A quick multi-thread on the importance of Economic Moats and How to Evaluate them when studying businesses:

Pat Dorsey is one of the leading figures that breakdown this topic succinctly.

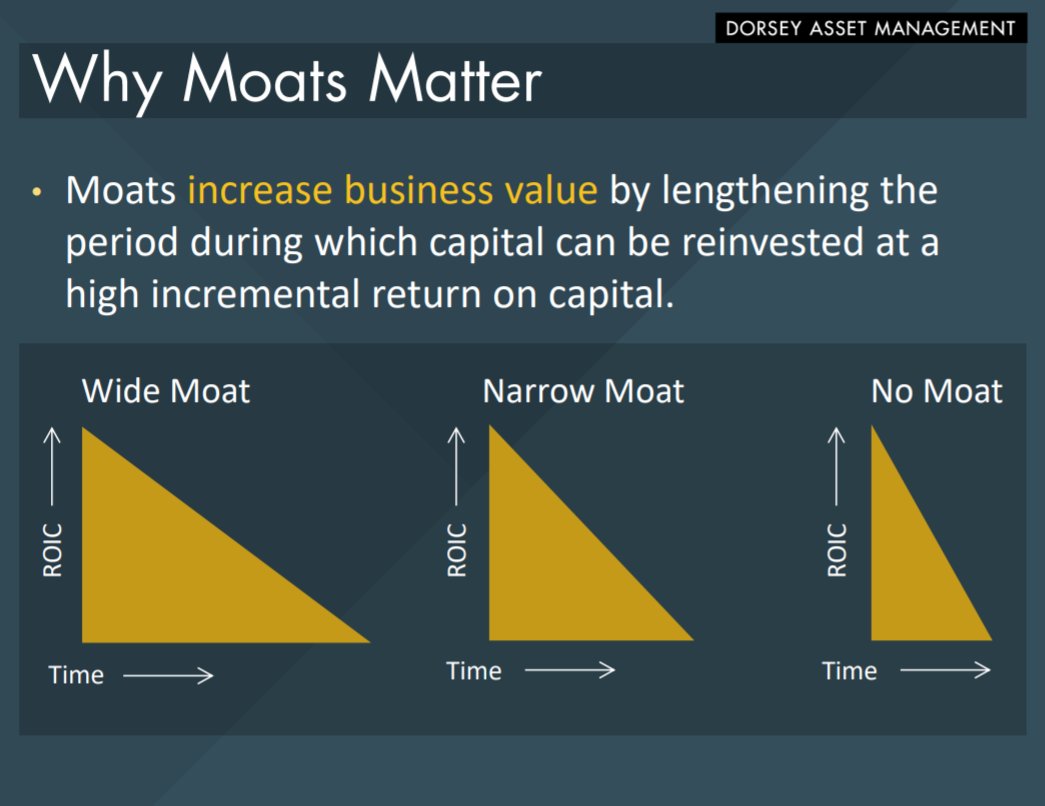

First, Why Moats Matter (1/6)

Pat Dorsey is one of the leading figures that breakdown this topic succinctly.

First, Why Moats Matter (1/6)

2/ The Three Types of Moats:

If you are a b-school graduate - You're familiar.

However, IMO - For any investor, Atleast one of the following factors have to be present in any good investment.

If you are a b-school graduate - You're familiar.

However, IMO - For any investor, Atleast one of the following factors have to be present in any good investment.

3/ The Three Key Reasons Why they matter long-term:

+ Increase business value

+ Reduce risks

+ Pricing arbitrage

+ Increase business value

+ Reduce risks

+ Pricing arbitrage

4/ Once you have Economic moats present.

It doesn't stop there.

A good investor continues watching how an operator ReInvests into those opportunities to increase shareholder value:

It doesn't stop there.

A good investor continues watching how an operator ReInvests into those opportunities to increase shareholder value:

5/ More on ROIC's and the Reinvestment Ratios:

This thread by @10kdiver and @skhetpal expands more on this important concept.

This thread by @10kdiver and @skhetpal expands more on this important concept.

https://twitter.com/10kdiver/status/1472268340223565827?s=20

6/ The qualitative factors + Measuring Reinvestment opportunities are the factors of helping Investors gauge the durability of a business.

As Dorsey says:

"Moats matter because they can increase business value,

reduce business risk, and be inefficiently priced."

As Dorsey says:

"Moats matter because they can increase business value,

reduce business risk, and be inefficiently priced."

7/7 -END:

Pat Dorsey is one of the leading voices that has helped me appreciate the importance of economic moats (this is a core component of evry deep dive/analysis I do)

tl;dr: Investors should watch for moats + Reinvestments Opps

Source to read more:

dorseyasset.com/wp-content/upl…

Pat Dorsey is one of the leading voices that has helped me appreciate the importance of economic moats (this is a core component of evry deep dive/analysis I do)

tl;dr: Investors should watch for moats + Reinvestments Opps

Source to read more:

dorseyasset.com/wp-content/upl…

Any additional points to add: @10kdiver @realdennishong @honam @skhetpal @IrnestKaplan @LiviamCapital - Thanks!

• • •

Missing some Tweet in this thread? You can try to

force a refresh