Professional Trader, 10+ years experience - Founder at https://t.co/oHBJyNQTZd and https://t.co/GEJpgVvdaY.

7 subscribers

How to get URL link on X (Twitter) App

Right now, based on structure, I see a new LL & LH, so pullback/consolidation is underway.

Right now, based on structure, I see a new LL & LH, so pullback/consolidation is underway.

The first thing to consider first & foremost that could lead to a range/choppy day often comes from outside elements like:

The first thing to consider first & foremost that could lead to a range/choppy day often comes from outside elements like:

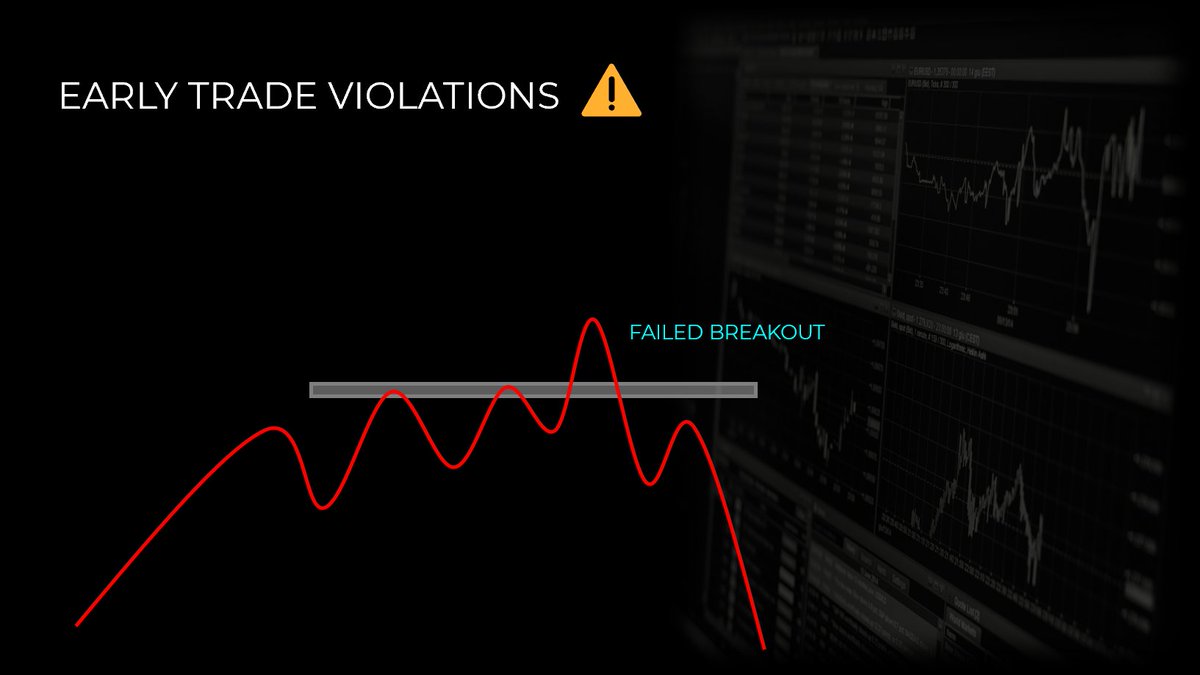

Not every stock entry will work, no matter the fundamentals or how much you did research on it.

Not every stock entry will work, no matter the fundamentals or how much you did research on it.

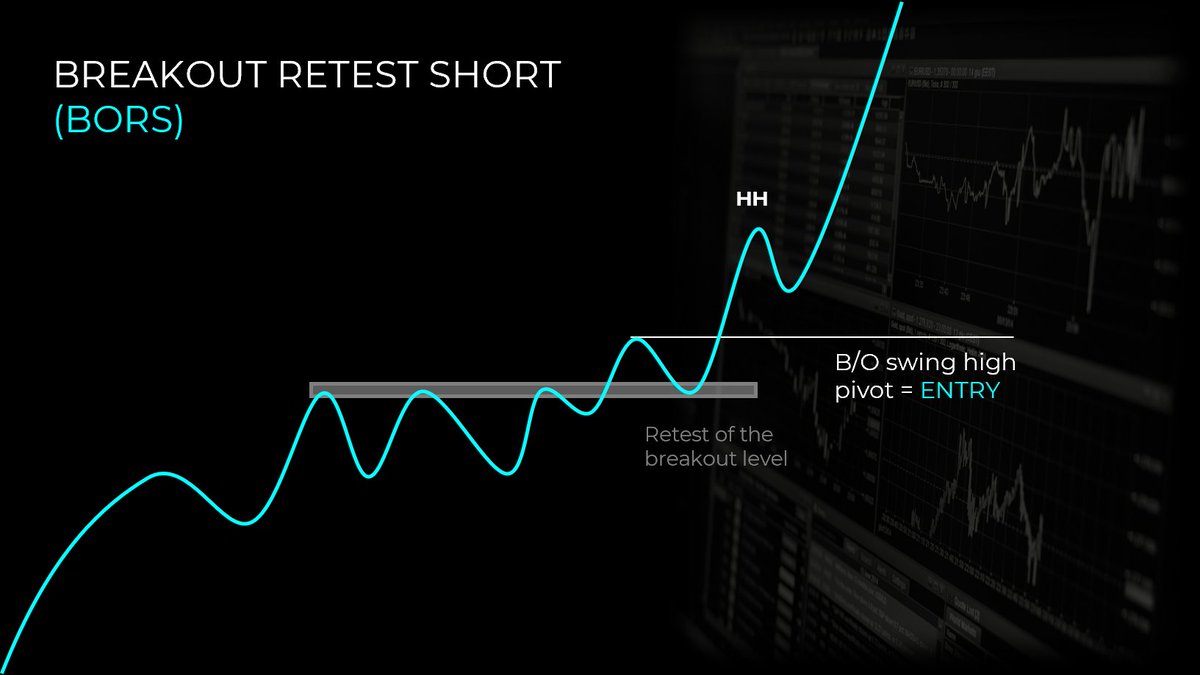

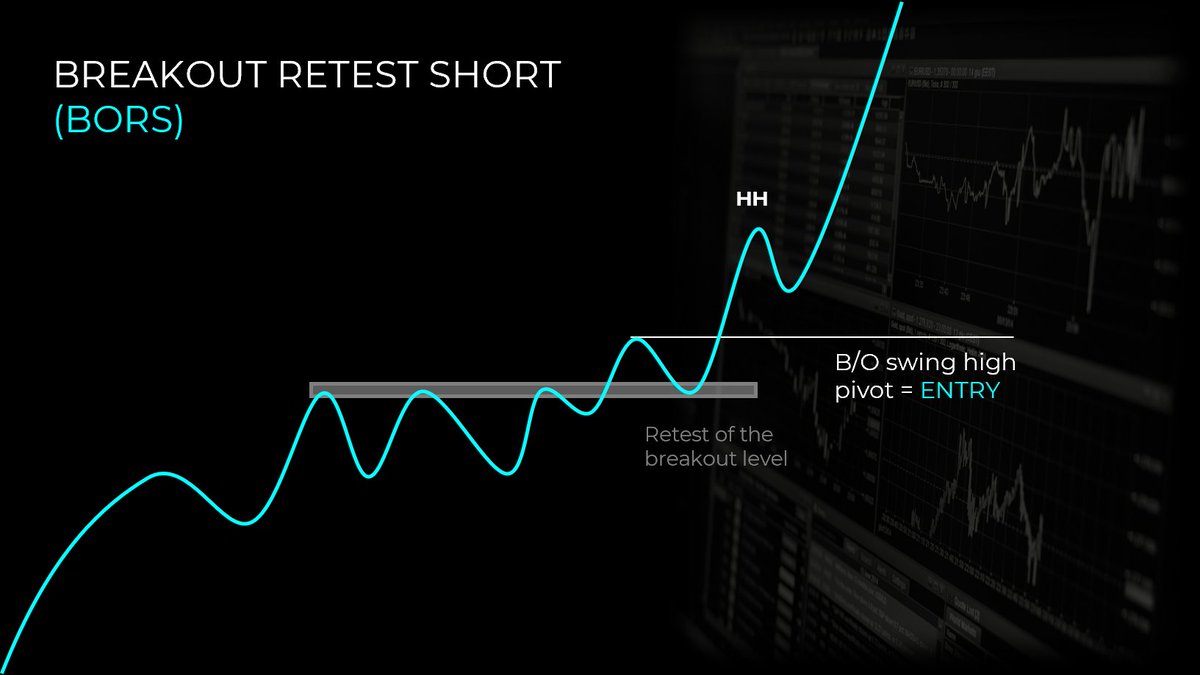

After a base breakout, the BORS setup takes place when price comes back testing the BO pivot within a short period of time.

After a base breakout, the BORS setup takes place when price comes back testing the BO pivot within a short period of time.

Price forming an orderly pullback contained by a down trend line (DTL). You want to see low volume within that wedge formation, with small down swings ideally.

Price forming an orderly pullback contained by a down trend line (DTL). You want to see low volume within that wedge formation, with small down swings ideally.

https://twitter.com/PrimeTrading_/status/1541030756658675714?s=20&t=ffFPXRSye9saEyyG5oAEtg

https://twitter.com/PrimeTrading_/status/1541030756658675714?s=20&t=bHYNCFeWuhnNKPySeQVWDQ

https://twitter.com/PrimeTrading_/status/1538495800468201474?s=20&t=6Ph3Gen4_ZlN8cp3QYhXbQ