The PA:

P1 (Core): $CRWD, $PLTR, $UPWK, $UPST $AFRM $CFLT $AMPL * $DLO * $S

P2: (Mgmd) $AMD $SE $AMBA $SI $GDYN $BILL $MNDY $ZS $DDOG

Company updates, Commentary, and a general recap of the past 30-days:

P1 (Core): $CRWD, $PLTR, $UPWK, $UPST $AFRM $CFLT $AMPL * $DLO * $S

P2: (Mgmd) $AMD $SE $AMBA $SI $GDYN $BILL $MNDY $ZS $DDOG

Company updates, Commentary, and a general recap of the past 30-days:

1/ Every month, I post a portfolio snapshot update (Last month portfolio recap)

Exits: $DOCN $LC $GRAB $MAGT $PATH $COIN.

Initiations: $S, $DLO (I'll explain later), Bit of $UPWK in my core.

In P2, Added more $GDYN, $ZS.

New pos: $BILL and $MNDY.

Exits: $DOCN $LC $GRAB $MAGT $PATH $COIN.

Initiations: $S, $DLO (I'll explain later), Bit of $UPWK in my core.

In P2, Added more $GDYN, $ZS.

New pos: $BILL and $MNDY.

https://twitter.com/InvestiAnalyst/status/1457536891910197252?s=20

2/ Individual Updates with P2:

$AMBA:

+ Accelerating top-line growth with a healthy 24% EBITDA Margins and 15% FCF

+ Semiconductors are the highest-ranked industry in tech and AMBA has been one of the strongest.

$AMBA:

+ Accelerating top-line growth with a healthy 24% EBITDA Margins and 15% FCF

+ Semiconductors are the highest-ranked industry in tech and AMBA has been one of the strongest.

https://twitter.com/InvestiAnalyst/status/1465823304594464778?s=20

3/ $MNDY:

+ I dug deeper into $MNDY & $ASAN.

+ Solid Q2 results.

+ To be honest, I sold & bought again. My conviction isn't super high as I suspect growth MIGHT soon fall off due to a low moat

+ But right now, MNDY has one of the best SaaS metrics. Hold.

+ I dug deeper into $MNDY & $ASAN.

+ Solid Q2 results.

+ To be honest, I sold & bought again. My conviction isn't super high as I suspect growth MIGHT soon fall off due to a low moat

+ But right now, MNDY has one of the best SaaS metrics. Hold.

https://twitter.com/InvestiAnalyst/status/1462249614736695302?s=20

4/ $DDOG:

Happily started a position on the $155 dip.

+ DDOG is the best of breed, high conviction SaaS name. I'm hoping we get more dips, so I can add shares.

+ They made some interesting announcements

Happily started a position on the $155 dip.

+ DDOG is the best of breed, high conviction SaaS name. I'm hoping we get more dips, so I can add shares.

+ They made some interesting announcements

https://twitter.com/InvestiAnalyst/status/1466842784929832966?s=20

5/ $ZS:

I have a low-cost basis on $ZS as I've owned for a while, but happily added on the recent dip (hope for more).

+ ZS is executing on all fronts. Acceleration in growth and demand for their next-gen ZTA products.

High conviction, nothing more:

I have a low-cost basis on $ZS as I've owned for a while, but happily added on the recent dip (hope for more).

+ ZS is executing on all fronts. Acceleration in growth and demand for their next-gen ZTA products.

High conviction, nothing more:

https://twitter.com/InvestiAnalyst/status/1467999866567774214?s=20

6/ $CRWD:

CRWD delivered business as usual.

Growth is decelerating and it wasn't their strongest quarter, but still very impressive. I continue to hold.

CRWD delivered business as usual.

Growth is decelerating and it wasn't their strongest quarter, but still very impressive. I continue to hold.

https://twitter.com/InvestiAnalyst/status/1466185583315886080?s=20

7/ $AFRM

I wrote out my thesis to answer the question of a lack of moat.

I've seen data from AMZN customers, PYPL and Shopify's Black Friday that confirm AFRM should see a strong next Q.

Everyone knows about my conviction here, but happy to be wrong

I wrote out my thesis to answer the question of a lack of moat.

I've seen data from AMZN customers, PYPL and Shopify's Black Friday that confirm AFRM should see a strong next Q.

Everyone knows about my conviction here, but happy to be wrong

https://twitter.com/InvestiAnalyst/status/1462594177024335882?s=20

8/ $UPST:

Yikes is the word!

I had an $84 Cost bas., but sucks that so much profit wiped away!

Overall, I still think it's hard to find a Co like $UPST growing 70%+ with 30%+ EBITDA Margins, solid founder!

Might add in the low 150's, but I like them.

Koyfin estimates below

Yikes is the word!

I had an $84 Cost bas., but sucks that so much profit wiped away!

Overall, I still think it's hard to find a Co like $UPST growing 70%+ with 30%+ EBITDA Margins, solid founder!

Might add in the low 150's, but I like them.

Koyfin estimates below

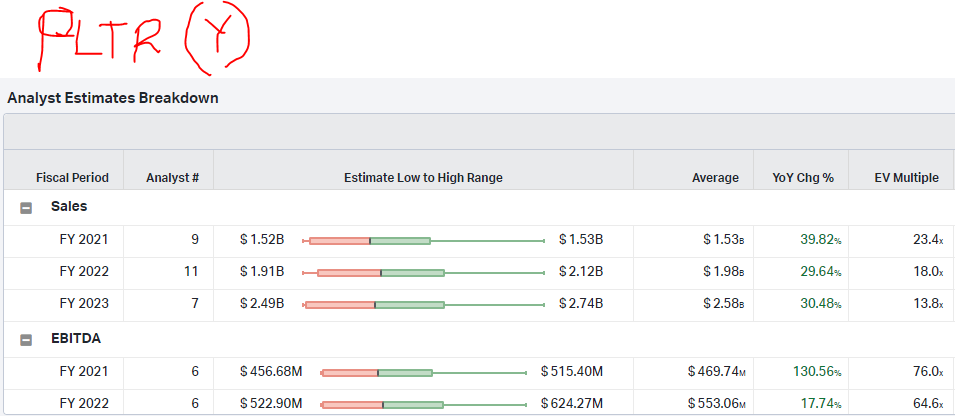

9/ $PLTR:

My conviction is waning to be honest. From my analysis, I fear $PLTR is going to be an Unprofitable Low 30% grower w/ high SBC.

I continue to hold b'cos of the Product potential, Tailwinds, & Founders, but if by Q2 2022, growth doesn't rev up. I fear a sell.

My conviction is waning to be honest. From my analysis, I fear $PLTR is going to be an Unprofitable Low 30% grower w/ high SBC.

I continue to hold b'cos of the Product potential, Tailwinds, & Founders, but if by Q2 2022, growth doesn't rev up. I fear a sell.

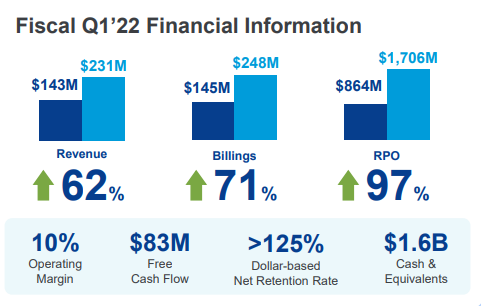

10/ $AMPL:

Great product w/ immense potential within a new category.

However, huge part of my thesis relies on the fundamentals (Growth at least 60%+), but I'm beginning to have mixed feelings about it and I'm doubting the guide for next Q. Hold for nw

Great product w/ immense potential within a new category.

However, huge part of my thesis relies on the fundamentals (Growth at least 60%+), but I'm beginning to have mixed feelings about it and I'm doubting the guide for next Q. Hold for nw

https://twitter.com/InvestiAnalyst/status/1458222163304062979?s=20

11/ $DLO:

Interesting One. I sold out immediately in the After-hours at around $42 when we didn't get any Q4 guidance.

I discussed the importance of exiting a highly-valued stock especially when growth starts to slows or there is high uncertainty.

Interesting One. I sold out immediately in the After-hours at around $42 when we didn't get any Q4 guidance.

I discussed the importance of exiting a highly-valued stock especially when growth starts to slows or there is high uncertainty.

https://twitter.com/InvestiAnalyst/status/1461216051144757248?s=20

12/ $DLO Cont'd:

After a 32% fall & see @Investing_Lion tweet

"$DLO is one of the quickest contractions in multiples I have seen this year. It went from 116x EV/GP NTM in Aug, 79x in Oct, and nw 47x."

I picked a small pos as my risk is lower and I like the 30% EBITDA Margins.

After a 32% fall & see @Investing_Lion tweet

"$DLO is one of the quickest contractions in multiples I have seen this year. It went from 116x EV/GP NTM in Aug, 79x in Oct, and nw 47x."

I picked a small pos as my risk is lower and I like the 30% EBITDA Margins.

13/ $GDYN:

+ A leading tech consulting Co focused on ML/AI.

+ Accelerating growth (120% YoY)

+ 14% EBITDA Margins

+ Young and early.

One of the strongest stocks in the current market. I added to my position.

+ A leading tech consulting Co focused on ML/AI.

+ Accelerating growth (120% YoY)

+ 14% EBITDA Margins

+ Young and early.

One of the strongest stocks in the current market. I added to my position.

14/ $PATH Exit:

My Thesis was wrong.

+ Growth is slowing down

+ ARR is hanging on a clip

+ Selective disclosure by Mgmt is worrying (No DBNRR & some missing metrics)

+ As a result, they don't deserve their current valuation.

I'll re-evaluate in Q4.

My Thesis was wrong.

+ Growth is slowing down

+ ARR is hanging on a clip

+ Selective disclosure by Mgmt is worrying (No DBNRR & some missing metrics)

+ As a result, they don't deserve their current valuation.

I'll re-evaluate in Q4.

https://twitter.com/InvestiAnalyst/status/1468714816663695360?s=20

15/ $S:

Started a position:

I shared all my thesis this week and on Twitter Spaces. Not much to say unless, I'm hoping we get a dip to the low <30's, so I can build and add more shares.

Started a position:

I shared all my thesis this week and on Twitter Spaces. Not much to say unless, I'm hoping we get a dip to the low <30's, so I can build and add more shares.

https://twitter.com/InvestiAnalyst/status/1468796820788629506?s=20

16/ SentinelOne vs CRWD Spaces Recording below:

Discussed FTNT, PANW, ZS and other key topics:

Discussed FTNT, PANW, ZS and other key topics:

https://twitter.com/InvestiAnalyst/status/1469694211926765573?s=20

17/ Cash:

I added over 25% cash. Its ultimately that the stocks I want badly are not low enough.

I spend some time on Macro's, although I prefer not to discuss them on Twitter. End of QE will make markets volatile going btw now and Feb. Just my opinion

I added over 25% cash. Its ultimately that the stocks I want badly are not low enough.

I spend some time on Macro's, although I prefer not to discuss them on Twitter. End of QE will make markets volatile going btw now and Feb. Just my opinion

https://twitter.com/InvestiAnalyst/status/1466937918577168387?s=20

18/ The end of QE (120b/mnth) never ends calmly. So as Growth/Tech Investor, volatility is part of the game, so personally, I'm prepared for a 30% drawdown.

ALSO, growth could slow/10-yr is low, so tech could do well. I cant time markets. I like my position & ready for Vol.

ALSO, growth could slow/10-yr is low, so tech could do well. I cant time markets. I like my position & ready for Vol.

19/ Together with preparing myself for high volatility over the next 90-days.

The most important thing is to be level-headed. SUPER ACTIVE watching the strongest stocks/refreshing your trigger watchlist. This is what I do every night.

I'll share my observations so far below:

The most important thing is to be level-headed. SUPER ACTIVE watching the strongest stocks/refreshing your trigger watchlist. This is what I do every night.

I'll share my observations so far below:

20/ This is a period to watch changes in valuations and Co's that can drive 20-30% growth over nxt 5yrs. Obviously, % from ATH doesn't mean a stock is cheap (look back at stocks that fell from Dec '18)

List below is solid & I rec follow @Investing_Lion:

List below is solid & I rec follow @Investing_Lion:

https://twitter.com/Investing_Lion/status/1467210327427366913?s=20

21/ Watchlist/Sector:

I ran a scan and If you peel out the Nasdaq - apart from Big Tech/large caps holding the market.

My scan shows Electric Semiconductor are the strongest stocks: $NVDA $QCOM $AMD $AVGO, $AMBA

If you look at fundamentals, many are seeing accelerating growth

I ran a scan and If you peel out the Nasdaq - apart from Big Tech/large caps holding the market.

My scan shows Electric Semiconductor are the strongest stocks: $NVDA $QCOM $AMD $AVGO, $AMBA

If you look at fundamentals, many are seeing accelerating growth

22/ Second aspect of tech holding the market is Cybersecurity ($FTNT, $PANW), Tech consulting services ($ACN, $GDYN) and Data Infrastructure ($DDOG, $SNOW, $ORCL)

The other companies below: I'd add: $PUBM, $TTD, $NVDA.

The other companies below: I'd add: $PUBM, $TTD, $NVDA.

https://twitter.com/InvestiAnalyst/status/1468419466681798657?s=20

23/ From my analysis, it appears the market is pricing high earnings growth 4 Semiconductors in 2022.

Within the enterprise, market is pricing in strong growth in cybersecurity and the Data Infrastructure and database part of the market. Only an opinion.

Within the enterprise, market is pricing in strong growth in cybersecurity and the Data Infrastructure and database part of the market. Only an opinion.

https://twitter.com/InvestiAnalyst/status/1460015767047524353?s=20

24/ Lastly, there is something that has been enticing to study $TOST, $MQ, $FTNT, $DASH, $HCP closely. I'm still digging deep.

Anyways, this is my last portfolio recap for 2021. I've done almost 10-/11. Now, I'll be reflecting back on all my horrible decisions this year...a/

Anyways, this is my last portfolio recap for 2021. I've done almost 10-/11. Now, I'll be reflecting back on all my horrible decisions this year...a/

25/ I'll look back at all my decisions in 2021, frameworks, write out my lessons and highlights for 2022 on substack over the holidays. Likely put out a couple threads on them.

I'll also be writing a deep-dive evaluating the entire Data/ML Database Infrastructure space.

I'll also be writing a deep-dive evaluating the entire Data/ML Database Infrastructure space.

26/ END: I'm giving myself a new year's challenge to write more long-form on Substack.

Most of my tweets/threads help formulate my thesis and serve as a decision-making journal, but structured long-form might be better, so nxt Jan, I'll do this on SS.

Anyways, have a great Dec!

Most of my tweets/threads help formulate my thesis and serve as a decision-making journal, but structured long-form might be better, so nxt Jan, I'll do this on SS.

Anyways, have a great Dec!

@threadreaderapp Unroll Please

• • •

Missing some Tweet in this thread? You can try to

force a refresh