This thread is about the technical setups I use day in/out to trade the markets📒

1⃣Wedge break (WB)

2⃣Wedge break pullback (WBPB)

3⃣Breakout Retest short (BORS)

4⃣Breakout Retest Long (BORL)

5⃣Breakout 10ema PB (BO10PB)

6⃣Breakout 21ema PB (BO21PB)

That's my playbook 👇

1⃣Wedge break (WB)

2⃣Wedge break pullback (WBPB)

3⃣Breakout Retest short (BORS)

4⃣Breakout Retest Long (BORL)

5⃣Breakout 10ema PB (BO10PB)

6⃣Breakout 21ema PB (BO21PB)

That's my playbook 👇

1⃣ Wedge break (WB)

Price forming a orderly pullback contained by a down trend line (DTL)

I buy on the DTL breakout ideally on higher than avrg. volume

Price forming a orderly pullback contained by a down trend line (DTL)

I buy on the DTL breakout ideally on higher than avrg. volume

2⃣ Wedge break pullback (WBPB)

After the WB, you often have a pullback to the kma's (10/21), we then find support and follow through on the upside.

I usually buy on the intraday WB (15min/1 hour)

After the WB, you often have a pullback to the kma's (10/21), we then find support and follow through on the upside.

I usually buy on the intraday WB (15min/1 hour)

3⃣ Breakout Retest short (BORS)

After a base breakout, the BORS takes place when price comes back testing the BO pivot within a couple days only.

I buy the bullish candle on the retest.

After a base breakout, the BORS takes place when price comes back testing the BO pivot within a couple days only.

I buy the bullish candle on the retest.

4⃣ Breakout Retest Long (BORL)

Sometimes we breakout with a lot of strength, but we pullback during a couple weeks back to the BO level in a wedge pattern.

I either buy the BO pivot retest OR the wedge breakout

Sometimes we breakout with a lot of strength, but we pullback during a couple weeks back to the BO level in a wedge pattern.

I either buy the BO pivot retest OR the wedge breakout

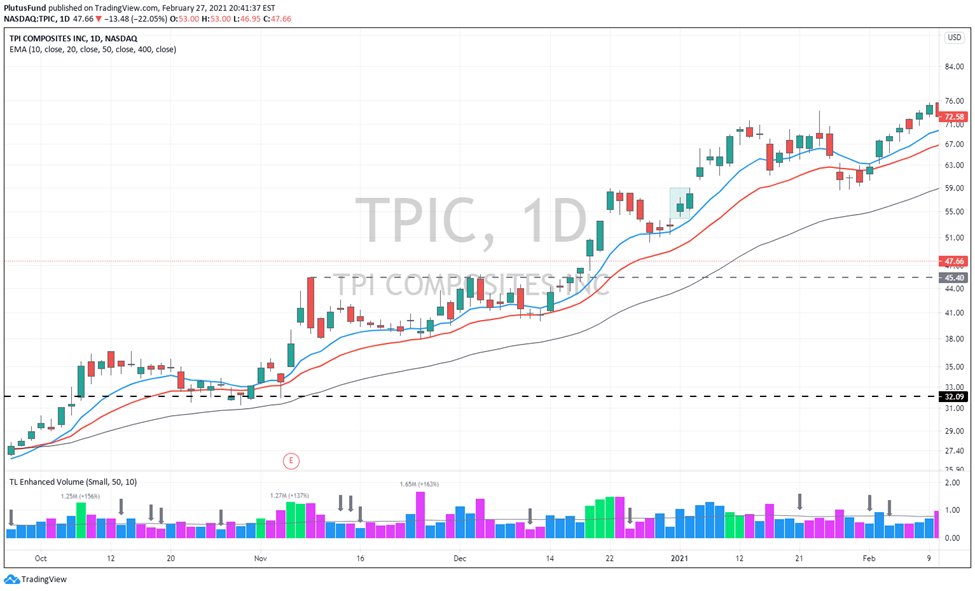

5⃣ Breakout 10ema PB (BO10PB)

When the breakout is powerful & buying pressure is sustained, we don't always get a BO level retest. In that case we might only get a pullback to the 10dma.

I buy the intraday wedge break or tight action at the ema.

When the breakout is powerful & buying pressure is sustained, we don't always get a BO level retest. In that case we might only get a pullback to the 10dma.

I buy the intraday wedge break or tight action at the ema.

6⃣ Breakout 21ema PB (BO21PB)

Just like the BO10PB, we often retrace to the 21dma after the breakout. Gives a good low risk entry.

Just like the BO10PB, we often retrace to the 21dma after the breakout. Gives a good low risk entry.

➕ BONUS : SECOND ENTRY (SE)

Try a first time to bounce of level, retrace back to it and bounce higher & on higher volume (higher low).

If you see that bonus price action at key levels (KMA's & pivots), it indicates that buying pressure in really building up. It's super bullish

Try a first time to bounce of level, retrace back to it and bounce higher & on higher volume (higher low).

If you see that bonus price action at key levels (KMA's & pivots), it indicates that buying pressure in really building up. It's super bullish

• • •

Missing some Tweet in this thread? You can try to

force a refresh