BREAKING: New analysis finds that America's 661 billionaires pumped $1,200,000,000 into the 2020 elections.

That's double what they contributed in 2016, and 39x more than they contributed before Citizens United was decided.

It's been 12 years. It's time to #EndCitizensUnited.

That's double what they contributed in 2016, and 39x more than they contributed before Citizens United was decided.

It's been 12 years. It's time to #EndCitizensUnited.

But wait, there's more.

661 billionaires gave about $1 out of every $10 (9%) contributed in the 2020 election cycle.

As recently as 2010, billionaires gave *less than 1%* of all donations.

That was before the Citizens United decision.

661 billionaires gave about $1 out of every $10 (9%) contributed in the 2020 election cycle.

As recently as 2010, billionaires gave *less than 1%* of all donations.

That was before the Citizens United decision.

Almost 40% of billionaire campaign contributions made since 1990 came during the 2020 election.

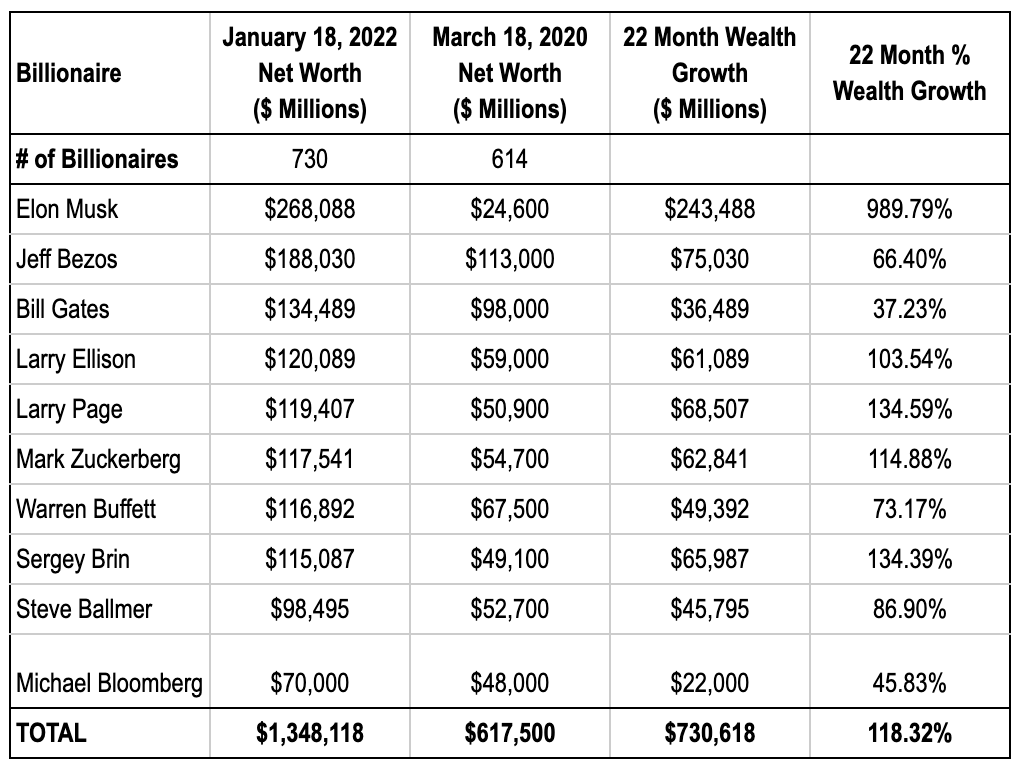

That's partly because billionaires' wealth grew by 1/3 between the pandemic's start and October of that year.

The richer billionaires get, the more distorted our democracy becomes.

That's partly because billionaires' wealth grew by 1/3 between the pandemic's start and October of that year.

The richer billionaires get, the more distorted our democracy becomes.

Corporations are not people, and billionaires shouldn't get to use their enormous wealth to pick and choose who they want in office.

It's well beyond time for Citizens United to go, and to put real action towards getting big money out of politics.

Our democracy depends on it.

It's well beyond time for Citizens United to go, and to put real action towards getting big money out of politics.

Our democracy depends on it.

Read the full report, including a full breakdown of the biggest billionaire donors, right here:

americansfortaxfairness.org/issue/billiona…

americansfortaxfairness.org/issue/billiona…

• • •

Missing some Tweet in this thread? You can try to

force a refresh