New trade!

Short Oil (CL1 future)

Entry: 85.1

First target: 72.4 (15%)

Stop loss: 93.6 (10%)

- Real demand & inflation to disappoint against what's discounted

- Long oil crowded as hell

- Decent backwardation given the macro framework

A short thread.

1/6

Short Oil (CL1 future)

Entry: 85.1

First target: 72.4 (15%)

Stop loss: 93.6 (10%)

- Real demand & inflation to disappoint against what's discounted

- Long oil crowded as hell

- Decent backwardation given the macro framework

A short thread.

1/6

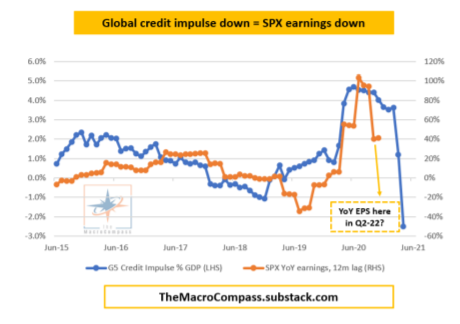

Real demand and growth are likely to disappoint from here, in my opinion.

Here are earnings lagged by 12m against credit impulse.

For reference, consensus expectations for Q1-Q2 for S&P500 YoY earnings are +5-6% versus same quarters last year.

2/6

Here are earnings lagged by 12m against credit impulse.

For reference, consensus expectations for Q1-Q2 for S&P500 YoY earnings are +5-6% versus same quarters last year.

2/6

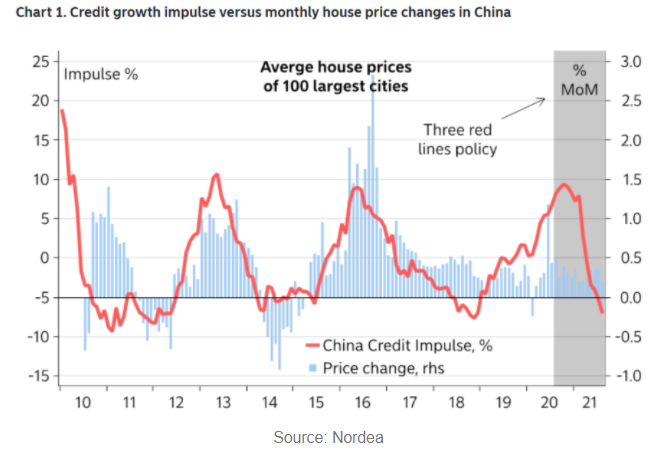

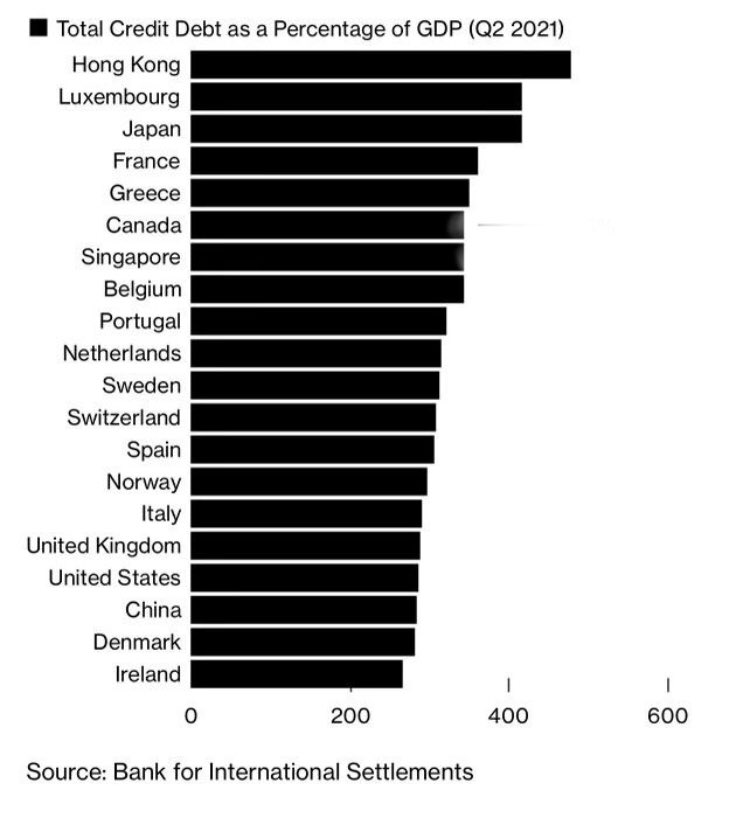

Inflationary pressures are likely to fade away too, and much more quickly than what consensus and breakevens are pricing in here (2022 YoY inflation priced at 3-4%, I expect <2%).

3/6

3/6

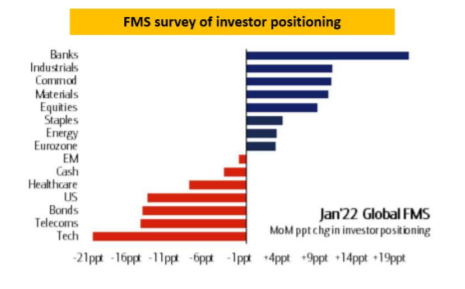

Long oil is crowded

This is because everybody is chasing the ''long cyclicals'' trades, while the macro environment is looking more like mid-2018

Nominal growth is not accelerating anymore, but investors are long banks, industrials and commodities as if it's early cycle

4/6

This is because everybody is chasing the ''long cyclicals'' trades, while the macro environment is looking more like mid-2018

Nominal growth is not accelerating anymore, but investors are long banks, industrials and commodities as if it's early cycle

4/6

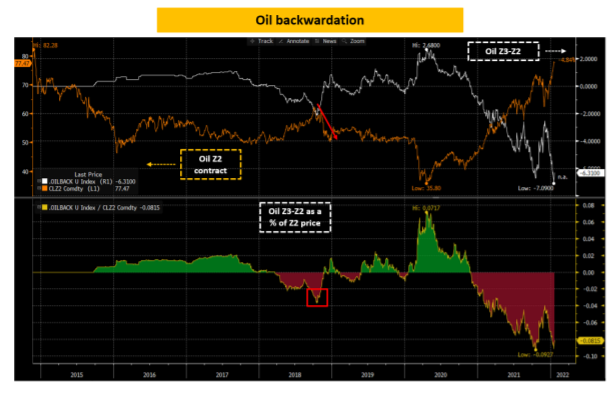

Although a 10%+ backwardation sends stronger statistical signals re the evolution of spot price, the backwardation in the Dec23-Dec22 oil curve ($6 or 8% of the Dec22 implied price) anticipated a decent correction during a similar macro environment (mid-to-late 2018).

5/6

5/6

Long-term, I am constructive on selected commodities.

Short-term, I believe this might be a decent chance to lean short.

Let's see.

6/6

Short-term, I believe this might be a decent chance to lean short.

Let's see.

6/6

Bonus tweet, I forgot.

Tomorrow I'll publish another article at TheMacroCompass.substack.com where I'll present more trades and the rationale behind.

Feel free to subscribe if you find that interesting.

(It's free anyway).

Tomorrow I'll publish another article at TheMacroCompass.substack.com where I'll present more trades and the rationale behind.

Feel free to subscribe if you find that interesting.

(It's free anyway).

• • •

Missing some Tweet in this thread? You can try to

force a refresh