need to open up a third slot in your portfolio for #reits. Buy your own fiat printer.

Take a look at what happens when you combine leveraged reits with bitcoin.

You need to open up a third slot in your portfolio for #reits. Buy your own fiat printer.

• • •

Missing some Tweet in this thread? You can try to

force a refresh