0/ How is sentiment post FOMC?

For today’s Delphi Daily, we examined the aftermath of this week's FOMC meeting, current stablecoin utilization rates, and the amount of unique NFT buyers.

For more 🧵👇

For today’s Delphi Daily, we examined the aftermath of this week's FOMC meeting, current stablecoin utilization rates, and the amount of unique NFT buyers.

For more 🧵👇

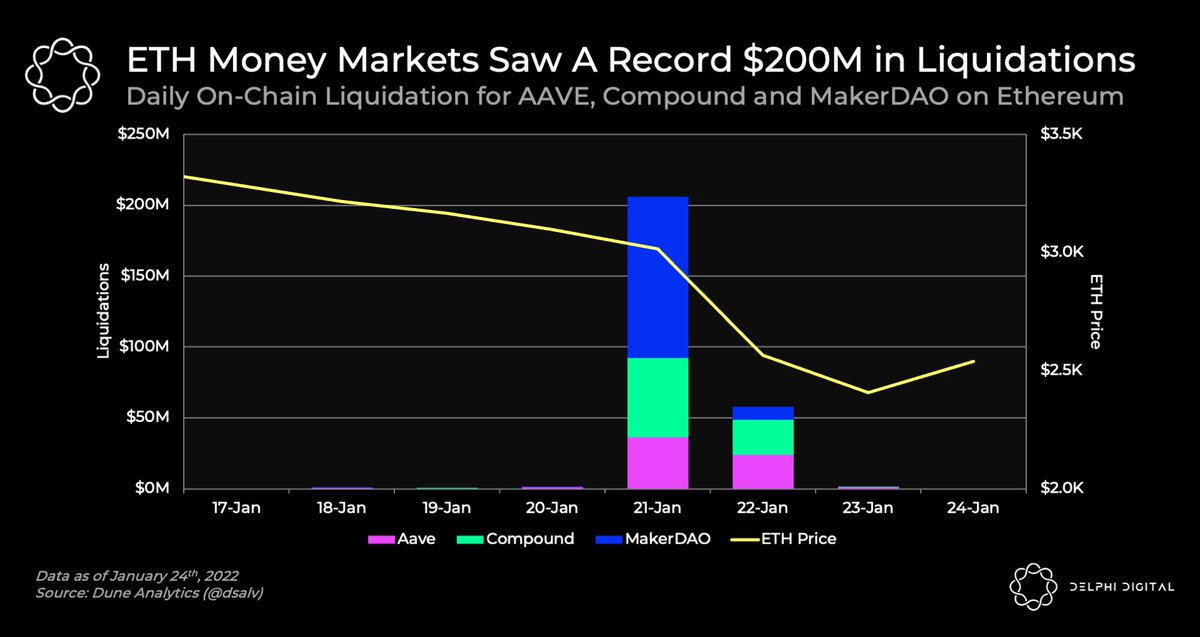

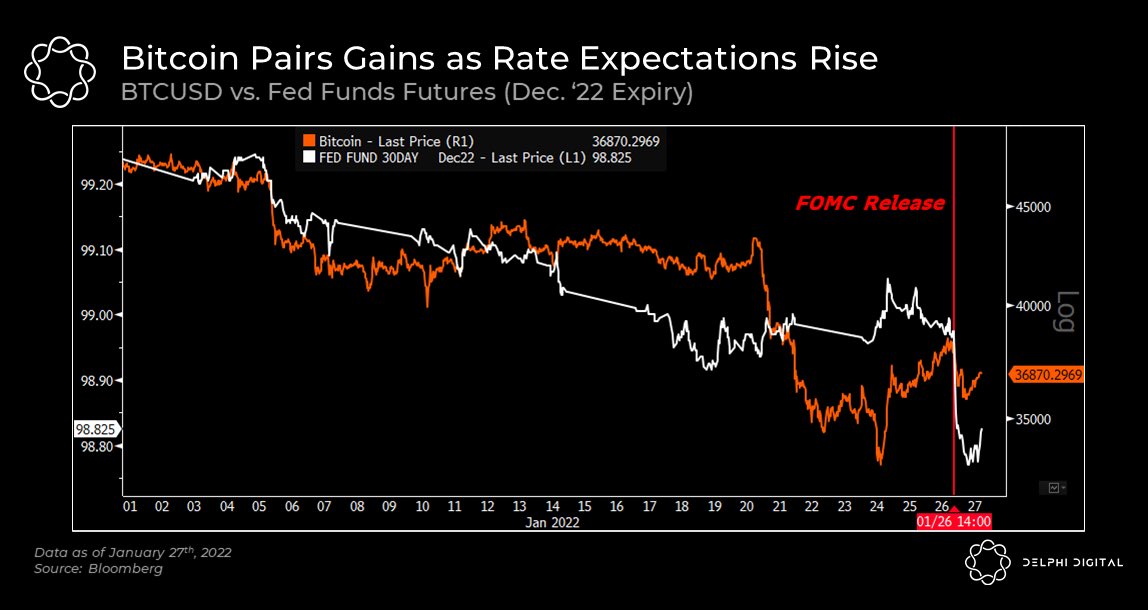

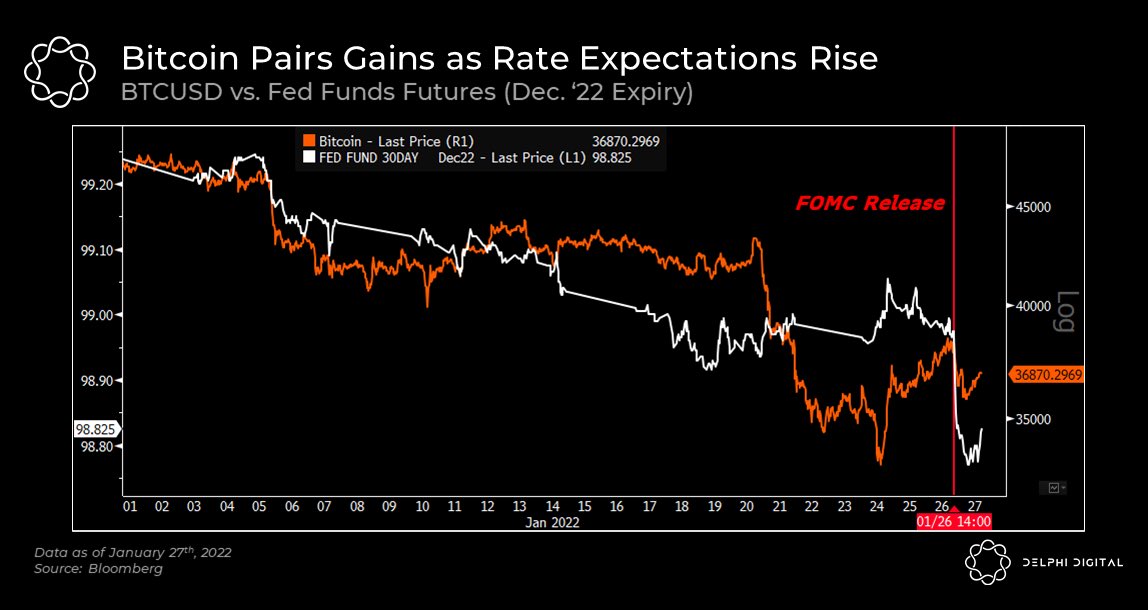

1/ The FOMC decided to leave rates untouched but signaled for a hike in March’s FOMC. US10Y closed the trading day up 5%, and DXY was up 0.46%.

Risk assets like SPX, NDX, and crypto assets wound up pairing back their initial gains as the market digested the Fed’s commentary.

Risk assets like SPX, NDX, and crypto assets wound up pairing back their initial gains as the market digested the Fed’s commentary.

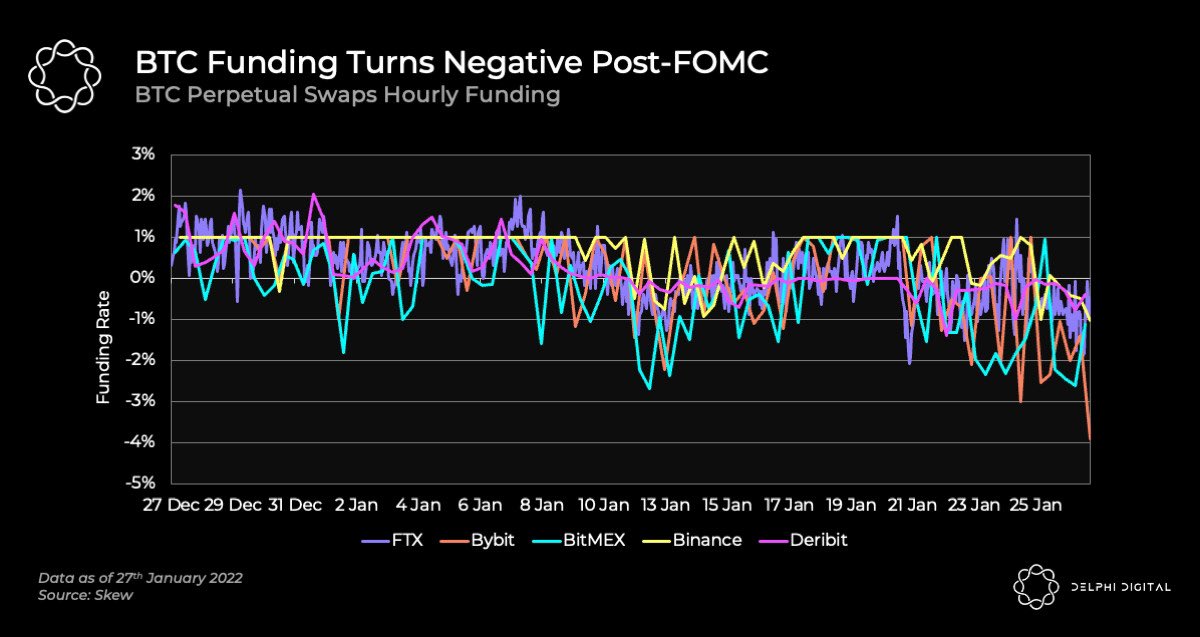

2/ Funding turned even more negative post FOMC as investors were spooked by Powell’s resolve to fight inflation.

All in all, it seems like the market is expecting Bitcoin to make a lower low after recently testing the $34k level.

All in all, it seems like the market is expecting Bitcoin to make a lower low after recently testing the $34k level.

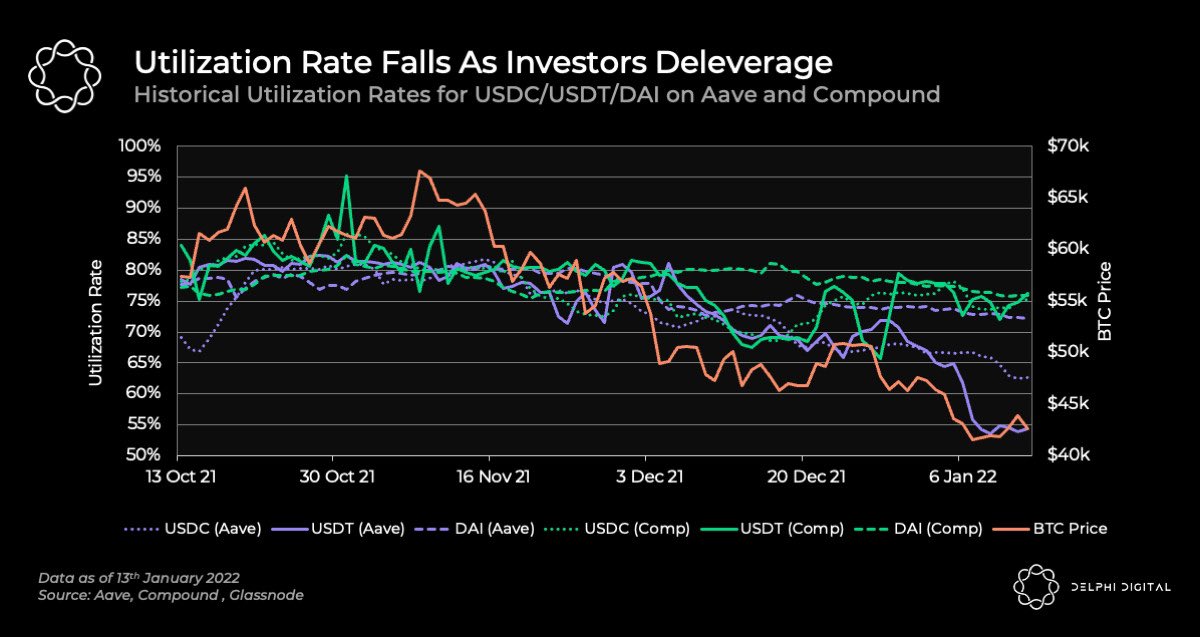

3/ Stablecoin utilization rates on major money markets have fallen since Bitcoin hit all-time highs in October last year.

On-chain data shows that utilization of stablecoins on @AaveAave and @Compoundfinance has fallen as investors pay back their loans.

On-chain data shows that utilization of stablecoins on @AaveAave and @Compoundfinance has fallen as investors pay back their loans.

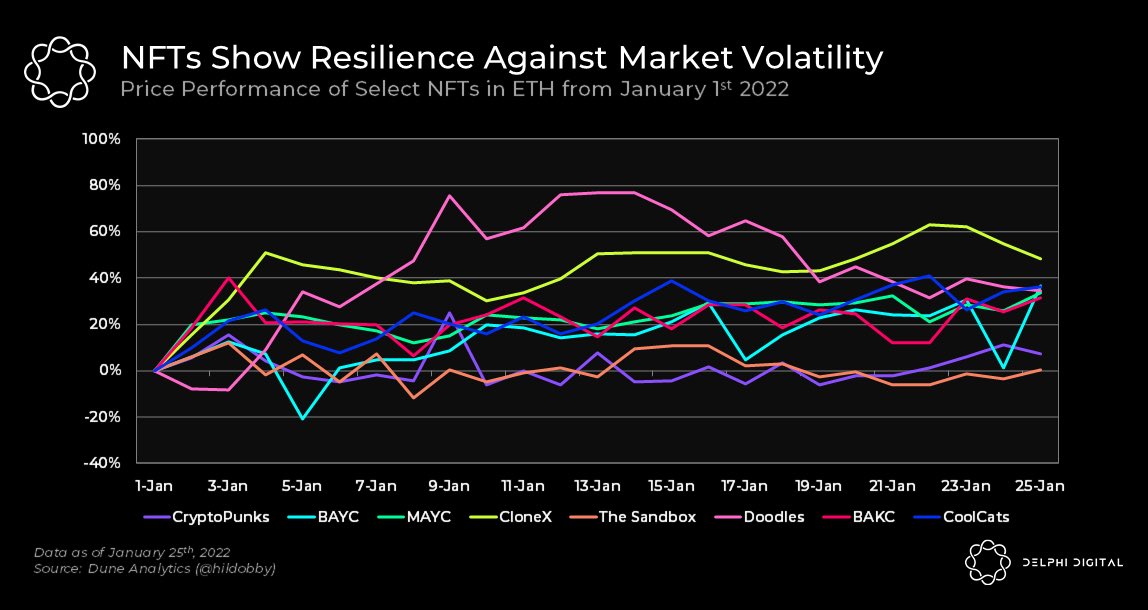

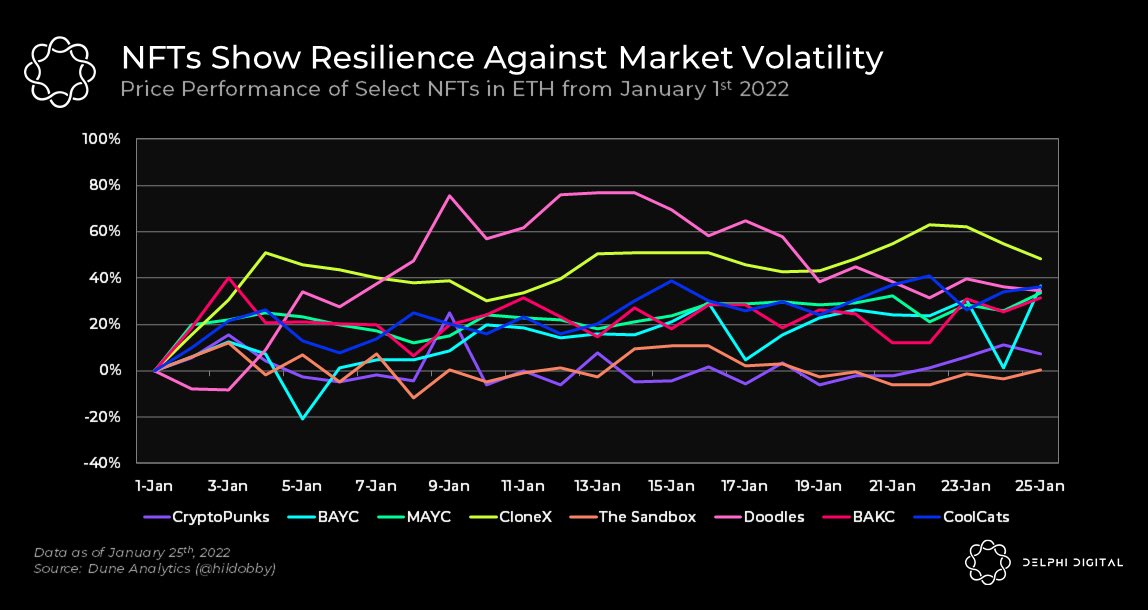

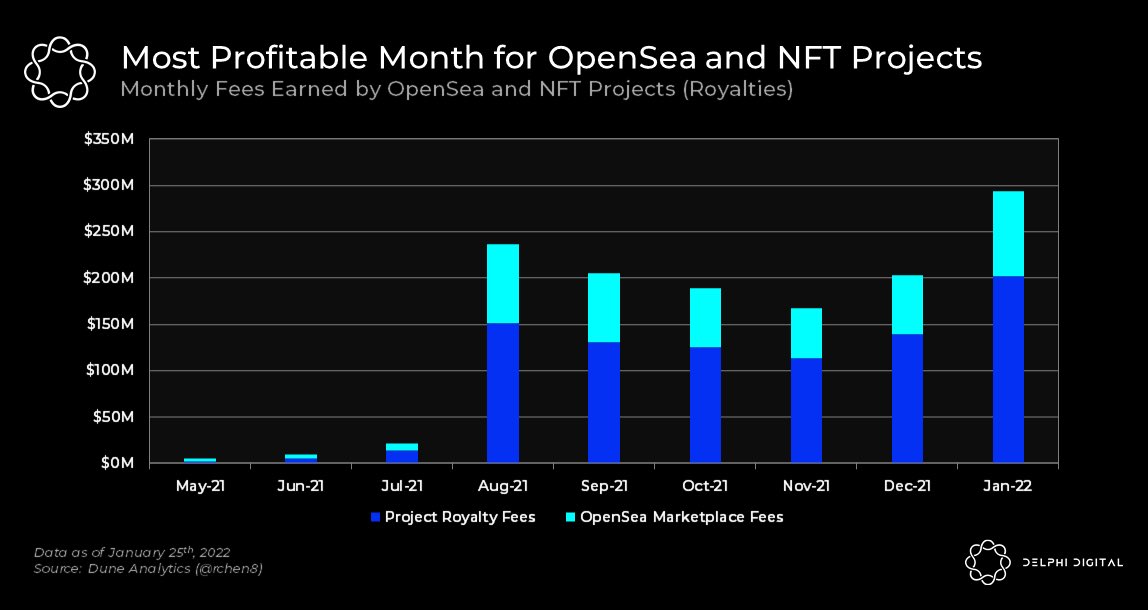

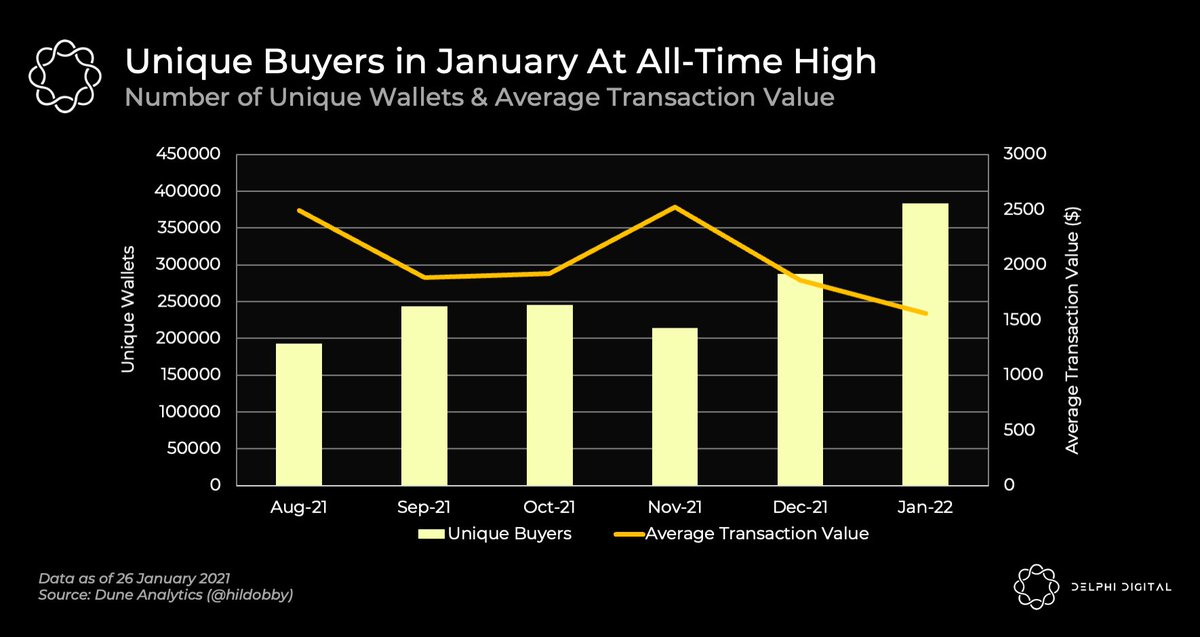

4/ Despite the broader market downturn, NFT activity remains vibrant.

The number of unique wallets buying NFTs this month has doubled from just 5 months ago (380k now vs 190k in Aug 2021), showing that interest in the space is booming.

The number of unique wallets buying NFTs this month has doubled from just 5 months ago (380k now vs 190k in Aug 2021), showing that interest in the space is booming.

5/ Tweets of the day!

Vitalik’s Soulbound

Vitalik’s Soulbound

https://twitter.com/VitalikButerin/status/1486375000793776131

9/ Crypto moves fast. Delphi has you covered. Sign up here to get Delphi's free daily newsletter delivered right to your inbox every weekday

delphidigital.io/daily/

delphidigital.io/daily/

• • •

Missing some Tweet in this thread? You can try to

force a refresh