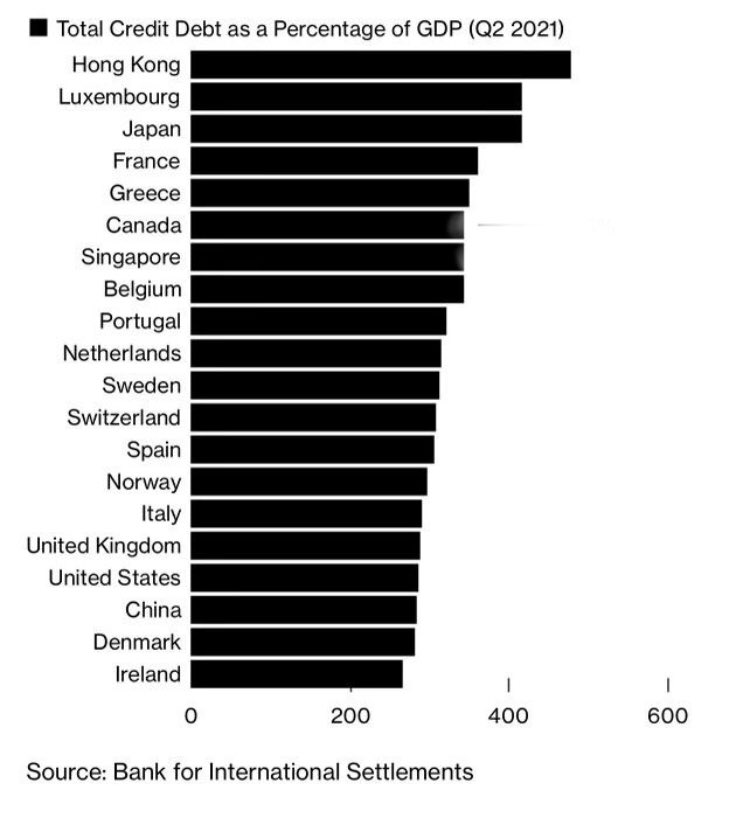

A revealing macro chart: total economy debt as % of GDP.

Many “rich” and “frugal” countries in here, too: surprised?

You shouldn’t be: instead of using public debt, they chose to lever up the private sector.

A short thread on credit (=money) creation and myths around it.

1/7

Many “rich” and “frugal” countries in here, too: surprised?

You shouldn’t be: instead of using public debt, they chose to lever up the private sector.

A short thread on credit (=money) creation and myths around it.

1/7

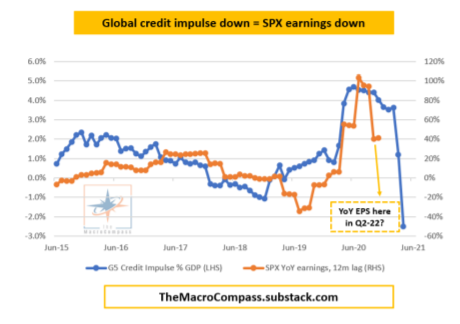

Our system encourages credit creation.

As the long-term driver of economic growth stagnate & we have a keen interest in growing fast&now, we use credit.

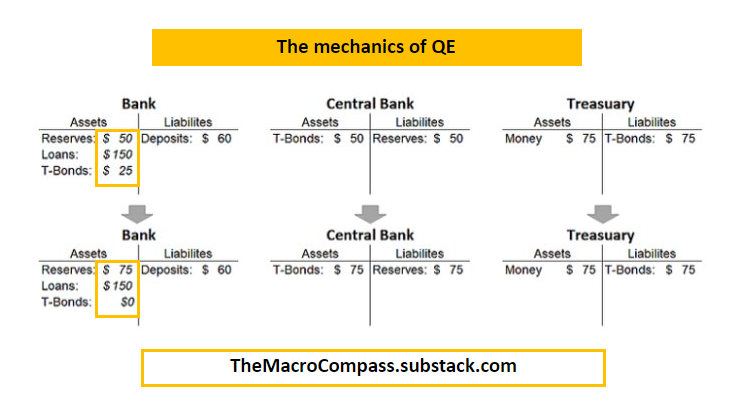

Credit creation is the process of real money printing: the private sector gets more net worth out of thin air.

2/7

As the long-term driver of economic growth stagnate & we have a keen interest in growing fast&now, we use credit.

Credit creation is the process of real money printing: the private sector gets more net worth out of thin air.

2/7

Credit creation can end up on the govt balance sheet (public debt) or on the private sector balance sheet (private debt)

Mainstream financial commentators focus 99.9% of their time discussing public debt and ignore private debt - Italy is indebted, Denmark is not

Bulls**t

3/7

Mainstream financial commentators focus 99.9% of their time discussing public debt and ignore private debt - Italy is indebted, Denmark is not

Bulls**t

3/7

Many “rich and frugal” countries have simply leveraged up the private sector instead of their govt balance sheet.

By providing cheap and easy-to-access credit to the private sector, they don’t need to lever up the public sector too.

On top, there are some accounting tricks

4/7

By providing cheap and easy-to-access credit to the private sector, they don’t need to lever up the public sector too.

On top, there are some accounting tricks

4/7

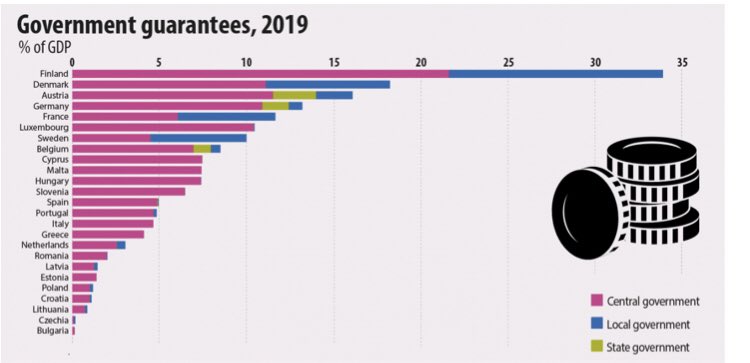

If you guarantee liabilities incurred by government sponsored entities, this often does NOT end up in the government debt to GDP calculations.

Crazy, right?

Look who’s leading that table: yes, the “frugal” countries.

Fannie & Freddie in the US, similar stuff.

5/7

Crazy, right?

Look who’s leading that table: yes, the “frugal” countries.

Fannie & Freddie in the US, similar stuff.

5/7

The bottom line?

There is no magic: as trend growth is poor, every country goes for credit creation to boost cyclical activity.

Some lever up the public sector, some the private sector.

They all must create credit to kick the can down the road.

6/7

There is no magic: as trend growth is poor, every country goes for credit creation to boost cyclical activity.

Some lever up the public sector, some the private sector.

They all must create credit to kick the can down the road.

6/7

How long can this go on for?

I recently wrote an article on The Macro EndGame that recorded more than 80.000 unique views.

themacrocompass.substack.com/p/endgame

I recently wrote an article on The Macro EndGame that recorded more than 80.000 unique views.

themacrocompass.substack.com/p/endgame

• • •

Missing some Tweet in this thread? You can try to

force a refresh