New stablecoin strategy on the Terra ecosystem

A safer variant of the Degenbox $UST - $MIM on Abracadabra

Earn 55% APY with no risk of impermanent loss using the auto-compounder Spectrum Protocol.

No leverage. No liquidation risk.

Step-by-step THREAD

/1

A safer variant of the Degenbox $UST - $MIM on Abracadabra

Earn 55% APY with no risk of impermanent loss using the auto-compounder Spectrum Protocol.

No leverage. No liquidation risk.

Step-by-step THREAD

/1

To understand the strategy it's important to understand the concept of 2 other Terra protocols: Nexus Protocol and Pylon Protocol.

Nexus Protocol has the token $PSI which was launched in October last year.

Aggressive marketing of the token led to 46x of the price...

/2

Nexus Protocol has the token $PSI which was launched in October last year.

Aggressive marketing of the token led to 46x of the price...

/2

before the token dumped to "only" 5x before Christmas (a large presale unlock was dumped on the market at the same time).

To fix this, @NexusProtocol now wants to reduce inflation in the $PSI token by taking ownership of their own liquidity (think DeFi 2.0).

3/

To fix this, @NexusProtocol now wants to reduce inflation in the $PSI token by taking ownership of their own liquidity (think DeFi 2.0).

3/

Okay, Nexus has a problem they want to solve.

Why should degens like us care?

Hang on a second, anon. You will understand soon.

But before you see the full picture let's talk about @pylon_protocol.

Pylon Protocol lets investors make loss-less investments in...

/4

Why should degens like us care?

Hang on a second, anon. You will understand soon.

But before you see the full picture let's talk about @pylon_protocol.

Pylon Protocol lets investors make loss-less investments in...

/4

Terra projects by locking UST deposits into project-specific pools for 6, 12, or 18/24 months.

The deposit is put to work on Anchor Earn and the 19,5% APY is redirected into buying the project’s token ($MINE), which becomes redeemable halfway through the agreed period,...

/5

The deposit is put to work on Anchor Earn and the 19,5% APY is redirected into buying the project’s token ($MINE), which becomes redeemable halfway through the agreed period,...

/5

while the capital UST investment is redeemable at the end of the period.

Not the worst idea, but the problem is that these pools are illiquid and not very attractive for DeFi degens.

The solution?

The two Terra Protocols decided to work together to bring in a solution...

/6

Not the worst idea, but the problem is that these pools are illiquid and not very attractive for DeFi degens.

The solution?

The two Terra Protocols decided to work together to bring in a solution...

/6

The solution:

A Liquid Nexus Pylon Pool, where investors can make lossless UST investments to earn $PSI without any lockup-period, while Nexus Protocol can make some of this yield for their treasury and fix their tokenomics (think DeFi 2.0 like $OHM / $TIME).

/7

A Liquid Nexus Pylon Pool, where investors can make lossless UST investments to earn $PSI without any lockup-period, while Nexus Protocol can make some of this yield for their treasury and fix their tokenomics (think DeFi 2.0 like $OHM / $TIME).

/7

A pool was launched at Pylon but the process was manual and a little hassle (and APY was lower).

Two weeks after the launch of the Pylon Pool the auto-compounder @SpecProtocol released their Spectrum bPsi Degenbox which yields 54% APY.

This is almost 2.5 x of Anchor's...

8/

Two weeks after the launch of the Pylon Pool the auto-compounder @SpecProtocol released their Spectrum bPsi Degenbox which yields 54% APY.

This is almost 2.5 x of Anchor's...

8/

yield and equals a "safe" version of Abracadabra's UST Degenbox with 0.80 liq price, but without having to leave the Terra Ecosystem.

The best part? No liquidation risk because you don't use leverage.

When you deposit UST in this Liquid Pylon Pool, you receive a token...

9/

The best part? No liquidation risk because you don't use leverage.

When you deposit UST in this Liquid Pylon Pool, you receive a token...

9/

that is equivalent to the UST investment.

The token is called bPsi.

bPsi remains roughly 1:1 with UST as it is ultimately a UST deposit with benefits, with the $Psi yield separate from the $UST deposit.

This pool will be active for 24 months, so you have plenty of time...

10/

The token is called bPsi.

bPsi remains roughly 1:1 with UST as it is ultimately a UST deposit with benefits, with the $Psi yield separate from the $UST deposit.

This pool will be active for 24 months, so you have plenty of time...

10/

to get some yield.

Sounds great, but how do you get in?

Deposit $UST directly on Spectrum Protocol (see screenshot)

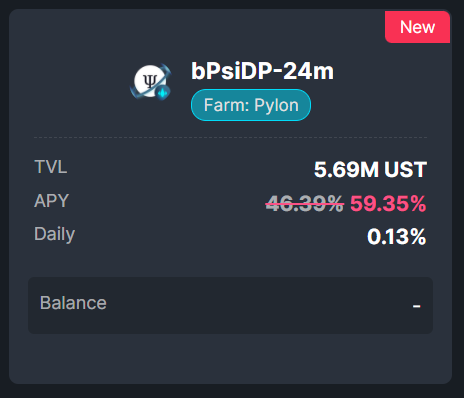

Step 1: Go to Spectrum's website ( terra.spec.finance/vaults ) and connect your Terra Wallet.

Step 2: Go to the bPsiDP-24m Single Asset Farm.

11/

Sounds great, but how do you get in?

Deposit $UST directly on Spectrum Protocol (see screenshot)

Step 1: Go to Spectrum's website ( terra.spec.finance/vaults ) and connect your Terra Wallet.

Step 2: Go to the bPsiDP-24m Single Asset Farm.

11/

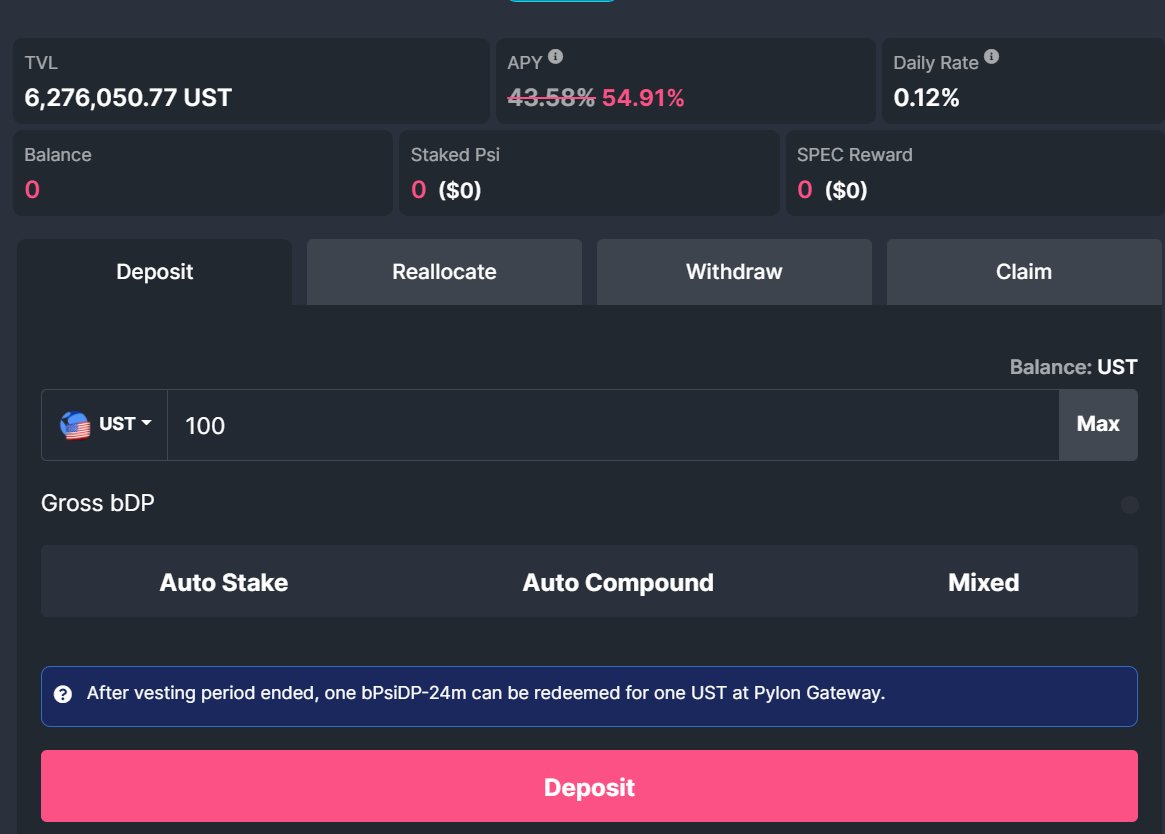

Step 3: Deposit $UST and choose from Auto-Compounding or Auto-Staking (or a Mix of both).

For this particular stablecoin farming strategy, we will use Auto Compound.

Step 4: Before depositing, make sure that you are getting a fair amount of bPsi for your $UST.

/12

For this particular stablecoin farming strategy, we will use Auto Compound.

Step 4: Before depositing, make sure that you are getting a fair amount of bPsi for your $UST.

/12

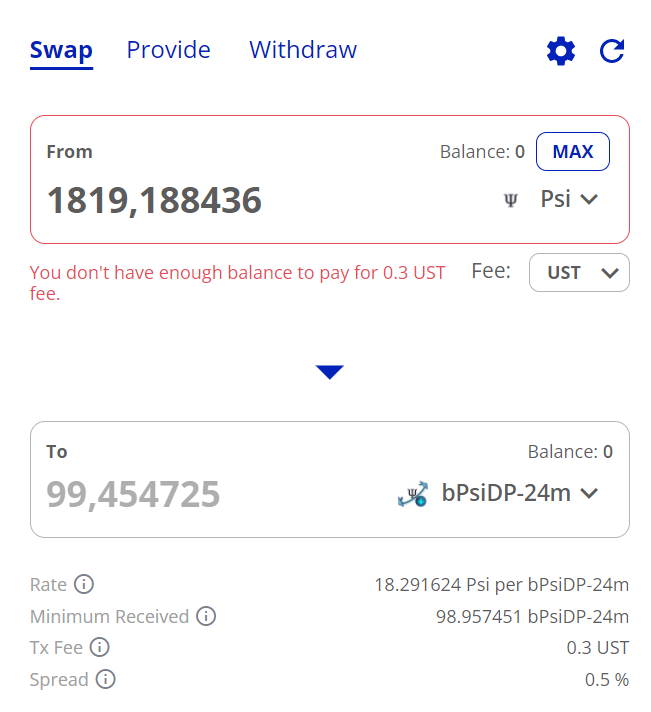

Depending on market conditions, sometimes you can get slightly more bPsi than the deposited $UST.

Play around with the numbers and also check terraswap.io if it's possible to get more $bpsi there through the swap function (example below).

/13

Play around with the numbers and also check terraswap.io if it's possible to get more $bpsi there through the swap function (example below).

/13

If you want to sell your bPsi elsewhere than directly on Spectrum Protocol, you can trade the bPsi token back to UST on Terraswap.io through two trades:

1. bPsi --> Psi

2. Psi --> UST.

/14

1. bPsi --> Psi

2. Psi --> UST.

/14

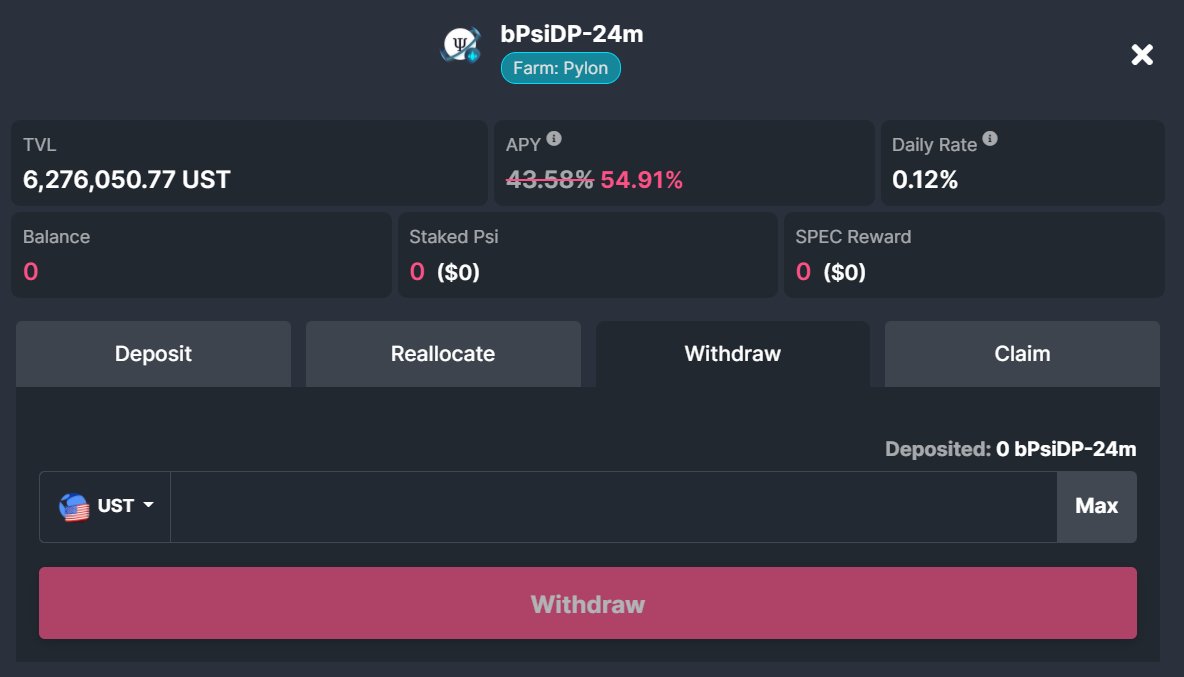

If you want to withdraw your money, simply go to withdraw.

See the screenshot below.

Note that there is a 0.1% Spectrum deposit fee, but there are no withdrawal fees.

/15

See the screenshot below.

Note that there is a 0.1% Spectrum deposit fee, but there are no withdrawal fees.

/15

This is a low-risk strategy, but let's look at some risks:

1. Gains from this farm also depend on how close the market can keep the bPsi to UST peg.

If it significantly loses its 1:1 peg, getting out of the farm could come at a cost (think $FTM / $TOMB)

16/

1. Gains from this farm also depend on how close the market can keep the bPsi to UST peg.

If it significantly loses its 1:1 peg, getting out of the farm could come at a cost (think $FTM / $TOMB)

16/

On the bright side, after the 24 month period, bPsi can be claimed back to UST on a 1:1 through the Pylon website (if it depegs).

But 24 months is loooong in crypto.

/17

But 24 months is loooong in crypto.

/17

Smart Contract Risk:

Auto-compounders always come with added smart contract vulnerability risks.

The recent hack of Grim Auto-compounder on Fantom saw users lose all of their assets.

@SpecProtocol is audited by Halborn.

/18

Auto-compounders always come with added smart contract vulnerability risks.

The recent hack of Grim Auto-compounder on Fantom saw users lose all of their assets.

@SpecProtocol is audited by Halborn.

/18

APR varies: The %APR of the farm depends on the price of $Psi. If the price halves, %APR halves, and %APY drops even more.

On the bright side, interest rates won't really go below that of @anchor_protocol.

/19

On the bright side, interest rates won't really go below that of @anchor_protocol.

/19

That was it!

I first heard about this idea from @ccrush89 which I definitely recommend you to follow (Terra $LUNA degen).

You can read his blog post here:

Also worth mentioning that the ideas are inspired by this podcast: terraspaces.org/2021/12/27/bps…

20/

I first heard about this idea from @ccrush89 which I definitely recommend you to follow (Terra $LUNA degen).

You can read his blog post here:

https://twitter.com/CCrush89/status/1477643474061213698?s=20

Also worth mentioning that the ideas are inspired by this podcast: terraspaces.org/2021/12/27/bps…

20/

Thank you so much!

I hope you learned something new.

Follow me on @route2fi for more strategies in DeFi!

I also have a free newsletter that you can subscribe to here:

getrevue.co/profile/route2…

/21

I hope you learned something new.

Follow me on @route2fi for more strategies in DeFi!

I also have a free newsletter that you can subscribe to here:

getrevue.co/profile/route2…

/21

If you liked this thread I would love it if you could share it with your friends by retweeting the first tweet:

/22

https://twitter.com/Route2FI/status/1478054213531934724?s=20

/22

• • •

Missing some Tweet in this thread? You can try to

force a refresh