My China timeline is full of latest fertility and population data, and as far as I can tell only @michaelxpettis and I have tweeted on GDP. Far more important. Nothing new in the demographics data, honest. Nothing to see you hadn't seen before. Read on 1/7 reuters.com/markets/asia/c…

With fertility below 1.3, which we knew from census and demographers last year, quite clear China's pop is peaking, and will start dropping. But while the effects are important, especially via working age pop and old age dependency, they're glacial and cumulative. 2/7

Doubtful government can change this, encourage people to procreate more, however patriotic the cause. Passing of pandemic may help eventually but biggest contraceptive is income per head + depressed wages/salaries in GDP, high housing and ed costs. Also why GDP is more imp. 3/7

The annual rate in Q4 dropped to 4%, but focus on the quarterly numbers. Q3 was revised up from 0.2 to 0.7%, and Q4 is estimated to have come in at 1.6%. That's just absurd, and fictional. Totally incompatible with the reams of other higher frequency data on economy 4/7

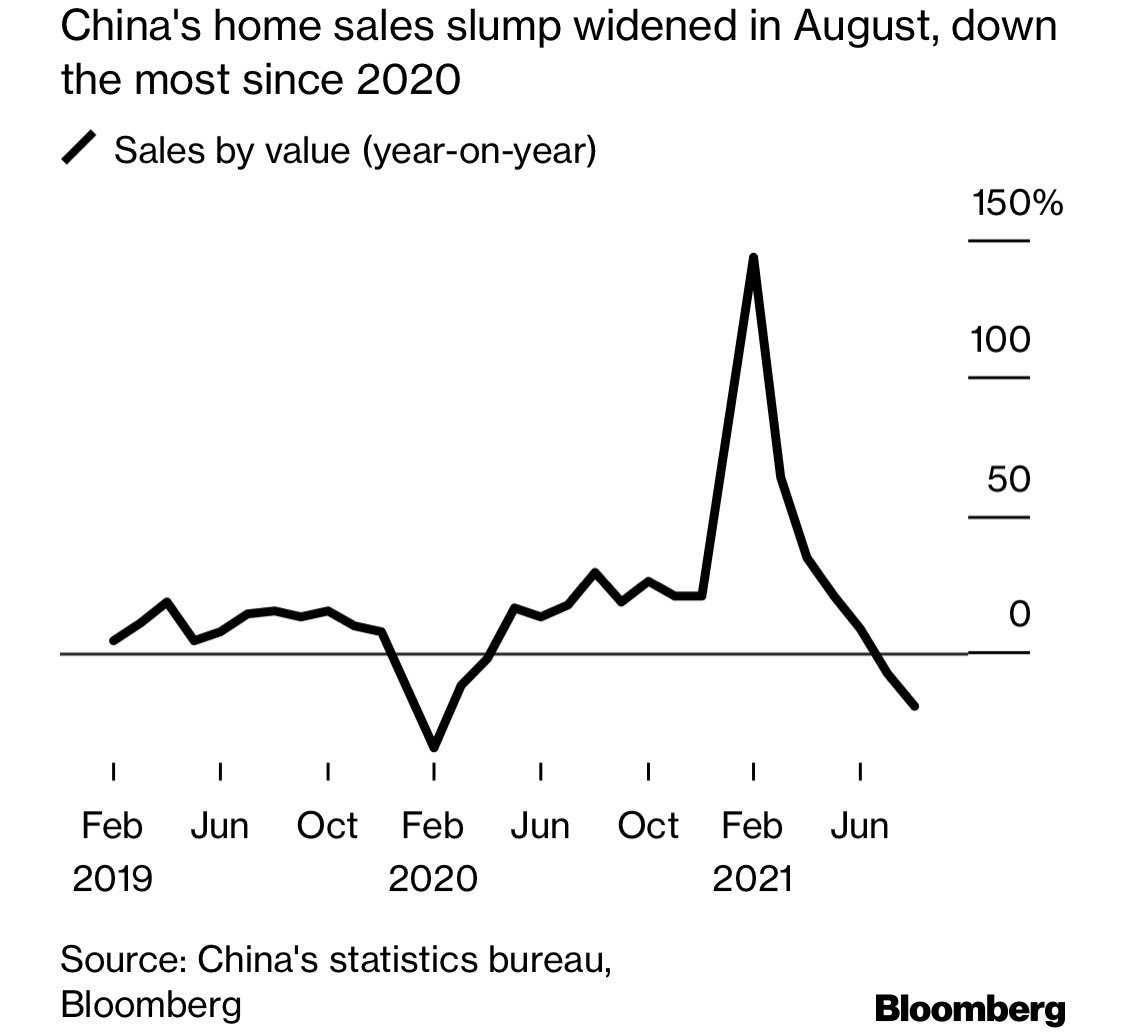

We know quite a lot about what happened to retail sales, investment spending, indust production, and the beleaguered property sector which started to seriously roll over in October. Now it's possible that there's been a massive data revision that's not yet on the radar. 5/7

So, we shall have to wait and see what the stats people come up with, but it seems extraordinary that the economy did what the government says it did in 2nd half 2021. And if it did, why the flurry of rate cuts, RRR cuts, and infra spending speed up and more on the way? 6/7

I'd wager that the numbers flatter, that the government's repetitive 'supply shock, demand contraction and weak expectations' are for real, and that if there's a 5-5.5% growth target for this year (announced in March), there'll be more policy heavy lifting to do. Ends

• • •

Missing some Tweet in this thread? You can try to

force a refresh