Have you ever wondered if you should listen to stock picks made by Jim Cramer on MadMoney (@jimcramer, @MadMoneyOnCNBC )?

Well, wonder no more! I have analyzed 20,000+ recommendations made by Jim Cramer during the last 5 years.

A thread 👇

1/12

marketsentiment.substack.com/p/cramer-perfo…

Well, wonder no more! I have analyzed 20,000+ recommendations made by Jim Cramer during the last 5 years.

A thread 👇

1/12

marketsentiment.substack.com/p/cramer-perfo…

First, some stats!

@jimcramer has made 21,609 stock picks in the past 5 years! Here is one person, making buy/sell/hold recommendations on more than 2,200+ different stocks across all types of industries.

On average, he was making 20+ picks per episode of his show!

2/12

@jimcramer has made 21,609 stock picks in the past 5 years! Here is one person, making buy/sell/hold recommendations on more than 2,200+ different stocks across all types of industries.

On average, he was making 20+ picks per episode of his show!

2/12

While we can all argue about his expertise in making such a wide array of recommendations, what I wanted to know was:

1. How accurate were his predictions?

2. Would you have made or lost money if you followed them?

3. Finally, can you beat the market using his picks?

3/12

1. How accurate were his predictions?

2. Would you have made or lost money if you followed them?

3. Finally, can you beat the market using his picks?

3/12

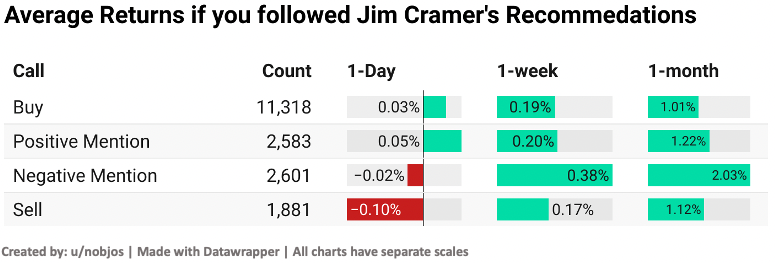

1-day performance of @jimcramer recommendations is excellent!

On average, the Buy and Positive mention stocks went up by 0.03 and 0.05% respectively, and sell and negative mention stocks went down by 0.1 and 0.02%.

4/12

On average, the Buy and Positive mention stocks went up by 0.03 and 0.05% respectively, and sell and negative mention stocks went down by 0.1 and 0.02%.

4/12

Another interesting fact is that you would not have lost money if you followed Cramer’s Buy recommendations 🤯.

Across the time periods, his Buy recommendations have on average netted you positive returns

5/12

Across the time periods, his Buy recommendations have on average netted you positive returns

5/12

His sell recommendations did not pan out so well. Even though they dropped in price the next day, over the next week and month, they returned inline or even better than his buy recommendations!

6/12

6/12

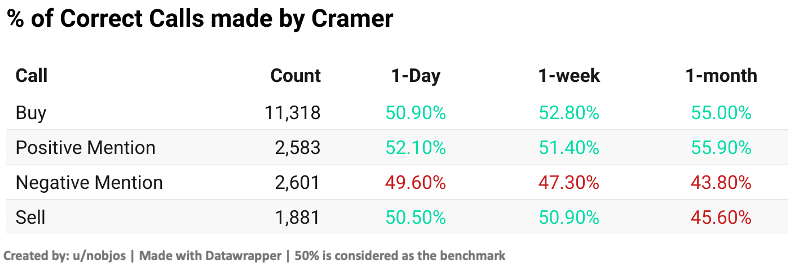

So, what about his accuracy? Was he good at picking winners?

In his Buy and Positive recommendations, Cramer did only slightly better than a coin toss with his predictive powers becoming worse in Sell recommendations.

7/12

In his Buy and Positive recommendations, Cramer did only slightly better than a coin toss with his predictive powers becoming worse in Sell recommendations.

7/12

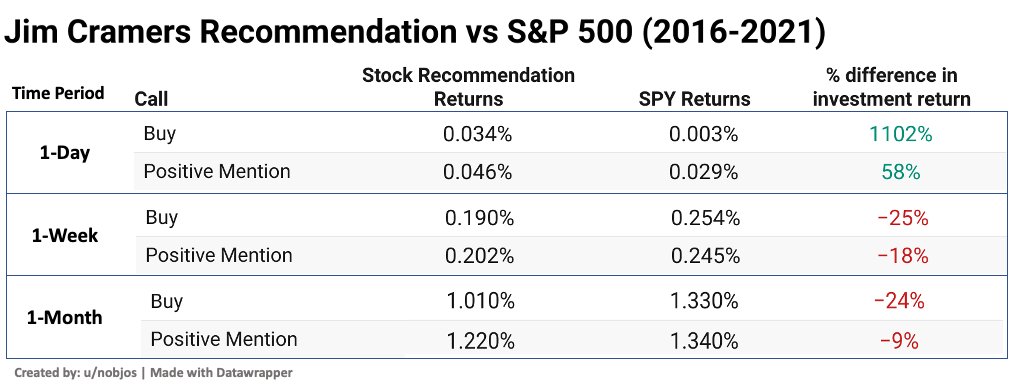

Finally, it’s time we pit @jimcramer against the market.

Do his recommendations beat the market?

Cramer’s Buy recommendations beat the S&P500 by a factor of 10 for the one-day time frame.

But, if you held it for anytime longer, you would have underperformed the market

8/12

Do his recommendations beat the market?

Cramer’s Buy recommendations beat the S&P500 by a factor of 10 for the one-day time frame.

But, if you held it for anytime longer, you would have underperformed the market

8/12

Before you go day trade on his recommendations you should know that the numbers we are seeing here are heavily influenced by outliers.

If you miss out on the top 1% (~110 stocks out of the 11,000+ buy recommendations), your 1-day return would be -0.062% instead of +0.034%

9/12

If you miss out on the top 1% (~110 stocks out of the 11,000+ buy recommendations), your 1-day return would be -0.062% instead of +0.034%

9/12

No matter the public opinion on Cramer, we can generate excellent 1-day returns following his buy recommendations (even beating the market in doing so!)

10/12

10/12

It only makes sense to listen to his advice if you are a day-trader or an algo-trader who is trading a large variety of stocks over short periods of time.

For everyone else, just sticking to the S&P 500 would give you better returns over the long run :)

11/12

For everyone else, just sticking to the S&P 500 would give you better returns over the long run :)

11/12

Data used in the analysis

Live tracker containing the performance of Cramer’s 2021 picks: rows.com/market-sentime…

Excel file containing all the Recommendations and Financial data: docs.google.com/spreadsheets/d…

12/12

Live tracker containing the performance of Cramer’s 2021 picks: rows.com/market-sentime…

Excel file containing all the Recommendations and Financial data: docs.google.com/spreadsheets/d…

12/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh