1/13

2021 was a year like no other for FinTech deal activity!

Here are some of the most eye-popping stats, all using

@FTPartners

proprietary data …

#FinTech

2021 was a year like no other for FinTech deal activity!

Here are some of the most eye-popping stats, all using

@FTPartners

proprietary data …

#FinTech

2/13

2021 established new records across global private FinTech company financing, M&A, IPOs and SPACs

#FinTech

2021 established new records across global private FinTech company financing, M&A, IPOs and SPACs

#FinTech

3/13

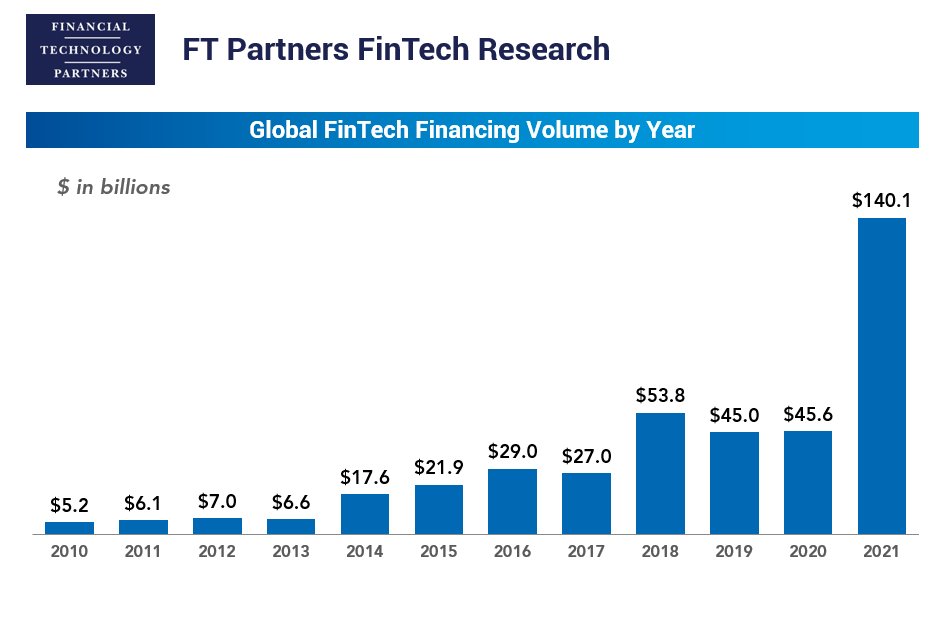

Total capital raised by private FinTech companies was 3x higher than 2020 and nearly as much as the prior three years combined!

#FinTech

Total capital raised by private FinTech companies was 3x higher than 2020 and nearly as much as the prior three years combined!

#FinTech

4/13

The number of $100 million+ rounds was off the charts at 396 vs. 107 in 2020, the prior record.

#FinTech

The number of $100 million+ rounds was off the charts at 396 vs. 107 in 2020, the prior record.

#FinTech

5/13

Perhaps even more dramatic, the number of $500 million+ financing rounds was more than the prior 4 YEARS combined!

#FinTech

Perhaps even more dramatic, the number of $500 million+ financing rounds was more than the prior 4 YEARS combined!

#FinTech

6/13

Funding round sizes increased across the board in 2021 - The medians for both Series C and Series D rounds rose ~67% over 2020 to $80 million and $130 million, respectively.

#FinTech

Funding round sizes increased across the board in 2021 - The medians for both Series C and Series D rounds rose ~67% over 2020 to $80 million and $130 million, respectively.

#FinTech

7/13

Banking Tech was the most active FinTech sector for financing in 2021. Crypto experienced the greatest growth, with total capital raised up 9x over 2020 – Crypto volume in 2021 was larger than ALL PRIOR YEARS combined!

#FinTech #Crypto #Blockchain #BankingTech

Banking Tech was the most active FinTech sector for financing in 2021. Crypto experienced the greatest growth, with total capital raised up 9x over 2020 – Crypto volume in 2021 was larger than ALL PRIOR YEARS combined!

#FinTech #Crypto #Blockchain #BankingTech

8/13

Every region globally reached record levels of FinTech funding activity – South America, The Middle East, Australia / New Zealand, and Africa all recorded 100%+ growth over 2020 in number of FinTech financing transactions.

#FinTech

Every region globally reached record levels of FinTech funding activity – South America, The Middle East, Australia / New Zealand, and Africa all recorded 100%+ growth over 2020 in number of FinTech financing transactions.

#FinTech

9/13

2021 had the highest number of SPAC mergers with FinTech companies ever with 40 new transactions compared to 15 in 2020 and 2 in 2019.

#FinTech #SPACs

2021 had the highest number of SPAC mergers with FinTech companies ever with 40 new transactions compared to 15 in 2020 and 2 in 2019.

#FinTech #SPACs

10/13

2021 was the largest year ever for FinTech IPOs by capital raised and count, with more than 50 IPOs globally.

#FinTech #IPOs #FinTechIPOs

2021 was the largest year ever for FinTech IPOs by capital raised and count, with more than 50 IPOs globally.

#FinTech #IPOs #FinTechIPOs

11/13

M&A activity also set a new record as the number of FinTech M&A transactions was up 50% over 2020, reaching nearly 1,450 FinTech mergers and acquisitions globally in 2021.

#FinTech

M&A activity also set a new record as the number of FinTech M&A transactions was up 50% over 2020, reaching nearly 1,450 FinTech mergers and acquisitions globally in 2021.

#FinTech

12/13

In 2021 there were more than 70 FinTech M&A deals valued at $1 billion or more, up from 41 in 2020 and just 23 in 2019.

#FinTech

In 2021 there were more than 70 FinTech M&A deals valued at $1 billion or more, up from 41 in 2020 and just 23 in 2019.

#FinTech

13/13

Much more data to come in FT Partners’ 2021 FinTech Almanac, to be published later in January. Meanwhile, check out all of our research here: ftpartners.com/fintech-resear…

Happy New Year!

#FinTech

Much more data to come in FT Partners’ 2021 FinTech Almanac, to be published later in January. Meanwhile, check out all of our research here: ftpartners.com/fintech-resear…

Happy New Year!

#FinTech

• • •

Missing some Tweet in this thread? You can try to

force a refresh