The cash strategy 👇☢️👇

1⃣ #stock selection process - always choose that stock which are consolidating near all time high

(Because whenever stock will give all time high breakout then it will easily give 20/30% return in 1/2 months

1⃣ #stock selection process - always choose that stock which are consolidating near all time high

(Because whenever stock will give all time high breakout then it will easily give 20/30% return in 1/2 months

You can also choose 52 week high stocks , if stock going to give BO more then 3 years of range .

For finding all time high or 52 week high stocks you can use trading view scanner or indmoney scanner .

Here is threads of both 👇

For finding all time high or 52 week high stocks you can use trading view scanner or indmoney scanner .

Here is threads of both 👇

https://twitter.com/Trading0secrets/status/1451909270279127040?t=bli4IsFEfsdssZYI1CQQWg&s=19

https://twitter.com/Trading0secrets/status/1482370483278745601?t=CwHQhTcPpwIMV-exOCS_HA&s=19

2⃣volume analysis - In that consolidating period volume should be high of up move days then down move days. And last 3/4 month volume of accumulation is much higher.

Here is 👇 volume thread🧵 in details

Here is 👇 volume thread🧵 in details

https://twitter.com/Trading0secrets/status/1450848376115765251?t=3FdyQ2E0jqSqL5vT2VD-bg&s=19

3️⃣ fund diversification - always deploy your capital in 3/4 stocks, not more then that or not less then 3.

And, your 3/4 stocks must be from different different sectors.

And, your 3/4 stocks must be from different different sectors.

4⃣comunding magic - If you hold 10 stocks then if 2 stocks will give 100% return then portfolio impact is 20% only. (here time period is 8/15 months)

If you hold 3 stocks out of them 2 will give 40% then ur portfolio impact is 25%

(Here time period is 1/3 months)

If you hold 3 stocks out of them 2 will give 40% then ur portfolio impact is 25%

(Here time period is 1/3 months)

5⃣sectors analysis - always choose that sector stocks which are near support or breakout stage.

If any stocks is out of nifty sector then u can open stock scanner website and check their peer charts.If out of 5 ,3 are strong then u can select that company

screener.in/screens/95733/…

If any stocks is out of nifty sector then u can open stock scanner website and check their peer charts.If out of 5 ,3 are strong then u can select that company

screener.in/screens/95733/…

6⃣ Pivot Entry rule📍 - pivot point is that point in which chances of big move occur is much more.

If stock making good contraction of price near major/minor demand & supply then only enter that trade 👇l

Ex - #paushak /// #tatapower

If stock making good contraction of price near major/minor demand & supply then only enter that trade 👇l

Ex - #paushak /// #tatapower

7⃣ exit rule - if anyone given breakout and give 15% then book 50% now trailing sl is cost to cost.

➡️sl rule - don't risk more then 4/6% in your one trade. ( u have to exit at sl anyhow)

Here is detail thread 🧵👇

➡️sl rule - don't risk more then 4/6% in your one trade. ( u have to exit at sl anyhow)

Here is detail thread 🧵👇

https://twitter.com/Trading0secrets/status/1481299526283833344?t=THbQi03ecgkO1m3dN7JsTQ&s=19

8⃣ greed control rule - don't touch future and option until u have more then 20lac and 4 years of experiences.

And your cash and fno account must be different .

You can also do option selling for hedging purpose in different account.

👇👇👇

And your cash and fno account must be different .

You can also do option selling for hedging purpose in different account.

👇👇👇

https://twitter.com/Trading0secrets/status/1457032297761308674?t=bTJWR5LRfzRuf11UCAMR2A&s=19

9⃣ here is latest example of trades 👇

Which fixes at my all criteria .

One is near 52 week high another is near all time high.

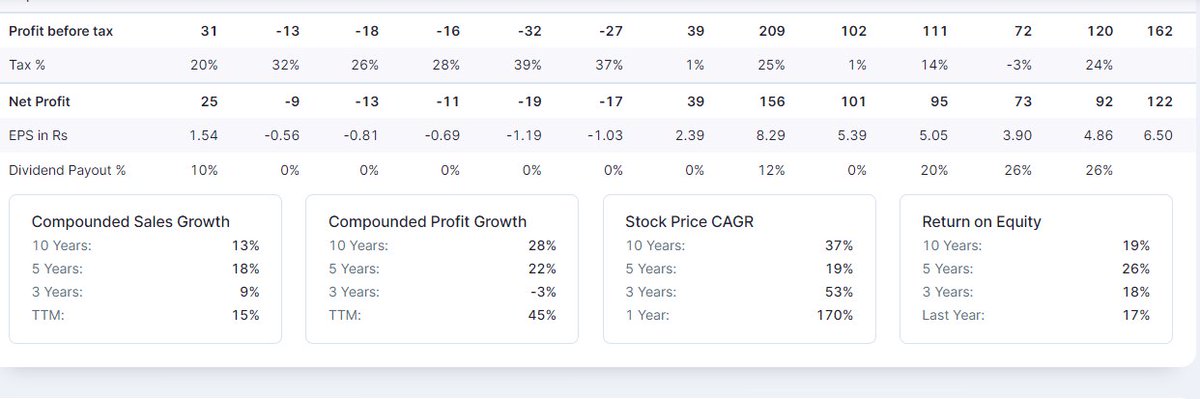

#grp Ltd

#indotech

Which fixes at my all criteria .

One is near 52 week high another is near all time high.

#grp Ltd

#indotech

I hope you love ❤ mini threads book.

For more such 🧵threads follow

@Trading0secrets

Here is last #price actions lessons you must know 👇🙏👇

For more such 🧵threads follow

@Trading0secrets

Here is last #price actions lessons you must know 👇🙏👇

https://twitter.com/Trading0secrets/status/1443962901950124032?t=-5t5VdHxOxnkGRA_AQXBfg&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh