Happy New Year: So far in Asia, we have the same winners in 2022 as in 2021 and the same losers are doing badly.

Chinese listed stocks in Hong Kong falling while India, Taiwan, Indonesia, Vietnam are up!

Chinese listed stocks in Hong Kong falling while India, Taiwan, Indonesia, Vietnam are up!

Commodities are up, especially food. Oil up too, now 80/barrel.

Dollar is up, yield is up, and inflation is now more key than growth concerns. Why? Look at this chart.

Dollar is up, yield is up, and inflation is now more key than growth concerns. Why? Look at this chart.

US cases & deaths in five days (net change). Cases exploding but deaths are actually lower (yes, I know it is lagging but so far hospitalization, esp ICU, points to likely lower fatality).

The way it surges in the US, likely reaching herd immunity rather fast.

The way it surges in the US, likely reaching herd immunity rather fast.

What's the best vaccine for Covid? Having had Covid obvs (and survive!) A study shows that 87% Indonesians have antibody & 73.2% of the population w/ no vaccines + no history of Covid have antibody (likely asymptomatic?)

So good news for Indonesia.

So good news for Indonesia.

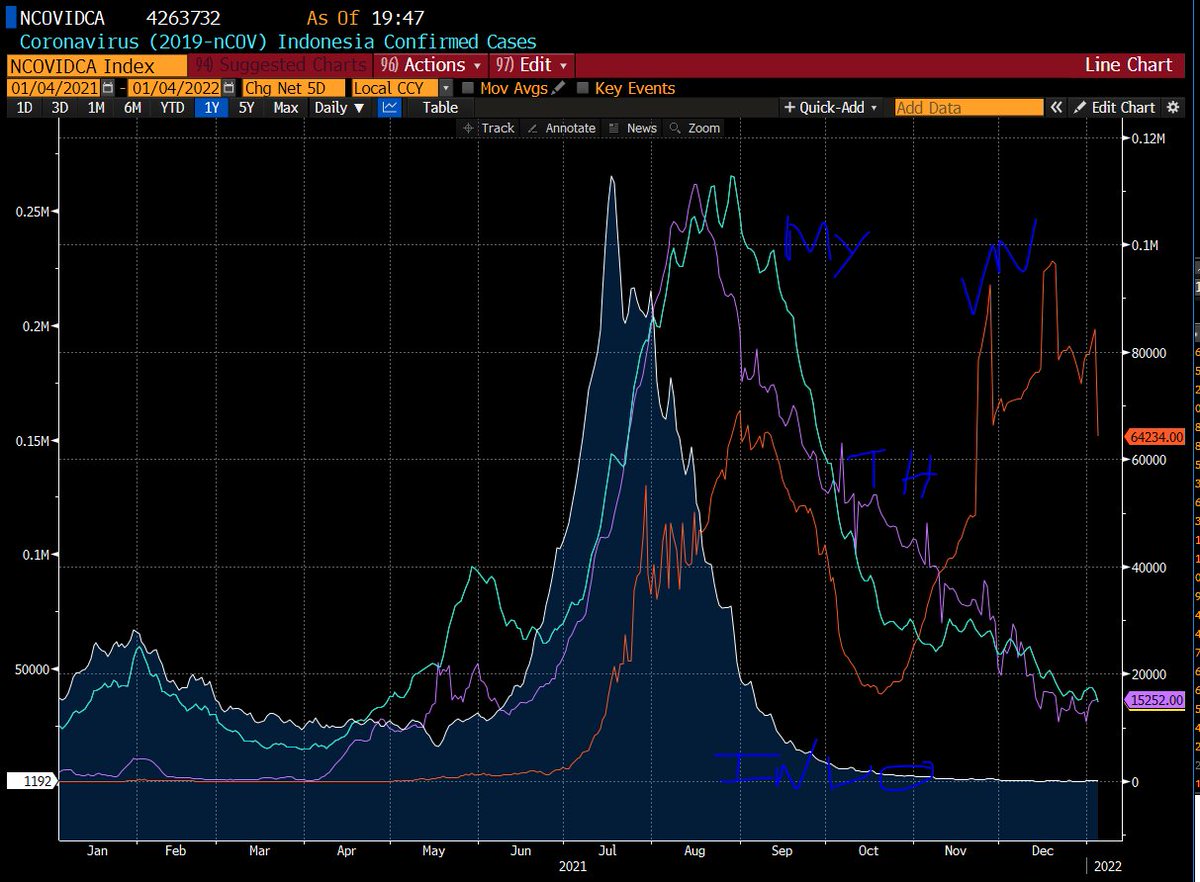

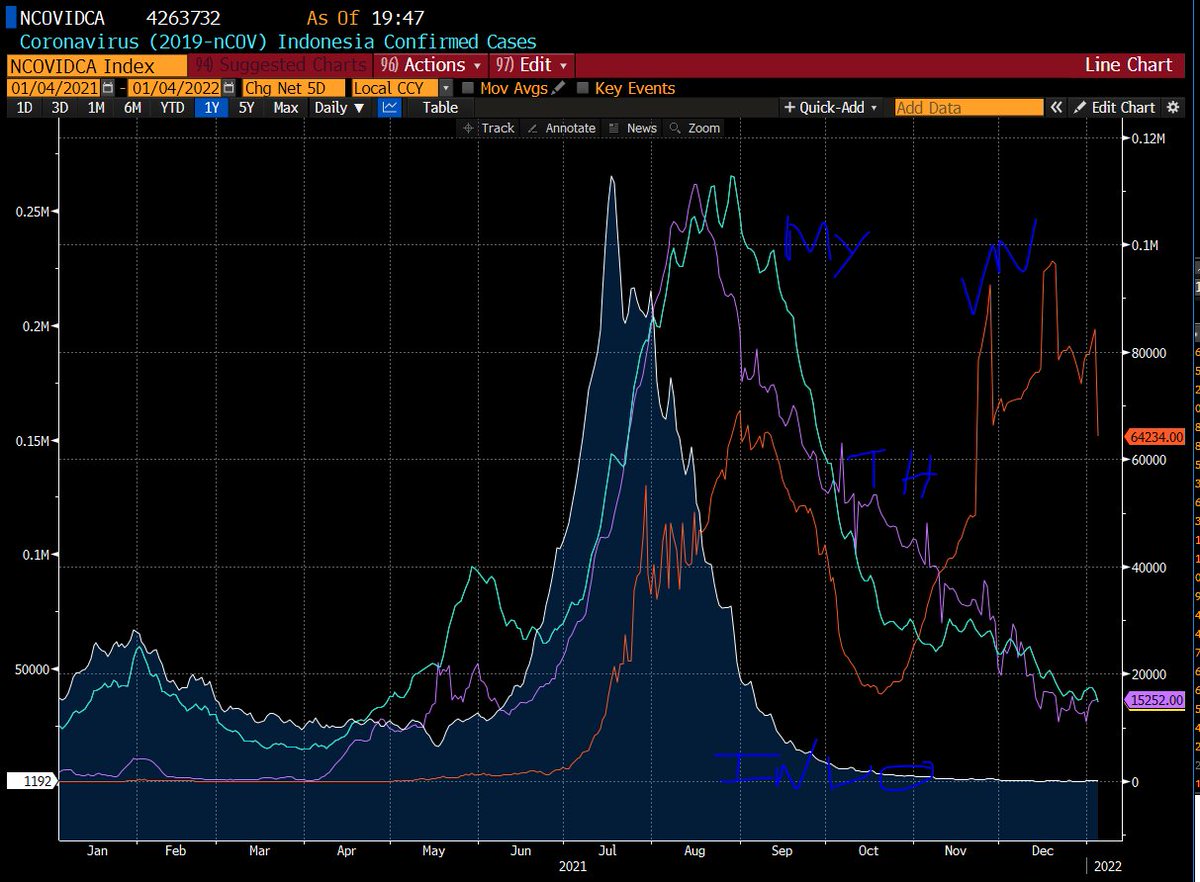

Here are the cases in Southeast Asia: Indonesia is going DOWNNN and that's a good thing.

So is Malaysia, Thailand. Vietnam too but still high. Either way, Southeast Asia data looks good :-) after bad Delta, Omicron seems to be not raging here.

So is Malaysia, Thailand. Vietnam too but still high. Either way, Southeast Asia data looks good :-) after bad Delta, Omicron seems to be not raging here.

Factors that help??? Well, high vaccination + high antibody (note for Indonesia, those not vaccinated & even cases of Covid got antibody so they must have had it and fought it off without knowing it).

In other words, this makes me optimistic about 2022 & the endemic strategy.

In other words, this makes me optimistic about 2022 & the endemic strategy.

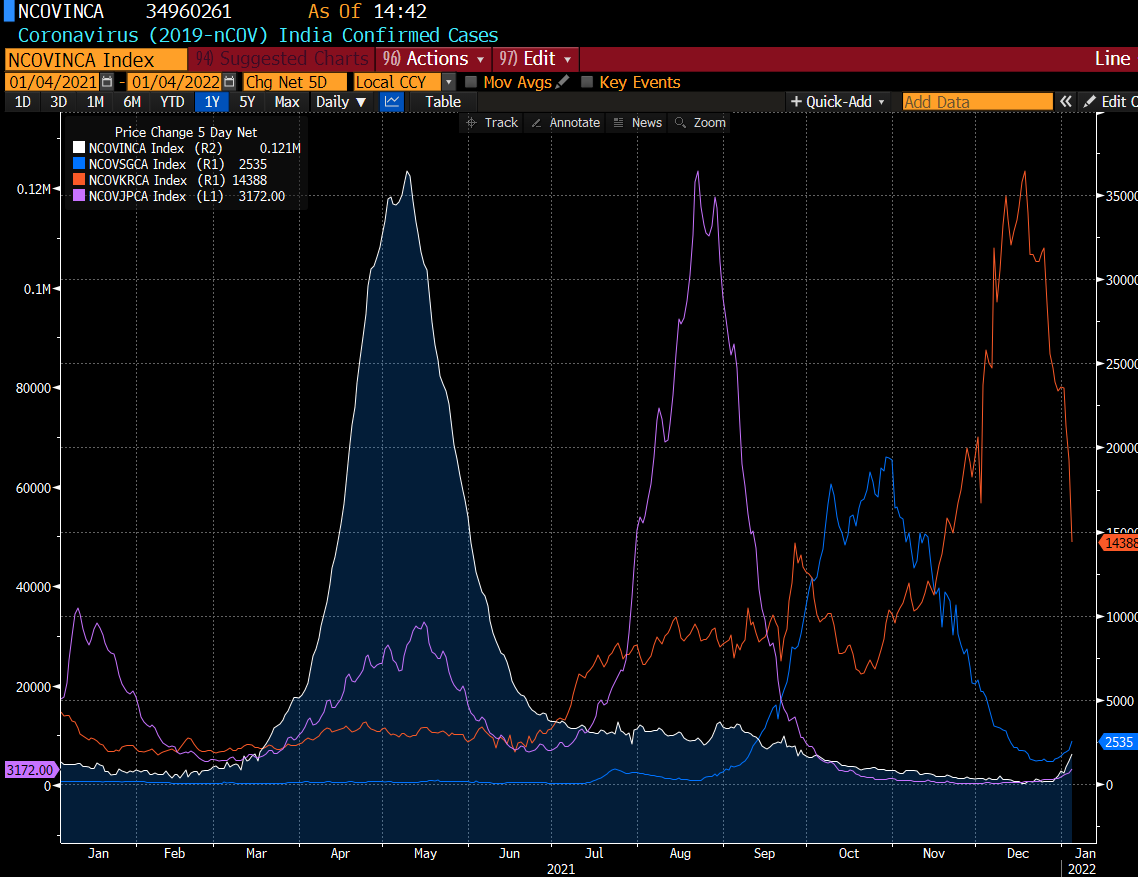

Here are the cases for the rest of Asia: lower for South Korea, low for India, Japan, and Singapore but trending upward. Overall manageable. Note all these economies are going for endemic, including Southeast Asia.

No far, no lockdown in Asia ex China. And that is one of the key optimism for our 2022 outlook. Time to move on from 2020 strategy as vaccination is higher (and antibody is there!)

• • •

Missing some Tweet in this thread? You can try to

force a refresh