0/ Can NFT prices weather the storm?

In today’s Delphi Daily, we analyzed the resilience of marquee NFT brands, @opensea fees, @GMX_io’s surge in volume, and investors start to realize losses.

For more 🧵👇

In today’s Delphi Daily, we analyzed the resilience of marquee NFT brands, @opensea fees, @GMX_io’s surge in volume, and investors start to realize losses.

For more 🧵👇

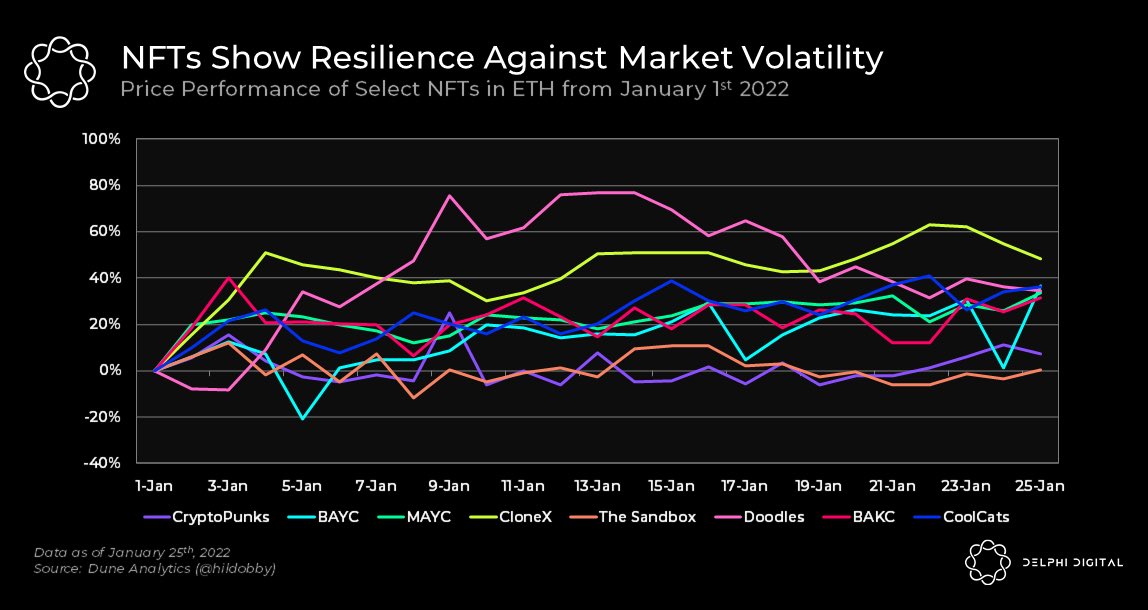

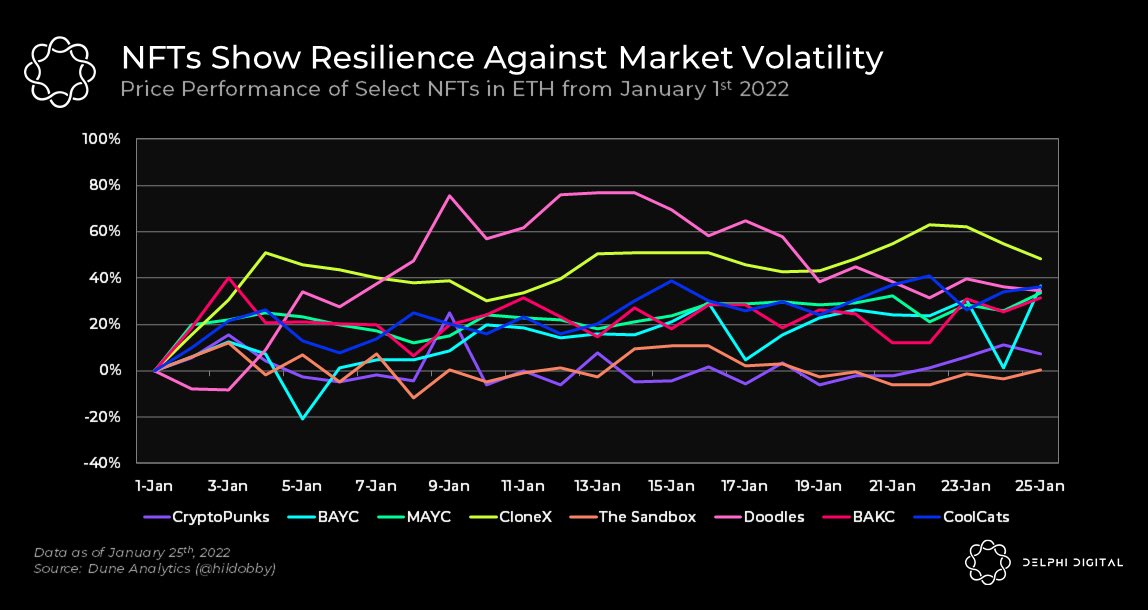

1/ Marquee NFT brands have stayed resilient amid all the recent macro uncertainty.

While ETH has fallen 35% since the start of the year, NFTs have grown in price (in ETH terms).

Since NFTs are denominated in ETH, they are still exposed to the price changes of ETH.

While ETH has fallen 35% since the start of the year, NFTs have grown in price (in ETH terms).

Since NFTs are denominated in ETH, they are still exposed to the price changes of ETH.

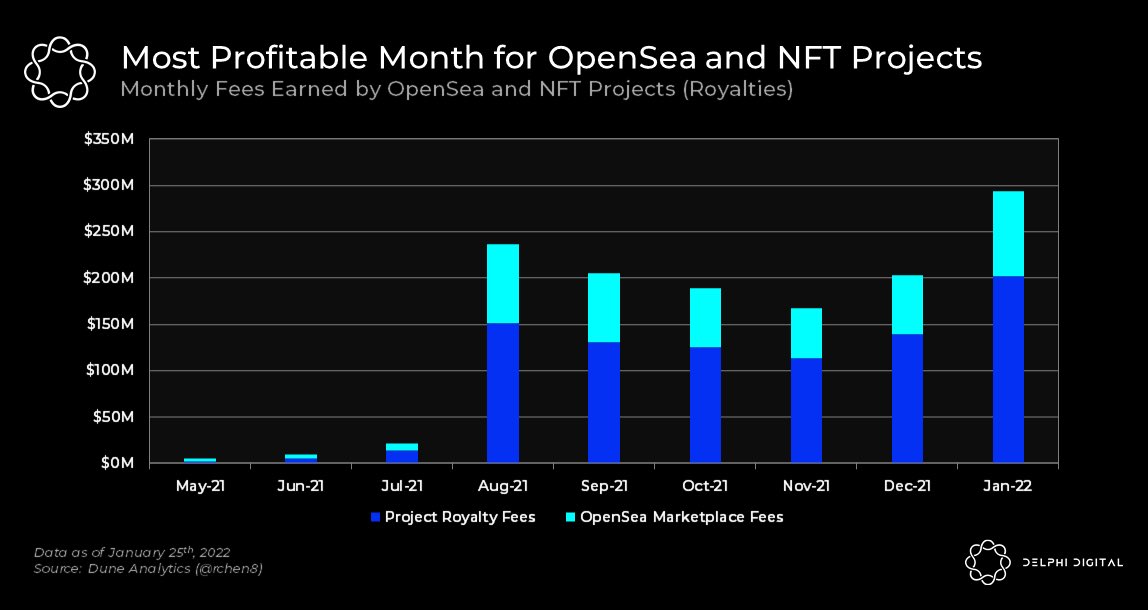

2/ With the rise of NFT volumes, @OpenSea and NFT projects have been earning massive fees.

OpenSea has made $93M in marketplace fees, while projects have earned a cumulative $202M in royalty fees in January alone.

OpenSea has made $93M in marketplace fees, while projects have earned a cumulative $202M in royalty fees in January alone.

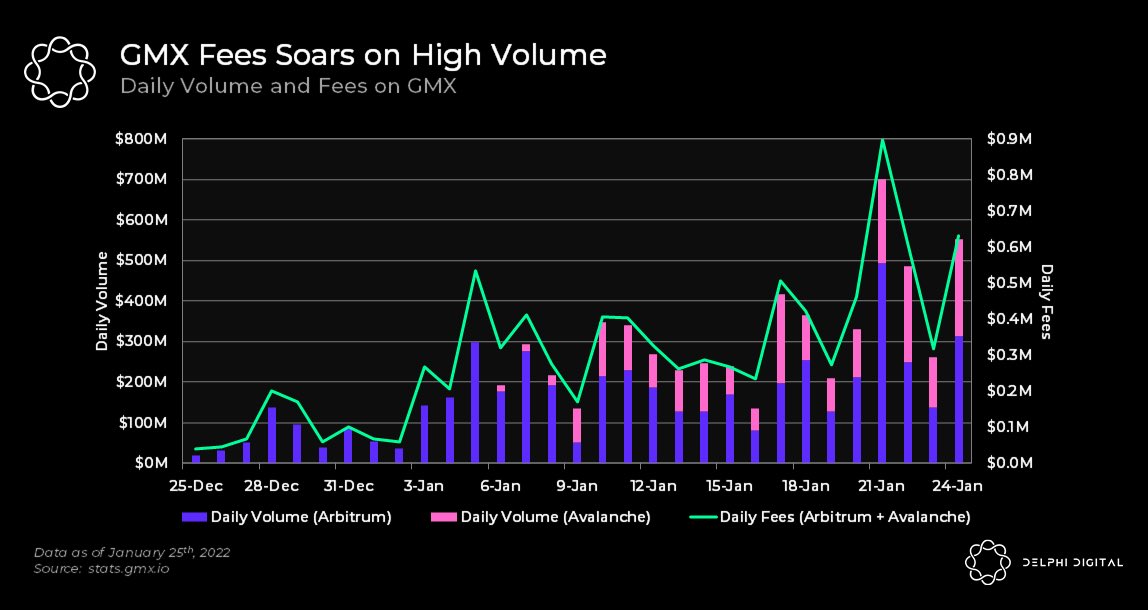

3/ Volatile markets have driven volume to @GMX_io, resulting in a surge on both @Arbitrum and @Avalancheavax

Combined daily volume on both chains hit $700M on Jan 21st, the highest the platform has ever seen. This led to the platform earning $900k in fees for GMX and GLP stakers

Combined daily volume on both chains hit $700M on Jan 21st, the highest the platform has ever seen. This led to the platform earning $900k in fees for GMX and GLP stakers

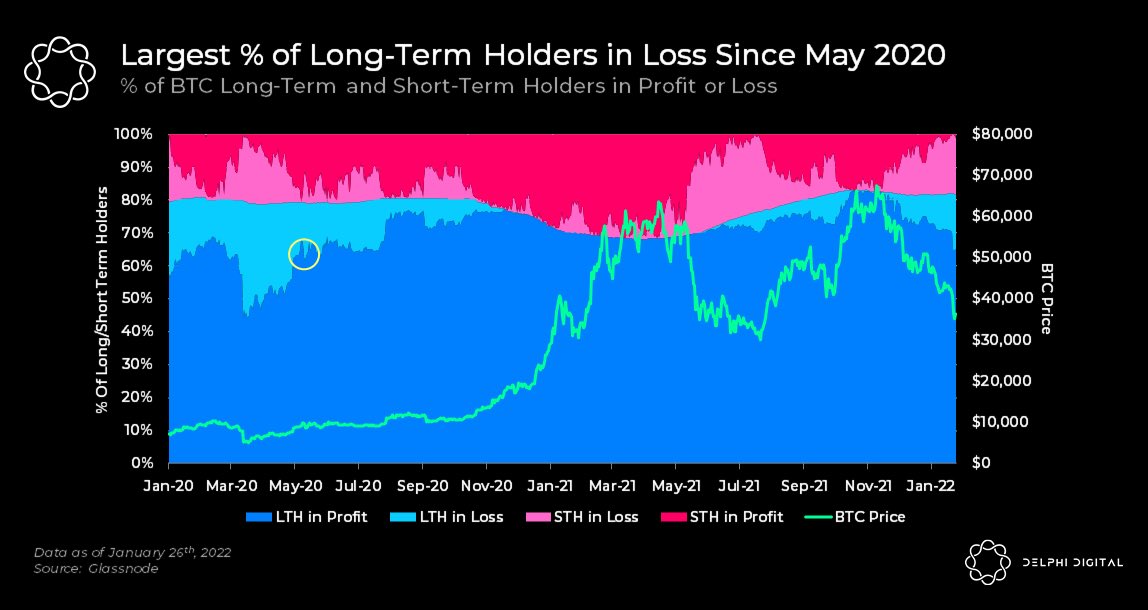

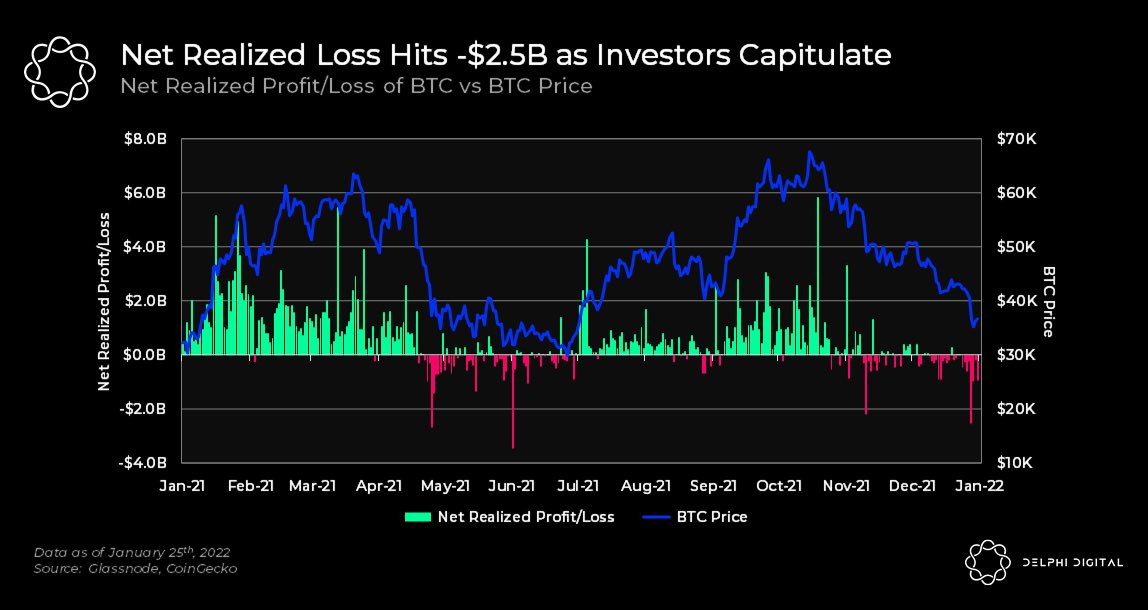

4/ Investors have capitulated on the recent downward movement of BTC to $35k.

As fear strikes the hearts crypto investors, $2.5B of net losses have been realized on the day that BTC hit $35k.

This level of net realized losses hasn’t been seen since June of last year.

As fear strikes the hearts crypto investors, $2.5B of net losses have been realized on the day that BTC hit $35k.

This level of net realized losses hasn’t been seen since June of last year.

5/ Tweets of the day!

SyndicateDAO Launches Web3 Investment Clubs

SyndicateDAO Launches Web3 Investment Clubs

https://twitter.com/SyndicateDAO/status/1486001592692260870

7/ Solidly, A New AMM, To Launch on Fantom

https://twitter.com/AndreCronjeTech/status/1485879205992796161

9/ Crypto moves fast. Delphi has you covered. Sign up here to get Delphi's free daily newsletter delivered right to your inbox every weekday

delphidigital.io/daily/

delphidigital.io/daily/

• • •

Missing some Tweet in this thread? You can try to

force a refresh