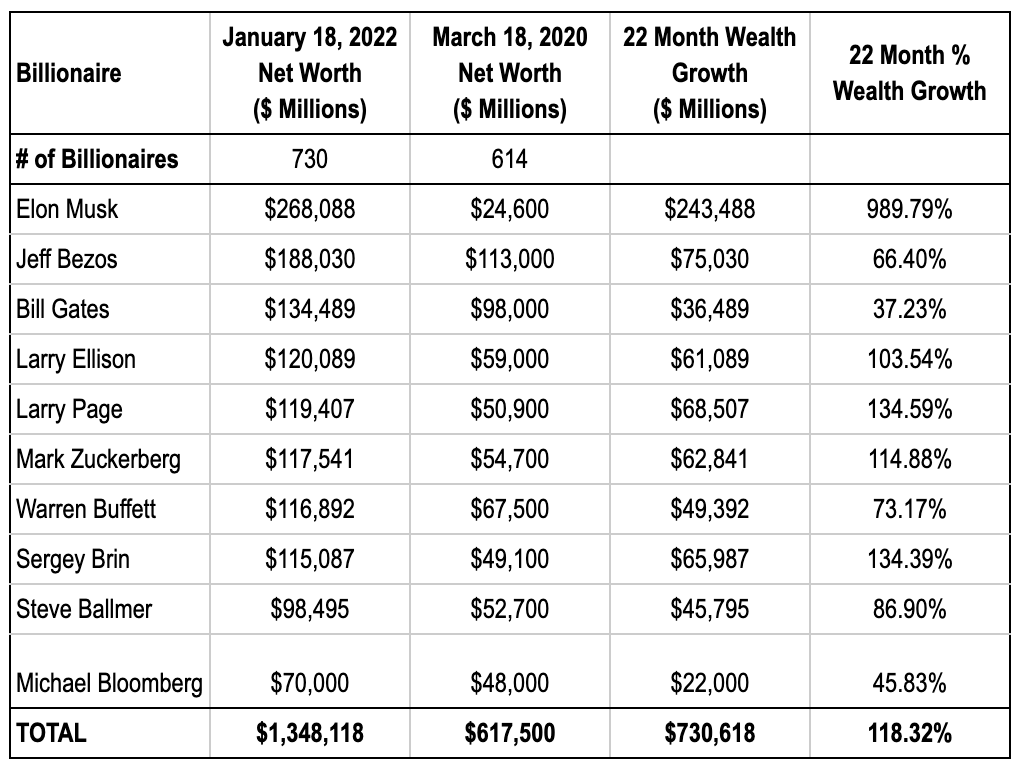

BREAKING: The collective wealth of America's 10 richest billionaires has more than DOUBLED during the pandemic.

That breaks down to $1 billion every day.

Each made about the same in a single minute as the average American household earns in an entire year.

This can't continue.

That breaks down to $1 billion every day.

Each made about the same in a single minute as the average American household earns in an entire year.

This can't continue.

We crunched the numbers after our friends at @Oxfam reported that the wealth of the world’s ten wealthiest billionaires also doubled while incomes fell for 99% of the world, 160 million were forced into poverty, and 21,000 died per day.

Economic inequality is killing us.

Economic inequality is killing us.

During the pandemic, the U.S. minted a new billionaire every 6 days.

The richest 156 U.S. billionaires now hold the same amount of wealth as the entire bottom 1/2 of American households.

But somehow we "can't afford" to make investments in working families in Build Back Better.

The richest 156 U.S. billionaires now hold the same amount of wealth as the entire bottom 1/2 of American households.

But somehow we "can't afford" to make investments in working families in Build Back Better.

All this while the super-wealthy gather virtually this week for the World Economic Forum, confronted by calls from @PatrioticMills to finally tax their wealth.

It's time.

reuters.com/business/milli…

It's time.

reuters.com/business/milli…

Taxing billionaires' wealth gains can help fund some of the priorities in Build Back Better that have been wrongly criticized as "too expensive."

A Billionaires Income Tax, as proposed by @RonWyden, could raise $550 billion over 10 years.

A Billionaires Income Tax, as proposed by @RonWyden, could raise $550 billion over 10 years.

Read our full breakdown here: americansfortaxfairness.org/issue/top-10-a…

• • •

Missing some Tweet in this thread? You can try to

force a refresh