1/X | PETROTAL SET TO TAKE OFF IN 2022

With only a couple of days left in 2021, I decided to write a “year-in-review” on Petrotal. 2021 brought some great highlights, some of the usual, but as always: The company grew stronger and are now in a great position…

#PTAL #TAL #OOTT

With only a couple of days left in 2021, I decided to write a “year-in-review” on Petrotal. 2021 brought some great highlights, some of the usual, but as always: The company grew stronger and are now in a great position…

#PTAL #TAL #OOTT

2/X | PETROTAL SET TO TAKE OFF IN 2022 cont.

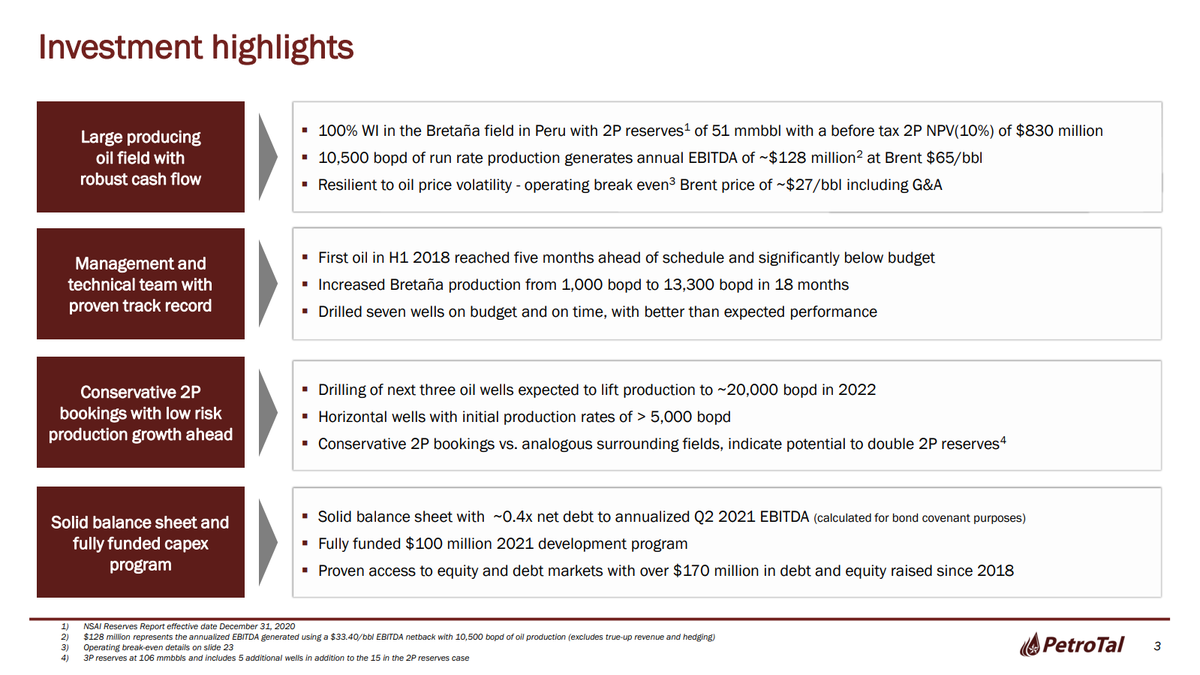

to take advantage of the bullish oil market we have ahead of us. Record high production numbers ahead of plan, unparalleled drill results and much more to come

This is what happened in 2021 and why #PTAL is our best bet going forward:

to take advantage of the bullish oil market we have ahead of us. Record high production numbers ahead of plan, unparalleled drill results and much more to come

This is what happened in 2021 and why #PTAL is our best bet going forward:

3/X | PERUVIAN POLITICS

The election of Pedro Castillo caused some stir among investors. But with ~6 months since his installation: Little has been achieved (1).

Tax hikes, nationalisation, etc, all turned down by a centre/right majority. As expected, and to be continued (2)

The election of Pedro Castillo caused some stir among investors. But with ~6 months since his installation: Little has been achieved (1).

Tax hikes, nationalisation, etc, all turned down by a centre/right majority. As expected, and to be continued (2)

4/X | PERUVIAN POLITICS cont.

In recent approval ratings, Castillo has plummeted to about 25 percent, without majority support from any demographic (1). So anyone expecting a Peruvian revolution, or a changed constitution, might not want to hold their breaths.

In recent approval ratings, Castillo has plummeted to about 25 percent, without majority support from any demographic (1). So anyone expecting a Peruvian revolution, or a changed constitution, might not want to hold their breaths.

5/X | SOCIAL DISRUPTION

The appointed government’s failure to focus on real matters put a hold on the recent commitments agreed upon regarding lifting rural communities from poverty. Causing indigenous communities to once again block the operations of the Norperuano pipeline.

The appointed government’s failure to focus on real matters put a hold on the recent commitments agreed upon regarding lifting rural communities from poverty. Causing indigenous communities to once again block the operations of the Norperuano pipeline.

6/X | SOCIAL DISRUPTION cont.

With Petrotal now having a solid balance sheet, for any shareholder who sat through the shutdowns in 2020, this +70 day lockdown, in comparison, felt merely like a breeze. In review it actually made the future investment case stronger. Here’s why:

With Petrotal now having a solid balance sheet, for any shareholder who sat through the shutdowns in 2020, this +70 day lockdown, in comparison, felt merely like a breeze. In review it actually made the future investment case stronger. Here’s why:

7/X | OIL EXPORT OPTIONS

The increased export to Brazil, one of many highlights in 2021, is now set to ship ~240 000 barrels per month from January. And the CEO expect this number to grow already in Q2 2022 (3) making it presumable that Brazil shipments in 2022 could be equal...

The increased export to Brazil, one of many highlights in 2021, is now set to ship ~240 000 barrels per month from January. And the CEO expect this number to grow already in Q2 2022 (3) making it presumable that Brazil shipments in 2022 could be equal...

8/X | OIL EXPORT OPTIONS cont.

to Petrotal’s full year production in 2021.

The Brazil deal allowed Petrotal to keep average production above 10 000 bopd during the 75 day Pipeline shutdown. A great de-risker and the added bullet in their latest presentation tells you the rest

to Petrotal’s full year production in 2021.

The Brazil deal allowed Petrotal to keep average production above 10 000 bopd during the 75 day Pipeline shutdown. A great de-risker and the added bullet in their latest presentation tells you the rest

9/X | MAJOR SHAREHOLDERS

In January 2021 Gran Tierra Energy tried to sell off the majority of their 30% holding for ~0.17 CAD/10p. The deal fell through but shortly after they managed to sell ~110M shares and during the recent protests they sold off their remaining 137M shares.

In January 2021 Gran Tierra Energy tried to sell off the majority of their 30% holding for ~0.17 CAD/10p. The deal fell through but shortly after they managed to sell ~110M shares and during the recent protests they sold off their remaining 137M shares.

10/X | MAJOR SHAREHOLDERS cont.

Buying the majority of the 137M shares were already invested major holders Kite Lake Capital and Burggraben Holding.

In short we lost someone desperate to get out, and they were replaced by people with ambition to move forward

Buying the majority of the 137M shares were already invested major holders Kite Lake Capital and Burggraben Holding.

In short we lost someone desperate to get out, and they were replaced by people with ambition to move forward

11/X | UNRIVALLED DRILLING RESULTS

Petrotal ends 2021 with a production of over 20 000 bopd. This was achieved after bringing the 8H and 9H well online. The 8H well came online in September with a record production of 7 600 bopd over a ten-day period (4)…

Petrotal ends 2021 with a production of over 20 000 bopd. This was achieved after bringing the 8H and 9H well online. The 8H well came online in September with a record production of 7 600 bopd over a ten-day period (4)…

12/X | UNRIVALLED DRILLING RESULTS cont.

only to be beaten by the 9H well which now in December averaged 8 200 bopd (5) during the same period.

The results speak for themselves and the world class quality of the Bretana field.

only to be beaten by the 9H well which now in December averaged 8 200 bopd (5) during the same period.

The results speak for themselves and the world class quality of the Bretana field.

13/X | UNRIVALLED DRILLING RESULTS cont.

The 10H well drilling is ongoing with completion in ~5 weeks. Attached drilling schedule will take production to 25 000 bopd.

I encourage anyone to show me a company that is doing it better. Cause if you can, I want to invest in that!

The 10H well drilling is ongoing with completion in ~5 weeks. Attached drilling schedule will take production to 25 000 bopd.

I encourage anyone to show me a company that is doing it better. Cause if you can, I want to invest in that!

14/X | ESG COMMITMENT

Petrotal has always been a leader regarding environmental and social commitment. Providing infrastructure, electricity, education to local communities in their operating areas.

Starting January 2022, Petrotal has offered to share…

Petrotal has always been a leader regarding environmental and social commitment. Providing infrastructure, electricity, education to local communities in their operating areas.

Starting January 2022, Petrotal has offered to share…

15/X | ESG COMMITMENT cont.

2,5% of the value of Block 95 production to a social trust. A great way for Petrotal to try and maximize production for the continued period of their contract. For this commitment, Petrotal is asking for a 10 year contract extension. Updates to follow

2,5% of the value of Block 95 production to a social trust. A great way for Petrotal to try and maximize production for the continued period of their contract. For this commitment, Petrotal is asking for a 10 year contract extension. Updates to follow

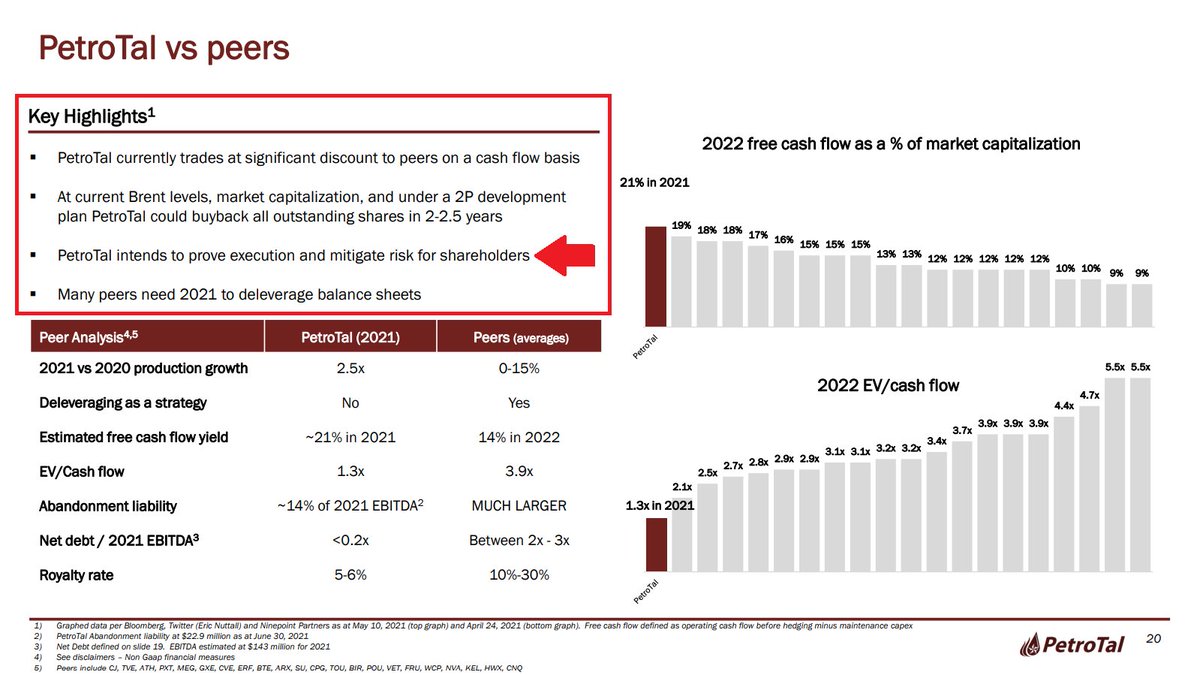

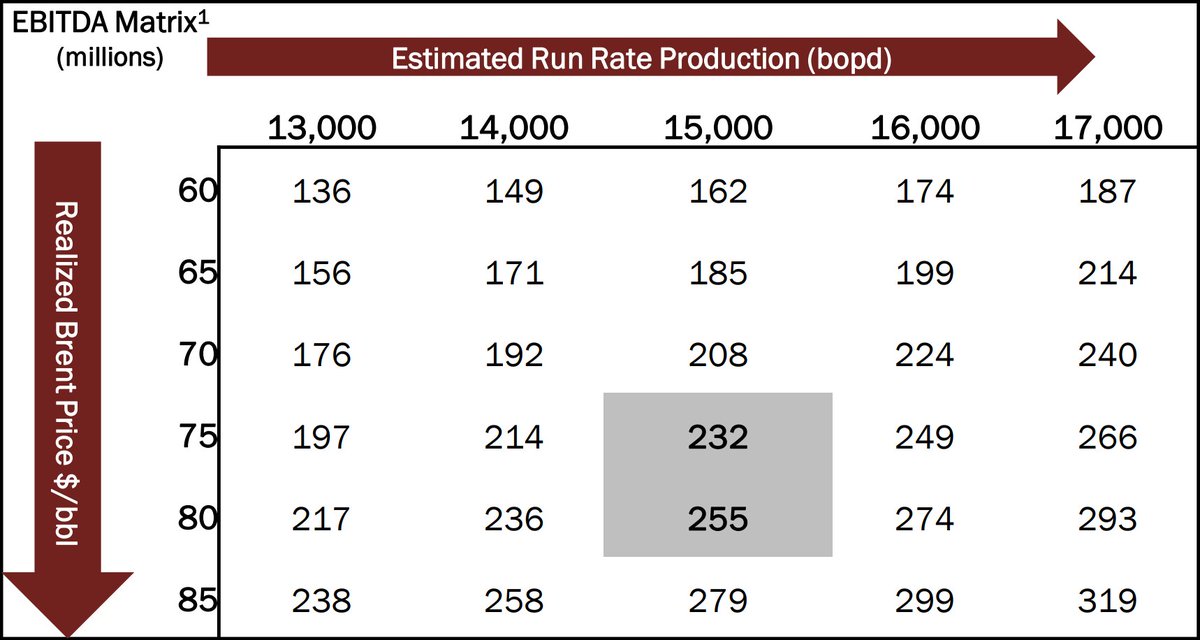

16/X | FORWARD CASH GENERATION

Petrotal has “a focus on generating industry leading free cash flow margins with an option for growth”. Estimates for EBITDA in their own material look conservative given their current production. And we know it will become even better.

Petrotal has “a focus on generating industry leading free cash flow margins with an option for growth”. Estimates for EBITDA in their own material look conservative given their current production. And we know it will become even better.

17/X | FORWARD CASH GENERATION cont.

In 2022 Petrotal is set to become debt free, and in their own words a “robust dividend/buyback program” will follow. At their current valuation, Petrotal generates so much cash they could buyback all outstanding shares within 2-3 years.

In 2022 Petrotal is set to become debt free, and in their own words a “robust dividend/buyback program” will follow. At their current valuation, Petrotal generates so much cash they could buyback all outstanding shares within 2-3 years.

18/X | EXPECTATIONS FOR OIL IN 2022

With oil sentiment effected by the spreading of the Omicron variant, green energy lobbyism, oil supply naiveness and what-not, it’s easy to expect volatility. But oil price will remain high.

And with Omicron looking to be a mild variant…

With oil sentiment effected by the spreading of the Omicron variant, green energy lobbyism, oil supply naiveness and what-not, it’s easy to expect volatility. But oil price will remain high.

And with Omicron looking to be a mild variant…

19/X | EXPECTATIONS FOR OIL IN 2022 cont.

…we are already seeing oil bouncing back up. Higher demand will again put pressure on supply issues due to the lack of investments in oil infrastructure (6). In short, reality is in support of bullish oil prices for years to come (7)

…we are already seeing oil bouncing back up. Higher demand will again put pressure on supply issues due to the lack of investments in oil infrastructure (6). In short, reality is in support of bullish oil prices for years to come (7)

20/X | EXPECTATIONS FOR PETROTAL IN 2022

Starting the year at 20 000 bopd production, social issues resolved with improved stability, GTE out of the picture. Petrotal is in its best shape ever!

I expect Petrotal having a real breakout year…

Starting the year at 20 000 bopd production, social issues resolved with improved stability, GTE out of the picture. Petrotal is in its best shape ever!

I expect Petrotal having a real breakout year…

21/X | EXPECTATIONS FOR PETROTAL IN 2022 cont.

in terms of operational performance and free cash flow. I also see them getting the respect and notice they deserve among investors in oil or any commodities. And I obviously expect that share price will follow.

in terms of operational performance and free cash flow. I also see them getting the respect and notice they deserve among investors in oil or any commodities. And I obviously expect that share price will follow.

22/X | EXPECTATIONS FOR PETROTAL IN 2022 cont.

I expect updates regarding the bond and wouldn’t be surprised if management negotiates terms that allow for earlier share buybacks or shareholder dividend. Regardless, I expect dividend payouts and share buybacks in the end of 2022.

I expect updates regarding the bond and wouldn’t be surprised if management negotiates terms that allow for earlier share buybacks or shareholder dividend. Regardless, I expect dividend payouts and share buybacks in the end of 2022.

23/X | ROUNDING OFF

I see a continued revaluation for Petrotal in 2022. With all aspects mentioned, shareholders will – for years to come – be rewarded. Some refer to uncertainty but I advise anyone to look deeper into it. Petrotal’s numbers are impossible to ignore…

I see a continued revaluation for Petrotal in 2022. With all aspects mentioned, shareholders will – for years to come – be rewarded. Some refer to uncertainty but I advise anyone to look deeper into it. Petrotal’s numbers are impossible to ignore…

24/X | ROUNDING OFF cont.

and they’ve proved their ability to operate. I keep myself updated. So for me personally, Petrotal is one of the investments I worry the least about.

If you’re holding Petrotal, please share your view. And for everyone else, read up on #PTAL

and they’ve proved their ability to operate. I keep myself updated. So for me personally, Petrotal is one of the investments I worry the least about.

If you’re holding Petrotal, please share your view. And for everyone else, read up on #PTAL

X/X | REFERENCED SOURCES

(1) worldpoliticsreview.com/amp/articles/3…

(2) mining.com/web/perus-cong…

(3) andina.pe/agencia/notici…

(4) petrotal-corp.com/petrotal-annou…

(5) petrotal-corp.com/petrotal-provi…

(6) thenationalnews.com/business/energ…

(7) reuters.com/business/energ…

(1) worldpoliticsreview.com/amp/articles/3…

(2) mining.com/web/perus-cong…

(3) andina.pe/agencia/notici…

(4) petrotal-corp.com/petrotal-annou…

(5) petrotal-corp.com/petrotal-provi…

(6) thenationalnews.com/business/energ…

(7) reuters.com/business/energ…

• • •

Missing some Tweet in this thread? You can try to

force a refresh