This is the most hawkish Powell I can remember since late 2018.

There are major implications for asset classes across the board: let's go through it with a short thread.

Ah, and few trade updates!

1/8

There are major implications for asset classes across the board: let's go through it with a short thread.

Ah, and few trade updates!

1/8

The synopsis of the press conference:

Journalist *asks whatever type of question*

Powell *I don't care, I'm gonna tighten*

You name it: growth scares? LFPR being weak? yield curve being very flat? risk assets and financial conditions wobbling?

Zero f*cks given by Jpow.

2/8

Journalist *asks whatever type of question*

Powell *I don't care, I'm gonna tighten*

You name it: growth scares? LFPR being weak? yield curve being very flat? risk assets and financial conditions wobbling?

Zero f*cks given by Jpow.

2/8

He did nothing to remove the most disruptive tail of the distribution of future outcomes.

Asked about 50 bps hike? Didn't deny it.

Asked about hiking at every meeting? Didn't deny it.

So, here is what the market is now pricing by Dec 2022.

Almost 5 (!) hikes as base case.

3/8

Asked about 50 bps hike? Didn't deny it.

Asked about hiking at every meeting? Didn't deny it.

So, here is what the market is now pricing by Dec 2022.

Almost 5 (!) hikes as base case.

3/8

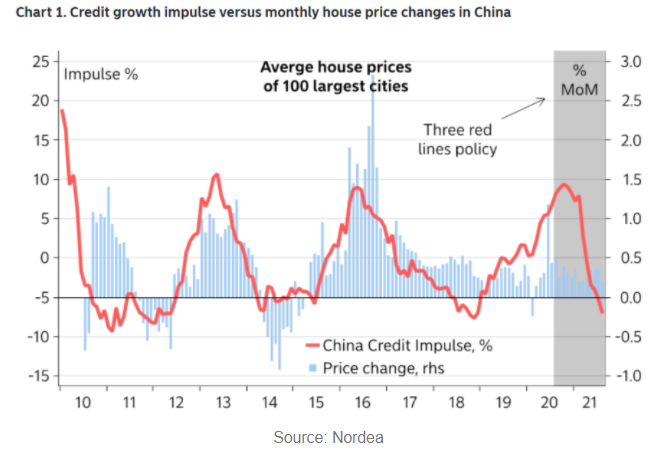

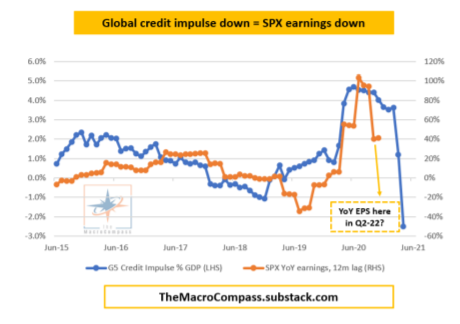

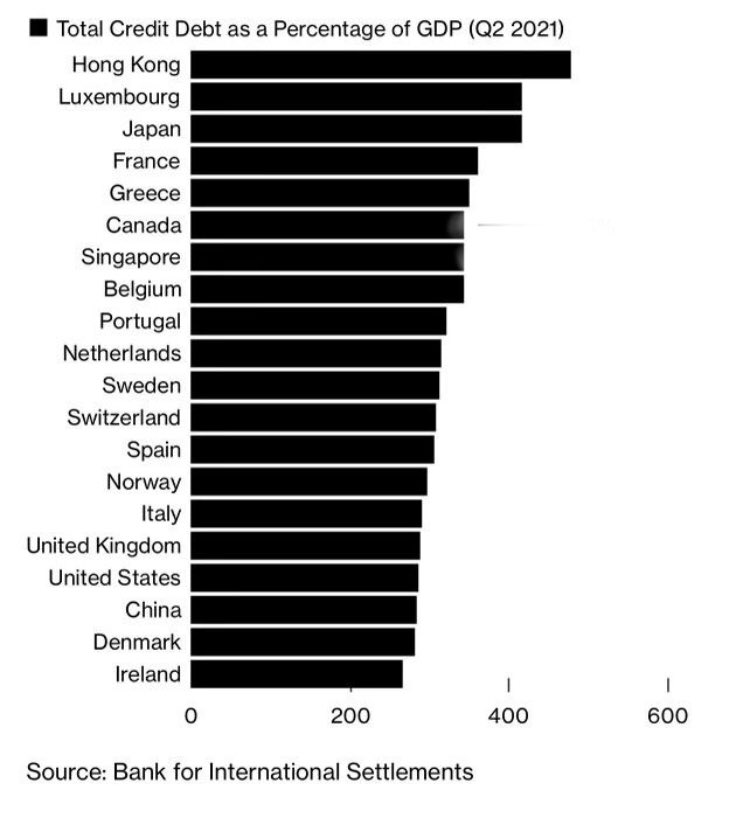

My G5 Credit Impulse has been speaking loudly about a deteriorating in growth impulse in H122 and we are starting to see that happen.

The result is that the slope of the 5-30y part of the yield curve (in swaps: 24 bps today) is likely to become inverted.

4/8

The result is that the slope of the 5-30y part of the yield curve (in swaps: 24 bps today) is likely to become inverted.

4/8

Also, as front-end nominal yields go to the moon to incorporate the reiterated hawkish Fed stance but inflation break-evens go nowhere (or actually fall, as implied by my G5 Credit Impulse)...

...real yields spike fast. Very fast.

5y real yields in the chart below.

5/8

...real yields spike fast. Very fast.

5y real yields in the chart below.

5/8

Higher real yields are bad for multiples, and an aggressive Fed compounds the negative pressure on earnings anticipated by a falling Credit Impulse

The market is going to challenge Powell here

When facts change, I change my mind hence making some portfolio adjustments too

6/8

The market is going to challenge Powell here

When facts change, I change my mind hence making some portfolio adjustments too

6/8

The most important are:

*Moving my long 10y bonds to a 2s10s flattener (trade closed at no cost, new trade opened at 74 bps): safer way to express the view

*Opened a short in HYG at 85: junk credit spreads are way too tight in this environment.

7/8

*Moving my long 10y bonds to a 2s10s flattener (trade closed at no cost, new trade opened at 74 bps): safer way to express the view

*Opened a short in HYG at 85: junk credit spreads are way too tight in this environment.

7/8

Powell also shed some light on QT

The Fed is not going to sell bonds outright to the market, and they are going to be cautious about the pace of QT

This is my primer on how QT works & what to focus on when they are going to give full details

Enjoy!

8/8

themacrocompass.substack.com/p/qt-explained

The Fed is not going to sell bonds outright to the market, and they are going to be cautious about the pace of QT

This is my primer on how QT works & what to focus on when they are going to give full details

Enjoy!

8/8

themacrocompass.substack.com/p/qt-explained

• • •

Missing some Tweet in this thread? You can try to

force a refresh