This escalated quickly. An eventful January timeline of BharatPe's saga:

Jan 5 - An audio clip was posted by an anonymous Twitter account where Ashneer Grover hurled expletives towards a Kotak employee for missing out on share allotment during Nykaa's IPO.

Jan 5 - An audio clip was posted by an anonymous Twitter account where Ashneer Grover hurled expletives towards a Kotak employee for missing out on share allotment during Nykaa's IPO.

Jan 6 - Grover claims that the clip is fake; on his Twitter account, he wrote, "Folks. Chill! It's FAKE audio by some scamster trying to extort funds.”

Jan 7 - Grover deletes his tweet and tells the media that he did it because the audio clip is no longer on social media.

Jan 7 - Grover deletes his tweet and tells the media that he did it because the audio clip is no longer on social media.

Jan 9 - Kotak Mahindra Bank responds to say that they will take legal action against Grover - confirming the validity of the audio clip. A leaked document of Grover’s legal notice sent to Kotak in October 2021 also became public.

Jan 17 - ET reported that Ashneer Grover also had an altercation with Sequoia India's Harshjit Sethi in August 2020

economictimes.indiatimes.com/tech/startups/…

economictimes.indiatimes.com/tech/startups/…

Jan 18 - The CapTable reported that Bhavik Koladia, one of BharatPe's Co-founder, was convicted in the US for credit card fraud. Koladia leads product and technology at Bharatpe.

[Free Read]

the-captable.com/2022/01/bharat…

[Free Read]

the-captable.com/2022/01/bharat…

Jan 19 - BharatPe announces that Grover is taking voluntary leave till March-end to rejuvenate himself

Jan 27 - Suhail Sameer CEO, BharatPe says the board is united on Ashneer Grover's issue and is reviewing internal governance processes.

"Any company does not run solely on one individual."

moneycontrol.com/news/business/…

"Any company does not run solely on one individual."

moneycontrol.com/news/business/…

Jan 27 - Centrum Group Chairman Jaspal Bindra said, "Ashneer Grover is definitely not on the board today. Till things are settled, he will not be."

bloombergquint.com/business/pmc-b…

bloombergquint.com/business/pmc-b…

Jan 29 - Reuters reported that BharatPe's investors have hired PwC and Alvarez & Marsal to carry out an independent governance audit.

reuters.com/markets/funds/…

reuters.com/markets/funds/…

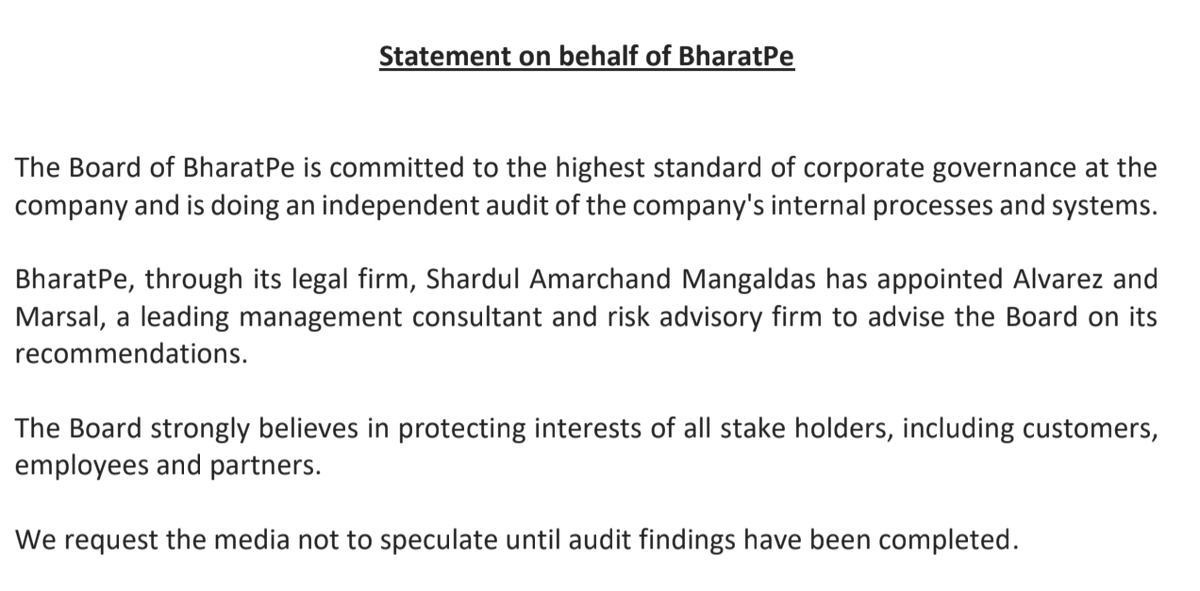

Jan 29: Bharatpe issues a statement confirming that the board has approved a financial audit.

Hours later, Mint reports:

livemint.com/companies/peop…

Hours later, Mint reports:

livemint.com/companies/peop…

Following Mint’s report, Bharatpe board clarifies that it’s not fired Grover.

https://twitter.com/chandrarsrikant/status/1487442414214455299

• • •

Missing some Tweet in this thread? You can try to

force a refresh