I write/film about money for a living -- both for @themotleyfool and with @BrianFeroldi

Therefore, you deserve to know

💰 WHAT I OWN

📈 HOW I'VE DONE

Here are ALL THE FACTS as 2022 begins ⤵️

Therefore, you deserve to know

💰 WHAT I OWN

📈 HOW I'VE DONE

Here are ALL THE FACTS as 2022 begins ⤵️

First, it's important to know my 💰 situation

I am:

📅 40 Years Old

👨👩👧👧 Married with two children (both under 10)

🏦 No major debt other than mortgage

👩👧 Near fam & friends who create support net

My net worth breaks down like this:

I am:

📅 40 Years Old

👨👩👧👧 Married with two children (both under 10)

🏦 No major debt other than mortgage

👩👧 Near fam & friends who create support net

My net worth breaks down like this:

Your life situation is probably different.

What makes sense for me *will* often be different than what makes sense for you.

That being said, here's how I've done as investor (using numbers possible as far back as I have).

What makes sense for me *will* often be different than what makes sense for you.

That being said, here's how I've done as investor (using numbers possible as far back as I have).

YTD (end of 2021): 10% , or (18%) UNDERperformance

3-Year Returns: 218%, or +128%

5-Year Returns: 530%, or +396%

10-Year Returns: 850% or +490%

📈That = 25.3% CAGR

📉 S&P = 16.6% CAGR

How did I do it? Two simple steps...

3-Year Returns: 218%, or +128%

5-Year Returns: 530%, or +396%

10-Year Returns: 850% or +490%

📈That = 25.3% CAGR

📉 S&P = 16.6% CAGR

How did I do it? Two simple steps...

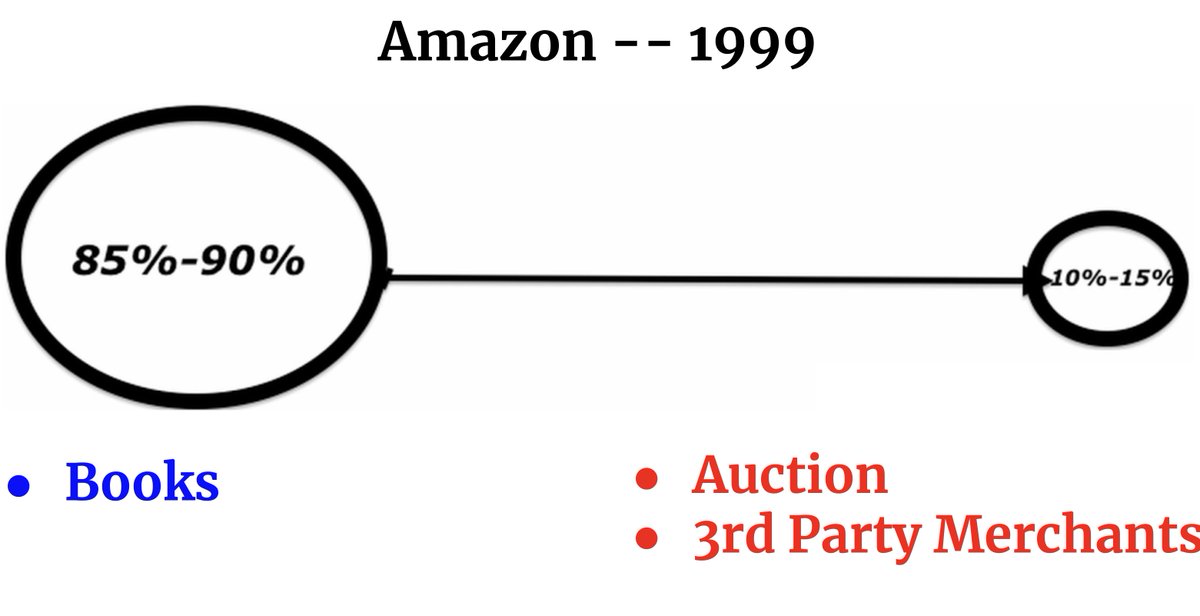

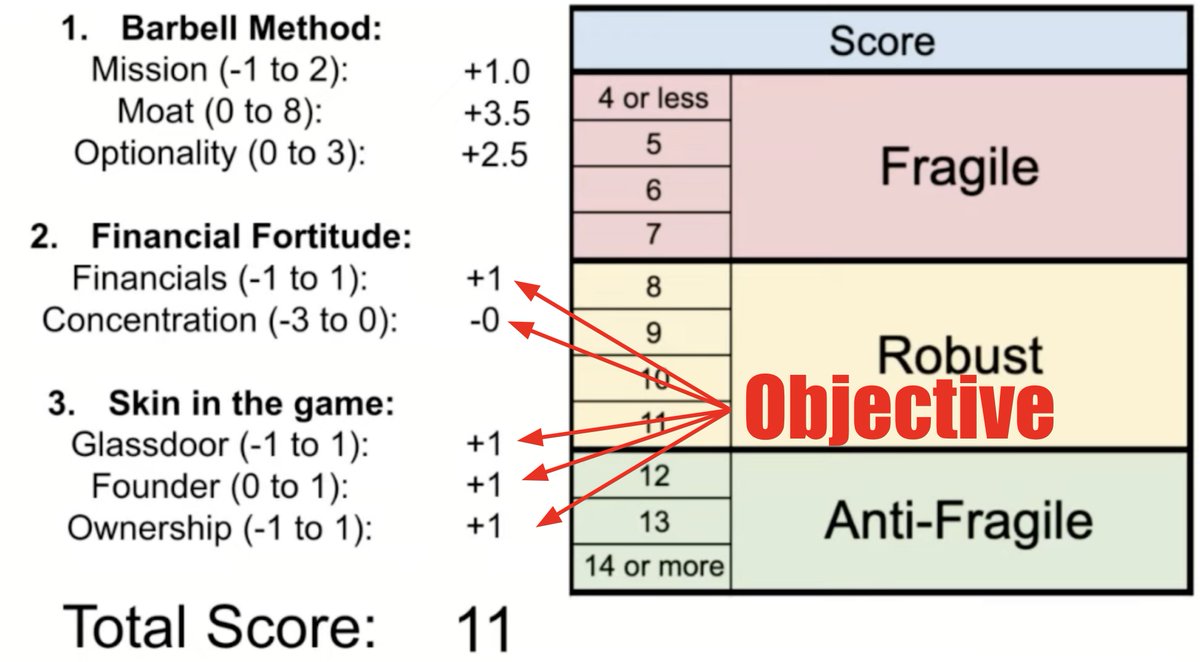

1⃣Took @nntaleb's INCERTO principles and applied to stocks.

(NB: Not something he advocates, it's my application of ideas from his books).

The result: THE ANTIFRAGILE FRAMEWORK

You can see me use it 3X per week with @BrianFeroldi (for FREE), here:

youtube.com/brianferoldiyt…

(NB: Not something he advocates, it's my application of ideas from his books).

The result: THE ANTIFRAGILE FRAMEWORK

You can see me use it 3X per week with @BrianFeroldi (for FREE), here:

youtube.com/brianferoldiyt…

2⃣ I used @themotleyfool as my education and stock filtering machine.

I was a middle school teacher w/ NO background in money in 2007.

Here's what's in that portfolio **as of 1/1/21**.

STOCK -- % of PORT -- Cum. Returns ⤵️

I was a middle school teacher w/ NO background in money in 2007.

Here's what's in that portfolio **as of 1/1/21**.

STOCK -- % of PORT -- Cum. Returns ⤵️

1) $SHOP 17%, 2,300%

2) $MDB 8%, 600%

3) $MELI 8%, 800%

4) Cash 7%

5) $DDOG 7%, 400%

6) $CRWD 6%, 200%

7) $TEAM 6%, 200%

8) $AXON 5%, 400%

9) $AMZN 5%, 1,700%

10) $SE 5%, 60%

11) $U 5%, 40%

12) $GOOG/L 5%, 750%

13) $VEEV 4%, 650%

14) $ISRG 3%, 900%

15) $ABNB 3%, 5% ⤵️

2) $MDB 8%, 600%

3) $MELI 8%, 800%

4) Cash 7%

5) $DDOG 7%, 400%

6) $CRWD 6%, 200%

7) $TEAM 6%, 200%

8) $AXON 5%, 400%

9) $AMZN 5%, 1,700%

10) $SE 5%, 60%

11) $U 5%, 40%

12) $GOOG/L 5%, 750%

13) $VEEV 4%, 650%

14) $ISRG 3%, 900%

15) $ABNB 3%, 5% ⤵️

16) $PAYC 3%, 800%

17) $SNOW 2%, 25%

18) $DOCU 2%, (30%)

19) $TSLA 1%, 75%

20) $PATH 1%, (15%)

21) $PUBM 1%, 15%

22) $ZM 1%, (25%)

23) $SEMR 1%, (10%)

24) $RSKD <1%, (80%)

Of those picks:

✅ 13 are current MOTLEY FOOL STOCK ADVISOR recs

✅ They account for 75% of the port

17) $SNOW 2%, 25%

18) $DOCU 2%, (30%)

19) $TSLA 1%, 75%

20) $PATH 1%, (15%)

21) $PUBM 1%, 15%

22) $ZM 1%, (25%)

23) $SEMR 1%, (10%)

24) $RSKD <1%, (80%)

Of those picks:

✅ 13 are current MOTLEY FOOL STOCK ADVISOR recs

✅ They account for 75% of the port

I'm offering an (AFFILIATE) link to the service below.

WHY sell something here?

First, as @BrianFeroldi and I get our (FREE) YT channel off the ground, I have to make ends meet.

Second, my own portfolio, I clearly believe in the service.

WHY sell something here?

First, as @BrianFeroldi and I get our (FREE) YT channel off the ground, I have to make ends meet.

Second, my own portfolio, I clearly believe in the service.

You can get one year of STOCK ADVISOR for 50% off below.

I did the math. That's:

🧮 $8.25 per month

🧮 $4.13 per recommendation

In 2010, I paid $4.13 for $AMZN rec. The $500 I put in is worth ~ $14,000 today.

It's a great deal⤵️

fool.com/stoffel

I did the math. That's:

🧮 $8.25 per month

🧮 $4.13 per recommendation

In 2010, I paid $4.13 for $AMZN rec. The $500 I put in is worth ~ $14,000 today.

It's a great deal⤵️

fool.com/stoffel

To review 2021 Recap

📊 Stock Port = 82% of net work

📈 25.3% CAGR over past 10 years

Five Largest Holdings

$SHOP

$MDB

$MELI

Cash

$DDOG

Link for 50% off Stock Advisor: fool.com/stoffel

📊 Stock Port = 82% of net work

📈 25.3% CAGR over past 10 years

Five Largest Holdings

$SHOP

$MDB

$MELI

Cash

$DDOG

Link for 50% off Stock Advisor: fool.com/stoffel

• • •

Missing some Tweet in this thread? You can try to

force a refresh