A thread about all the opportunities in the Terra $LUNA ecosystem:

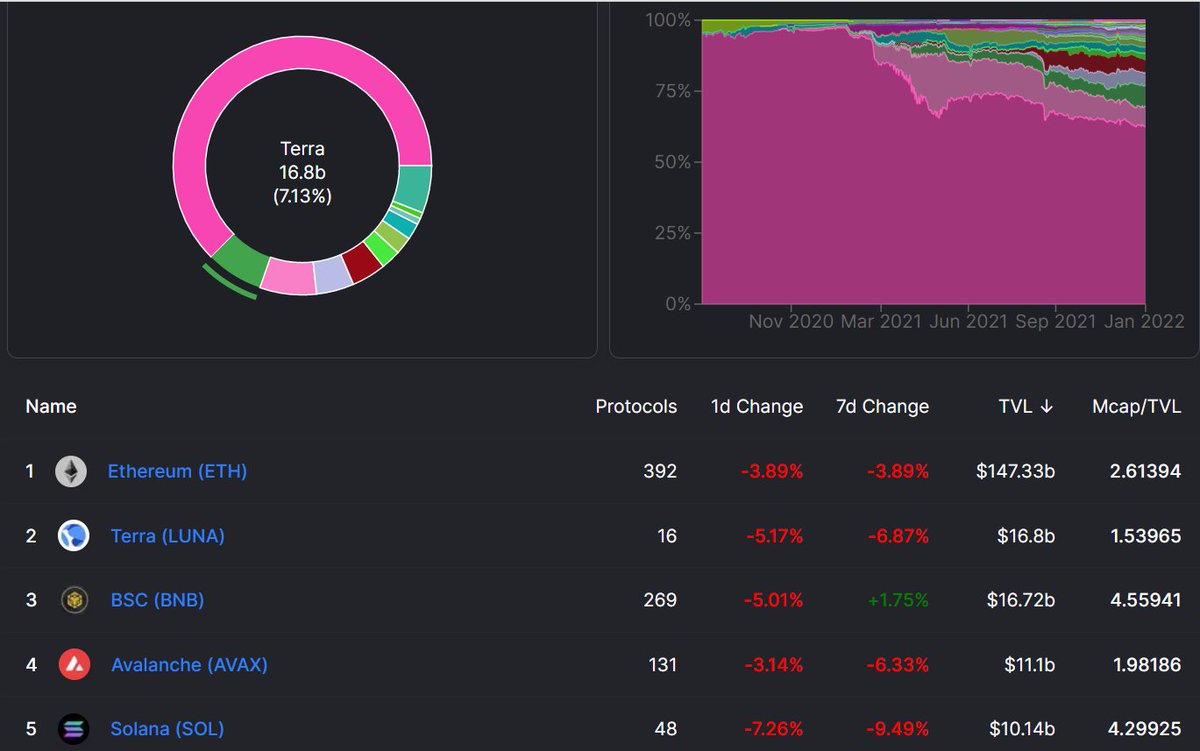

In this thread, I'll focus on the nr. 2 biggest ecosystem in terms of TVL in DeFi ($16.8b).

There are plenty of opportunities in crypto to earn yield.

Let's look at how you can make it with Terra $LUNA

/THREAD

In this thread, I'll focus on the nr. 2 biggest ecosystem in terms of TVL in DeFi ($16.8b).

There are plenty of opportunities in crypto to earn yield.

Let's look at how you can make it with Terra $LUNA

/THREAD

Before we deep-dive into the strategies, it's important that you understand the tokenomics behind $LUNA.

The ecosystem operates with 2 tokens: $UST and $LUNA

$UST is a stablecoin that is 1:1 pegged to USD, while $LUNA is the governance token.

1/

The ecosystem operates with 2 tokens: $UST and $LUNA

$UST is a stablecoin that is 1:1 pegged to USD, while $LUNA is the governance token.

1/

The whole ecosystem is built around the stablecoin $UST.

In order to create more $UST we have to burn $LUNA (which means that the token is deflationary).

The $UST demand change determines what amount of LUNA needs to be burned.

LUNA burn reduces the supply...

/2

In order to create more $UST we have to burn $LUNA (which means that the token is deflationary).

The $UST demand change determines what amount of LUNA needs to be burned.

LUNA burn reduces the supply...

/2

of $LUNA --> supply reduction increases the $LUNA price.

Back in early November, there was a huge demand for the stablecoin $UST (eg. over $1b due to the launch of Degenbox $UST - $MIM on Abracadabra + lots of protocols launching after the Columbus 5-upgrade).

We saw the...

/3

Back in early November, there was a huge demand for the stablecoin $UST (eg. over $1b due to the launch of Degenbox $UST - $MIM on Abracadabra + lots of protocols launching after the Columbus 5-upgrade).

We saw the...

/3

market cap increase from 2.5b to 10b in the span of 2 months (see the screenshots below).

So while the mcap of $UST has 4x since November, the price of $LUNA went from $40 to $103 (2.5x), before the price came down to approx. $70 where it is atm.

/4

So while the mcap of $UST has 4x since November, the price of $LUNA went from $40 to $103 (2.5x), before the price came down to approx. $70 where it is atm.

/4

Is $LUNA undervalued? I think so, but I'm big a big fan of the Terra ecosystem and I'm biased.

If you're interested in reading what could go wrong with Terra $LUNA I recommend you to read this thread:

/5

If you're interested in reading what could go wrong with Terra $LUNA I recommend you to read this thread:

https://twitter.com/0xHamz/status/1479261181135269893?s=20

/5

I feel the author @0xHamz makes a lot of good points and I agree with most of it, but a lot of mechanisms were implemented in the Terra system as a consequence of the May 2021-crash in the crypto market which is missing in the analysis:

-Implementation of the @whitewhale ...

/6

-Implementation of the @whitewhale ...

/6

to protect the peg

-@riskharbor Ozone Protocol (insurance protection)

-@TeamKujira Orca (in a down-trend market you can buy other people's liquidated assets from Anchor Protocol)

These 3 protocol helps the Terra ecosystem to protect the peg of $UST and to prevent a cascade

/7

-@riskharbor Ozone Protocol (insurance protection)

-@TeamKujira Orca (in a down-trend market you can buy other people's liquidated assets from Anchor Protocol)

These 3 protocol helps the Terra ecosystem to protect the peg of $UST and to prevent a cascade

/7

I could continue to write about the Terra ecosystem, but now that you know more about how $UST and $LUNA works, let's look at the DeFi opportunities!

Let's start with the simplest one to understand: @anchor_protocol

Anchor Earn is a protocol that...

/8

Let's start with the simplest one to understand: @anchor_protocol

Anchor Earn is a protocol that...

/8

lets you stake your $UST and in return, you get a 19,5% APY.

Pretty brilliant, and it was because of this protocol I completely stopped investing in the stock market.

Think about Anchor as a crypto savings account.

/9

Pretty brilliant, and it was because of this protocol I completely stopped investing in the stock market.

Think about Anchor as a crypto savings account.

/9

I've covered Anchor Protocol in detail here:

But the thread above only covers the "Anchor Earn" functionality.

Let's have a look at a function I feel that too many people are sleeping on.

/10

https://twitter.com/Route2FI/status/1442835869879181312?s=20

But the thread above only covers the "Anchor Earn" functionality.

Let's have a look at a function I feel that too many people are sleeping on.

/10

2)Anchor Borrow: Another function is the ability to borrow money by using your assets as collateral (see screenshot below)

For now, you can borrow against your $ETH and $LUNA, but very soon $SOL and $ATOM will be implemented too

The assets have to be in a bonded version...

/11

For now, you can borrow against your $ETH and $LUNA, but very soon $SOL and $ATOM will be implemented too

The assets have to be in a bonded version...

/11

in order for you to use this method.

How to do it:

1) Connect your Terra wallet to Anchor: app.anchorprotocol.com/borrow

2) If you don't have bonded ETH or bonded LUNA you could buy them on Terraswap.io with $UST.

If you have $LUNA already you can...

/12

How to do it:

1) Connect your Terra wallet to Anchor: app.anchorprotocol.com/borrow

2) If you don't have bonded ETH or bonded LUNA you could buy them on Terraswap.io with $UST.

If you have $LUNA already you can...

/12

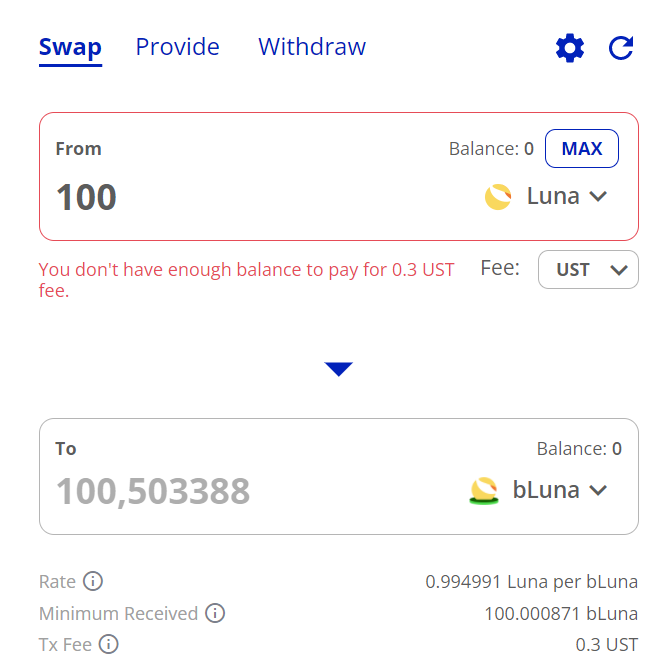

make it bLUNA by going here: app.anchorprotocol.com/bond/mint

I prefer using terraswap.io, because most often I get more bLuna than what I have in $LUNA (see screenshot below).

If I convert my $LUNA to bLUNA at Terraswap I get 0.5 $LUNA extra. Sometimes you can get...

/13

I prefer using terraswap.io, because most often I get more bLuna than what I have in $LUNA (see screenshot below).

If I convert my $LUNA to bLUNA at Terraswap I get 0.5 $LUNA extra. Sometimes you can get...

/13

more, and I remember the summer 2021 the conversion rate was sometimes 100/108 (that's 8 free $LUNA!).

You could also buy $LUNA / $ETH with $UST.

3) You have bLuna or bETH in your wallet. Provide your assets here app.anchorprotocol.com/borrow

/14

You could also buy $LUNA / $ETH with $UST.

3) You have bLuna or bETH in your wallet. Provide your assets here app.anchorprotocol.com/borrow

/14

4) Then click on the Borrow button and choose how much you want to borrow. You can borrow 50% as a max of your collateral value.

Eg. If you have 100 $LUNA tokens (they're worth $70 as of this writing) and your collateral value is 100 x 70 = $7,000. This means you can...

/15

Eg. If you have 100 $LUNA tokens (they're worth $70 as of this writing) and your collateral value is 100 x 70 = $7,000. This means you can...

/15

borrow $3,500 (which is 50% of your collateral value).

If $LUNA goes to $100 your collateral value is now 100 tokens x $100 = $10,000.

You may now borrow $5,000. As you can see, how much you can borrow is fleeting.

Another important point, you will get liquidated if...

/16

If $LUNA goes to $100 your collateral value is now 100 tokens x $100 = $10,000.

You may now borrow $5,000. As you can see, how much you can borrow is fleeting.

Another important point, you will get liquidated if...

/16

your position hits 60% of your collateral value.

That's why it can be smart to monitor your LTV-ratio. If this is the first time you're going to try this, start by borrowing 10% to understand the mechanism.

5) With your borrowed money you can do whatever you want:

...

/17

That's why it can be smart to monitor your LTV-ratio. If this is the first time you're going to try this, start by borrowing 10% to understand the mechanism.

5) With your borrowed money you can do whatever you want:

...

/17

-Buy more bLuna/bETH

-Deposit into Anchor Earn to get 19.5% APY

-Send to another ecosystem to buy your favorite coins

-Withdraw to fiat

There's no payback time. At the moment the interest rate is +0,14% which actually means that you're getting paid to borrow.

/18

-Deposit into Anchor Earn to get 19.5% APY

-Send to another ecosystem to buy your favorite coins

-Withdraw to fiat

There's no payback time. At the moment the interest rate is +0,14% which actually means that you're getting paid to borrow.

/18

6) If you want to repay your loan in full (or repay some of it to make your position more healthy), just click on "Repay".

7) After you have repaid you can press "withdraw" to remove your collateral and go to terraswap.io to convert bLuna to $LUNA/$UST

/19

7) After you have repaid you can press "withdraw" to remove your collateral and go to terraswap.io to convert bLuna to $LUNA/$UST

/19

8) Everything written above remains the same for $ETH, so just follow the same instructions.

However, if you have native $ETH (ERC-20) you have to convert it to a Terra-native token through Lido: anchor.lido.fi, but I personally find it...

20/

However, if you have native $ETH (ERC-20) you have to convert it to a Terra-native token through Lido: anchor.lido.fi, but I personally find it...

20/

much easier to sell my ERC-20 $ETH to a stablecoin and then bridge it over to the Terra network, eg. through the Terra bridge: bridge.terra.money

So this is what I personally do with all my $LUNA and $ETH, I borrow against them and usually I deposit it into...

21/

So this is what I personally do with all my $LUNA and $ETH, I borrow against them and usually I deposit it into...

21/

Anchor Earn to get 19.5%.

When I feel more degen I use the borrowed money to buy more bLuna/bETH.

Then I use my new bLUNA/bETH and provide them as collateral to borrow more $UST.

Go to terraswap.io and buy more bLUNA/bETH.

/22

When I feel more degen I use the borrowed money to buy more bLuna/bETH.

Then I use my new bLUNA/bETH and provide them as collateral to borrow more $UST.

Go to terraswap.io and buy more bLUNA/bETH.

/22

You can continue this loop 8-10x times.

You should at least double your initial position. So if you had 100 LUNA, now you should have over 200 LUNA.

PS! Very high risk. NFA. DYOR.

/23

You should at least double your initial position. So if you had 100 LUNA, now you should have over 200 LUNA.

PS! Very high risk. NFA. DYOR.

/23

Mirror Protocol:

Mirror is a synthetic asset platform.

You can buy stocks, commodities, and crypto at their site. Cool concept and a way to earn extra yield for degens like us.

I've already written 2 detailed threads about Mirror:

1)

cont.

24/

Mirror is a synthetic asset platform.

You can buy stocks, commodities, and crypto at their site. Cool concept and a way to earn extra yield for degens like us.

I've already written 2 detailed threads about Mirror:

1)

https://twitter.com/Route2FI/status/1454065822515830787?s=20

cont.

24/

2)

Start by reading them to understand Mirror better.

The two threads focused mostly on how to do a delta neutral strategy, eg. buy $AMZN both long/short and earn a yield on both sides.

It's worth mentioning that after I made this thread

/25

https://twitter.com/Route2FI/status/1454519452888969220?s=20

Start by reading them to understand Mirror better.

The two threads focused mostly on how to do a delta neutral strategy, eg. buy $AMZN both long/short and earn a yield on both sides.

It's worth mentioning that after I made this thread

/25

in October 2021, Mirror Protocol has capped their rates, so the strategy isn't that profitable anymore.

If you want to go either long or short I can still recommend using it to generate some extra yield, but I really miss the days where you could earn...

/26

If you want to go either long or short I can still recommend using it to generate some extra yield, but I really miss the days where you could earn...

/26

almost 60% APY on a stablecoin play by being in a delta neutral position.

These days I only use the Terra Degen Yield Strategy which you can read in detail here with step by step instructions:

/27

These days I only use the Terra Degen Yield Strategy which you can read in detail here with step by step instructions:

https://twitter.com/Route2FI/status/1473626708314136585?s=20

/27

It's a great way to increase your yield from 20% to 40% APY, however, it's not completely delta neutral.

I know the @mirror_protocol team is working on making new strategies, and I think we will see lots of interesting things from them going further into 2022.

/28

I know the @mirror_protocol team is working on making new strategies, and I think we will see lots of interesting things from them going further into 2022.

/28

Stader Labs:

Want to stake your Luna? You basically have 2 options. Do it at Terra Station, or go to @staderlabs

Stader Labs has a super interesting concept of liquid staking meaning you can stake your $LUNA and get 9-10% APY on your $LUNA, then receive...

/29

Want to stake your Luna? You basically have 2 options. Do it at Terra Station, or go to @staderlabs

Stader Labs has a super interesting concept of liquid staking meaning you can stake your $LUNA and get 9-10% APY on your $LUNA, then receive...

/29

a $LUNAX token which you probably can use as collateral at Mirror, Anchor, or Spectrum Protocol.

Read the thread from @wolf_of_defi to learn more:

and check out this thread about liquid staking at Staderlabs:

/30

Read the thread from @wolf_of_defi to learn more:

https://twitter.com/wolf_of_defi/status/1478444498296451074?s=20

and check out this thread about liquid staking at Staderlabs:

https://twitter.com/FarmerTuHao/status/1477281635221393411?s=20

/30

So the question is, should you stake your $LUNA or should you use it as collateral on Anchor to earn extra yield instead?

Or should you buy tokens in the Terra ecosystem and farm them in an LP?

No right or wrong answer here, and it really depends on your risk level.

/31

Or should you buy tokens in the Terra ecosystem and farm them in an LP?

No right or wrong answer here, and it really depends on your risk level.

/31

Check out some strategies to double your bag of $LUNA here:

/32

https://twitter.com/Shigeo808/status/1466333047771389956?s=20

https://twitter.com/thegoogleguy/status/1479278738021912577?s=20

/32

Kujira Orca:

Remember I told you that you can get liquidated at Anchor Protocol if you borrow too much?

Meet @TeamKujira, the protocol which lets you buy other people's liquidated assets.

To explain how it works, see this tweet:

/33

Remember I told you that you can get liquidated at Anchor Protocol if you borrow too much?

Meet @TeamKujira, the protocol which lets you buy other people's liquidated assets.

To explain how it works, see this tweet:

https://twitter.com/Route2FI/status/1468550926340399111?s=20

/33

It's simple to use and the UX is beautiful.

I haven't made a thread myself, but check out this great thread about how you can use the protocol step-by-step:

/34

I haven't made a thread myself, but check out this great thread about how you can use the protocol step-by-step:

https://twitter.com/shivsakhuja/status/1468635649473331206?s=20

/34

So if you either want to make a quick arbitrage trade or build a big bag of $LUNA or $ETH, but don't want to buy at full market price, I definitely recommend you to check out orca.kujira.app

/35

/35

Spectrum Protocol:

Spectrum is a yield optimizer that allows users to earn compound interest on their LP farming crypto assets.

Lots of different farms you can check out here: terra.spec.finance/vaults

Personally I use the new stablecoin strategy bPSIDP-24M which...

/36

Spectrum is a yield optimizer that allows users to earn compound interest on their LP farming crypto assets.

Lots of different farms you can check out here: terra.spec.finance/vaults

Personally I use the new stablecoin strategy bPSIDP-24M which...

/36

used to give 55% APY, but the rate is now 32%.

You can read my strategy in full here if you want to do it step by step:

32% is still better than 20% on Anchor, so I think it's still worth trying.

cont.

/37

You can read my strategy in full here if you want to do it step by step:

https://twitter.com/Route2FI/status/1478054213531934724?s=20

32% is still better than 20% on Anchor, so I think it's still worth trying.

cont.

/37

Other than that they have lots of farms for $ANC, $MINE, $SPEC, $MIR, $PSI, etc. if you want to make some extra yield (100%+ APY).

/38

/38

Risk Harbor Ozone:

If you want to protect your stablecoin yield on Anchor Protocol against smart contract hacks, check out this thread I made about @riskharbor Ozone Protocol:

39/

If you want to protect your stablecoin yield on Anchor Protocol against smart contract hacks, check out this thread I made about @riskharbor Ozone Protocol:

https://twitter.com/Route2FI/status/1476929845498204161?s=20

39/

I feel like the best is yet to come for Terra, and what we've seen is only the start.

Other protocols that have launched that I didn't write about: Pylon Protocol, Nexus Protocol, Astroport, Apollo, LOOP +++

I am waiting for some strategies that I think will be amazing,

40/

Other protocols that have launched that I didn't write about: Pylon Protocol, Nexus Protocol, Astroport, Apollo, LOOP +++

I am waiting for some strategies that I think will be amazing,

40/

and I can't wait to make threads about them:

1) Nexus Protocol $UST Mirror vault: Delta Neutral strategies with no risk of liquidation

2) Kinetic Money: a way to double your Anchor stablecoin yield without liquidation risk, see this tweet:

/41

1) Nexus Protocol $UST Mirror vault: Delta Neutral strategies with no risk of liquidation

2) Kinetic Money: a way to double your Anchor stablecoin yield without liquidation risk, see this tweet:

https://twitter.com/Route2FI/status/1468660678475067392?s=20

/41

3) @WhiteWhaleTerra: A way to increase my APY on Anchor Protocol while I'm also helping the Terra Ecosystem to protect the peg.

4) Kash and Alice Visa card --> spend my $UST everywhere. Check @kashdefi and @alice_finance

/42

4) Kash and Alice Visa card --> spend my $UST everywhere. Check @kashdefi and @alice_finance

/42

5) Prism Protocol: Split your $LUNA into several different $LUNA tokens and stake them, farm them, lend them all at the same time.

Super degen stuff, check out this thread about some opportunities:

/43

Super degen stuff, check out this thread about some opportunities:

https://twitter.com/TheDefiDunce/status/1478753695986823171?s=20

/43

6) Mars Protocol: @mars_protocol will be a decentralized bank. They will enable money markets (borrowing and lending) for various different assets ( $LUNA, $UST, $ANC, and more)

7) @Levana_protocol: $LUNA 2x token (a way to leverage your native $LUNA.

/44

7) @Levana_protocol: $LUNA 2x token (a way to leverage your native $LUNA.

/44

8) @leservedao: The $OHM fork that no one knows enough about. They've been building it for 3 months now, I'm guessing this will be one of the biggest ones. More info to come :)

9) Neptune Finance: Automated yield farming with a twist

/45

9) Neptune Finance: Automated yield farming with a twist

/45

10) Spar Protocol: Asset management (for the lazy investor or the person that wants to spend less time at the PC). You will still earn great yield!

Also, check out this list of 136 protocols aka. the full overview of what's coming to Terra this year...

/46

Also, check out this list of 136 protocols aka. the full overview of what's coming to Terra this year...

/46

(the list also includes existing protocols):

/47

https://twitter.com/FynnToTheMoon/status/1477415008690708481?s=20

/47

Lastly, if you want to stay up to date on everything that is happening at Terra, I definitely recommend you follow these Terra people:

@cryptoharry_

@cephii1

@themoonmidas

@josephilow

@lejimmy

@jayjaboneta

@nicolasflamelx

@jwang815

@alphaseeker21

@archon_0x

@danku_r

/48

@cryptoharry_

@cephii1

@themoonmidas

@josephilow

@lejimmy

@jayjaboneta

@nicolasflamelx

@jwang815

@alphaseeker21

@archon_0x

@danku_r

/48

@petertheterran

@sjpark_TFL

@caleb_twt_

@terrayoda

@fynntothemoon

@fishmarketacad

@cy_coleman

@lunaterraluna

@shigeo808

@speicherx

@gabrielgfoo

@theryanlion

@rebel_defi

@drcle4n

@wolf_of_defi

@shivsakhuja

@panterra0x

@CCrush89

/49

@sjpark_TFL

@caleb_twt_

@terrayoda

@fynntothemoon

@fishmarketacad

@cy_coleman

@lunaterraluna

@shigeo808

@speicherx

@gabrielgfoo

@theryanlion

@rebel_defi

@drcle4n

@wolf_of_defi

@shivsakhuja

@panterra0x

@CCrush89

/49

That was it for this time.

If you liked this thread I would love it if you followed me @route2fi for more threads about DeFi, $LUNA and all the stablecoin opportunities.

I also have a free newsletter which you can subscribe to here: getrevue.co/profile/route2…

/50

If you liked this thread I would love it if you followed me @route2fi for more threads about DeFi, $LUNA and all the stablecoin opportunities.

I also have a free newsletter which you can subscribe to here: getrevue.co/profile/route2…

/50

If you liked this thread, I would love it if you could help me share it by retweeting the first tweet:

👇

Thank you!

/51

👇

https://twitter.com/Route2FI/status/1479500417025417220?s=20

Thank you!

/51

• • •

Missing some Tweet in this thread? You can try to

force a refresh