The market expectations were tall. it was at TTM 37 p/e before results. The results are sort of a mixed bag.

1. The revenue growth was ONLY 4% QoQ. That's low given that even larger ones like Infy are growing at 7% QoQ.

1. The revenue growth was ONLY 4% QoQ. That's low given that even larger ones like Infy are growing at 7% QoQ.

In b/w lines: Management mentions that main reason is seasonality. Furlows in Q3 (lot of client development also stops in Q3). Management also mentions that 9M growth is 29% so longer term growth is strong.

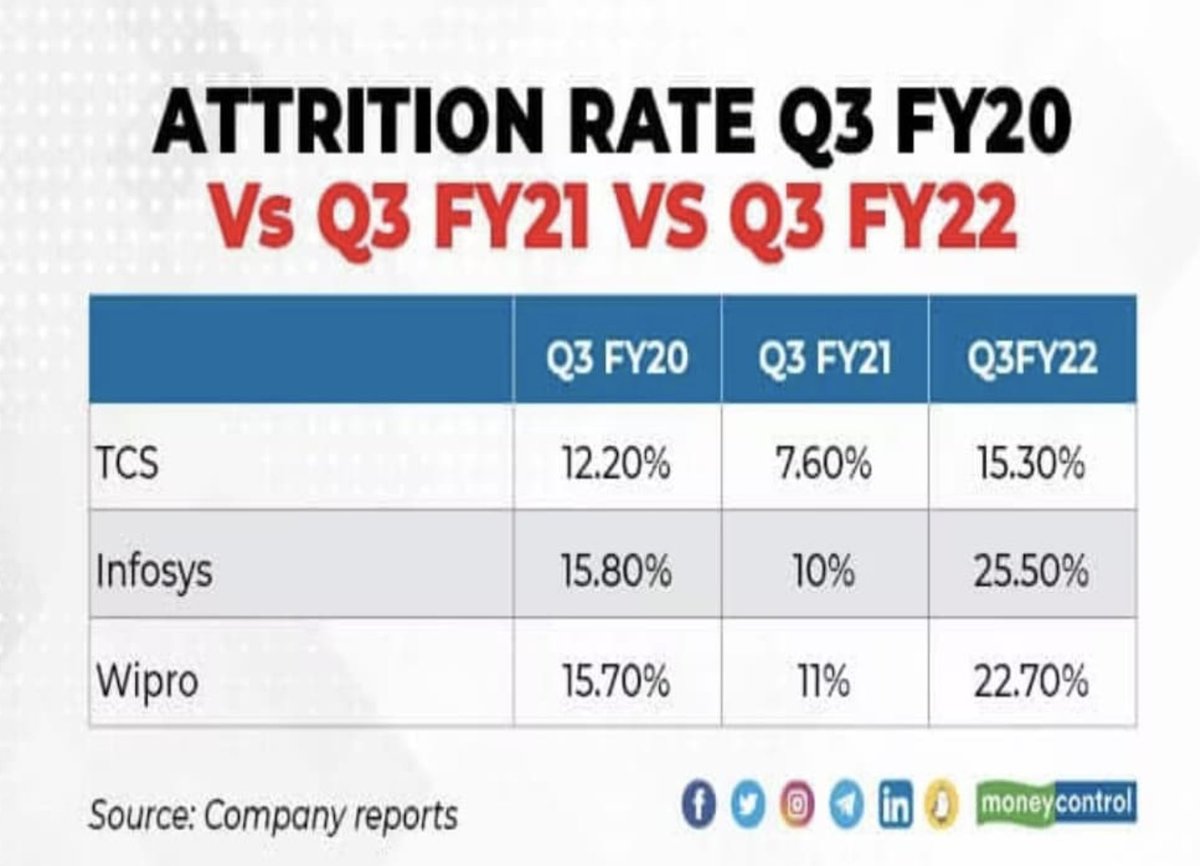

2. Mastek attrition rates are high. 28% in trailing 12 months.

In b/w lines: Management has mentioned that attrition has peaked out. Attrition has spiked for all the IT cos. Attrition was 24% for birlasoft (Q2), 26% for Infosys (Q3)!!

In b/w lines: Management has mentioned that attrition has peaked out. Attrition has spiked for all the IT cos. Attrition was 24% for birlasoft (Q2), 26% for Infosys (Q3)!!

Keep in mind that mastek attrition has always been high (20%+ even 2 years ago).

3. Someone on Valuepickr did a wonderful analysis. Generally, mastek's revenue in Quarter X+1 is 48% of order book in quarter X. The slowdown in current quarter was baked in in Q2 itself. See for yourself.

forum.valuepickr.com/t/mastek-limit…

Based on this we might see 10% growth in Q3.

forum.valuepickr.com/t/mastek-limit…

Based on this we might see 10% growth in Q3.

4. Diversification across platforms.

Co is mainly focussed on oracle due to evosys aquisition. At same time they are present in AWS & microsoft value chains (Dev ops, Azure). Focus is on winning in Oracle ERP space. This space is huge. so large opportunity size imo.

Co is mainly focussed on oracle due to evosys aquisition. At same time they are present in AWS & microsoft value chains (Dev ops, Azure). Focus is on winning in Oracle ERP space. This space is huge. so large opportunity size imo.

5. What are my thoughts?

Listening to the concall, looking at the results. Definitely looks like lumpiness in revenues. As prices reduce, valuations become attractive imo because My investment thesis is intact. I might or might not add.

Listening to the concall, looking at the results. Definitely looks like lumpiness in revenues. As prices reduce, valuations become attractive imo because My investment thesis is intact. I might or might not add.

Not interested in sharing granular buy or sell decisions.

Do your own due diligence. Do not follow anyone blindly. Listen to concall, read investor presentation. Make up your own mind.

bseindia.com/xml-data/corpf…

Do your own due diligence. Do not follow anyone blindly. Listen to concall, read investor presentation. Make up your own mind.

bseindia.com/xml-data/corpf…

• • •

Missing some Tweet in this thread? You can try to

force a refresh