2021 was a year of massive growth for #Chainlink. Thank you to all the developers, node operators, data providers, community members, and contributors who helped make this past year a success.

Here are 7 key pillars of Chainlink's 2021 momentum: blog.chain.link/the-year-in-ch…

Here are 7 key pillars of Chainlink's 2021 momentum: blog.chain.link/the-year-in-ch…

1/ The Total Value Secured (TVS) of the Chainlink Network surpassed $75B, a 10x+ increase on the previous year.

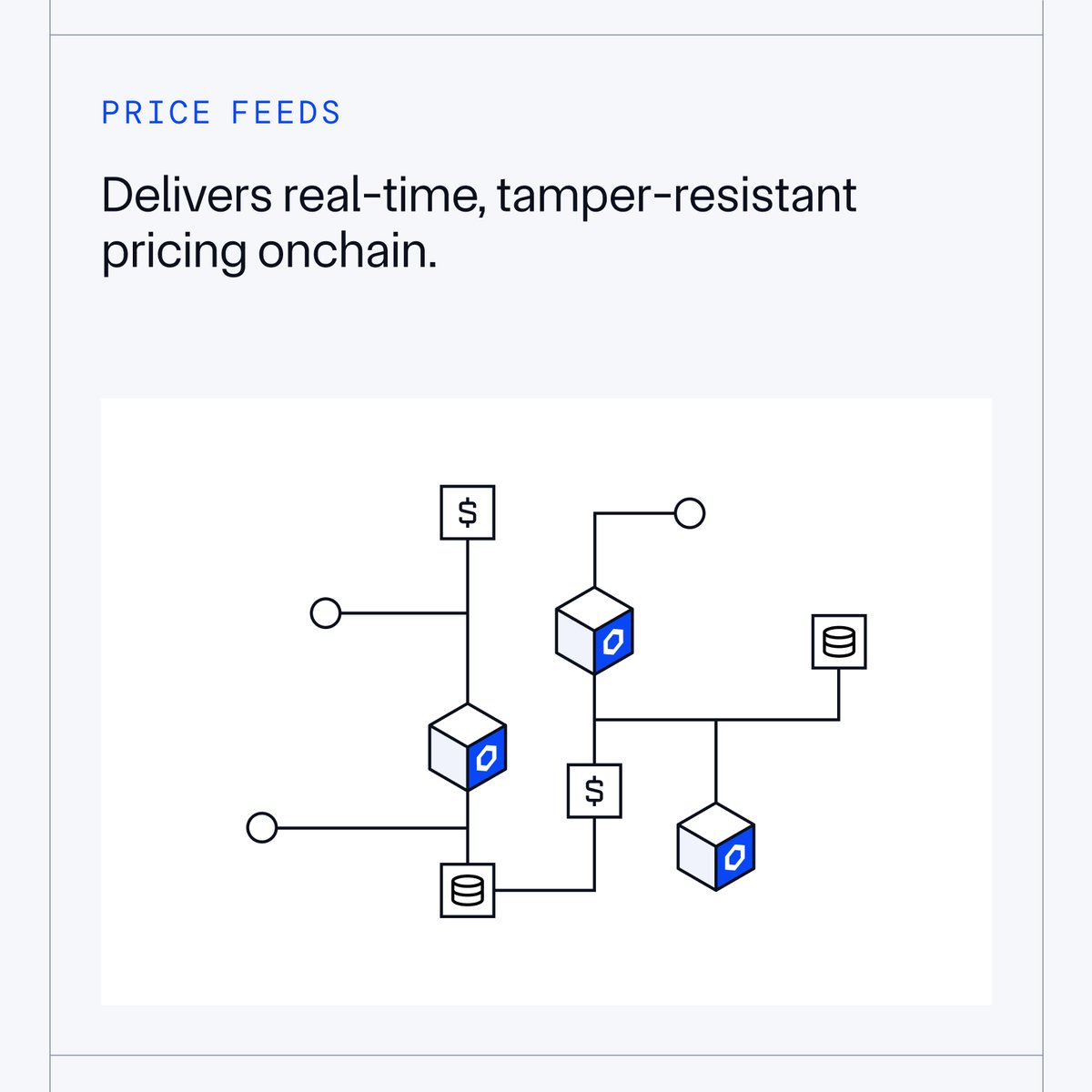

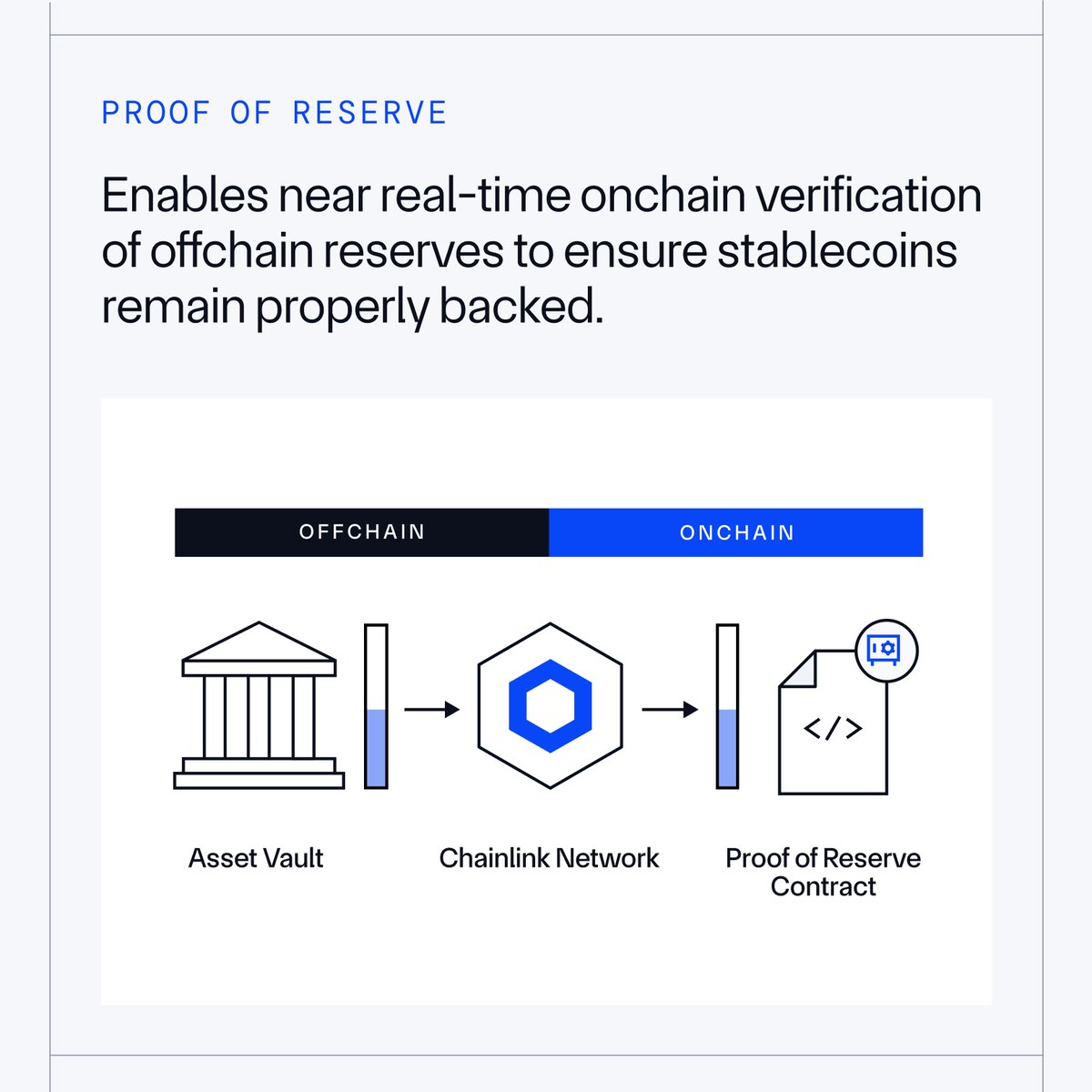

Chainlink now supports 700+ oracle networks, with oracles feeding market data & other datasets on-chain, such as weather data, sports stats, Proof of Reserve, & more.

Chainlink now supports 700+ oracle networks, with oracles feeding market data & other datasets on-chain, such as weather data, sports stats, Proof of Reserve, & more.

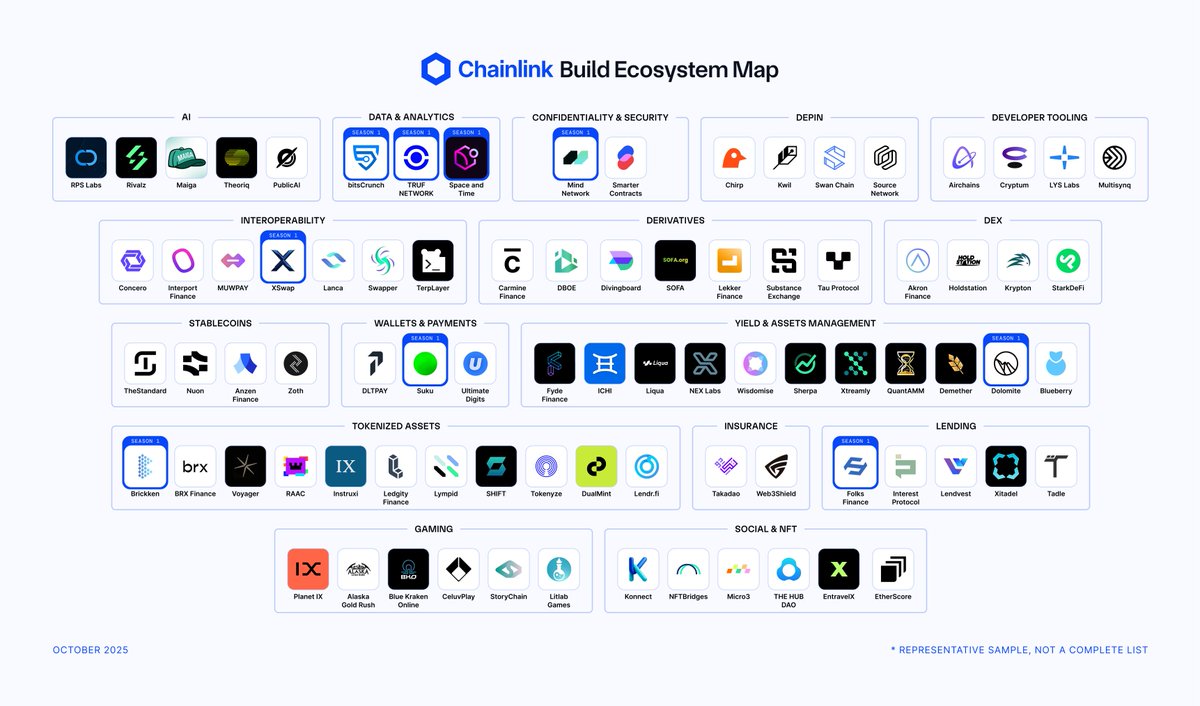

2/ The Chainlink ecosystem now consists of 1,000+ projects, with half of all integrations taking place in 2021.

Chainlinked applications secure the majority of TVL across #DeFi lending & derivatives markets, supported by oracle networks that bring critical market data on-chain.

Chainlinked applications secure the majority of TVL across #DeFi lending & derivatives markets, supported by oracle networks that bring critical market data on-chain.

3/ Chainlink oracles have serviced 2.5M+ requests for secure off-chain computation.

Chainlink VRF and Chainlink Keepers have expanded support to more blockchains, providing developers access to a secure and reliable source of verifiable randomness and DevOps automation.

Chainlink VRF and Chainlink Keepers have expanded support to more blockchains, providing developers access to a secure and reliable source of verifiable randomness and DevOps automation.

4/ As a blockchain-agnostic protocol, Chainlink has expanded to support 12 chains and layer-2 scaling solutions.

When Chainlink oracles are deployed on a new network, that on-chain ecosystem experiences a surge of growth as developers are empowered to build more advanced dApps.

When Chainlink oracles are deployed on a new network, that on-chain ecosystem experiences a surge of growth as developers are empowered to build more advanced dApps.

5/ Across 2 Chainlink hackathons, there were:

11,000+ signups

420+ submissions

$730k+ in prizes

The open-source dev ecosystem supporting Chainlink has rapidly grown, with 3,300+ pull requests from 180+ contributors in 2021 & 4,000+ public GitHub repos now referencing Chainlink.

11,000+ signups

420+ submissions

$730k+ in prizes

The open-source dev ecosystem supporting Chainlink has rapidly grown, with 3,300+ pull requests from 180+ contributors in 2021 & 4,000+ public GitHub repos now referencing Chainlink.

6/ Chainlink is the leading oracle network in terms of enterprise adoption.

Top enterprises like the AP, AccuWeather, AWS, GCP, & Swisscom joined the Chainlink ecosystem to access the blockchain economy and help the Chainlink Network securely deliver 1.1B+ data points on-chain.

Top enterprises like the AP, AccuWeather, AWS, GCP, & Swisscom joined the Chainlink ecosystem to access the blockchain economy and help the Chainlink Network securely deliver 1.1B+ data points on-chain.

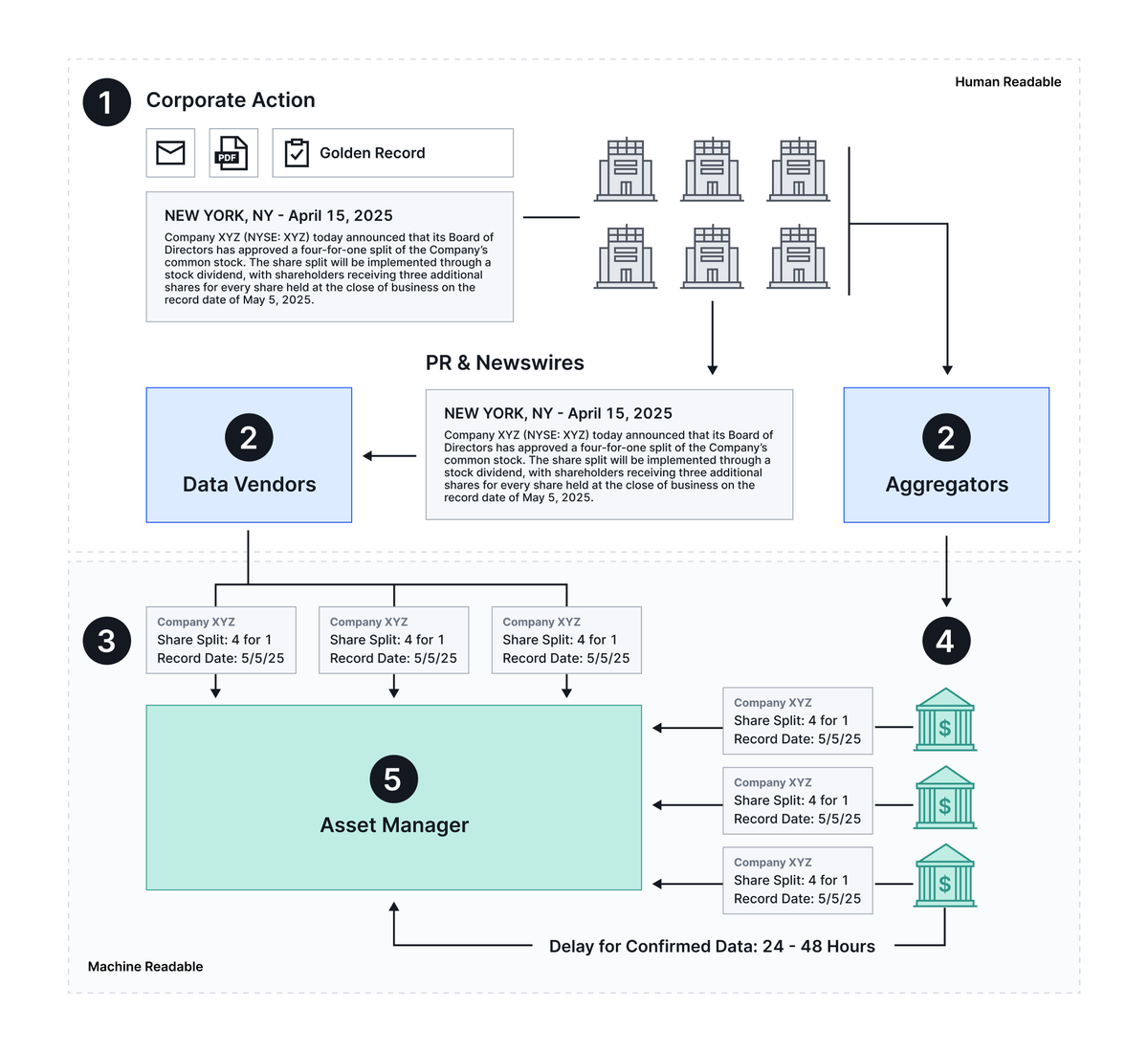

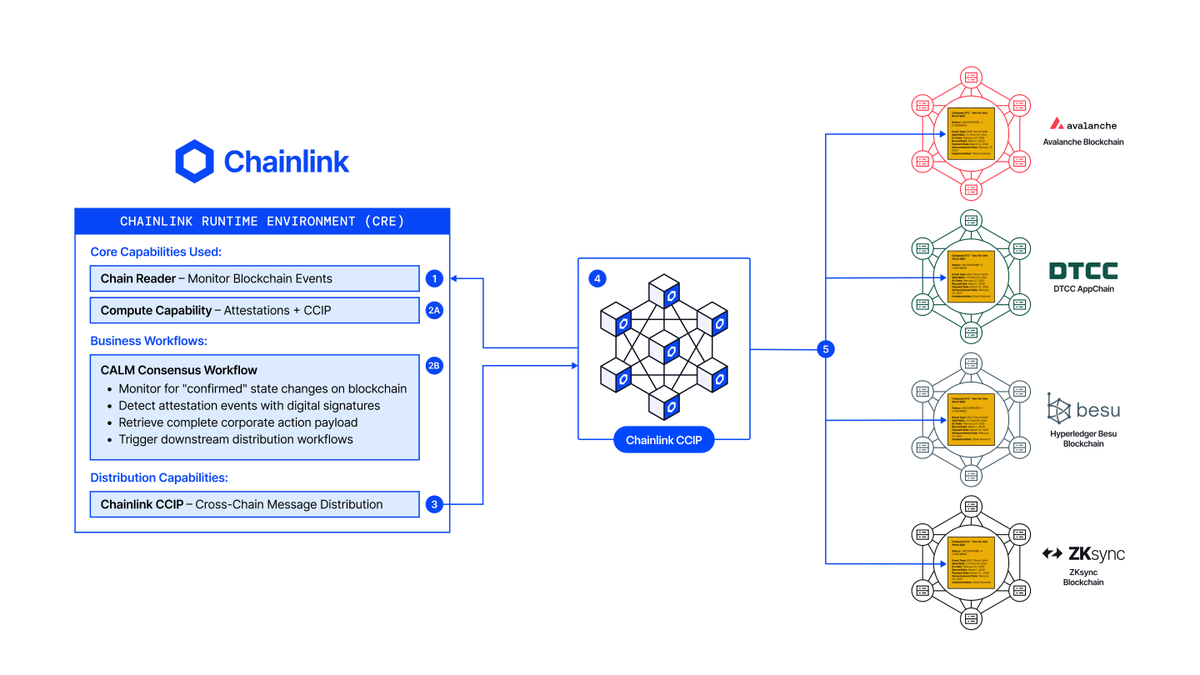

7/ Chainlink is supporting the growth of the #multichain ecosystem by developing the Cross-Chain Interoperability Protocol (CCIP).

Cross-chain innovation is set to unlock massive value across global industries and help enable the shift to a world powered by cryptographic truth.

Cross-chain innovation is set to unlock massive value across global industries and help enable the shift to a world powered by cryptographic truth.

• • •

Missing some Tweet in this thread? You can try to

force a refresh