I added well into my $ZS Scaler position today. Couple of reasons below:

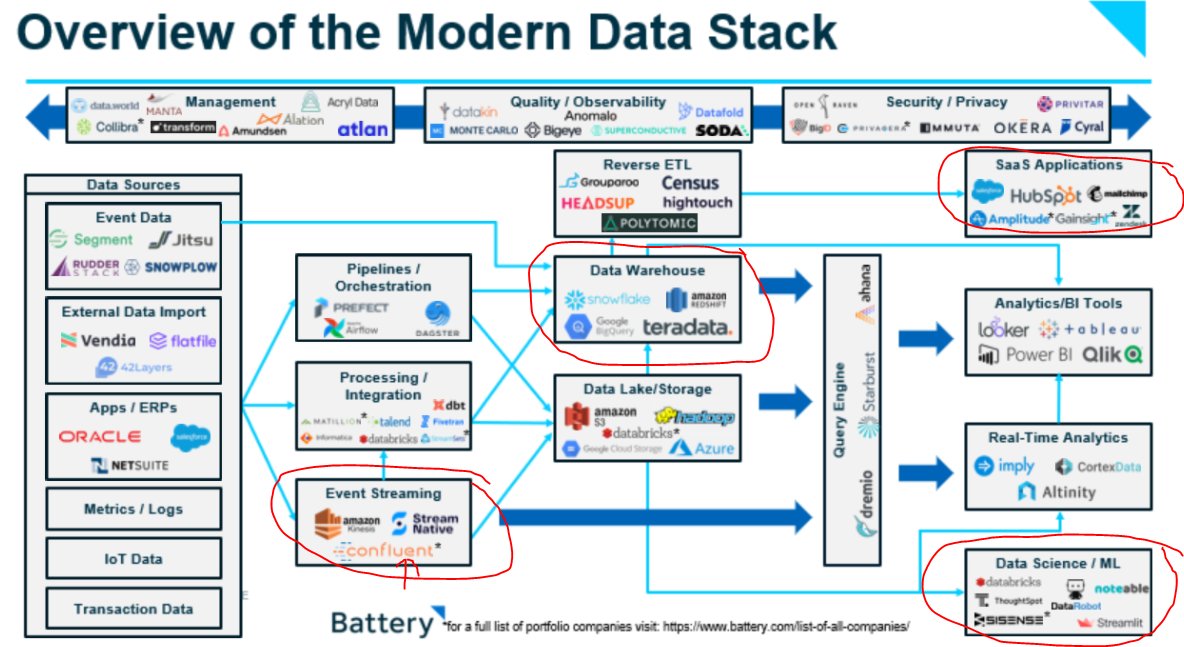

+ Leader within the fastest-growing segments of enterprise security. (ZTA, SASE, ZIA)

+ Clearly differentiated, cloud-native moat

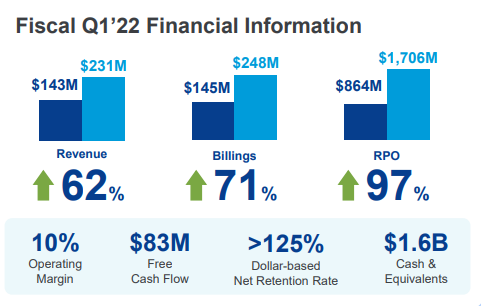

+ 71% billings growth and 62% YoY on $1B ARR on 30% FCF

Short thread (1/4)

+ Leader within the fastest-growing segments of enterprise security. (ZTA, SASE, ZIA)

+ Clearly differentiated, cloud-native moat

+ 71% billings growth and 62% YoY on $1B ARR on 30% FCF

Short thread (1/4)

2/2: Brief overview of last earnings:

+ They've CAGR over 50%+ growth over the past 5-years.

+QoQ accel to 17%

+ They could easily CAGR 60%+ growth into 2022 due to new Govt contracts

+ 87% in >$1million customers

+ RPO grew 97%

+ FCF✅

I expect to see

+ They've CAGR over 50%+ growth over the past 5-years.

+QoQ accel to 17%

+ They could easily CAGR 60%+ growth into 2022 due to new Govt contracts

+ 87% in >$1million customers

+ RPO grew 97%

+ FCF✅

I expect to see

https://twitter.com/InvestiAnalyst/status/1436104668942413827?s=20

3/3:

Clear leader in their industry with early penetration (25% of Fortune 2000) into $72B TAM.

Over 70% of companies are still on on-premise firewalls, but $ZS ZTA architecture way ahead of comps which is why growth has been durable.

Clear leader in their industry with early penetration (25% of Fortune 2000) into $72B TAM.

Over 70% of companies are still on on-premise firewalls, but $ZS ZTA architecture way ahead of comps which is why growth has been durable.

https://twitter.com/InvestiAnalyst/status/1424208687082651653?s=20

4/4:

+ Sustainable growth especially against tough comps

+ High-margins

+ FCF

A clear leader within a fast-growing TAM is one of the reasons $ZS will never be cheap.

I might do a future full thread, but this is a very special company and it's one of my highest-conviction names.

+ Sustainable growth especially against tough comps

+ High-margins

+ FCF

A clear leader within a fast-growing TAM is one of the reasons $ZS will never be cheap.

I might do a future full thread, but this is a very special company and it's one of my highest-conviction names.

• • •

Missing some Tweet in this thread? You can try to

force a refresh