Thread/ $TCEHY back-of-envelope valuation.

Since the IPO in 2004, Tencent has returned ~45% annually to shareholders, turning $1 into $553.

Let's have a brief look at what returns could look like moving forward over the next 5yrs...

Since the IPO in 2004, Tencent has returned ~45% annually to shareholders, turning $1 into $553.

Let's have a brief look at what returns could look like moving forward over the next 5yrs...

1/

Let's start with a base case.

@JordsNel from Vineyard Holdings put in the hard work with his deep-dive that I highly recommend. He shared the est. global industry 5Y growth rates weighted against Tencent's revenue (see below).

Jordan's weighted avg. growth rate was 14.6%

Let's start with a base case.

@JordsNel from Vineyard Holdings put in the hard work with his deep-dive that I highly recommend. He shared the est. global industry 5Y growth rates weighted against Tencent's revenue (see below).

Jordan's weighted avg. growth rate was 14.6%

2/

Let's round that up to 15% which is still conservative considering China's CAGR in each industry is likely to be above the global avg.

Additionally the capital allocation from Pony Ma & management + the dominant market positioning is likely to lead to much higher returns

Let's round that up to 15% which is still conservative considering China's CAGR in each industry is likely to be above the global avg.

Additionally the capital allocation from Pony Ma & management + the dominant market positioning is likely to lead to much higher returns

3/

Base case (2021-2026)

- Revenue CAGR 15%

- Investment portfolio CAGR 15%

(includes investments from FCF on top of IRR)

- 25% FCF margin

- 20x FCF multiple (core business)

Base case 5Y annual return: 15%

Base case (2021-2026)

- Revenue CAGR 15%

- Investment portfolio CAGR 15%

(includes investments from FCF on top of IRR)

- 25% FCF margin

- 20x FCF multiple (core business)

Base case 5Y annual return: 15%

4/

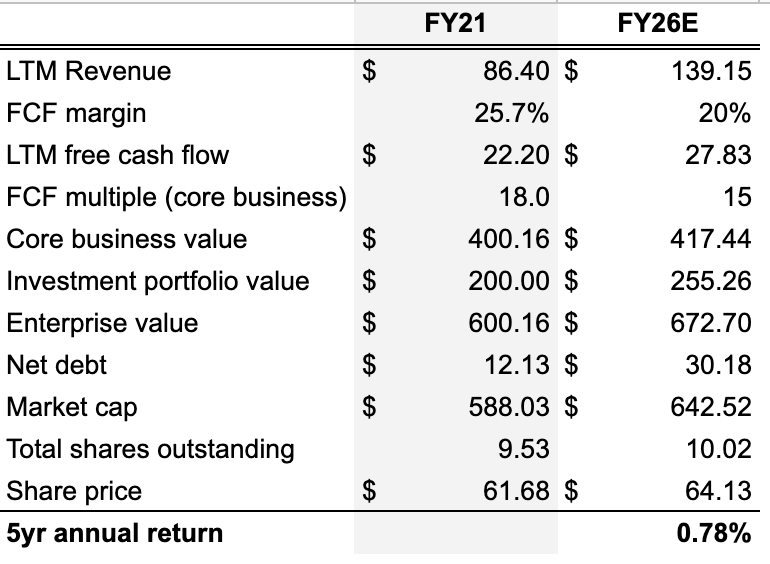

Bear case (2021-2026)

- Revenue CAGR 10%

- Investment portfolio CAGR 5%

(includes investments from FCF on top of IRR)

- 20% FCF margin

- 15x FCF multiple (core business)

Bear case 5Y annual return: 1%

Bear case (2021-2026)

- Revenue CAGR 10%

- Investment portfolio CAGR 5%

(includes investments from FCF on top of IRR)

- 20% FCF margin

- 15x FCF multiple (core business)

Bear case 5Y annual return: 1%

5/

Bull case (2021-2026)

- Revenue CAGR 20%

- Investment portfolio CAGR 20%

(includes investments from FCF on top of IRR)

- 30% FCF margin

- 25x FCF multiple (core business)

Bull case 5Y annual return: 27%

Bull case (2021-2026)

- Revenue CAGR 20%

- Investment portfolio CAGR 20%

(includes investments from FCF on top of IRR)

- 30% FCF margin

- 25x FCF multiple (core business)

Bull case 5Y annual return: 27%

6/

If we weight the probabilities of each scenario 25/50/25 then $TCEHY expected return over the next 5Y is 14.5%.

I would argue that is conservative, i'd personally weight the bull case at ~30% and bear case at ~10%. I was purposefully pessimistic in all scenarios.

If we weight the probabilities of each scenario 25/50/25 then $TCEHY expected return over the next 5Y is 14.5%.

I would argue that is conservative, i'd personally weight the bull case at ~30% and bear case at ~10%. I was purposefully pessimistic in all scenarios.

7/

I'm currently writing a ~3000 word deep-dive on $TCEHY for my newsletter in which I tackle the valuation with more accuracy and a more realistic return.

Sign-up for free to get the write-up sent to your inbox and access my first write-up.

seekingvalue.substack.com

I'm currently writing a ~3000 word deep-dive on $TCEHY for my newsletter in which I tackle the valuation with more accuracy and a more realistic return.

Sign-up for free to get the write-up sent to your inbox and access my first write-up.

seekingvalue.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh