#BristolCity 2020/21 financial results cover a season when they finished a “disappointing” 19th in the Championship with Nigel Pearson replacing head coach Dean Holden in February. Owner Steve Lansdown described COVID-impacted losses as “horrific”. Some thoughts follow.

#BristolCity pre-tax loss widened from £10.1m to £38.4m, mainly due to profit on player sales falling £19.4m from £25.6m to £6.2m, while revenue dropped £10.5m (39%) from £27.2m to £16.7m. Only slightly offset by a small expenses decrease of £0.6m (1%) to £62.9m.

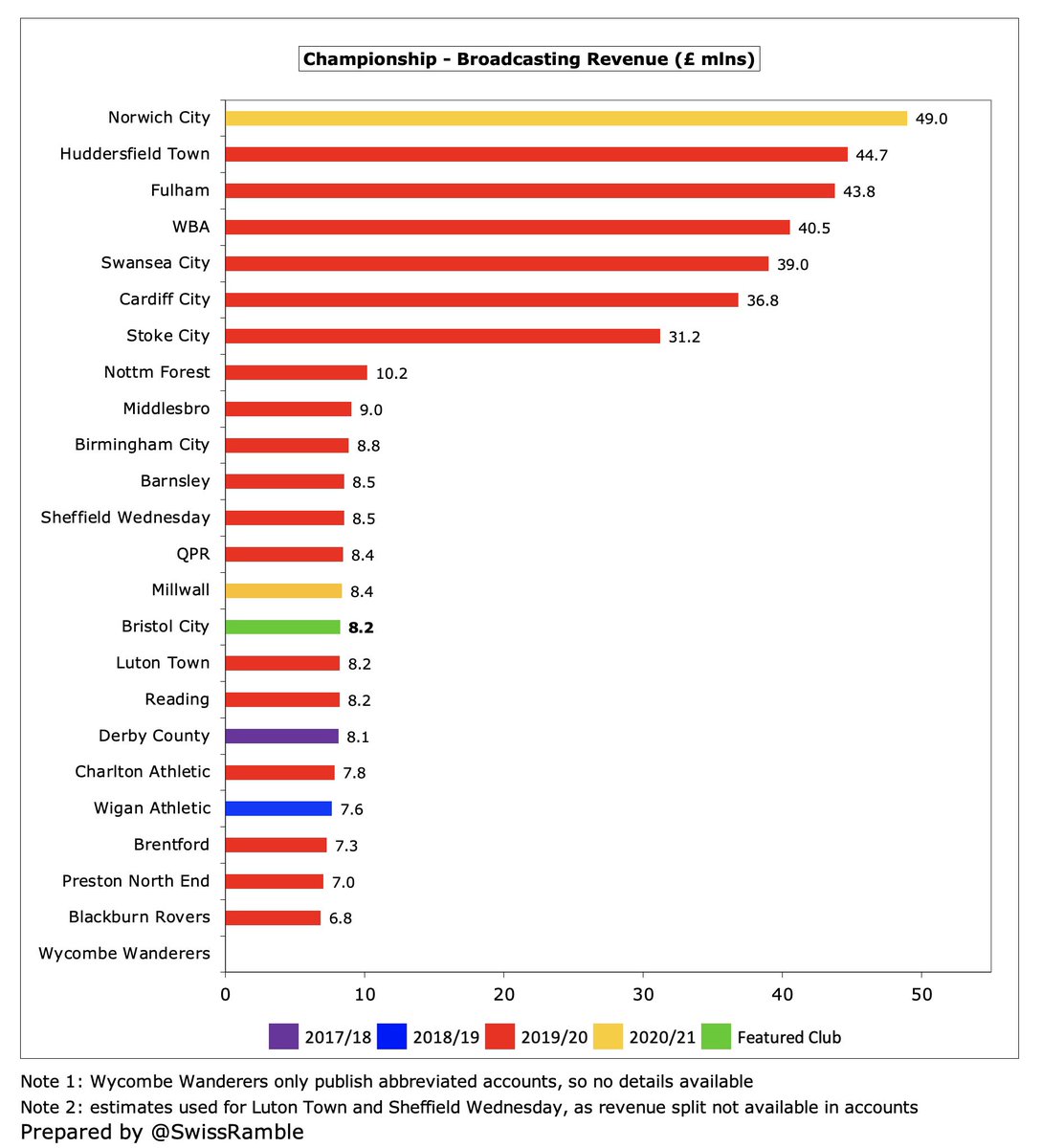

#BristolCity revenue decrease largely driven by COVID (games played behind closed doors & stadium lockdown), as commercial fell £6.1m (44%) to £7.7m and match day dropped £4.0m (85%) to £0.7m. Broadcasting also down £0.4m (5%) to £8.2m. Government grants up £1.0m to £1.6m.

Despite the revenue decline, #BristolCity wage bill grew £1.9m (6%) to £35.3m, while player amortisation rose £0.5m (4%) to £11.6m, though other expenses were cut £4.1m (27%) to £11.0m, due to reduction in business activity. Net interest payable up £0.3m (33%) to £1.3m.

As a technical aside, this analysis is based on the accounts for Bristol City Holdings Ltd, which owns two significant subsidiaries: Bristol City Football Club Ltd and Ashton Gate Ltd, which operates the stadium facilities.

#BristolCity CEO Richard Gould said, “The financial impact of COVID has resulted in extremely serious losses for the year”. Unsurprisingly, the £38m loss is one of the worst in the Championship, though other clubs’ figures will also be bad when they publish 2020/21 accounts.

I estimate that #BristolCity lost around £15m revenue in 2020/21 from a full season of COVID: £6m match day (games behind closed doors) and £9m commercial (conferences and events “heavily restricted”). This takes the total revenue loss over the past two years to £18m.

Clearly, #BristolCity are not alone here. Gould again: “The Championship is the competition most affected by the pandemic, across all sports. Football clubs will remain in a precarious position and we will be plugging holes left by the pandemic for perhaps the next four years.”

Furthermore, COVID shrunk Championship transfer market by 90% with #BristolCity profit on player sales significantly reducing from £26m to £6m, including Eliasson to Nimes and Szmodics to #PUFC. Much less than #NCFC £60m (another benefit for clubs relegated from Premier League).

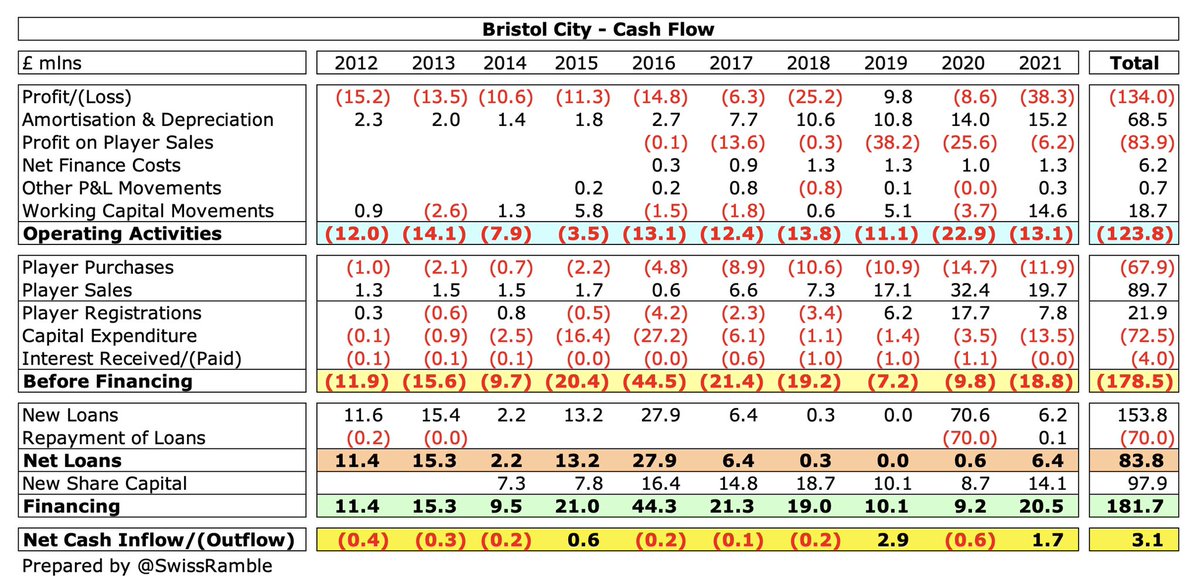

Losses are nothing new for #BristolCity, who have only posted a profit once in the last decade (£11m in 2019, thanks to £38m profit from player sales). In that period, the club has lost a hefty £131m, including £48m in the last two (COVID-impacted) seasons.

The transfer market crash severely hurt #BristolCity, as profit on player sales (“upon which we have been heavily reliant”) fell to just £6m in 2020/21, against impressive £64m in previous 2 seasons (Adam Webster, Lloyd Kelly, Booby Reid, Josh Brownhill, Aden Flint & Joe Bryan).

#BristolCity operating loss (i.e. excluding player sales and interest payable) widened from £35m to £43m, following the revenue fall. This is the club’s worst ever performance, but far from unusual in the Championship, where most clubs operate at a significant loss.

#BristolCity revenue has nearly halved since the pre-pandemic £30.3m peak in 2019, falling 45% (£13.6m) to £16.7m. Broadcasting has held up, but match day is down 88% (£5.3m) and commercial has decreased 52% (£8.4m).

Following the decrease, #BristolCity £17m revenue is now in the bottom half of the Championship, significantly below clubs with parachute payments, e.g. #NCFC £57m, though others will see similar revenue reductions when they publish 2020/21 accounts with a full season of COVID.

#BristolCity chief executive Richard Gould said, “Parachute payments are so significant that they are making the Championship an unfair competition. Three years’ parachute payments ruin the ability of other clubs to compete.” In 2019/20 a relegated club received £42m in year one.

Gould added, “The longer it goes on with these parachute payments that are out of kilter with the commercial reality of the Championship, the Premier League will just become a closed shop. The door is almost shut now.” This makes it extremely tough for clubs like #BristolCity.

#BristolCity broadcasting income fell £0.4m (5%) from £8.6m to £8.2m, as EFL distribution dropped £0.7m to £2.7m, partly offset by rise in PL solidarity payment from £4.5m to £4.65m. Most Championship clubs earn £7-9m, but there is a massive gap to clubs with parachute payments.

#BristolCity match day income fell £4.1m (85%) from £4.8m to £0.7m, as all home games were played behind closed doors because of the pandemic, leaving only some season ticket money. Before the big decrease, their gate receipts were 10th highest in the Championship.

#BristolCity crowds had significantly grown since promotion from League One, rising 87% from 11,681 to 21,809 in 2019/20 (for games played with fans). Their average attendance was 8th highest in the Championship, sandwiched between Cardiff City and Huddersfield Town.

#BristolCity commercial income fell £6.2m (44%) from £13.9m to £7.7m, as COVID restrictions had a “profound impact” on money from conferences and events at Ashton Gate. In the previous season, this revenue stream was second highest in the Championship, only surpassed by #LUFC.

Both #BristolCity principal commercial agreements changed in 2020/21: MansionBet replaced Dunder as shirt sponsor, while Hummel replaced in-house Bristol Sport as kit supplier.

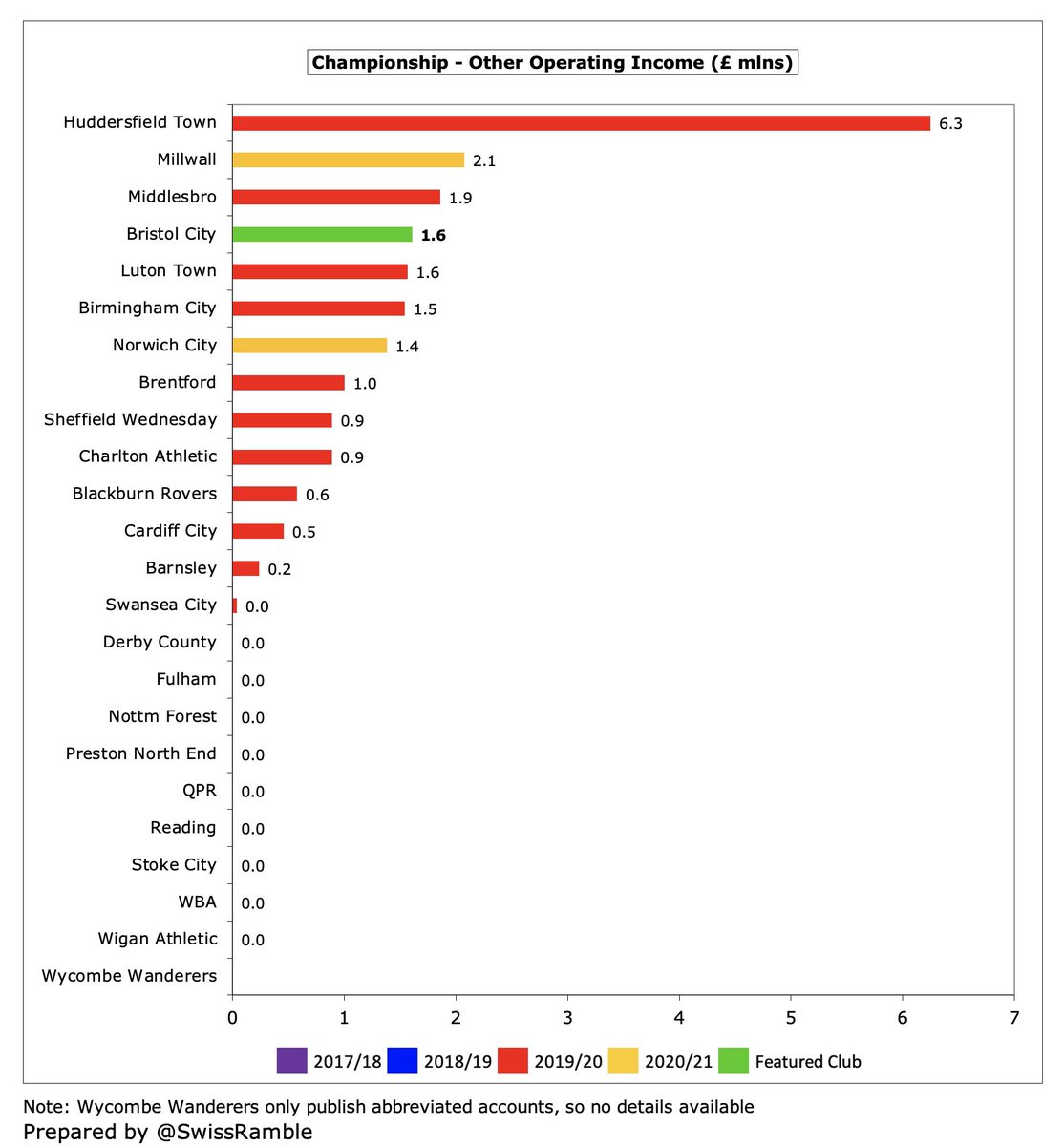

#BristolCity other operating income increased from £0.6m to £1.6m, entirely made up of government grants. It is worth noting that #HTAFC sizeable £6.3m here in 2019/20 included £5.7m from player loans.

Despite the revenue fall, #BristolCity wage bill rose £1.8m (6%) from £33.5m to £35.3m, a new club record. Wages have more than doubled (up £18m) since the first season after promotion from League One in 2016, though many players have since been released this summer to cut costs.

Even after this significant growth in the past few years, #BristolCity £35m wage bill is still only mid-table in the Championship, around half the size of those clubs benefiting from parachute payments, e.g. #NCFC £67m in 2020/21.

#BristolCity wages to turnover ratio shot up from 123% to 212%, which is clearly not sustainable, though is severely impacted by the COVID revenue decrease in 2020/21. Even before the pandemic, most clubs in the ultra-competitive Championship had ratios well above 100%.

#BristolCity directors’ remuneration decreased from £143k to £106k, very much on the low side for the Championship, especially compared to the likes of Birmingham City £1.6m, Fulham £948k, Stoke City £834k and Cardiff City £712k.

#BristolCity other expenses fell £4.1m (27%) from £15.1m to £11.0m, because of reduced business activity. This followed 5 years of growth from less than £4m in 2014, partly due to costs associated with commercial growth.

#BristolCity player amortisation, the annual charge to expense transfer fees, rose £0.5m to £11.6m. Significantly up from £1m in 2014, reflecting major investment in the squad, but still a fair way below the likes of #FFC £40m and Stoke City £30m. Also booked £0.7m impairment.

#BristolCity spent just £2m on player purchases, mainly on bringing in Joe Williams from #WAFC, significantly lower than the £26m they splashed out the previous season. Many other clubs spent more in 2019/20, though their expenditure will surely be less in 2020/21.

Even after the low 2020/21 outlay, #BristolCity have significantly increased their gross transfer spend, amounting to £64m in the last 5 years, though they still had £30m net sales, thanks to £94m sales in this period. Only sizeable net spend in last decade was £10m in 2018.

#BristolCity gross debt rose £22m from £74m to £96m, with £89m of this owed to owner Steve Lansdown (Pula Sports Ltd £72m plus group undertakings £17m). Also included £6.8m interest-free loans from the English Football League and a £0.6m overdraft.

#BristolCity gross debt of £96m is quite large for a club of their size, and is actually 5th highest in the Championship. The debt is not an issue, so long as Steve Lansdown remains a friendly owner, as he demonstrated last year by converting another £14m of debt to equity.

#BristolCity only paid £57k interest (on the overdraft). Lansdown’s Pula Sports loan interest rate is 2% above base rate, but to date the interest has simply been added to the outstanding debt, rather than being paid. Most owners in the Championship provide debt interest-free.

#BristolCity transfer debt decreased from £17m to £7m, much lower than clubs like #FFC £86m and #NCFC £23m. The amount owed to City from other clubs also fell from £24m to £11m, giving a net receivable of £4m.

After adding back non-cash items and working capital, #BristolCity had £13m negative operating cash flow, partly offset by £8m from player trading (sales £20m, purchases £12m), then spent £13m on new training ground. Funded by £14m share capital from Lansdown and £6m EFL loans.

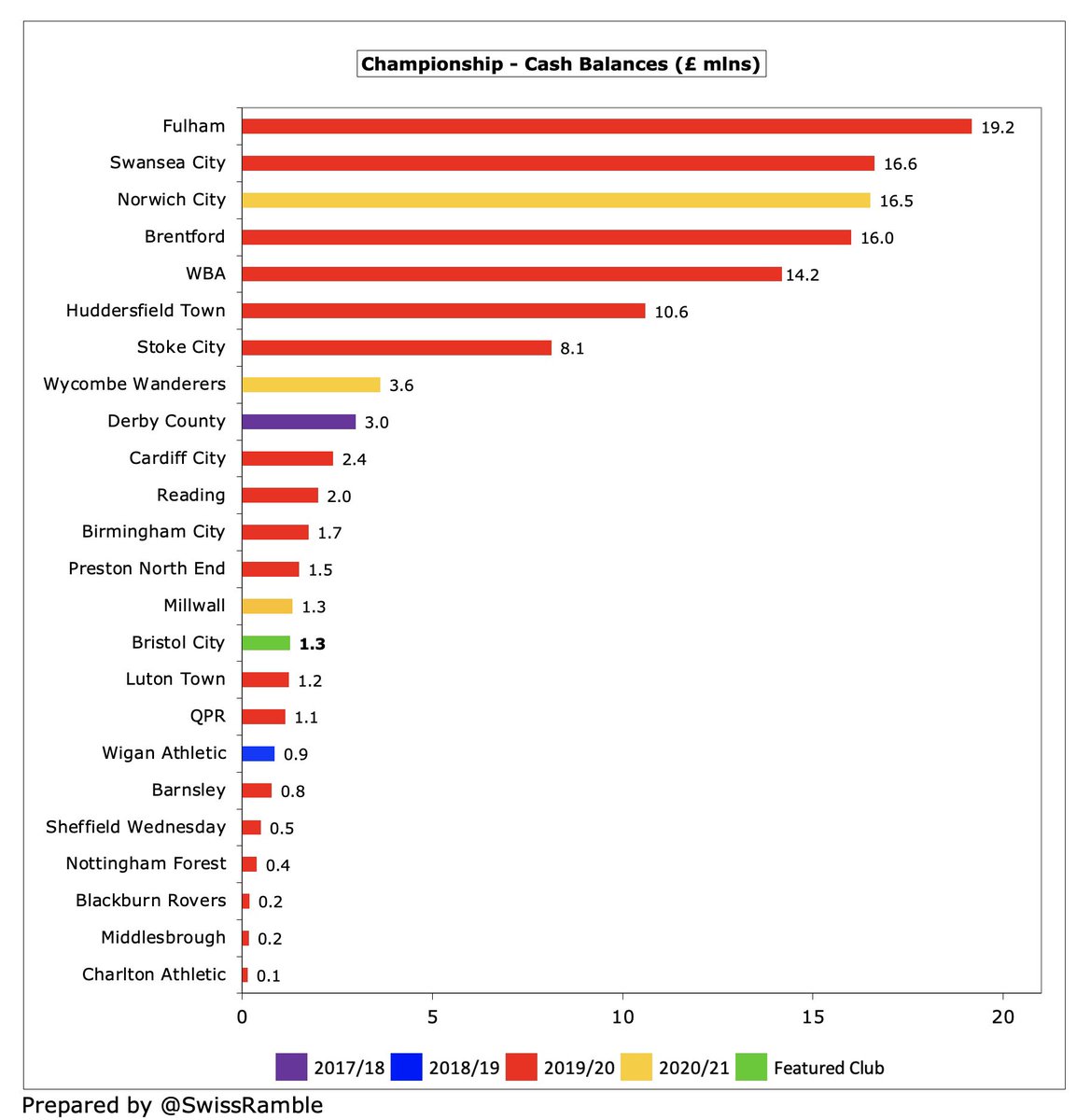

As a result, #BristolCity cash balance increased from £0.9m to £1.3m, which is not that much, but the reality is that most clubs in the Championship have less than £2m in the bank, relying on money from their owners.

Since 2012 #BristolCity had available cash of £204m: (a) £98m from issuing share capital; (b) £84m from loans; (c) £22m from (net) player sales. Most of this has been used to cover operating losses £124m and on infrastructure investment £73m (stadium & training ground).

#BristolCity are dependent on funding from Lansdown, who said, “I hope people recognise what it takes to run a football club at the level we’re at”. Indeed, my calculation is that he has put in around £217m to date (capital £147m, loans £70m), which is a huge commitment.

In the 10 years up to 2019/20, #BristolCity benefited from £169m of money from the owner, the fifth highest in the Championship. There is little sign of the need for this funding going away, which helps explain why Lansdown is reportedly looking to bring in outside investment.

Despite the chunky loss, #BristolCity are still fine with Profitability & Sustainability rules. Reported £38m losses over 3-year monitoring period are within the £39m target even before estimated £15m allowable deductions for academy, community, infrastructure.

It is true that #BristolCity profitable 2018/19 season will drop out of the 3-year FFP period next year, but there will be special dispensation for losses resulting from COVID, so they should be OK for a while yet.

Like most other clubs, #BristolCity make substantial operational losses, though they managed to limit the damage with profitable player trading, at least before COVID struck. They are lucky to have a benevolent owner in Lansdown, especially during the pandemic.

• • •

Missing some Tweet in this thread? You can try to

force a refresh