0/ Has Ethereum turned deflationary?

In today’s Delphi Daily, we examined stablecoin supply growth, long-term holder’s losses, ETH burns, and NFT Aggregator competition.

For more 🧵👇

In today’s Delphi Daily, we examined stablecoin supply growth, long-term holder’s losses, ETH burns, and NFT Aggregator competition.

For more 🧵👇

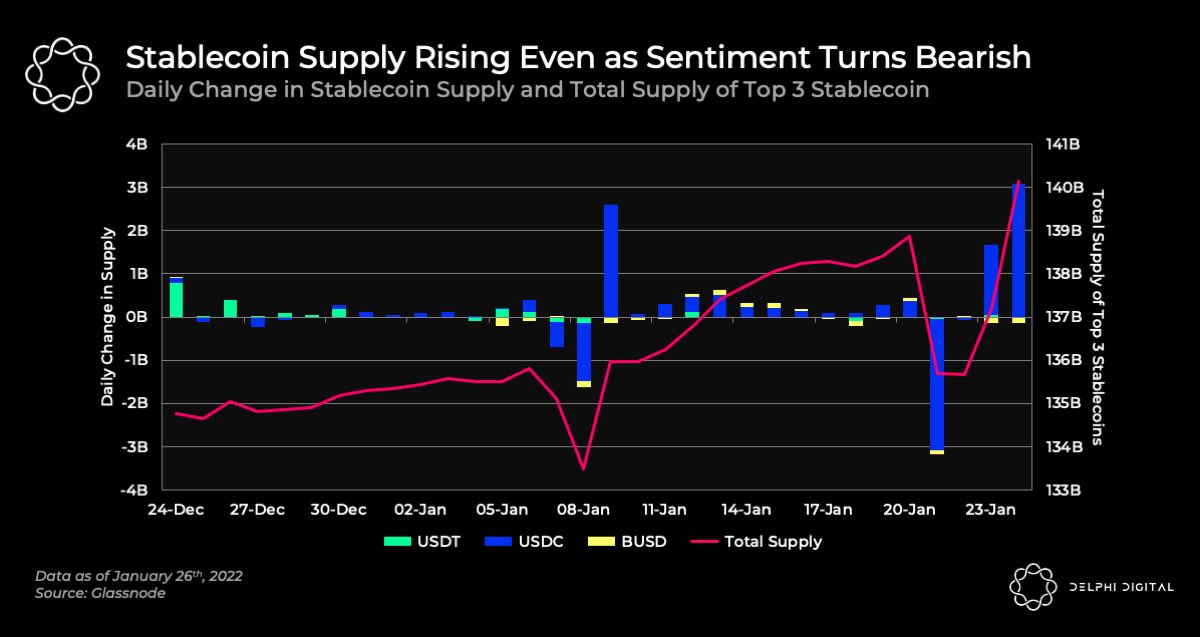

1/ Despite the current volatile environment, the stablecoin supply has grown by $5.3B over the past month.

USDC’s growth has recently become more pronounced, surging by $5.2B in supply in the last month.

USDT only grew by $700M.

USDC’s growth has recently become more pronounced, surging by $5.2B in supply in the last month.

USDT only grew by $700M.

2/ Long-Term Holders started going into loss as BTC tested the lows of $35k. LTHs in loss surged to 17% of all holders, which was last seen in May 2020 (circled in yellow).

Historically, it’s been a sign that the bottom may be in when both STHs and LTHs peak in losses.

Historically, it’s been a sign that the bottom may be in when both STHs and LTHs peak in losses.

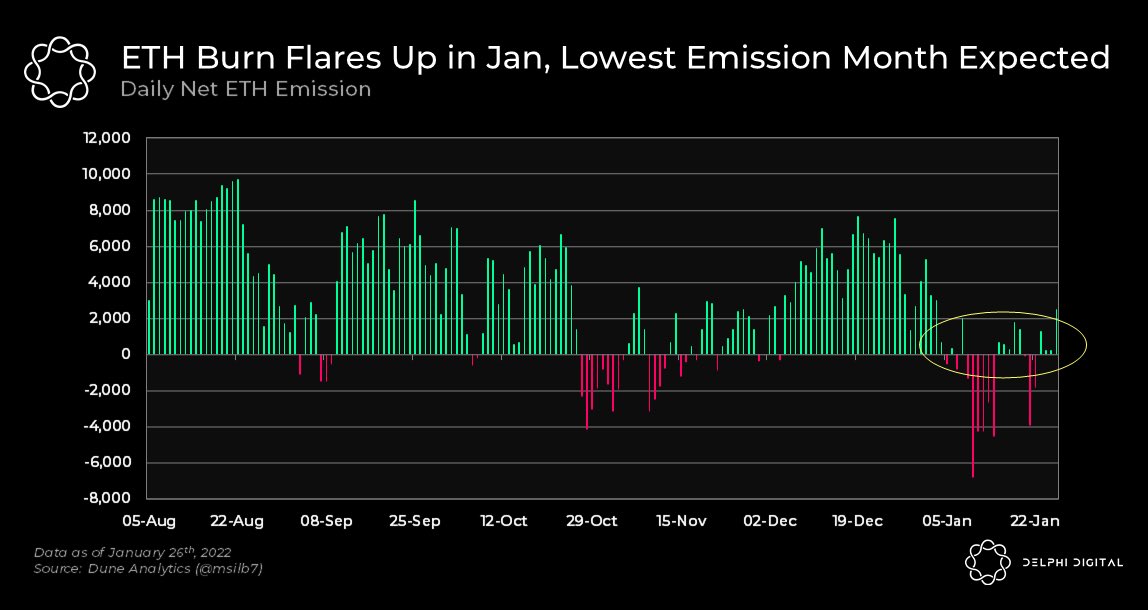

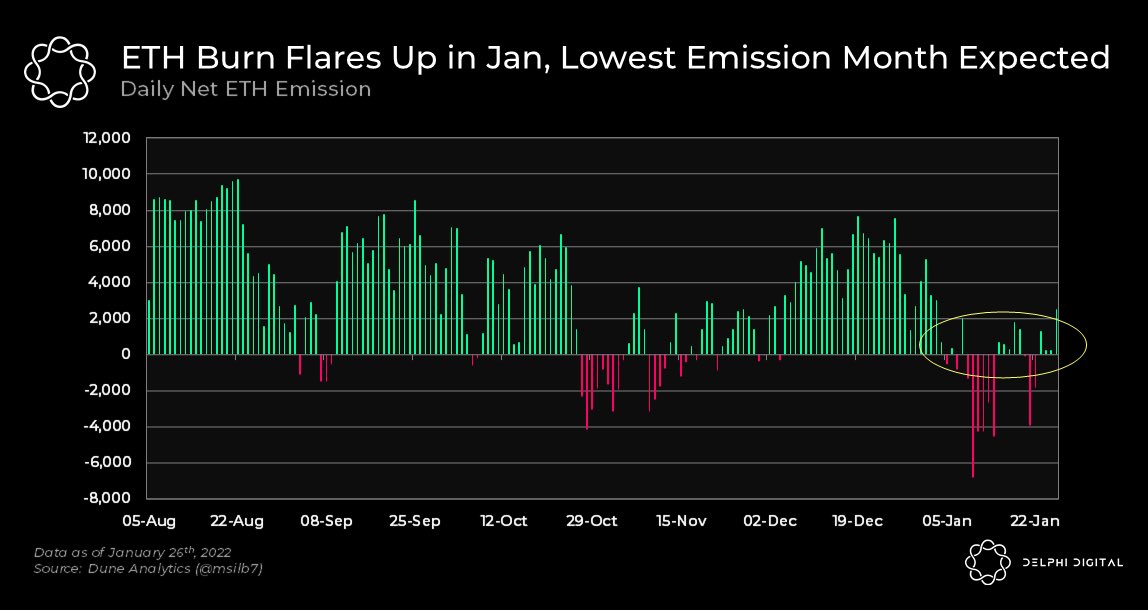

3/ Ethereum burns from EIP-1559 flared up in the month so far, resulting in the largest daily deflation of -6823 ETH on January 10th.

Comparing January’s ETH emissions to previous months, it’s clear that this month’s emissions are trending heavily towards a net burn.

Comparing January’s ETH emissions to previous months, it’s clear that this month’s emissions are trending heavily towards a net burn.

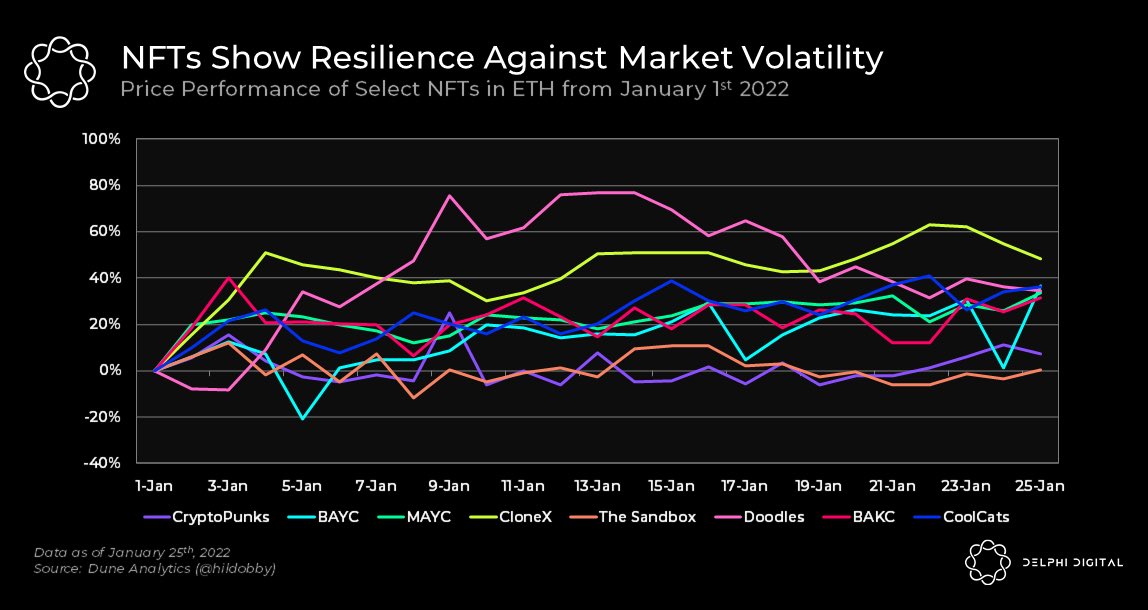

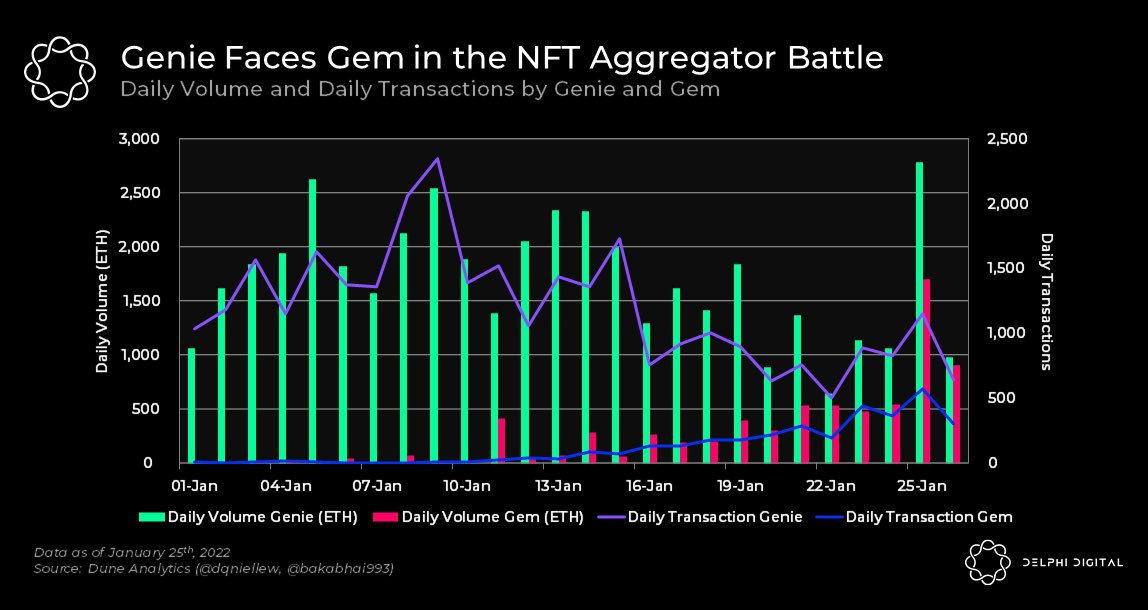

4/ The NFT Aggregator competition has been heating up.

@Geniexyz and @Gemxyz are two NFT aggregator platforms making it easy to shop and purchase across a number of NFT marketplaces.

They also provide the ability to bulk purchase NFTs in a single transaction.

@Geniexyz and @Gemxyz are two NFT aggregator platforms making it easy to shop and purchase across a number of NFT marketplaces.

They also provide the ability to bulk purchase NFTs in a single transaction.

5/ Tweets of the day!

FTX.US Raised at $8B Valuation

FTX.US Raised at $8B Valuation

https://twitter.com/TheBlock__/status/1486252336968310790

6/ Paradigm Releases NFT Mechanism CRISP

https://twitter.com/_Dave__White_/status/1486018529962848256

9/ Crypto moves fast. Delphi has you covered. Sign up here to get Delphi's free daily newsletter delivered right to your inbox every weekday

delphidigital.io/daily/

delphidigital.io/daily/

• • •

Missing some Tweet in this thread? You can try to

force a refresh