Earlier today I have launched v1.2 of my Google Sheet _Terra Tools and Resources_.

Most of the changes are related to analysing your LP position.

Here are a few observations (charts and data for current $LUNA - $UST LP).

🧵👇

/1

Most of the changes are related to analysing your LP position.

Here are a few observations (charts and data for current $LUNA - $UST LP).

🧵👇

/1

https://twitter.com/AgilePatryk/status/1484464860331229184

First, here is a look at the data I used (see picture).

All of that comes from 2 sources:

coinhall.org/charts/terra/t…

station.terra.money

Position value is arbitrarily chosen as $1000, but does not affect overall observations.

/2

All of that comes from 2 sources:

coinhall.org/charts/terra/t…

station.terra.money

Position value is arbitrarily chosen as $1000, but does not affect overall observations.

/2

First, let's look at the situation in short time horizon of 1 day.

On the chart, the difference between LP and LP+APR positions is negligible on a first sight (picture 2). We need to zoom in to see where the magic happens.

/3

On the chart, the difference between LP and LP+APR positions is negligible on a first sight (picture 2). We need to zoom in to see where the magic happens.

/3

Let's dive into 2 more snapshots with the focus on LP and 50:50 positions:

- price range $70 - $76

- price range $80 - $86

Pay attention to the relative positioning and intersections of the yellow line (50:50) and dashed orange line (LP + APR - 1 day horizon).

/4

- price range $70 - $76

- price range $80 - $86

Pay attention to the relative positioning and intersections of the yellow line (50:50) and dashed orange line (LP + APR - 1 day horizon).

/4

At $70 the yellow line is above = it is better to have 50:50 position rather than LP position when the price drops that far.

At ~$73, the lines cross = value of both LP and 50:50 are equal

At $76, the orange dashed line is above = LP position is worth more than 50:50.

/5

At ~$73, the lines cross = value of both LP and 50:50 are equal

At $76, the orange dashed line is above = LP position is worth more than 50:50.

/5

50:50 becomes better than LP again around $80-$86 range:

$80 --> LP still better

~$83 --> lines cross; LP = 50:50 (in terms of position value)

$86 --> 50:50 is better

/6

$80 --> LP still better

~$83 --> lines cross; LP = 50:50 (in terms of position value)

$86 --> 50:50 is better

/6

To sum up, in a 1-day time horizon:

- $LUNA - $UST LP will perform better than 50:50 in the ~$73-$83 price range

- $LUNA and $UST held 50:50 will outperform LP if the price of $LUNA dips below $73 or shoots up above $83.

/7

- $LUNA - $UST LP will perform better than 50:50 in the ~$73-$83 price range

- $LUNA and $UST held 50:50 will outperform LP if the price of $LUNA dips below $73 or shoots up above $83.

/7

In general, due to impermanent loss, 50:50 would outperform LP in every scenario, unless we take LP APR into account.

Since holding 50:50 does not provide any yield, that LP APR gives LP position an edge in case of small price changes, even in a span of 1 day.

/8

Since holding 50:50 does not provide any yield, that LP APR gives LP position an edge in case of small price changes, even in a span of 1 day.

/8

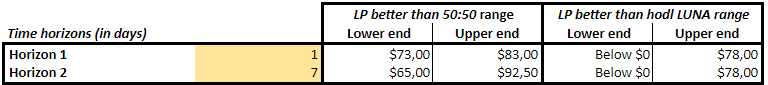

Tracking of that on a chart (as fun as it is) would be quite tedious and time-consuming.

That's why I have added a table that does the tracking for you:

When is LP better than 50:50? 🤔

When is LP better than hodling $LUNA? 🤯

/9

That's why I have added a table that does the tracking for you:

When is LP better than 50:50? 🤔

When is LP better than hodling $LUNA? 🤯

/9

The table takes into account:

- LP APR

- Staking APR for pure $LUNA hodl

The number are only as accurate as the step chosen. If your step is $0.50, the numbers should be treated as $73.00+/-$0.50.

If you want more accuracy, you can always narrow the range to your desire.

/10

- LP APR

- Staking APR for pure $LUNA hodl

The number are only as accurate as the step chosen. If your step is $0.50, the numbers should be treated as $73.00+/-$0.50.

If you want more accuracy, you can always narrow the range to your desire.

/10

So, what does all of that mean for different time horizons?

Let's look at that in 2 comparisons:

1️⃣ LUNA-UST LP vs hodling LUNA:UST 50:50

2️⃣ LUNA-UST LP vs staked $LUNA

/11

Let's look at that in 2 comparisons:

1️⃣ LUNA-UST LP vs hodling LUNA:UST 50:50

2️⃣ LUNA-UST LP vs staked $LUNA

/11

LUNA-UST LP will outperform LUNA:UST held 50:50 in the following price ranges:

- 1d: $72.60 - $82.90

- 1w: $65.00 - $92.50

- 2w: $60.50 - $99.50

- 1m: $54.00 - $111.75

- 2m: $46.25 - $130.50

- 3m: $41.25 - $146.75

- 6m: $32.00 - $190.00

- 1y: $22.50 - $272.00

/12

- 1d: $72.60 - $82.90

- 1w: $65.00 - $92.50

- 2w: $60.50 - $99.50

- 1m: $54.00 - $111.75

- 2m: $46.25 - $130.50

- 3m: $41.25 - $146.75

- 6m: $32.00 - $190.00

- 1y: $22.50 - $272.00

/12

LUNA-UST LP will outperform staked $LUNA in the following price ranges:

- 1d: below $77.60

- 1w: below $77.90

- 2w: below $78.30

- 1m: below $79.10

- 2m: below $80.70

- 3m: below $82.30

- 6m: below $87.00

- 1y: below $96.10

/13

- 1d: below $77.60

- 1w: below $77.90

- 2w: below $78.30

- 1m: below $79.10

- 2m: below $80.70

- 3m: below $82.30

- 6m: below $87.00

- 1y: below $96.10

/13

LP might challenge 50:50 in quite a broad price range once IL and LP APR are taken into account.

It wins with staked asset (e.g. $LUNA) on the downswing of price, but loses terribly if the price pumps.

/14

It wins with staked asset (e.g. $LUNA) on the downswing of price, but loses terribly if the price pumps.

/14

Hope you enjoyed it - have fun playing around with various LPs, APRs and charts!

docs.google.com/spreadsheets/d…

/15

docs.google.com/spreadsheets/d…

/15

DISCLAIMER: I made this tool myself and I am a human being - I could made a few errors. In fact, I corrected one even when writing this thread.

If you notice anything weird, let me know! I am happy to analyse/troubleshoot and fix as needed. :-)

/16-end

If you notice anything weird, let me know! I am happy to analyse/troubleshoot and fix as needed. :-)

/16-end

• • •

Missing some Tweet in this thread? You can try to

force a refresh