#Juventus have signed Serbian forward Dusan Vlahovic from Fiorentina for a €70m transfer fee (plus €10m add-ons) and €11.6m agent fees/FIFA solidarity payments. Given the financial challenges outlined by chairman Andrea Agnelli, some fans are wondering how this is possible.

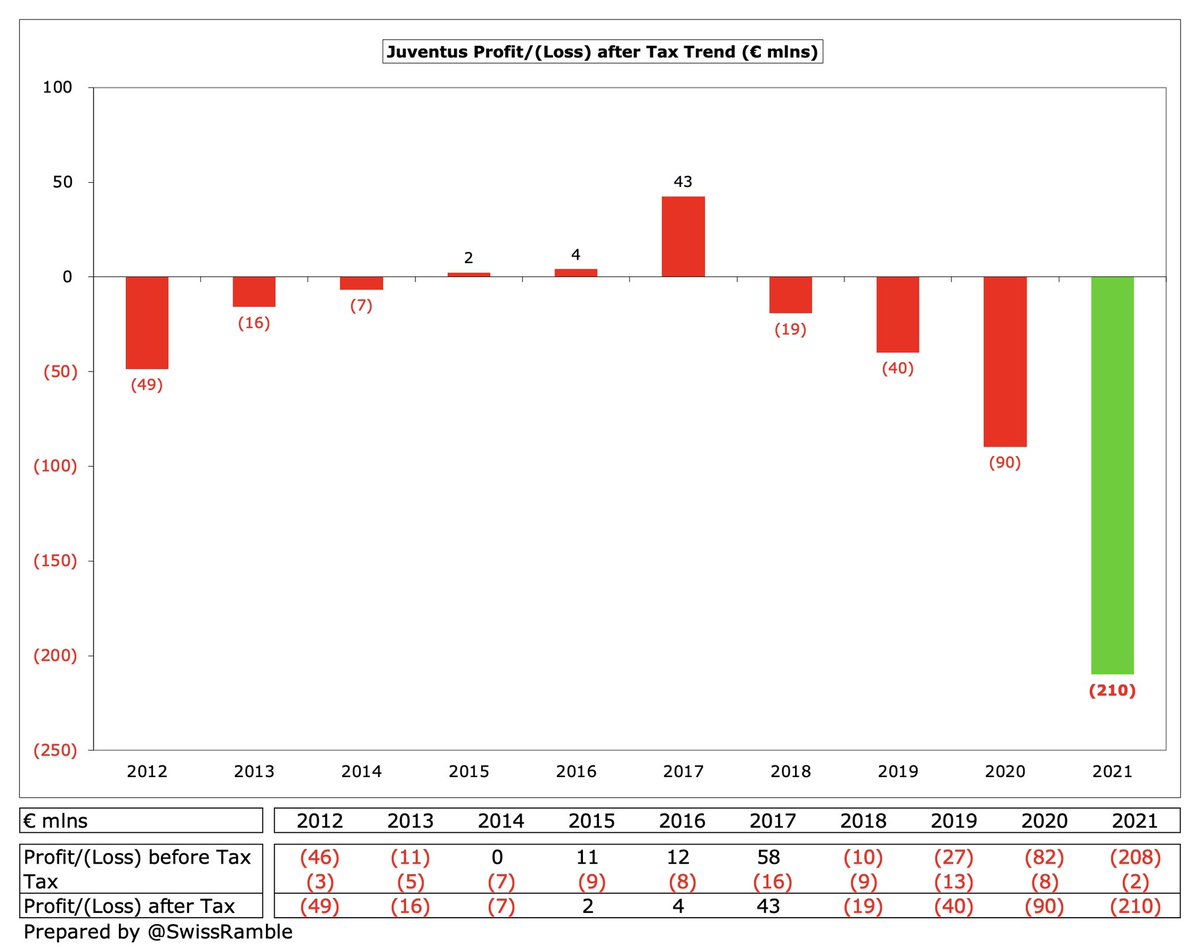

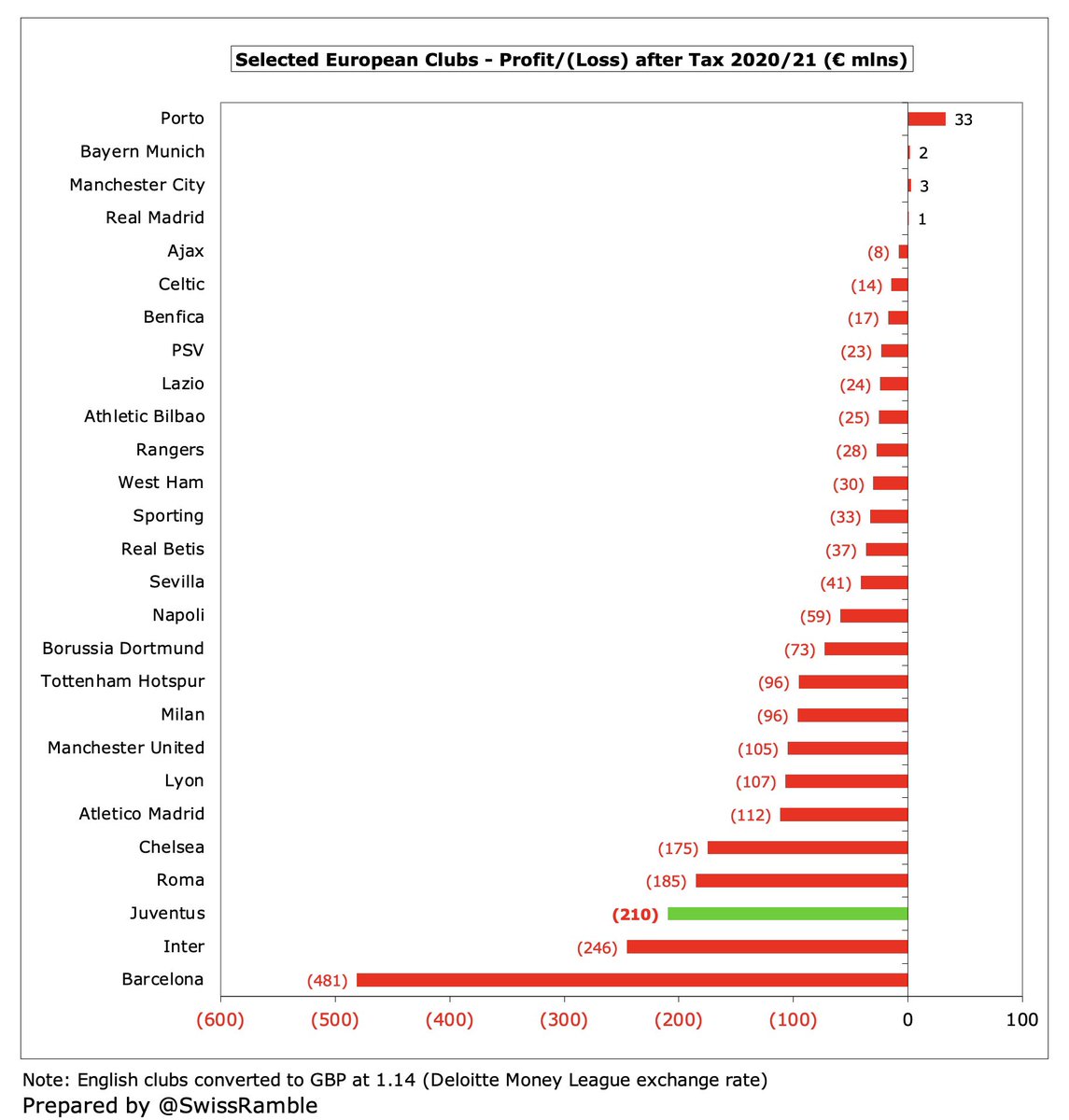

As a reminder, #Juventus reported a massive €210m net loss in 2020/21, only “beaten” in Europe by Barcelona €481m and Inter €246m. The club has lost money 4 years in a row, including €300m in the last 2 years alone, and has forecast another “significant loss” for this season.

Moreover, #Juventus operating loss, i.e. excluding player sales and interest, has been on a steady downward trend, falling from just €1m in 2015 to €228m last season. In fact, their €234m deficit in 2020 was the highest (worst) in Europe.

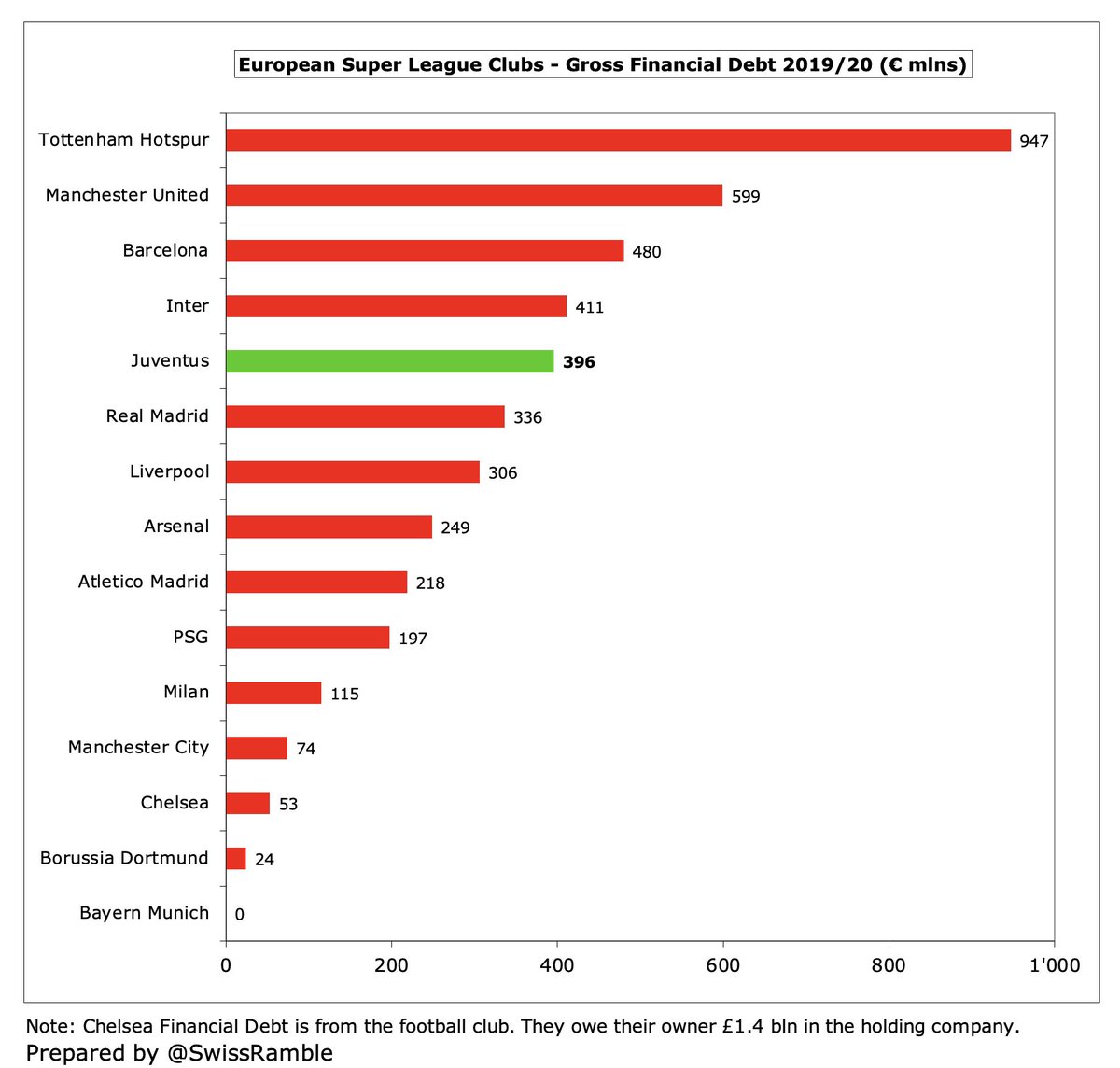

As a result, #Juventus gross financial debt has doubled in the last 6 years from €196m to €400m, one of the highest in Europe, though a fair way below #THFC & #MUFC. Much of this was for stadium development, but has increasingly been used to finance investment in the squad.

Following the debt growth, annual interest payments have also doubled from €6m to €11-12m, which again is on the high side for a football club, though in fairness is only around half as much as Barcelona €26m and #MUFC paid in 2019/20.

#Juventus gross transfer spend fell in 2021, but was still €122m. In the preceding 3-year period between 2018 and 2020, they splashed out €801m, only less than Barcelona in Europe, but more than big spending #CFC and #MCFC. Their outlay in last 5 years is an amazing €1.2 bln.

This has resulted in #Juventus transfer debt (money owed to other football clubs) almost tripling from €94m in 2015 to €265m in 2021. To be fair, this has reduced from prior year’s €301m, which was third highest in Europe, though net payables shot up from €5m to €123m.

So #Juventus have partly funded their expenditure by taking on more debt, but just as important have been capital injections from shareholders. The club has received over €900m since 2007, including around €700m in last 3 years alone: €298m in 2019/20 and €400m in 2021/22.

This is illustrated by #Juventus cash flow for 3 years to 2021. The huge €603m operating loss becomes €46m negative cash flow after adjusting for non-cash items, before spending net €224m on players, €30m interest, €18m capex & €17m tax. Largely covered by €298m capital.

The recently concluded €400m capital increase provided #Juventus with €320m new funding, as €75m had been paid by Exor in December (plus €5m fees). Of the remainder, €145m has been ring-fenced to cover the club’s financial needs over the next 12 months, leaving €175m.

Just over half of €175m will be used to repay loans from banks & other companies, reducing interest charges, so €80m is left for #Juventus to “maintain sporting competitiveness”, i.e. to invest in the transfer market (though some used for stage payments on previous purchases).

Vlahovic signed for #Juventus for €70m transfer fee (plus €10m add-ons) on a 4.5 year contract to June 2026. Adding €12m agent fees/solidarity payments means €82m cost, so €18m annual player amortisation. As he signed in January, impact on 2021/22 accounts is only half.

Vlahovic reported net salary is €7m, which means a gross cost of around €13m to #Juventus. Added to €18m player amortisation gives €31m annual impact. The total commitment over the contract is €140m: transfer fee €70m, agent fees €12m and salary €59m (4.5 years x €13m).

Payment of Vlahovic transfer fee will be in 3 instalments (assumed to be even). #Juventus have recently arranged deals on very favourable terms, e.g. Federico Chiesa (Fiorentina) and Manuel Locatelli (Sassuolo), where payments were spread with main fee only paid after 3 years.

#Juventus figures will benefit from Cristiano Ronaldo’s transfer to #MUFC last summer, which reduces annual expenses by around €85m, comprising €29m player amortisation and €56m salary (net €30m). CR7’s exit may have weakened the team, but it did create space in the budget.

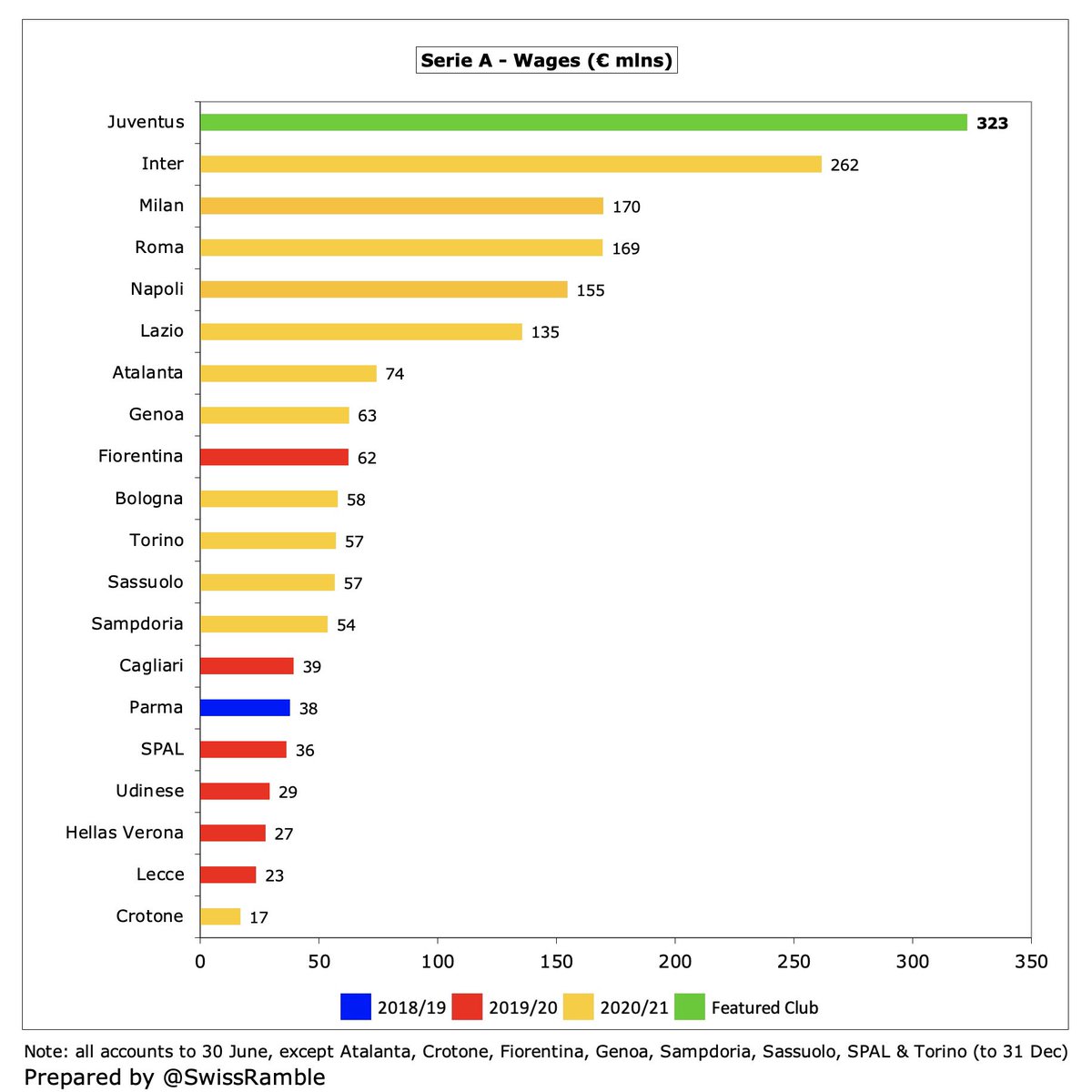

#Juventus €323m wage bill is almost back to the pre-pandemic high, so they will be looking to trim this to reduce their loss. They want to offload high earners like Aaron Ramsey, while there are reports of the club’s intention to cut salaries by 15% if players renew contracts.

The challenge for #Juventus is to remain competitive with the elite. Their €323m wage bill in 2021 was much higher than other Italian clubs (e.g. Inter €262m, Milan €170m), but they would fall far behind their European rivals if they were to cut salaries too aggressively.

This is precisely their dilemma in recent negotiations with Paulo Dybala, where talks about a new contract have been postponed. Arguably, if the Argentine forward were to leave, that would effectively fund Vlahovic’s arrival, though the club would surely miss his goals.

#Juventus high transfer spend has resulted in player amortisation more than doubling in 4 years to €177m. Their prior year charge of €167m was second highest in Europe, only below Barcelona €174m. This should fall after some prominent departures and contracts coming to an end.

In addition, in the past two years they have booked €47m of player write-downs with €27m in 2020 (Higuain, Matuidi) and €20m in 2021 (Ronaldo, Romero). If they can avoid similar impairments in the future, that would again improve the bottom line.

#Juventus also need to again generate profits from player sales. They only made €31m in 2021 compared to an average of €132m in the previous 4 years. COVID has greatly depressed the transfer market, but this may open up as the pandemic eases.

Indeed, #Juventus are now actively looking to get some players off the books. In this transfer window alone, potential departures include Rodrigo Bentancur, Dejan Kulusevski and Arthur, though some deals may only be loans with an option to buy.

Player trading has been very important to #Juventus, who made more money from this activity than any other leading club in Europe in the 5 years up to 2020. For this model to work, they will have to invest in young players, who perform on the pitch, but are also saleable assets.

Some will take these figures with a pinch of salt, as #Juventus are under investigation for false accounting relating to “plusvalenza” (gains on player sales) with the accusation that values have been artificially inflated to boost profits, though the club would argue otherwise.

One creative deal was when #Juventus sold Miralem Pjanic to Barcelona for €70m with Arthur moving the other way for €80m. Despite only net €10m changing hands, the accounting treatment allowed both clubs to record a profit of around €60m. That’s some fancy financial footwork.

Clearly, the pandemic has had an adverse impact on #Juventus revenue, which has fallen by €45m (9%) from the €494m pre-COVID peak to €450m, though 2021 was boosted by revenue deferred for games played after 2020 accounting close. Still have 10th highest revenue in the world.

#Juventus estimate the impact of COVID on 2021 revenue as €70m (match day & retail sales), while overall loss for 3-year period between 2020 and 2022, including lower player sales from less liquid transfer market, will amount to hefty €320m (assuming gradual recovery in 2022).

As games were played behind closed doors in 2020/21, #Juventus match day revenue slumped to just €8m. Two years ago before the pandemic struck, this was as high as €71m, by far the most in Italy, so will rebound with fans returning to the stadium.

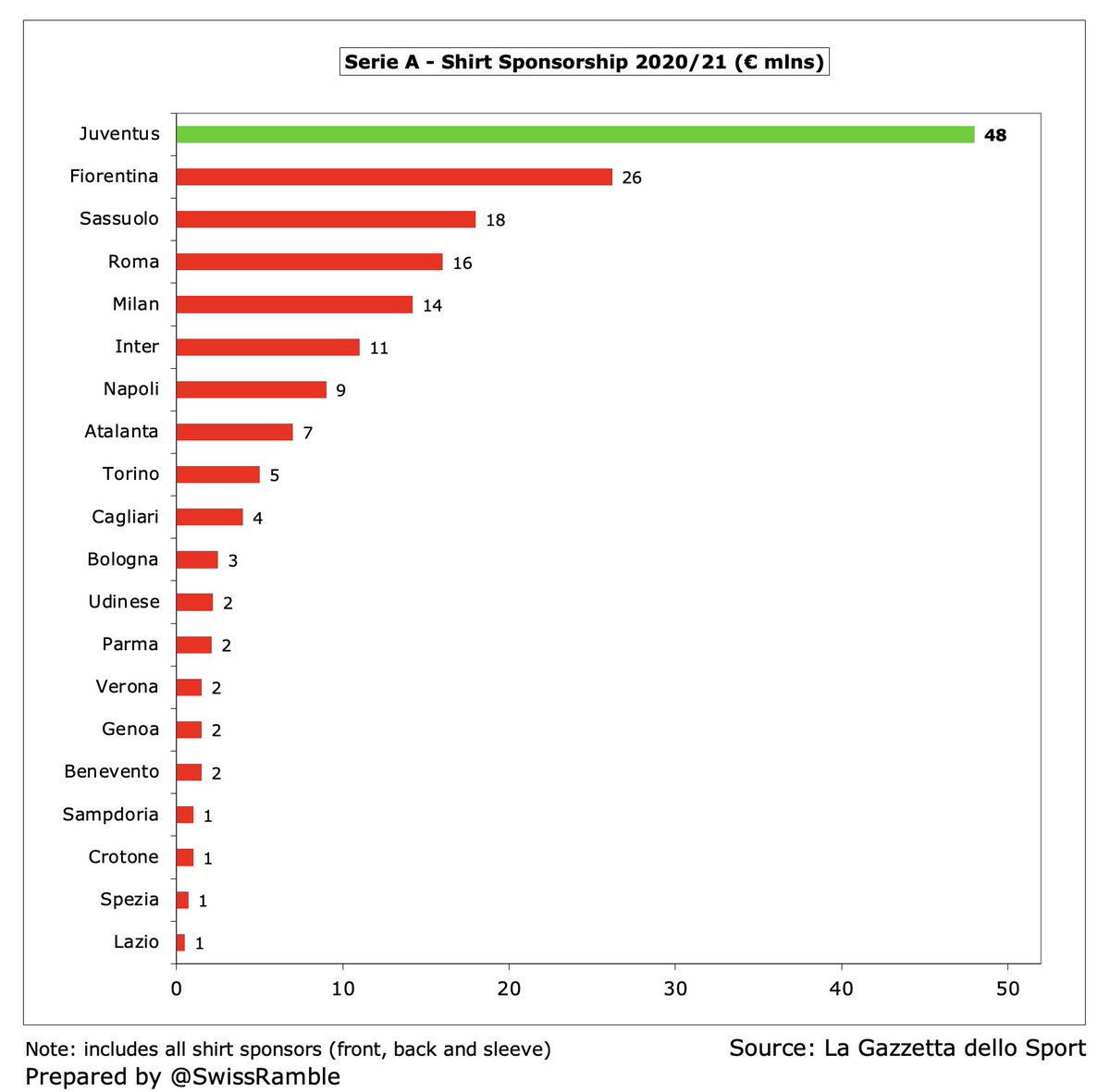

#Juventus have been successful on the commercial side with €194m income comfortably the highest in Italy. After signing Ronaldo in 2018, sponsorship & advertising grew by nearly 70% from €87m to €146m. It will be interesting to see how this develops after the sale of CR7.

Following Ronaldo’s arrival, #Juventus sponsorship deals have greatly increased. Shirt sponsor Jeep, owned by Fiat, extended to 2024 at €45m (only €17m in 2019), while Adidas kit deal rose from €23m to €51m in 2020. New sleeve sponsor Bitget is worth €6-7m a year.

One important question on the Vlahovic deal is whether #Juventus can afford not to buy him? They are currently battling to qualify for the Champions League, a key element of their strategy, worth at least €80m in TV money. In the last 5 years they earned a chunky €454m here.

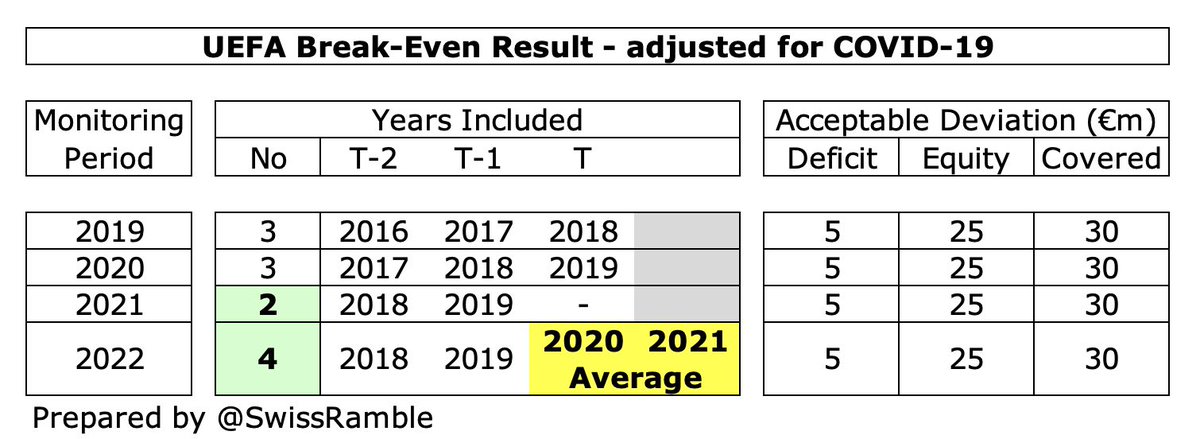

Despite UEFA relaxing their FFP rules, e.g. adjusting for COVID losses and combining 2019/20 and 2020/21 seasons, my calculations suggest that #Juventus have still just missed the target. This will need to be a consideration in any future transfers.

The #Juventus financial challenges, made worse by the pandemic, help explain why Agnelli remains interested in the European Super League project. According to some reports, they would have received a “welcome bonus” of €270m, followed by an estimated €224m each year.

So #Juventus are reliant on owner financing via substantial capital increases, while also taking on more debt. Vlahovic is the second most expensive purchase ever by an Italian club, but when it comes to making transfers work, it’s a case of “where there’s a will, there’s a way”.

• • •

Missing some Tweet in this thread? You can try to

force a refresh