So much fud about $UST on my timeline.

It's about time we're talking about Anchor Protocol, the sustainability of the 19,5% APY, $UST peg, and the impact of $LUNA's price.

We will also look at solutions for how Anchor Protocol can handle this in the best way.

Long THREAD

1/

It's about time we're talking about Anchor Protocol, the sustainability of the 19,5% APY, $UST peg, and the impact of $LUNA's price.

We will also look at solutions for how Anchor Protocol can handle this in the best way.

Long THREAD

1/

So, why are so many people hating on $UST and Anchor Protocol?

Just look at this.

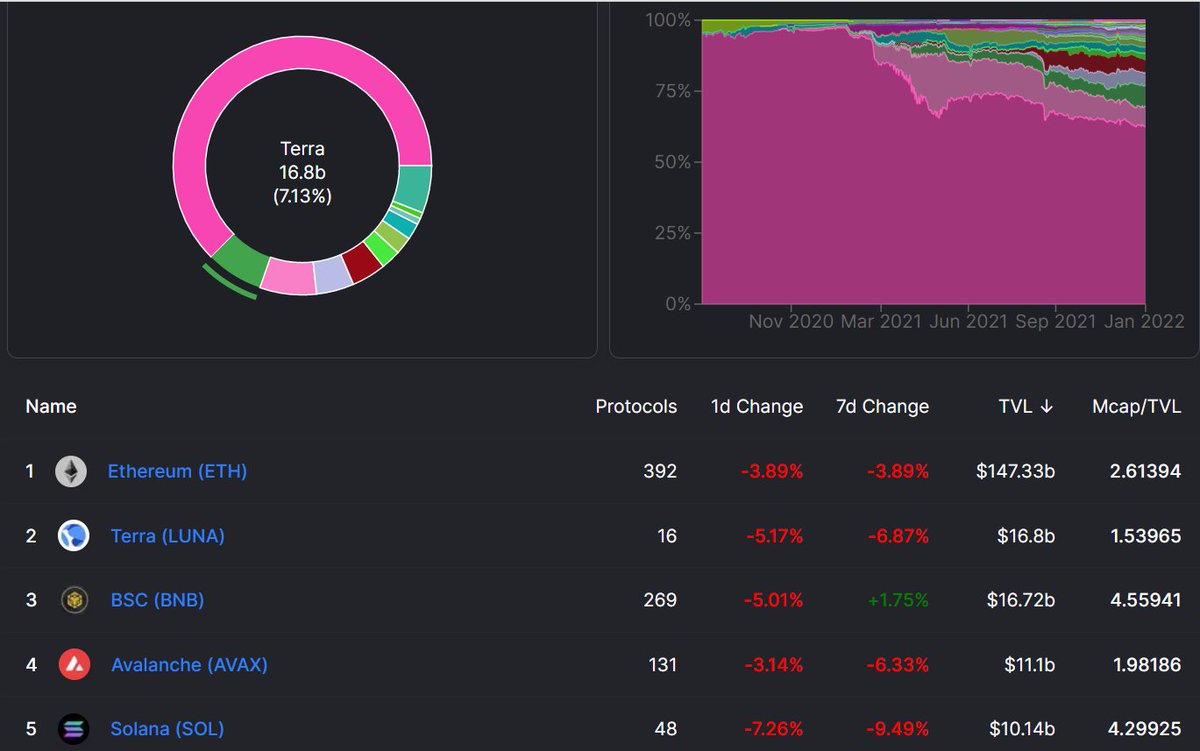

One year ago the mcap of $UST was $260M and Terra had only one protocol (Mirror Protocol).

Today it's $11,2B, and 17 protocols are launched (100+ will launch in 2022).

That's a 43x in 1 year

/2

Just look at this.

One year ago the mcap of $UST was $260M and Terra had only one protocol (Mirror Protocol).

Today it's $11,2B, and 17 protocols are launched (100+ will launch in 2022).

That's a 43x in 1 year

/2

$UST has surpassed $DAI and is aiming for the #1 spot among stablecoins

Sounds impossible? Maybe. But it's crazy to see how well Terra has succeeded with basically zero marketing

When the mcap of $UST was $1B, @stablekwon told people that $UST mcap would be $10B by EOY 2021

/3

Sounds impossible? Maybe. But it's crazy to see how well Terra has succeeded with basically zero marketing

When the mcap of $UST was $1B, @stablekwon told people that $UST mcap would be $10B by EOY 2021

/3

Few people believed in him. But he delivered.

So what is keeping the Terra ecosystem alive?

Answer: Anchor Protocol

Anchor Protocol is basically a stablecoin savings account and is so easy to use that even a 5-year old would understand it.

/4

So what is keeping the Terra ecosystem alive?

Answer: Anchor Protocol

Anchor Protocol is basically a stablecoin savings account and is so easy to use that even a 5-year old would understand it.

/4

Add 19,5% APY and that rewards are being paid out in $UST and you have a great savings product.

You deposit $UST. You get paid in $UST. That's it.

Almost every other stablecoin staking/yield farm opportunity is either harder to use or has a fleeting APY.

/5

You deposit $UST. You get paid in $UST. That's it.

Almost every other stablecoin staking/yield farm opportunity is either harder to use or has a fleeting APY.

/5

Anchor Protocol on the other hand has a savings product that has remained with 19-20% APY all the time.

Still not convinced why this product is so successful?

In our bubble on crypto Twitter there's a lot of degens with high technical skills. We understand how...

/6

Still not convinced why this product is so successful?

In our bubble on crypto Twitter there's a lot of degens with high technical skills. We understand how...

/6

to use wallets and navigate through the different chains. But remember that most people find this really hard.

Anchor Protocol has solved this by offering a stablecoin with a stable 19,5% savings rate that competes with investing in stocks, bonds, and real estate.

/7

Anchor Protocol has solved this by offering a stablecoin with a stable 19,5% savings rate that competes with investing in stocks, bonds, and real estate.

/7

This attracts normal people (which is in the majority compared to degens).

We'll get back to the sustainability of the 19,5% APY soon.

But before we move on we have to understand the mechanisms and the relationship with $UST and $LUNA.

/8

We'll get back to the sustainability of the 19,5% APY soon.

But before we move on we have to understand the mechanisms and the relationship with $UST and $LUNA.

/8

The $UST stablecoin are backed by another asset ($LUNA). To maintain peg, the supply of stablecoins in circulation will be altered to meet demand.

How?

It's done through a simple burning and minting mechanism between $UST and $LUNA.

/9

How?

It's done through a simple burning and minting mechanism between $UST and $LUNA.

/9

1 $UST can always be exchanged for $1 worth or $LUNA.

Example: $UST is at $0.95 (below peg)

In this case, anyone can buy $UST at $0.95 and burn it to receive $1 worth of $LUNA, this will result in $UST reapproaching its peg and the user receiving a $0.05 risk-free profit.

10/

Example: $UST is at $0.95 (below peg)

In this case, anyone can buy $UST at $0.95 and burn it to receive $1 worth of $LUNA, this will result in $UST reapproaching its peg and the user receiving a $0.05 risk-free profit.

10/

Example 2:

$UST is at $1.05 (above peg)

In this case, users could buy $1 worth of $LUNA and burn it to receive 1 $UST (worth $1.05), also resulting in $UST regaining peg with the user receiving a $0.05 risk-free profit.

Do you see how this works?

11/

$UST is at $1.05 (above peg)

In this case, users could buy $1 worth of $LUNA and burn it to receive 1 $UST (worth $1.05), also resulting in $UST regaining peg with the user receiving a $0.05 risk-free profit.

Do you see how this works?

11/

As $UST is minted, $LUNA is burned. In other words, as the demand for $UST goes up, the supply of $LUNA goes down.

Of course, this also works in the other direction.

/12

Of course, this also works in the other direction.

/12

In the autumn of 2021, we saw an immense increase in the $UST demand. This led to the burning of $LUNA = reduced supply (deflation).

With less $LUNA in circulation combined with the popularity of Anchor Protocol ($UST demand), $LUNA's price increased a lot.

/13

With less $LUNA in circulation combined with the popularity of Anchor Protocol ($UST demand), $LUNA's price increased a lot.

/13

$UST mcap went from $2,5B to $10B in 3 months and $LUNA's price did almost exactly the same (approx. $29 to $103 which was the ATH).

So when the market goes up all is good. The risk with a system like this is a death spiral and/or a bank run.

/14

So when the market goes up all is good. The risk with a system like this is a death spiral and/or a bank run.

/14

In the face of $UST dropping below peg for long periods of time, it'd be profitable to:

1. Burn $UST for $LUNA

2. Sell $LUNA at a profit

3. Repeat

This would supposedly result in $LUNA's price crashing, and $UST's reserve asset being worthless, leaving $UST unbacked.

/15

1. Burn $UST for $LUNA

2. Sell $LUNA at a profit

3. Repeat

This would supposedly result in $LUNA's price crashing, and $UST's reserve asset being worthless, leaving $UST unbacked.

/15

Let me explain further.

If the $UST goes below $1 it becomes profitable to burn it and mint $LUNA.

Burning of $UST = increased supply of $LUNA = reduced price of $LUNA (ofc not immediately, but with big volume over a period of time).

/16

If the $UST goes below $1 it becomes profitable to burn it and mint $LUNA.

Burning of $UST = increased supply of $LUNA = reduced price of $LUNA (ofc not immediately, but with big volume over a period of time).

/16

A reduced price of $LUNA could eventually lead to a panic where everyone sells their $LUNA and the trust will vanish in the Terra ecosystem, making the $UST worthless.

However, in May, $UST dropped below peg and this death spiral people speak about, never occurred.

/17

However, in May, $UST dropped below peg and this death spiral people speak about, never occurred.

/17

Is it possible that $LUNA will experience the same crash as in May when it went to $6?

A lot has happened in the Terra ecosystem since May, let me explain why I don't think we will have a heavy crash like that again.

This is also what the FUD-boys never mention.

/18

A lot has happened in the Terra ecosystem since May, let me explain why I don't think we will have a heavy crash like that again.

This is also what the FUD-boys never mention.

/18

In May when $BTC went from $60K to $30K there was a lot of panic in the market. Altcoins was bleeding. $LUNA was no exception.

The reason for the big drawdown of $LUNA was because of liquidations on Anchor Protocol.

/19

The reason for the big drawdown of $LUNA was because of liquidations on Anchor Protocol.

/19

People were borrowing against their $LUNA and $ETH and couldn't repay their loans fast enough

$LUNA price down with the rest of the market -> collateral value of borrowed assets down --> liquidation --> $LUNA price dropped more --> lower collateral value --> more liq. etc.

/20

$LUNA price down with the rest of the market -> collateral value of borrowed assets down --> liquidation --> $LUNA price dropped more --> lower collateral value --> more liq. etc.

/20

Why don't I think this will happen again?

1) Kujira Orca: A protocol where you can buy other people's liquidated assets from Anchor Protocol

Instead of sending the $LUNA out to the market, there will be buyers buying these assets immediately (protecting the price of $LUNA)

/21

1) Kujira Orca: A protocol where you can buy other people's liquidated assets from Anchor Protocol

Instead of sending the $LUNA out to the market, there will be buyers buying these assets immediately (protecting the price of $LUNA)

/21

2) Whitewhale Protocol: A protocol that lets retail investors like you and me use your Anchor Protocol money to utilize arbitrage opportunities.

This will protect the peg of the stablecoin $UST.

See video of how it works here:

/22

This will protect the peg of the stablecoin $UST.

See video of how it works here:

/22

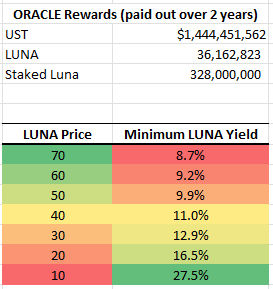

3) Oracle rewards: There are $1,4B $UST & 30M $LUNA tokens in a community pool that will reward $LUNA stakers over the next 2 years.

This will make the $LUNA staking rewards more attractive the lower the price of $LUNA. This will lead to more people buying $LUNA and...

/23

This will make the $LUNA staking rewards more attractive the lower the price of $LUNA. This will lead to more people buying $LUNA and...

/23

an increased price + fewer liquidations (see the picture in the last tweet).

Okay, now that we understand the mechanisms behind $UST & $LUNA let's talk more about Anchor Protocol and the sustainability of the 19,5% APY.

cont.

/24

Okay, now that we understand the mechanisms behind $UST & $LUNA let's talk more about Anchor Protocol and the sustainability of the 19,5% APY.

cont.

/24

Think about Anchor Protocol as a company.

In order to pay out 19,5% APY they need income.

Anchor earns money in two ways:

1) Interest earned from people borrowing $UST: 11,5% atm

2) Staking rewards from bonded collateral (bLUNA/bETH): 8,5% on bLUNA & 4,6% on bETH

/25

In order to pay out 19,5% APY they need income.

Anchor earns money in two ways:

1) Interest earned from people borrowing $UST: 11,5% atm

2) Staking rewards from bonded collateral (bLUNA/bETH): 8,5% on bLUNA & 4,6% on bETH

/25

Anchor balance sheet:

Expenses

Total deposit: $5.5B $UST x19.5% / 100 = $1.07B

Income:

Borrowed $UST: $1.35B x 15% / 100 = $0.20B

Staking rewards bLUNA: $2.8B x 8,5% / 100 = $0.24B

Staking rewards bETH: $0.43B x 4,6% / 100 = $0.02B

/26

Expenses

Total deposit: $5.5B $UST x19.5% / 100 = $1.07B

Income:

Borrowed $UST: $1.35B x 15% / 100 = $0.20B

Staking rewards bLUNA: $2.8B x 8,5% / 100 = $0.24B

Staking rewards bETH: $0.43B x 4,6% / 100 = $0.02B

/26

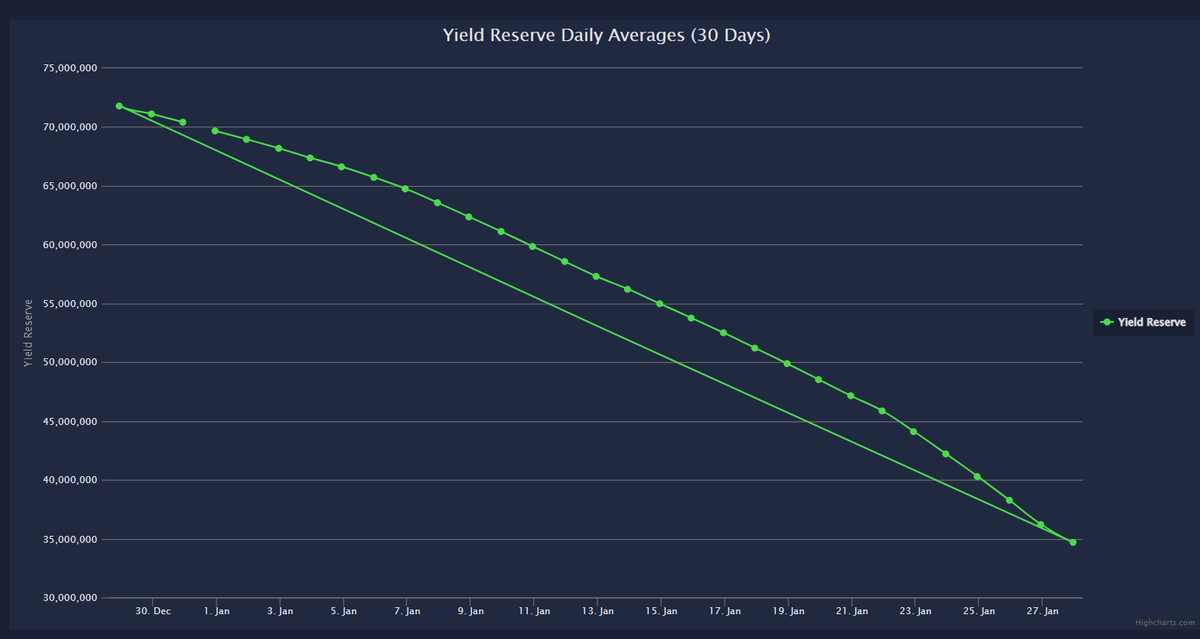

Balance sheet: -1.07B + 0.20 + 0.24 + 0.02 = -$0.61B

At the moment Anchor Protocol has a $610M deficit per year.

That equals $1.7M and is why the yield reserve has been dropping a lot since $LUNA's ATH in December.

/27

At the moment Anchor Protocol has a $610M deficit per year.

That equals $1.7M and is why the yield reserve has been dropping a lot since $LUNA's ATH in December.

/27

Yes, Anchor Protocol has a yield reserve that can pay out 19,5% until the reserve is empty.

The yield reserve has declined steadily in the last month, and people are starting to get worried.

/28

The yield reserve has declined steadily in the last month, and people are starting to get worried.

/28

But just remember that the yield reserve was created for market environments like this. We should be grateful that there even exists a yield reserve.

If the yield reserve goes to zero, it's not the end of the world. The APY will adjust after the market environment.

/29

If the yield reserve goes to zero, it's not the end of the world. The APY will adjust after the market environment.

/29

Right now that's approx. 9-10%. But it will be higher (you will see why soon).

So how can Terra solve this?

1) @stablekwon has hinted about a $100-$300M infusion into the yield reserve (however this is only a short-term solution)

/30

So how can Terra solve this?

1) @stablekwon has hinted about a $100-$300M infusion into the yield reserve (however this is only a short-term solution)

/30

2) more bAssets coming to Terra (bSOL & bATOM confirmed, and I'm sure there will be more).

3) Anchor V2 model: can add several bAssets (eg. $SOL or $AVAX). More income and higher staking rewards

4) Use $UST from the community pool to increase yield reserve (short term)

/31

3) Anchor V2 model: can add several bAssets (eg. $SOL or $AVAX). More income and higher staking rewards

4) Use $UST from the community pool to increase yield reserve (short term)

/31

5) Limit Degenbox $UST - $MIM: (this is in a way already taken care of after the Sifu-scandal of Wonderland $TIME).

I don't think people will continue borrowing $MIM and that eliminates the need for $UST too.

/32

I don't think people will continue borrowing $MIM and that eliminates the need for $UST too.

/32

6) Limit deposits per user (not very realistic because this will stop the growth of the Terra ecosystem)

7) Make a use-case for the $ANC-token in Anchor Protocol:

Look at eg. orion.money or crypto.com

If you have $ORION or $CRO in your...

/33

7) Make a use-case for the $ANC-token in Anchor Protocol:

Look at eg. orion.money or crypto.com

If you have $ORION or $CRO in your...

/33

portfolio you get a higher reward on your stablecoin compared to if you don't have their tokens.

Why can't Anchor do something similar? Eg. if you want 19.5% interest you have to have X amount of $ANC in your wallet. If you don't have it, you get 15% APY.

/34

Why can't Anchor do something similar? Eg. if you want 19.5% interest you have to have X amount of $ANC in your wallet. If you don't have it, you get 15% APY.

/34

I'm sure someone already has written about this, but I would love the Anchor team to explore this model more.

And if this already has been a rejected governance proposal I would love to know why :D

/35

And if this already has been a rejected governance proposal I would love to know why :D

/35

As you can see, there are a lot of solutions, and I think the Terra team will solve this.

My only concern would be if @stablekwon choose to not refill the yield reserve. Ofc, he doesn't have to.

/36

My only concern would be if @stablekwon choose to not refill the yield reserve. Ofc, he doesn't have to.

/36

But a fleeting Anchor interest rate between 10-15% would probably not be popular.

I feel confident that a lot of people would remove their deposits from Anchor and seek other yield opportunities (greed).

Think about it this way. In early November the...

/37

I feel confident that a lot of people would remove their deposits from Anchor and seek other yield opportunities (greed).

Think about it this way. In early November the...

/37

Degenbox strategy came and suddenly you could receive over 100% APY on your $UST stablecoin. People started to get used to this and more and more people became greedy

Also, yesterday people started to lose trust in the Degenbox strategy and now Anchor's 19.5% can be reduced

/38

Also, yesterday people started to lose trust in the Degenbox strategy and now Anchor's 19.5% can be reduced

/38

There are a lot of yield opportunities out there on $FTM, $AVAX, $SOL, and $ETH that are very attractive for investors. I don't think @stablekwon can afford to take the chance to not refill the yield reserve.

/39

/39

If the Anchor rate is lowered, people will flee from $UST to other opportunities (greed) and it will reduce mcap of UST and increase Luna supply = reduced Luna price.

/40

/40

Anchor Protocol is a super successful lending protocol and the cornerstone of the Terra Ecosystem.

I think it is crucial for Terra's success that Anchor continues with business as usual (19.5% APY).

/41

I think it is crucial for Terra's success that Anchor continues with business as usual (19.5% APY).

/41

If you want more reading material about:

-the yield reserve of Anchor Protocol, check out this:

/42

-the yield reserve of Anchor Protocol, check out this:

https://twitter.com/cptn3m0x/status/1487004068442607621?s=20&t=OtBQJIBt3QRo_Ey0mC_zEQ

/42

@yieldlabs thoughts about the yield reserve:

@jarzoombek thread about Anchor and $LUNA:

@danku_r video explanation about Anchor and the yield reserve:

/43

https://twitter.com/YieldLabs/status/1486748270646997007?s=20&t=OtBQJIBt3QRo_Ey0mC_zEQ

@jarzoombek thread about Anchor and $LUNA:

https://twitter.com/jarzoombek/status/1486698407561510919?s=20&t=OtBQJIBt3QRo_Ey0mC_zEQ

@danku_r video explanation about Anchor and the yield reserve:

/43

Also a huge shoutout to @cryptoharry_ & @Matt___Cohen for great discussions about Anchor Protocol

And if you're seeing these $DAI & $FRAX-boys spreading fud about $LUNA and $UST, just remember that they haven't read the Terra Luna and Anchor Protocol whitepapers.

/44

And if you're seeing these $DAI & $FRAX-boys spreading fud about $LUNA and $UST, just remember that they haven't read the Terra Luna and Anchor Protocol whitepapers.

/44

Nothing is risk-free in crypto, but I hope this thread made it easier for you to understand how Anchor, $LUNA, and $UST works.

That was it.

I also have a free newsletter which you can subscribe to here:

getrevue.co/profile/route2…

/45

That was it.

I also have a free newsletter which you can subscribe to here:

getrevue.co/profile/route2…

/45

If you liked his thread, I would love it if you could share it by retweeting the first one

👇

Thank you!

/46

👇

https://twitter.com/Route2FI/status/1487079648609640456

Thank you!

/46

• • •

Missing some Tweet in this thread? You can try to

force a refresh