Risk Harbor has launched Ozone V1.

An insurance product that protects you from smart contract risks, hacks, and attacks on Anchor Protocol.

You usually get 19.5% APY on Anchor.

With insurance, you get 17.5% APY.

A step-by-step thread for the safe, passive investor:

/1

An insurance product that protects you from smart contract risks, hacks, and attacks on Anchor Protocol.

You usually get 19.5% APY on Anchor.

With insurance, you get 17.5% APY.

A step-by-step thread for the safe, passive investor:

/1

Decentralized money needs truly decentralized protection.

@riskharbor is protection built by the people, for the people.

It is a marketplace for DeFi that utilizes a completely automated, transparent, and impartial claims mechanism to protect...

/2

@riskharbor is protection built by the people, for the people.

It is a marketplace for DeFi that utilizes a completely automated, transparent, and impartial claims mechanism to protect...

/2

liquidity providers and stakers against smart contract risks, hacks, and attacks.

The first protocol that is protected on Terra through Ozone is @anchorprotocol

Soon we will get protection for several Terra-protocols too.

Ozone V1 has been audited by Oak Security & Certik

/3

The first protocol that is protected on Terra through Ozone is @anchorprotocol

Soon we will get protection for several Terra-protocols too.

Ozone V1 has been audited by Oak Security & Certik

/3

Why do we need this?

Whenever a user deposits funds into a DeFi protocol there is a risk that those funds may be lost.

We've seen several hacks in DeFi already, and the latest big hack was at @grimfinance ($30M stolen).

/4

Whenever a user deposits funds into a DeFi protocol there is a risk that those funds may be lost.

We've seen several hacks in DeFi already, and the latest big hack was at @grimfinance ($30M stolen).

/4

If you invest in TradFI-products in the US you are insured up to $250,000.

But in DeFi, you are not insured at all.

There are already several DeFi insurance products on the market today, but they use governance to assess claims.

This means that if...

/5

But in DeFi, you are not insured at all.

There are already several DeFi insurance products on the market today, but they use governance to assess claims.

This means that if...

/5

you own governance tokens you can be among the people who decide if the incoming claims are valid.

The problem?

Those who hold governance tokens are most often the same people that are underwriters.

To explain this, let's say you have a $100K in a DeFi protocol...

/6

The problem?

Those who hold governance tokens are most often the same people that are underwriters.

To explain this, let's say you have a $100K in a DeFi protocol...

/6

that is hacked. You fill in a claim to the governor since you have insurance.

Then the governors are checking your claim to see if it's valid.

But even if it's valid, the governors are probably not very happy to pay you because then they have to use their own money.

/7

Then the governors are checking your claim to see if it's valid.

But even if it's valid, the governors are probably not very happy to pay you because then they have to use their own money.

/7

@riskharbor solves this by letting the smart contract check if your claim is valid (automated process), which means that if there would be a hack on Anchor Protocol and your money vanishes, you could make a claim and receive the money you've lost within some minutes.

/8

/8

How does it work?

Users who wish to purchase protection pay premiums to underwriters who agree to take on risks on behalf of policyholders.

However, specifically in Ozone V1, the Terra community fund will be the sole underwriter for Anchor as ample capacity is provided.

/9

Users who wish to purchase protection pay premiums to underwriters who agree to take on risks on behalf of policyholders.

However, specifically in Ozone V1, the Terra community fund will be the sole underwriter for Anchor as ample capacity is provided.

/9

Anchor protection is priced at a flat 2% annualized rate.

That means that instead of 19.5% APY, you'll end up with 17.5% APY.

Filing a claim is a two-step process.

The policyholder first sends their aUST claim token to Ozone. Ozone then calls the...

/10

That means that instead of 19.5% APY, you'll end up with 17.5% APY.

Filing a claim is a two-step process.

The policyholder first sends their aUST claim token to Ozone. Ozone then calls the...

/10

default detector contract which evaluates the validity of the claim.

If the policyholder is valid, after at least one block (to prevent flash loan attacks) they may finish the claim.

In this case, the protocol keeps the distressed claim tokens to distribute to...

/11

If the policyholder is valid, after at least one block (to prevent flash loan attacks) they may finish the claim.

In this case, the protocol keeps the distressed claim tokens to distribute to...

/11

underwriters and pays out the policyholder from the underwriting fund

I feel like I've bored you with enough theory, so let's look at how you can protect your capital step-by-step

I'll make this example with $100K, but the principle remains the same for $1K or $1M as well

/12

I feel like I've bored you with enough theory, so let's look at how you can protect your capital step-by-step

I'll make this example with $100K, but the principle remains the same for $1K or $1M as well

/12

Step 1: Deposit $100,000 in Anchor Protocol (equals 86,206 aUST)

Step 2: Go to: ozone.riskharbor.com and connect your wallet

Step 3: Go to "Protect" and enter the number of aUST you want to protect (see screenshot below)

/13

Step 2: Go to: ozone.riskharbor.com and connect your wallet

Step 3: Go to "Protect" and enter the number of aUST you want to protect (see screenshot below)

/13

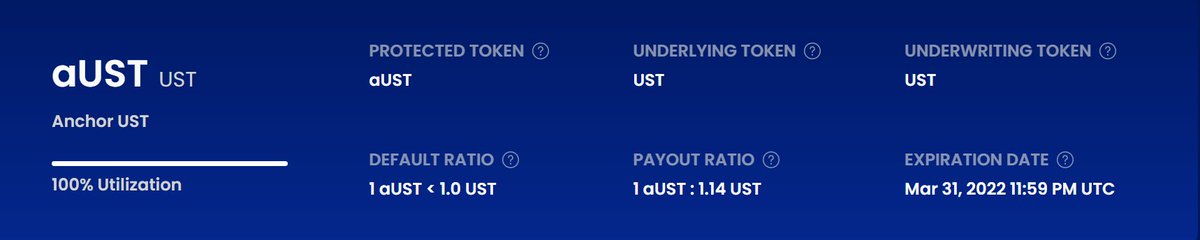

Step 4: In the image above, you are able to view two things.

First, you are able to see the “Payout”, which demonstrates how much you would get paid out denominated in UST if there is a default event on Anchor

Second, you are able to see the “Premium”, which is the price..

14/

First, you are able to see the “Payout”, which demonstrates how much you would get paid out denominated in UST if there is a default event on Anchor

Second, you are able to see the “Premium”, which is the price..

14/

of protection denominated in UST.

Why isn't the payout $100K $UST?

And why is the premium $425.64 $UST?

If a hack occurs you are paid out 1.14 UST per 1 aUST (pic below)

But 1 aUST is at the moment worth 1.164 UST, in other words youre paid:

86,206 x 1,14 = $98,2K

/15

Why isn't the payout $100K $UST?

And why is the premium $425.64 $UST?

If a hack occurs you are paid out 1.14 UST per 1 aUST (pic below)

But 1 aUST is at the moment worth 1.164 UST, in other words youre paid:

86,206 x 1,14 = $98,2K

/15

I'm not sure why @riskharbor has made a margin here, but I hope that they will peg the payout ratio 1:1 to aUST.

Otherwise, I feel that the product is getting less attractive over time.

Imagine in 1 year when aUST is 1.35, but the payout ratio is still 1.14 per 1 UST.

/16

Otherwise, I feel that the product is getting less attractive over time.

Imagine in 1 year when aUST is 1.35, but the payout ratio is still 1.14 per 1 UST.

/16

This is just me thinking out loud here, but I feel pretty confident that the payout ratio will be 1:1 soon

Why is the premium $425.64?

Ozone V1 lasts to the end of March before it is replaced by Ozone V2

So the premium is 0.5% for the first 3 months (2% for 1 year)

/17

Why is the premium $425.64?

Ozone V1 lasts to the end of March before it is replaced by Ozone V2

So the premium is 0.5% for the first 3 months (2% for 1 year)

/17

Step 5: Click “Purchase Protection” and you should now be protected.

If you purchased protection successfully, you should see a “Purchase Successful” notification pop up at the top right of your screen.

You can also view your transaction on Terra Finder.

/18

If you purchased protection successfully, you should see a “Purchase Successful” notification pop up at the top right of your screen.

You can also view your transaction on Terra Finder.

/18

Congratulations, you are now protected!

However, you're not protected against $UST depeg.

This is coming (hopefully early January).

Integration with Mirror will also come during Q1 2022, but the date is yet to be announced.

19/

However, you're not protected against $UST depeg.

This is coming (hopefully early January).

Integration with Mirror will also come during Q1 2022, but the date is yet to be announced.

19/

We will also probably also see options for insurance on most Terra platforms during 2022.

Especially: Kinetic Money, Nexus UST Vault and Mars Protocol (high up on my list).

I have not been able to buy insurance yet because the pool is full (expect it to be refilled soon).

/20

Especially: Kinetic Money, Nexus UST Vault and Mars Protocol (high up on my list).

I have not been able to buy insurance yet because the pool is full (expect it to be refilled soon).

/20

I have some questions that are unanswered that I hope @riskharbor can answer.

-How much assets can you have under management? How often will AUM increase so that more people can use your product?

-When will $UST de-peg be ready? And what will the price be?

/21

-How much assets can you have under management? How often will AUM increase so that more people can use your product?

-When will $UST de-peg be ready? And what will the price be?

/21

-How do you prevent hacks on Risk Harbor Ozone? Do we need to insure the insurance protocol? This should be very unlikely, but anyway a question.

-Which protocols do you plan to integrate with? And when will they be ready?

/22

-Which protocols do you plan to integrate with? And when will they be ready?

/22

-And as a side-note, will you make an insurance product for the Degenbox $UST - $MIM on $ETH / $FTM ?

I wish I had all the answers from Ozone already, but the protocol is only 1 day old.

So the best is yet to come!

/23

I wish I had all the answers from Ozone already, but the protocol is only 1 day old.

So the best is yet to come!

/23

That was everything.

I hope you learned something new!

If you want more updates on what's happening in DeFi, check out my free newsletter here:

getrevue.co/profile/route2…

/24

I hope you learned something new!

If you want more updates on what's happening in DeFi, check out my free newsletter here:

getrevue.co/profile/route2…

/24

If you liked this thread, I would love it if you could help me by sharing the first tweet by retweeting it👇

/25

https://twitter.com/Route2FI/status/1476929845498204161?s=20

/25

• • •

Missing some Tweet in this thread? You can try to

force a refresh