New trade!

Long Chinese equities, in particular Chinese Real Estate (ETF: CHIR).

Entry: 12.04

Stop: 9.63

First Target: 15.65

Sized conservatively given low liquidity and decent volatility, but targeting big upside (+30%).

A short thread on the rationale.

1/6

Long Chinese equities, in particular Chinese Real Estate (ETF: CHIR).

Entry: 12.04

Stop: 9.63

First Target: 15.65

Sized conservatively given low liquidity and decent volatility, but targeting big upside (+30%).

A short thread on the rationale.

1/6

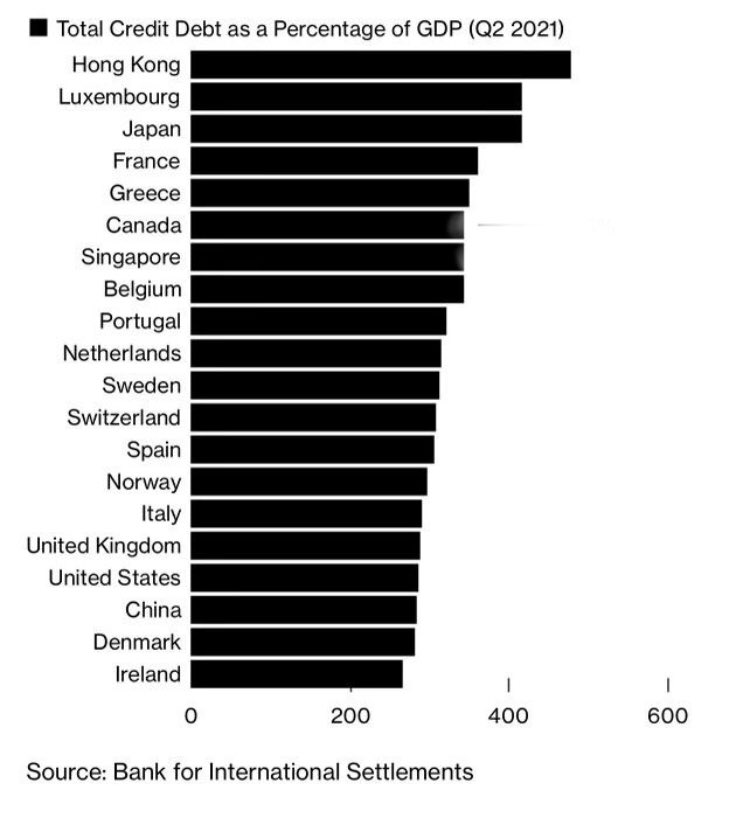

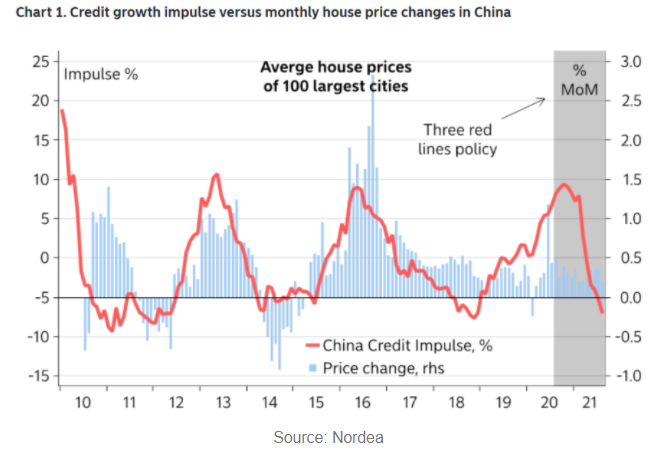

China has opened the credit taps again, and they have the unique possibility to direct credit when they want and where they want it.

The actions taken by the PBOC but most importantly the guidance given by officials towards state-owned banks to stop the bleeding are key.

2/6

The actions taken by the PBOC but most importantly the guidance given by officials towards state-owned banks to stop the bleeding are key.

2/6

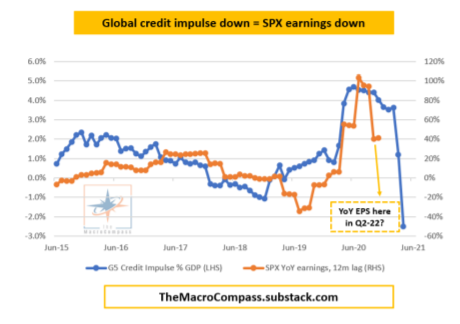

The deleveraging in Chinese real estate has been huge, and it has tracked the large '20-21 fall in the credit impulse

Now, the first concrete signs for a turn in credit impulse are there

And the first outlet for this newly created Chinese credit is Chinese assets

3/6

Now, the first concrete signs for a turn in credit impulse are there

And the first outlet for this newly created Chinese credit is Chinese assets

3/6

Also, the Chinese Politburo meeting will take place in late 2022 and Xi has zero incentives to get there with the private sector in full bleeding mode.

Even in China, incentive schemes are important.

The recent policy actions speak for themselves, imho.

4/6

Even in China, incentive schemes are important.

The recent policy actions speak for themselves, imho.

4/6

As a reminder, every trade on my global macro book is sized to lose max 2% of my remaining capital

The size is adjusted according to the volatility of the asset, and targets/stops are set asymmetrically to skew the odds my way

When wrong, I stop out

Transparency above all

5/6

The size is adjusted according to the volatility of the asset, and targets/stops are set asymmetrically to skew the odds my way

When wrong, I stop out

Transparency above all

5/6

Yesterday, I published a short update on the macro drivers behind the YTD moves and all the trades I am running in my global macro portfolio on my free newsletter The Macro Compass.

Come & check it out, so you can tease me when I get stopped out! 😀

themacrocompass.substack.com/p/market-erupt…

6/6

Come & check it out, so you can tease me when I get stopped out! 😀

themacrocompass.substack.com/p/market-erupt…

6/6

As my friend @MrBlonde_macro is correctly pointing out, in case you are looking for a more liquid proxy to get exposure to Chinese Real Estate then KHYB ETF works well.

It's credit rather than equity, but its exposure to Chinese Real Estate & Co is pretty big.

It's credit rather than equity, but its exposure to Chinese Real Estate & Co is pretty big.

• • •

Missing some Tweet in this thread? You can try to

force a refresh