With investors like @LuckyInvest_AK ashish Kacholia sir investing in it, let us look at one of the largest listed e-pharmacies & why I invested in it 8 months ago.

Get ready for a long 🧵. Focus on process.

Please retweet if you find it useful.

A 🧵🧵🧵 on SastaSundar ⤵️

Get ready for a long 🧵. Focus on process.

Please retweet if you find it useful.

A 🧵🧵🧵 on SastaSundar ⤵️

Outline:

0. Disclaimers

1. Industry Structure & Tailwinds

2. Business Model

3. Growth

4. Profitability

5. Equity Dilution & Fund raising

6. Digital Scuttlebutt

7. Valuations

8. Anti-thesis

0. Disclaimers

1. Industry Structure & Tailwinds

2. Business Model

3. Growth

4. Profitability

5. Equity Dilution & Fund raising

6. Digital Scuttlebutt

7. Valuations

8. Anti-thesis

0. Disclaimer

Before I start, some disclaimers. My sole reason to share these threads is to share with everyone how I do my research. It is to demonstrate to the retail investor the various ways in which they can have an edge over institutions.

Focus on the process.

Before I start, some disclaimers. My sole reason to share these threads is to share with everyone how I do my research. It is to demonstrate to the retail investor the various ways in which they can have an edge over institutions.

Focus on the process.

The company is only a medium to communicate the process. Please do not take information sharing as any buy or sell reco. I am not a research analyst & not an investor advisor. Just a motivated retail investor sharing his process. 🙏🙏

That out of the way.

1. Industry Structure & Tailwinds

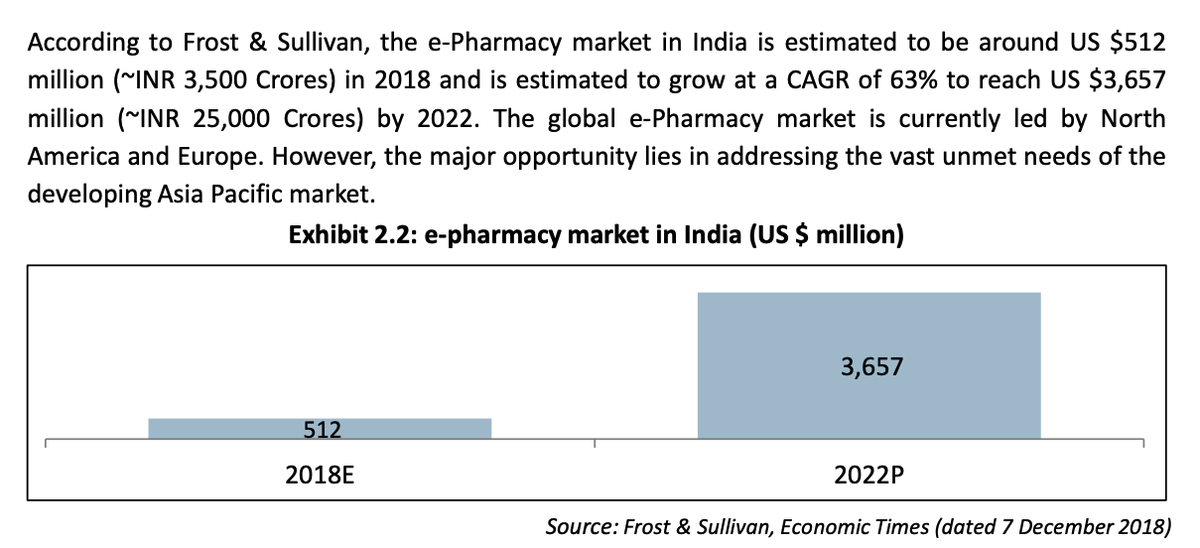

The frost and Sullivan report (2018; frost.com/wp-content/upl…) does a good job of explaining the e-pharmacy industry. To summarize the 50 page report in a few points:

1. Industry Structure & Tailwinds

The frost and Sullivan report (2018; frost.com/wp-content/upl…) does a good job of explaining the e-pharmacy industry. To summarize the 50 page report in a few points:

(i) Macro factors: India has a large and aging population. Healthcare Spending as % of GDP will increase. GDP will increase. Indian Pharma market will increase. (Part of reason for high domestic pharma valuations; longevity of growth).

(ii) e-Pharmacy Growth: the e-Pharmacy market in India is estimated to be around $512 M (~Rs 3500 Cr) in 2018 & is estimated to grow at a CAGR of 63% to reach US $3.6 B (~Rs 25000 Cr) by 2022.

If you check the YoY growth figures of large e-pharmacies, this won’t seem like a stretch to you. Bear in mind, report came out in 2018. Then covid happened. This impacted e-pharmacy & IPM as well.

(iii) The e-Pharmacy model could account for 15%-20% of the total sales in India over next 10 yr, largely by enhancing adherence & access to medicines for a majority of the under-served population.

If the Pharma market becomes 2.5x from 41B$ in 2021 to 100B$ in 2030 (9.5% CAGR), then e-pharmacy would be a 20B$ opportunity in 2030. That would be a CAGR of 24% for 8 years between the 2 estimates of e-pharmacy market size F&S provide to us.

63% growth for 3-4 years, and 24% growth for 8 more yr.

(iv) There are 2 business models prevalent in the sector: inventory based & market-place model. In inventory based, company maintains inventory of the medicines & in marketplace based, user is matched to a seller of medicine.

In fact this is the case for all ecommerce websites/apps. Most of them like Amazon & Flipkart are hybrid. They keep inventory & serve as a marketplace with inventory maintained by the seller.

(v) Key risks to existing e-pharmacy players: Brick & mortar (B&M) chains like Apollo pharmacy can establish online presence, established e-commerce players can enter (already happened with amazon and reliance), risk of consolidation (already happening)

(vi) Healthcare ministry recently (2018) announced some good e-pharmacy rules/guidelines. Key/primary takeaway for me was that e-pharmacies cannot advertise in any way or form on any medium. Need to share data with government for public good.

Cannot sell certain classes of drugs like habit forming drugs.

(vii) Why there is a need for e-pharmacies: single retail pharmacies due to their low volume, purchase drugs at high prices from distributors.

e-pharmacies due to large-scale purchase (from distributors or sometimes pharma companies directly) are able to drive better bargains & thus make the system as a whole more efficient. Quality also goes up since single retail pharmacies cannot control for quality easily.

Very hard for single retail pharmacies to stock all drugs forcing customers to visit multiple pharmacies. No such problem for e-pharmacies since inventory and orders are centrally managed. e-Pharmacies have the resource to invest in the latest information technology software.

Digitalization of pharmacies enables them to record & track transactions and increase productivity. E-pharmacies due to their centralised approach are also able to deliver to many rural locations in the country, which is a first.

Many of these places do not have any proper B&M pharmacies even.

Summary: High growth, formalisation, consolidation driving efficiencies. e-pharmacy can go from 5% to 15% of IPM in 10 years. Govt policy will disallow advertising going forward.

2. Sastasundar Business Model

The name of the company is essentially a callback to indian values of Savings and Quality. While some urban indians might find it funny or cringe worthy, I think most indians would appreciate the values it represents.

The name of the company is essentially a callback to indian values of Savings and Quality. While some urban indians might find it funny or cringe worthy, I think most indians would appreciate the values it represents.

SastaSundar has 4 business verticals. e-Pharmacy, FMCG (Own brands + other brands), diagnostics, B2B (Retailer shakti).

Their mission statement is “Providing comprehensive solution for all the healthcare needs- from preventive care to diagnostics to medicine procurement to doctor consultation”.

The core business is the e-pharmacy business. They only make 2cr from the diagnostics biz which is why most of the analysis is for the e-pharmacy biz. Sastasundar has an interesting hybrid sort of online-offline business model.

They allow users to either place an order online (on the app/website) or to walk into their stores which are asset/inventory light and place orders.

Orders are always delivered to your home, even if you place an order inside their store.

Orders are always delivered to your home, even if you place an order inside their store.

This is because SS understands the importance of inventory management. Customer experience suffers if pharmacist tells them “I dont have medicine X”.

Hence, thanks to their inventory based model they are able to ensure that they always maintain enough stock of all medicine and fulfill all orders. So why do they have the storefronts? I personally find this angle fascinating. It helps in 3 ways:

(i) A lot of people who require medicine are old and digitally uneducated. Many of them also refrain from trying to learn how to use an app. all such folks can simply walk into the store.

(ii) This enables SS to utilize a key part of their differentiated offering. As highlighted in earlier posts, they have a concept of a health buddy. Think of this as your personal assistant. They’ll help you place an order, create a personalized relationship with you.

Ensure you return back. No wonder that SS’s 90% orders come from repeat customers. This kind of customer loyalty is extremely hard to build. SS also ‘sweats’ their healthbuddy assets well by ensuring same person does multiple tasks for the company.

This hybrid model ensures that SS has good brand loyalty.

(iii) This hybrid model also ensures that they are able to capture mindspace of the customer. This is extremely important specially for e-pharmacies since they cannot advertise.

(iii) This hybrid model also ensures that they are able to capture mindspace of the customer. This is extremely important specially for e-pharmacies since they cannot advertise.

The assetlight (inventory light) storefronts (which are franchises not owned by SS) also serve as a tool to stay in the mindspace of the customer. Have seen same mental model in other investments: Saregama (carvaan), and Google (Google home, pixel) and Amazon (Echo) etc.

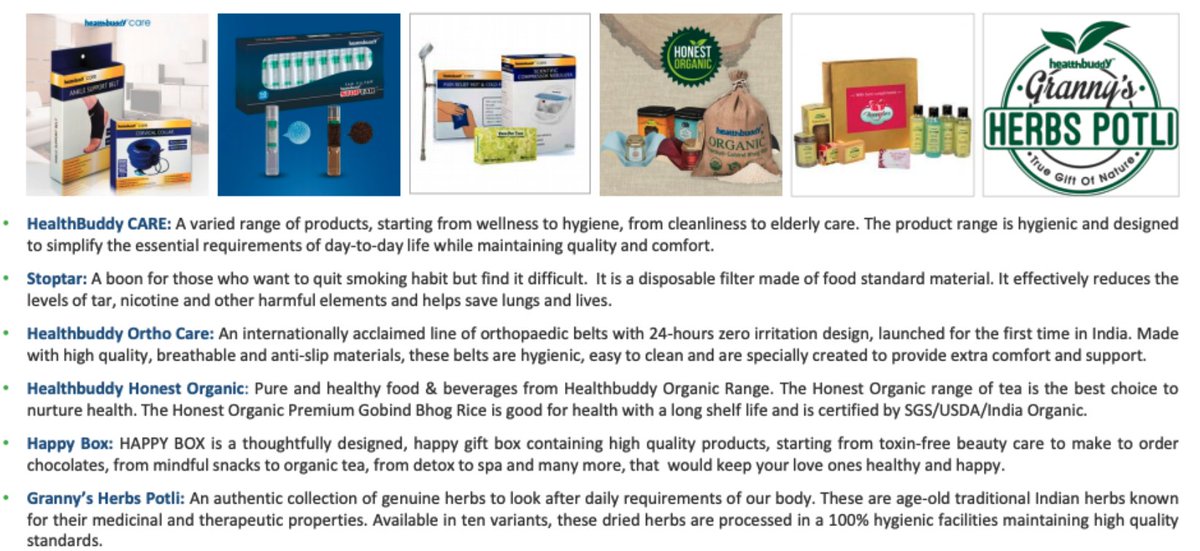

SS also cross-sells FMCG and their own brands. Own brands are of course at a much higher margin and FMCG also, they dont provide much discount. This cross-selling enables convenience for the customer and helps them capture larger pocket share of the customer.

If reliance can enter e-pharmacy, then SS can also sell biscuits :)

They seem to have an interesting process in terms of how they select which OTC medicine to sell.

They seem to have an interesting process in terms of how they select which OTC medicine to sell.

Their own brands have been created in a thoughtful way after analyzing the needs and wants of the customers and gaps/holes in the marketplace.

Perhaps the boldest slide one can find about SS is the vision 2024 slide in their FY18 investor presentation which has been removed from subsequent investor presentations. Generally investors only look at laest few presentations.

Investors would have TOTALLY missed this interesting vision slide UNLESS they pay attention to all investor presentations. Lesson: read all presentations not just the latest one.

sastasundarventures.com/Pdf/Investors_…

sastasundarventures.com/Pdf/Investors_…

Suffice to say, management must have received feedback not to share 6 year aggressive visions, but the fact that this slide appeared in public domain leads credence to the hypothesis that this is what the management’s vision and targets are.

Of course timelines can & will change (specially due to covid) & are dynamic. Whether this happens in 2026 or 2028, it would be a great thing if and when management can meet these bold targets.

In FY18, the distribution of GMV (gross merchandise value) between various categories looked like this:

Management has set a clear (though wildly ambitious) target of 7000cr of revenue with 15% EBITDA margins. We will analyze both the growth and profitability in subsequent sections. Management strategy for achieving the said growth:

To achieve this growth, SS is planning to target top 12 states in India, have 1 warehouse in each of the states, and open 250 micro pharmacies (SS assetlight stores) near each warehouse. They plan to capture 10% of the pharma market in each such region.

(I think what they mean is 10% the e-pharmacy market).

SS also has a B2B initiative called ‘Retailershakti’ which would mean, SS would act as distributor for independent retail pharmacies, thus driving more efficiencies and revenues.

Retailer Shakti provides competitive advantage to retailers’ customers in terms of wide range of products, price &

experience.

experience.

It provides the widest assortment of 35000+ products across 120 categories from regional, national & international brands at one place to online retailers & wholesalers at good margins.

Most e-pharmacies allow one to get diagnostics done but they focus on tie-ups with existing brands. SS has taken a different approach by starting their own diagnostics called Genu labs.

I like this approach for 2 reasons: industry has very good unit economics and secular growth runway. No need to provide discounts. Scale up here would boost overall business metrics. Genu labs is still very small. Did 2cr revenue in FY20 which was a 100% growth over FY19.

3. Sastasundar Growth

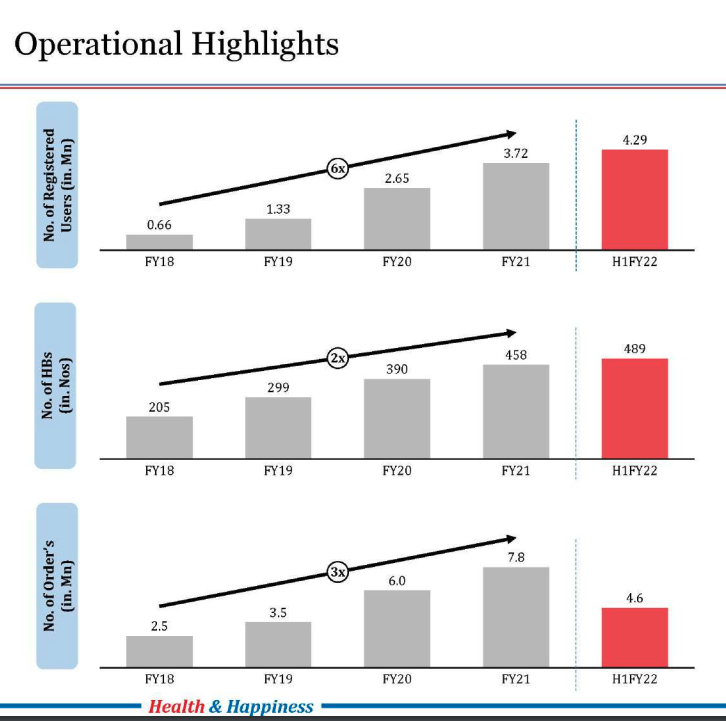

As far as I can tell, SastaSundar’s strategy is to remain near-profitable and grow in line with or slightly above average industry growth. We can see this in the past data.

As far as I can tell, SastaSundar’s strategy is to remain near-profitable and grow in line with or slightly above average industry growth. We can see this in the past data.

Growth has slightly slowed down in FY22 due to lack growth of capital. With the Flipkart deal growth is likely to pick back up in FY23.

Gross profits have gone fro around ~22cr in FY18 to 60cr in FY21. Neat.

Gross profits have gone fro around ~22cr in FY18 to 60cr in FY21. Neat.

Number of health buddies has scaled much slower than # of users & revenue thereby providing operating leverage. Naice.

Hope you're enjoying it. Take a break if you must. Its a long thread. Had to do lot of deep dive for this one.

Joke:

I was wondering why the frisbee kept getting bigger and bigger, but then it hit me.

Joke:

I was wondering why the frisbee kept getting bigger and bigger, but then it hit me.

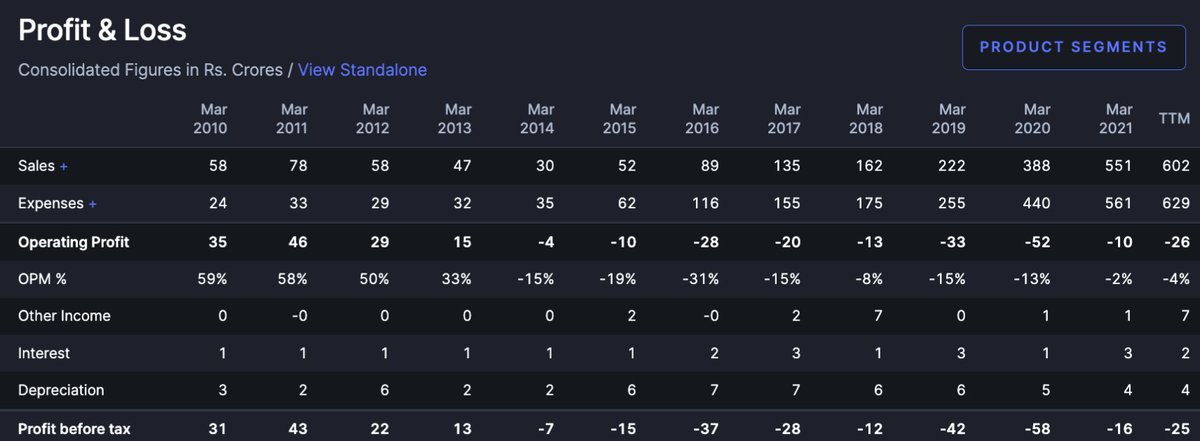

The company is still growing and yet to hit the inflection point wherein it can become profitable. We do know from the 2024 vision that they want to have 15% EBITDA margins. But how will they do it???

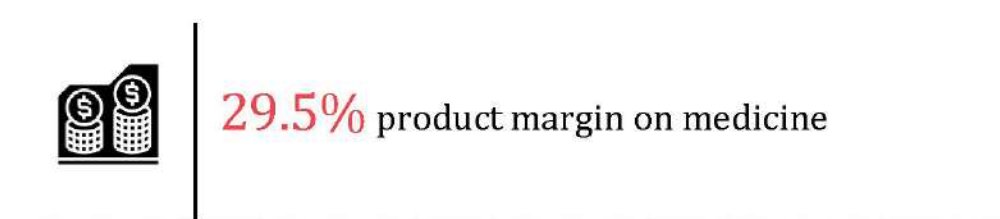

(i) As we can see from the F&S report, centralized inventory planning enables the e-pharmacy to place bulk orders at the scale wherein they are able to buy considerably below MRP. How low? See the next point.

(ii) In the latest Investor presentation, SS has shown that it makes 29.5% margins on medicines. This shows the power of buyer consolidation.

(iii) Then why does SS make losses at EBITDA level?? Major driver is the 15-18% discounts they need to give right now to stay competitive. Right now the industry norm is to provide at least 15% discounts on medicine. The industry is in its hyper-competitive stage.

Consolidation is happening. Netmeds got sold out to reliance. Medlife and pharmeasy merged. The offline retailers (which forms the bulk of the market) do not like the 15% discount either. The 15% discount wont remain forever. Same thing played out in Telecom too.

Post consolidation, the 15% discount is likely to go away. Then, the EBITDA profitability would emerge.

An investment in e-pharmacy is a bet on eventual EBITDA profitability in low discount regime in steady state.

An investment in e-pharmacy is a bet on eventual EBITDA profitability in low discount regime in steady state.

(iv) Despite giving 15% discounts, SS is very close to breaking even at an EBITDA level. Look at the narrowing of operating losses over the years!!

If one looks closely this is happening both because with scale they are able to buy the medicines cheaply and also because employee costs are going down as they scale up and operating leverage plays out. Sastasundar is a platform.

(v) Despite the need for inventory, this is an asset light business. Since the health-buddy centers are operated as franchises, the fixed assets have not growth since 7 years. They’re around 110 cr. Platform biz :)

Co has actually been stocking up on lot of inventory post covid to ensure smooth customer experiences and ensure there is no shortage.

Despite that, their total WC is only 54 cr. This gives a total capital deployed of 164 cr. This gives us a capital deployed turnover ratio of 3.7!! Extremely asset light biz. Even if co can make a 5% EBIT margin, ROCE would be 19%!!! If they can make a moderate 10% EBIT margin,

ROCE would be 37%. This shows us that this industry (specifically this business model) does have favorable unit economics, once profits are made. Once discounting ends. Whenw ill discounting end? God knows. Ask pharmeasy after it lists :)

(vi) I checked for international examples & US Brick & Mortar retailers are able to make around 5% EBITDA margins despite strong distributor consolidation.

It is not a stretch of imagination to imagine that indian e-pharmacies can make 10% EBITDA margins especially with the asset light nature.

(vii) As per a recent moneycontrol article , Sastasundar profitability is actually the best among all the players compared. Look at Q1FY22 losses for pharmeasy. -25% net profit margin.

5. Equity Dilution & Fund raising

When i invested in may-21 i knew that equity dilution would need to happen at some point. That is the nature of this business. Right now their focus markets are kolkatta, delhi, mumbai.

When i invested in may-21 i knew that equity dilution would need to happen at some point. That is the nature of this business. Right now their focus markets are kolkatta, delhi, mumbai.

For them to scale pan india they would need to burn more capital. For the hyper growth and pan-india presence this fundraising was required.

It would lead to equity dilution for existing shareholders which is a key negative, but that is what life is like when one invests in a hyper-growth company which needs to raise funds.

This is exactly what ended up happening. Very recently flipkart aquired 75% of the B2C part of sastasudar (Sastasundar marketplace limited).

Let us understand this deal structure. Key document: bseindia.com/xml-data/corpf…

Let us understand this deal structure. Key document: bseindia.com/xml-data/corpf…

First, let us understand the corporate structure of sastasundar. Sastasundar ventures (SVL) is the listed entity. It owns 72% of Sastasundar healthbuddy (SHBL). SHBL used to own 100% in retailer shakti (RSPL), Genu labs (GPL) & SML( Sastasundar marketplace)

SML allocated some shares to Flipkart. SHBL sold some of its holding to flipkart. Final outcome? SML got 372cr of rupees. SHBL got 690cr. of rupees.

What is the outcome:

(i) SVL has 700cr cash in step down sub.

(ii) SVL has 370cr of cash in step to step down sub

(iii) SHBL retains 100% ownership of genu labs & retailer shakti.

(iv) SBHL retains 25% ownership of SML.

(i) SVL has 700cr cash in step down sub.

(ii) SVL has 370cr of cash in step to step down sub

(iii) SHBL retains 100% ownership of genu labs & retailer shakti.

(iv) SBHL retains 25% ownership of SML.

Sastasundar will be renamed as flipkart health plus.

Will use flipkart's pan india reach to scale SS to pan india. WIll provide customers end to end offerings.

One problem solved. SS has a large amount of cash & a cash rich parent. :)

Will use flipkart's pan india reach to scale SS to pan india. WIll provide customers end to end offerings.

One problem solved. SS has a large amount of cash & a cash rich parent. :)

6. Digital scuttlebutt.

Perhaps most important part of this thread. Learn how you can evaluate a consumer tech co.

(i) Follow the key professionals on linkedin.

Interacting annecdote of MD of kotak mahindra AMC (mumbai resident):

linkedin.com/posts/blmittal…

Perhaps most important part of this thread. Learn how you can evaluate a consumer tech co.

(i) Follow the key professionals on linkedin.

Interacting annecdote of MD of kotak mahindra AMC (mumbai resident):

linkedin.com/posts/blmittal…

Many people find the name funny. But why the name sastasundar was chosen??

linkedin.com/posts/blmittal…

(ii) Search for company on youtube. Find the unit economics of how franchise works for the franchise owner.

linkedin.com/posts/blmittal…

(ii) Search for company on youtube. Find the unit economics of how franchise works for the franchise owner.

(iii) Google playstore is where the users are telling you, screaming at you to hear their experiences. Go hear them. :)

In june 2021 I went through several google play reviews for pharmeasy+medlife, SS and 1mg. methodology was as follows:

(i) Went to play.google.com/store/apps/det… 11

(i) Went to play.google.com/store/apps/det… 11

(ii) Looked at latest reviews. (relevant reviews would bring in google playstore ranking algorithm bias and might show us how the app/UX used to be, not how it is).

(iii) Only evaluated those reviews which were at least 5 words. Read 50 of these for each of the apps.

(

(iii) Only evaluated those reviews which were at least 5 words. Read 50 of these for each of the apps.

(

(iv) Documented what people are trying to tell the app & indirectly to app owners & investors.

Find the raw data/opinions in table below. If you have trouble reading this table, consider reading in this google sheets:

docs.google.com/spreadsheets/d…

In a single cell of the table, (a, b) means that opinion a was expressed in b reviews out of the 50 reviews I read.

docs.google.com/spreadsheets/d…

In a single cell of the table, (a, b) means that opinion a was expressed in b reviews out of the 50 reviews I read.

Key Conclusions when i did exercise in June-2021. Conclusions might be different if one repeats now. Focus is on process.

(i) Delivery: While the perception on forum is that Pharmeasy is fastest delivery. User reviews/perception is very interesting.

(i) Delivery: While the perception on forum is that Pharmeasy is fastest delivery. User reviews/perception is very interesting.

Both SS and PE are perceived to be fast. 1MG did not have that many reviews praising delivery times. While 1mg and PE oftentimes misplaced the orders with customers not getting their desired orders, SS seemed to err more on orders getting delayed.

Some customers also pointed out that 1mg outsources delivery to delhivery and other couriers which ends up making the delivery experience non consistent and bad.

(ii) Price: All these had similar perception WRT discounts. Interestingly most reviews do not seem to be about price. Very few complain about the price.

(iii) Ordering Experience: 1mg had many problems like orders not getting confirmed, getting expired medicine, not being able to see delivery times. Ss had similar problems but to lower extent.

People also appreciated being able to see manufacturing date. PE customers’ biggest problem was not being able to return orders.

(iv) Getting what you ordered: One of the biggest pain points for both 1MG and PE was getting what you ordered: Customers often got replacements for their ordered medicine without their consent, ...

...often had their items cancelled which were shown as in stock when the order was placed. SS has substantially low instances of this problem

(v) Medicine Availability: People were more opinionated on this for PE. Equally split between good and bad availability. SS had far fewer people talk about this, but equally split. 1mg nobody talked about this.

(vi) Comparisons with Competitors: While PE customers were split between whether it is better or worse than competitors, all such reviews on SS side emphatically said SS was better.

Many also appreciated that they were able to find medicine which were not available on other apps. 1MG users did not say much about this but they did say SS was better.

(vii) Billing: not many reviews on this, customers appreciated prompt billing for PE. For 1mg people complained not getting bills for tests they booked.

(viii) App: SS app was most appreciated, then 1mg then PE. Few problems were also pointed out for all 3 like not being able to login for SS, not being supported on phone for PE, having choice of labs removed and not trusting listed labs for 1mg.

(ix) Customer Care Experience: Far Far worse experiences for PE and 1mg. PE customers were scratching their heads on who the PE customer support were so nonchalant, and lacked basic understanding of what they were going through.

Similar, although less vocal concerns for 1mg. In stark contrast, most customers enjoyed their SS customer care experience with many describing as courteous, polite. Even when they complained, this was more around them not liking the resolution.

(x) Packaging: People appreciated SS packaging a lot, some complained about PE and some liked 1mg but opinion was less voiced on last 2 apps.

(xi) Responses from Business/app: This is our chance to see directly how the app treats their customers. PE responses were fairly templated, did not have any empathy for the customer, ...

...oftentimes they replied to bad customer experiences by saying “share our app with your friends to get 5% discount”. Lol. 1mg responses were better, although they only replied to negative comments mostly and often missed replying to comments.

SS comments were most thoughtful and addressed the reader in an empathetic way. They also made it a point to reply to most reviews if not all.

Summary: Meta-level conclusion: Although 1mg and PE have scaled, the scale is only in App and digital. The real world is frustrated with their bad user experiences. SS is treating its users far better by all accounts and all metrics this study shows us.

This also shows us why the app rating is far higher (even netmeds is also at 4.3) and also why customer retention is far better.

(something similar to Amazon Vs competitors might be playing out here with SS obsessing over customer experience similar to Amazon; need to verify with more scuttlebutt).

Also, such positive reviews come from all parts of India (I know this coz sometimes people mention in the review where they live). These are not only from Paschim Banga.

7. Valuations

I wrote about this briefly recently:

Planning to grow revenues 3x in 3 years.

I wrote about this briefly recently:

https://twitter.com/sahil_vi/status/1476053039316226052?s=20

Planning to grow revenues 3x in 3 years.

SS shareholders own 600 cr of the cash on books. Mcap of 1500 cr. 900cr for the biz. SS only owns 25% of the B2C biz but 100% of genu labs & retailer shakti both of which can & will hyper scale. I find valuations to be fair now.

Co has been a 2.5 bagger for me already. When i bought the co at 200 rupees it was grossly undervalued at 1 sales. that same margin of safety is not there any more. Have to see how pharmeasy ipo is price d since it has direct bearing on SS valuations.

8. Anti thesis

(i) Entire e-pharmacy industry could end up with delayed profitability due to heavy discounting money .

(ii) SS is a microcap stock and thus liquidity is low. All risks wrt ownership of microcaps apply here.

(i) Entire e-pharmacy industry could end up with delayed profitability due to heavy discounting money .

(ii) SS is a microcap stock and thus liquidity is low. All risks wrt ownership of microcaps apply here.

(iii) Further equity dilution is possible if capital bleed continues. I place low probability on this event. Consolidation already happening.

(iv) The 700 cr capital in SHBL could be deployed poorly.

(iv) The 700 cr capital in SHBL could be deployed poorly.

Hope this thread helped you understand Sastasundar, epharmacies, digital scuttlebutt better.

Entire evening spent in making such threads. :D

If you're new here consider following if you're interested in reading similar deep dives in the future.

Entire evening spent in making such threads. :D

If you're new here consider following if you're interested in reading similar deep dives in the future.

Please retweet the 1st tweet if you found this thread interesting.

Link to 1st tweet:

Link to 1st tweet:

https://twitter.com/sahil_vi/status/1484587940584079364

Here is a thread of all my major investment related threads:

Some of them are useful, or so I have been told.

https://twitter.com/sahil_vi/status/1406848206181335046?s=20

Some of them are useful, or so I have been told.

@NeilBahal @threadreaderapp unroll

@threadreaderapp unroll please

Some thoughts on discounts in industry since there were lot of questions on that part. 🙏🙏

https://twitter.com/sahil_vi/status/1484710195251249152?t=OVTCgohLsGdUT7UnwDwfvA&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh