How to get URL link on X (Twitter) App

2/X | FEBRUARY IN REVIEW

2/X | FEBRUARY IN REVIEW

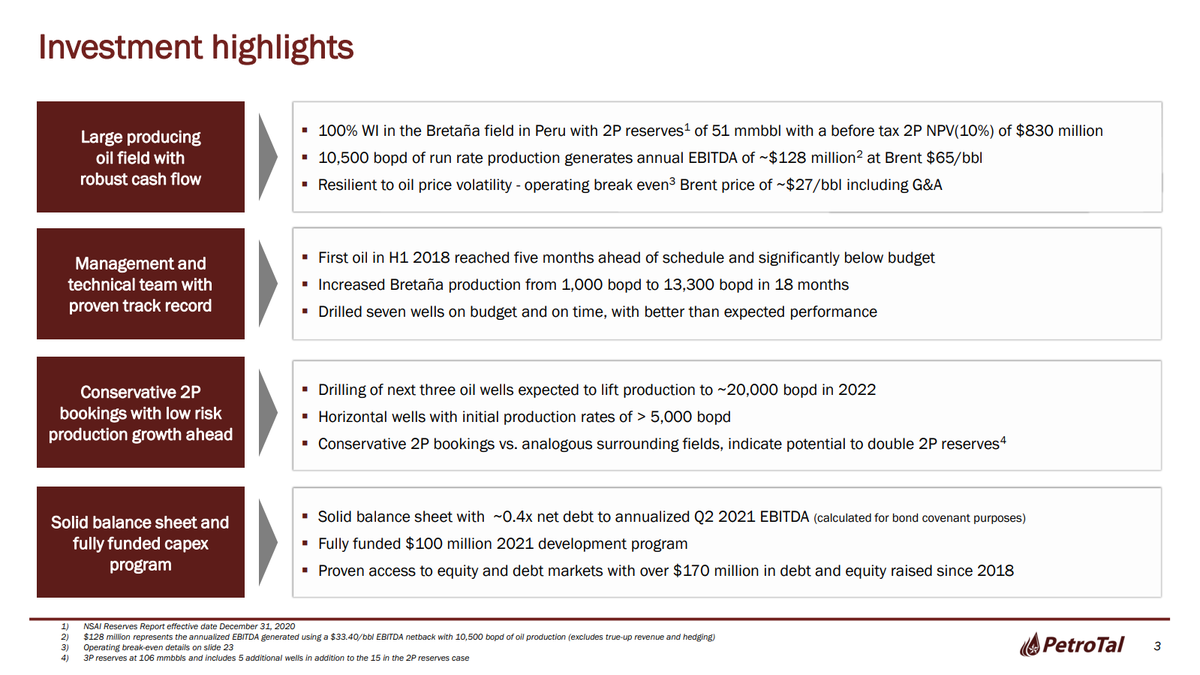

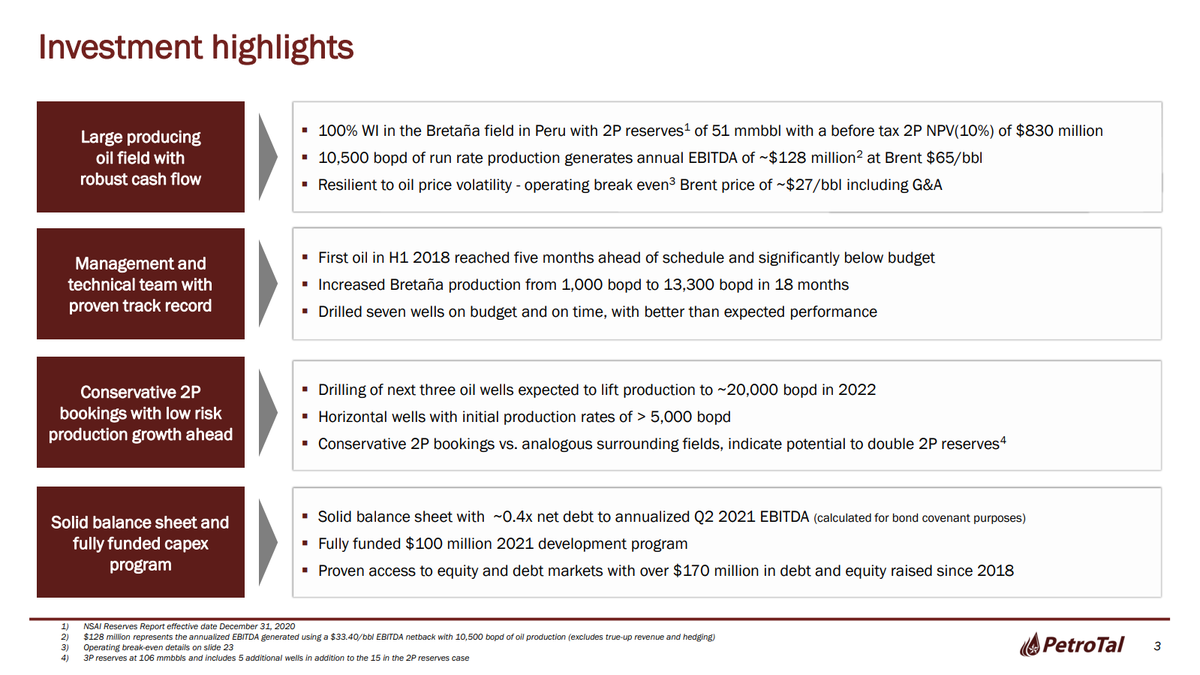

2/X | PETROTAL SET TO TAKE OFF IN 2022 cont.

2/X | PETROTAL SET TO TAKE OFF IN 2022 cont.

2/X | The 8H well – coming online any day – will boost production to ~13 000/14 000 bopd. And before year end we will see Petrotal producing somewhere around 18 000 bopd. During 2022 production at the Bretana field will continue increasing towards the 25 000 bopd target

2/X | The 8H well – coming online any day – will boost production to ~13 000/14 000 bopd. And before year end we will see Petrotal producing somewhere around 18 000 bopd. During 2022 production at the Bretana field will continue increasing towards the 25 000 bopd target