The Rising Challenge of SentinelOne:

$CRWD is the undoubted leader of the endpoint cybersecurity market. However, there is a very compelling thesis for $S - SentinelOne.

I'll outline my research notes in this full thread (and an upcoming Spaces!):

$CRWD is the undoubted leader of the endpoint cybersecurity market. However, there is a very compelling thesis for $S - SentinelOne.

I'll outline my research notes in this full thread (and an upcoming Spaces!):

***

1/ First, what is $S?

Similar to $CRWD, they are a cybersecurity firm that provides Endpoint detection (EPP) & Endpoint response (EDR)

This is just simply an advanced anti-virus(AV) installed on your computer or device to protect you compared to McAfee or Norton type of AV.

1/ First, what is $S?

Similar to $CRWD, they are a cybersecurity firm that provides Endpoint detection (EPP) & Endpoint response (EDR)

This is just simply an advanced anti-virus(AV) installed on your computer or device to protect you compared to McAfee or Norton type of AV.

2/ If you knw $CRWD, yu pretty much knw $S as they're similar. However, I'll focus on differences.

First, $S anti-virus product is uniquely architectured to combine best of both worlds of EPP & EDR into ONE single platform called XDR.

$S AV solution is unique for this reason.

First, $S anti-virus product is uniquely architectured to combine best of both worlds of EPP & EDR into ONE single platform called XDR.

$S AV solution is unique for this reason.

3/ $S Unique's product is called the singularity. It brings together 3-layers of an AI agent on your computer.

Their solution is slightly more architectured to be HIGHLY autonomous. This means an AI agent attacks a virus, cleans it & restore your system without any human need.

Their solution is slightly more architectured to be HIGHLY autonomous. This means an AI agent attacks a virus, cleans it & restore your system without any human need.

4/ Autonomous is a key area that $S is using to differentiate their platform from $CRWD.

$CRWD platform has heavily catered to enterprises and their platform needs *more human labour* for installation. However, $S requires less humans and they're improving. Listen to CC.

$CRWD platform has heavily catered to enterprises and their platform needs *more human labour* for installation. However, $S requires less humans and they're improving. Listen to CC.

5/ The reason Autonomous is key (and you'll hear over and over in their CC & Website) is that this will lead to a HIGHLY SCALABLE and profitable biz LT.

We're beginning to see signs. Gross Margins Acceleration:

Q4 "22:54%

Q1 "22-51%

Q2 "22-59%

Q3 "22-64% *highest ever since 2018

We're beginning to see signs. Gross Margins Acceleration:

Q4 "22:54%

Q1 "22-51%

Q2 "22-59%

Q3 "22-64% *highest ever since 2018

6/ Gartner Voice of the Customers:

The ranking is extremely tight, but I find it impressive for a company that is still young, SentinelOne beat Crowdstrike in this category.

Personally, I've spoken to developers who say they love $S Singularity platform as its easy and scales.

The ranking is extremely tight, but I find it impressive for a company that is still young, SentinelOne beat Crowdstrike in this category.

Personally, I've spoken to developers who say they love $S Singularity platform as its easy and scales.

7/ This is an expert call analysis quote from Tegus on SentinelOne customers or partners: h/t to @publiccomps for grabbing it.

They comment on sectors $CRWD wins and $S areas. Some differences:

They comment on sectors $CRWD wins and $S areas. Some differences:

8/ Key Technical differences between $CRWD vs $S by @convequity.

Convequity and partner have tremendous work on this topic (I have an announcement below!)

But this document highlights important differences. Interesting stuff!

Convequity and partner have tremendous work on this topic (I have an announcement below!)

But this document highlights important differences. Interesting stuff!

9/ Gartner's Review:

SentinelOne Improvements:

See the increasing ranking of SentinelOne over the last 3-years. The ranking is also similar in Forester

SentinelOne Improvements:

See the increasing ranking of SentinelOne over the last 3-years. The ranking is also similar in Forester

https://twitter.com/InvestiAnalyst/status/1408122759620698114?s=20

10/ MITRE which is like the Gartner for Cybersecurity has ranked $S over most of the industry players including $CRWD.

It appears $S Static AI performs well in the area of detecting and analyzing new threats on an endpoint must faster than peers.

It appears $S Static AI performs well in the area of detecting and analyzing new threats on an endpoint must faster than peers.

11/ Speed of Detection, configuration, and response to cyber attacks:

$S product is more superior to $CRWD both in Elastic's report and in MITRE ATT&CK report. It implies for every attack, how quick is a providers process and SPEED of their AI in responding to attacks.

$S product is more superior to $CRWD both in Elastic's report and in MITRE ATT&CK report. It implies for every attack, how quick is a providers process and SPEED of their AI in responding to attacks.

12/ From my research, most of this product advantages that $S has over $CRWD is based on their unique architecture of have ONE-integrated product that combines 3-key areas of AI for protection. Meanwhile, $CRWD has individual modules where customers have the choice to buy

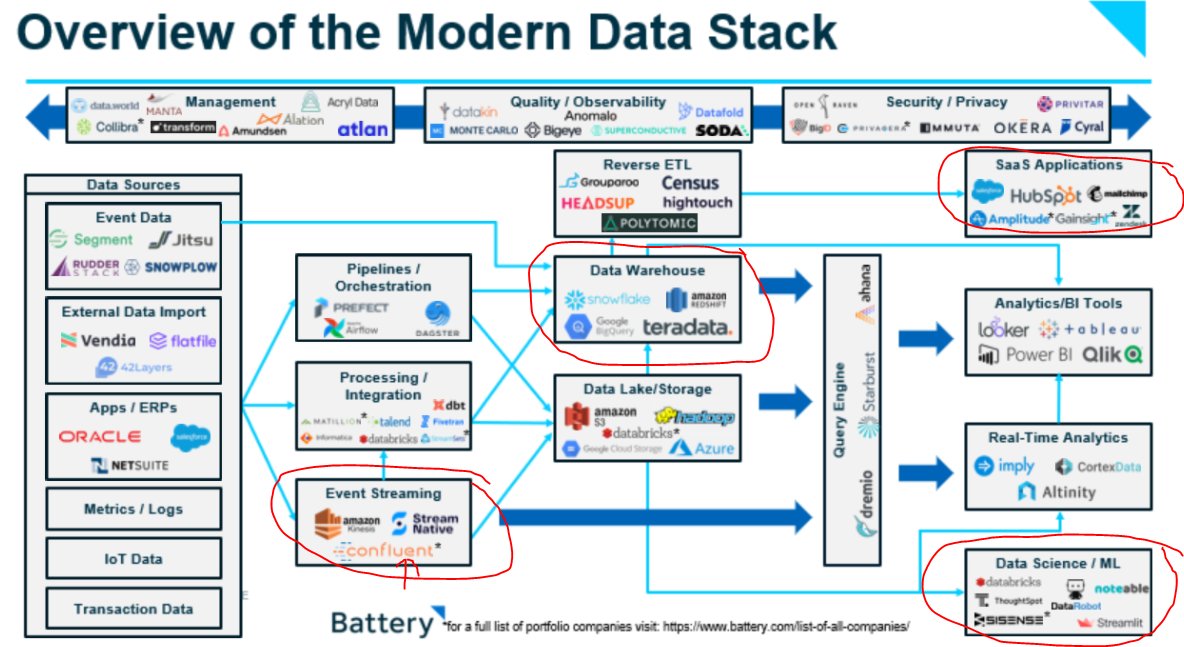

13/ GTM:

$S has differentiated itself by using Partner ecosystem reseller programs for sales. They also cater a lot to SMB's as $S PRICING is more affordable.

$CRWD has been more effective in their enterprise GTM and won more. $CRWD use typical SaaS land & expand for modules.

$S has differentiated itself by using Partner ecosystem reseller programs for sales. They also cater a lot to SMB's as $S PRICING is more affordable.

$CRWD has been more effective in their enterprise GTM and won more. $CRWD use typical SaaS land & expand for modules.

14/ $S Customer growth:

+ This $S GTM seems to be working as they just achieved their HIGHEST EVER NRR quarter (130%)

+ triple-digit growth in customers of

140%!

Total customers grew 75%, this was a slowdown from 80% but still very impressive. Gross

+ This $S GTM seems to be working as they just achieved their HIGHEST EVER NRR quarter (130%)

+ triple-digit growth in customers of

140%!

Total customers grew 75%, this was a slowdown from 80% but still very impressive. Gross

15/ GTM Customer Expansion:

$CRWD is now trying to target and go to mid-markets. Meanwhile, $S is now targeting the large enterprises after capturing many SMB's.

See the growth of customers with ARR >100K:

- Q4 21": 111%

- Q1: 127%

- Q2: 138%

- Q3 2022: 140% YoY (Crazy!)

$CRWD is now trying to target and go to mid-markets. Meanwhile, $S is now targeting the large enterprises after capturing many SMB's.

See the growth of customers with ARR >100K:

- Q4 21": 111%

- Q1: 127%

- Q2: 138%

- Q3 2022: 140% YoY (Crazy!)

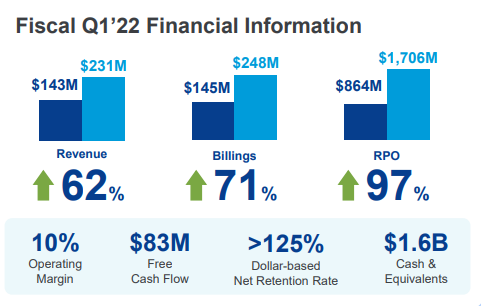

16/ Few Metrics: Last 4-qtrs of Revenue Growth:

+ Q4 2021 Fiscal: 108%,

+ Q1 "22 Fiscal: 121%

+ Q2 "22: 128%

+ Q3 "22: 128%,

+ Q4 "22 Guide: 104% YoY, (likely 128% again using similar past estimates).

This Qtr they had a big 13% beat above consensus

+ Q4 2021 Fiscal: 108%,

+ Q1 "22 Fiscal: 121%

+ Q2 "22: 128%

+ Q3 "22: 128%,

+ Q4 "22 Guide: 104% YoY, (likely 128% again using similar past estimates).

This Qtr they had a big 13% beat above consensus

17/ Sequential growth is a better measure of strength:

Revenue: Q3 2022:

Consistent QoQ Revs of: 2022: 25% > 22% > 22%

$61M next Q guidance vs $57M Estimates ( a 7% raise).

Revenue: Q3 2022:

Consistent QoQ Revs of: 2022: 25% > 22% > 22%

$61M next Q guidance vs $57M Estimates ( a 7% raise).

18/ ARR:

- $237M ARR (+131%):

Q4 2021 Fiscal: 117% YoY

Q1 "22 Fiscal: 124%

Q2 "22: 129%

Q3 "22: 130%,

+ Net acceleration QoQ of: 2% > 7% > 13%

- $237M ARR (+131%):

Q4 2021 Fiscal: 117% YoY

Q1 "22 Fiscal: 124%

Q2 "22: 129%

Q3 "22: 130%,

+ Net acceleration QoQ of: 2% > 7% > 13%

19/ $S Operating leverage and economics are poor:

$CRWD had similar growth rates to $S though all similar negative margins, during this stage as seen by the chart.

When $CRWD was at this level, they broadly had slightly better metrics than $S

$CRWD had similar growth rates to $S though all similar negative margins, during this stage as seen by the chart.

When $CRWD was at this level, they broadly had slightly better metrics than $S

https://twitter.com/jaminball/status/1400832464134750212?s=20

20/ $S is gradually going into the Zero-Trust Cybersecurity area with big partnerships with Cloudflare This is future boost for future growth amongst enterprise and I touched briefly on this thread on $ZS.

https://twitter.com/InvestiAnalyst/status/1467999866567774214?s=20

19/ More on Margins:

+ N-GAAP Operating Income: It went from -126% a year ago to now -69%. For comparison, during this Qtr in 2018, $CRWD had a similar -55% and -66%

+ $S FCF last 4-Qts is improving: -85% > -87%> -98% > NOW,-37%.

We know from $CRWD margins, thing will improve.

+ N-GAAP Operating Income: It went from -126% a year ago to now -69%. For comparison, during this Qtr in 2018, $CRWD had a similar -55% and -66%

+ $S FCF last 4-Qts is improving: -85% > -87%> -98% > NOW,-37%.

We know from $CRWD margins, thing will improve.

20/ Yes, $CRWD is the leader of the EPP Industry when yu combine the full Product + GTM. Discl: $CRWD is one of my largest holdings, so this not a REBUKE!

However, there is no reason why $S AND $CRWD cannot cannibalize legacies!

See more on this Vast TAM momentumcyber.com/cybersecurity-…

However, there is no reason why $S AND $CRWD cannot cannibalize legacies!

See more on this Vast TAM momentumcyber.com/cybersecurity-…

21/

This is a 27-PAGES report, yes, I said 27! Authored by @convequity that goes into detail on all the areas where $S1's product is better than $CRWD using evidence and data points.

It was said the report got the attention of official $CRWD reps!

seekingalpha.com/article/445438…

This is a 27-PAGES report, yes, I said 27! Authored by @convequity that goes into detail on all the areas where $S1's product is better than $CRWD using evidence and data points.

It was said the report got the attention of official $CRWD reps!

seekingalpha.com/article/445438…

22/ The GREAT announcement!

I will be hosting a technologist @convequity on Twitter Spaces this Saturday who authored that report above!

We'll go in-depth on $CRWD vs $S. We'll Open it to people's opposing thoughts!

I will be hosting a technologist @convequity on Twitter Spaces this Saturday who authored that report above!

We'll go in-depth on $CRWD vs $S. We'll Open it to people's opposing thoughts!

23/ Now, my core thesis boils down to 3-tweets:

TI:

a/ If a company w/ <$200 ARR already has a similar advanced product than a $1.7B ARR (even better than incumbents in niche areas)

If we assume a Long-Term 40% R&D spend, what will $S market leadership look like in 5-yrs?!

TI:

a/ If a company w/ <$200 ARR already has a similar advanced product than a $1.7B ARR (even better than incumbents in niche areas)

If we assume a Long-Term 40% R&D spend, what will $S market leadership look like in 5-yrs?!

24/

TII:

+ Founder-Led

+ 98% Glassdoor + High Product Velocity

+ Improving profit margins (as seen w/ $CRWD at this stage)

+ Valuation was 30x 2022 Sales on 100% growth and on a forward basis, not crazy to assume 70% 3yr CAGR?

TII:

+ Founder-Led

+ 98% Glassdoor + High Product Velocity

+ Improving profit margins (as seen w/ $CRWD at this stage)

+ Valuation was 30x 2022 Sales on 100% growth and on a forward basis, not crazy to assume 70% 3yr CAGR?

25/ TIII:

• High, defensible product moat

• >100%+ growth (Revs, Custs, DBNRR ALL accelerating)

• Mission-critical product (Cybersecurity is no longer luxury!)

• Early into the most important and fastest-growing TAM of our era’

As a result of TI-TIII, I started a position.

• High, defensible product moat

• >100%+ growth (Revs, Custs, DBNRR ALL accelerating)

• Mission-critical product (Cybersecurity is no longer luxury!)

• Early into the most important and fastest-growing TAM of our era’

As a result of TI-TIII, I started a position.

26/ For my followers that know, you'll notice as an ex-PM, I'm a #1 Product-first Investor, #2 Revenue, #3 Bottom-margins in the context of valuation.

I have a fundamental belief that if you have product-market fit with a high moat, #2 Flows and Ultimately, a durable #3 evolves.

I have a fundamental belief that if you have product-market fit with a high moat, #2 Flows and Ultimately, a durable #3 evolves.

27/ Hope you me join me and @convequity on Sat!

See @convequity past in-depth analysis of the cybersecurity industry: On $FTNT, $PANW, $NET $PLTR and his latest analysis on SaaS business economics of 2021 compared to 2007 evaluating if we're in a bubble.

twitter.com/i/spaces/1BdGY…

See @convequity past in-depth analysis of the cybersecurity industry: On $FTNT, $PANW, $NET $PLTR and his latest analysis on SaaS business economics of 2021 compared to 2007 evaluating if we're in a bubble.

twitter.com/i/spaces/1BdGY…

28/ Our conversation should be fun (We'll have a recording available!)

Hope this thread on the $S and $CRWD thesis was helpful. Long Cybersecurity. I'll put out a future write-up on this! Happy to hear your thoughts!

Thanks for reading my late-night blurb!

Hope this thread on the $S and $CRWD thesis was helpful. Long Cybersecurity. I'll put out a future write-up on this! Happy to hear your thoughts!

Thanks for reading my late-night blurb!

• • •

Missing some Tweet in this thread? You can try to

force a refresh